Mexico PE Pipes Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico PE Pipes Market Overview:

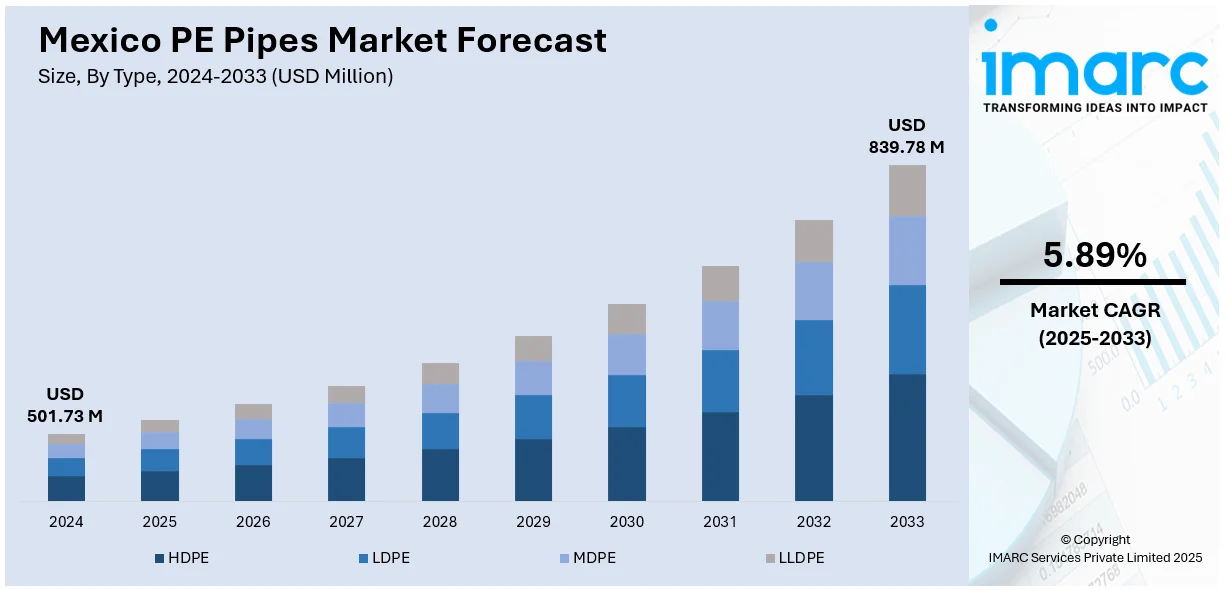

The Mexico PE pipes market size reached USD 501.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 839.78 Million by 2033, exhibiting a growth rate (CAGR) of 5.89% during 2025-2033. The market is driven by growing demand for efficient water management in agriculture, rapid urbanization requiring modern water and sewage infrastructure, and expanding natural gas distribution networks. Government support for sustainable irrigation and infrastructure upgrades further boosts market growth, along with PE pipes’ durability, flexibility, and cost-effectiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 501.73 Million |

| Market Forecast in 2033 | USD 839.78 Million |

| Market Growth Rate 2025-2033 | 5.89% |

Mexico PE Pipes Market Trends:

Rising Demand in Agricultural Irrigation Systems

One major trend of Mexico PE pipes market outlook is the growing use of effective irrigation systems, like drip and sprinkler systems, to combat water shortages and ensure sustainable agriculture. The government's initiative to update irrigation infrastructure is pushing this change, with the goal of conserving 2.8 billion cubic meters of water—three times Mexico City's annual water consumption. These government initiatives help promote the increasing application of PE pipes in farming because they are flexible, long-lasting, and corrosion-resistant. The transition is especially dominant within northern and central Mexico since extensive irrigation is crucial to agribusiness. In addition, the fact that PE pipes are light and simple to install makes them best suited for rural areas, boosting their use in agriculture. This is improving the distribution of water for agriculture as well as for human use.

Urban Infrastructure Modernization and Water Management

Mexico is making significant investments to modernize its aging water supply and sewage systems, with a historic €5.6 billion allocated for strategic water projects. These initiatives, including water supply upgrades in the Mexico Valley Metropolitan Area, will benefit over 21.6 million people. As urban populations grow in cities like Mexico City, Guadalajara, and Monterrey, there is an increasing demand for efficient water distribution and drainage systems. PE pipes, known for their long lifespan, chemical resistance, and minimal leakage compared to concrete or PVC, are playing a key role in these upgrades. Government-led projects aimed at reducing water loss and improving public health are prioritizing PE pipes. Additionally, smart city initiatives and climate resilience planning are driving the integration of advanced materials like PE pipes for sustainable, low-maintenance infrastructure.

Growth in Natural Gas Distribution Networks

The Mexico PE pipes market share is driven by the expansion of natural gas distribution networks, fueled by efforts to increase domestic natural gas usage. Mexico’s energy reform policies, coupled with significant private and public investments in gas infrastructure, are leading to the development of new pipelines and local distribution systems. A notable example is the Comisión Federal de Electricidad's (CFE) plan to construct 6.3 GW of new combined-cycle gas turbine power plants in states like Baja California and Colima. High-density polyethylene (HDPE) pipes are specifically designed for low-pressure gas distribution, thanks to their strength, flexibility, and stress cracking resistance. With both industrial and domestic sectors increasingly adopting natural gas, polyethylene (PE) pipes are emerging as the preferred solution for safe, durable, and cost-effective distribution systems, thereby driving the Mexico PE pipes market growth.

Mexico PE Pipes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- HDPE

- LDPE

- MDPE

- LLDPE

The report has provided a detailed breakup and analysis of the market based on the type. This includes HDPE, LDPE, MDPE, and LLDPE.

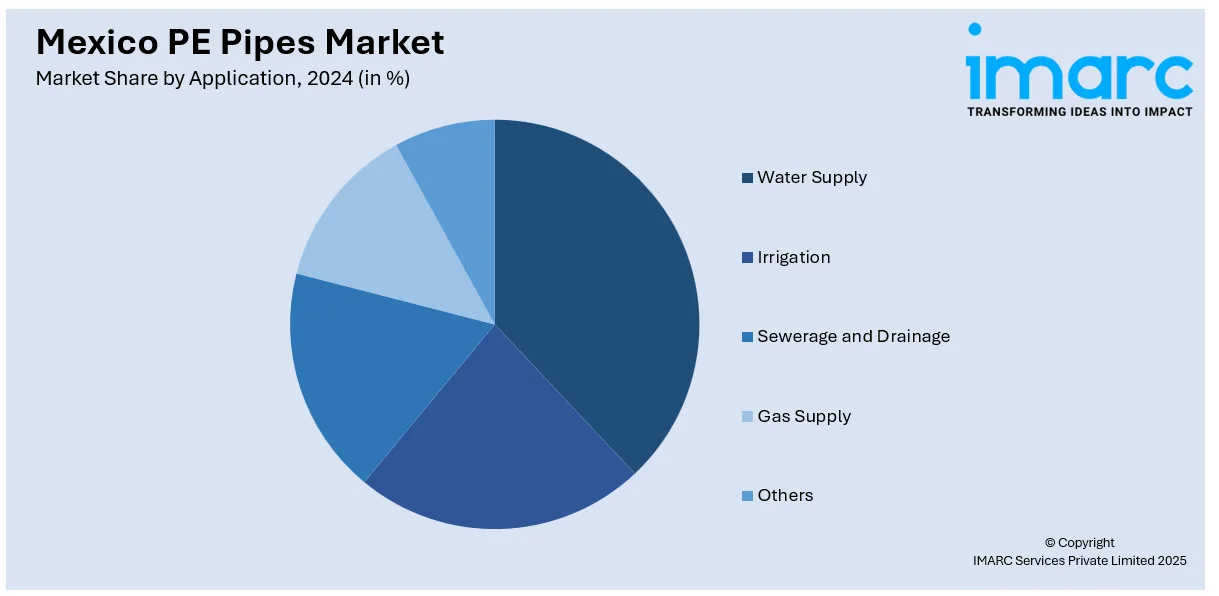

Application Insights:

- Water Supply

- Irrigation

- Sewerage and Drainage

- Gas Supply

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water supply, irrigation, sewerage and drainage, gas supply, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico PE Pipes Market News:

- In March 2025, Supreme Industries signed an MoU to acquire Wavin India’s piping business for $30 million plus net working capital. The deal includes manufacturing units, assets, IP rights, and workforce, boosting Supreme’s capacity by 73,000 MT annually. It also grants exclusive access to Wavin’s technologies for seven years, enhancing innovation in water and sanitation solutions. The acquisition strengthens Supreme’s market presence across India and SAARC, with completion expected by June 30, 2025.

- In January 2025, McElroy launched dedicated micro-sites for Mexico, Peru, and Chile to better serve its growing customer base in Latin America’s pipe fusion market. These localized platforms offer access to equipment details, service options, training, and certifications. Designed to boost efficiency and support regional industries like mining, natural gas, and pisciculture, the sites streamline communication with McElroy’s international teams, enhancing customer experience and promoting high-quality thermoplastic fusion practices.

Mexico PE Pipes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | HDPE, LDPE, MDPE, LLDPE |

| Applications Covered | Water Supply, Irrigation, Sewerage and Drainage, Gas Supply, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico PE pipes market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico PE pipes market on the basis of type?

- What is the breakup of the Mexico PE pipes market on the basis of application?

- What is the breakup of the Mexico PE pipes market on the basis of region?

- What are the various stages in the value chain of the Mexico PE pipes market?

- What are the key driving factors and challenges in the Mexico PE pipes?

- What is the structure of the Mexico PE pipes market and who are the key players?

- What is the degree of competition in the Mexico PE pipes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico PE pipes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico PE pipes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico PE pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)