Mexico Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Peanut Butter Market Overview:

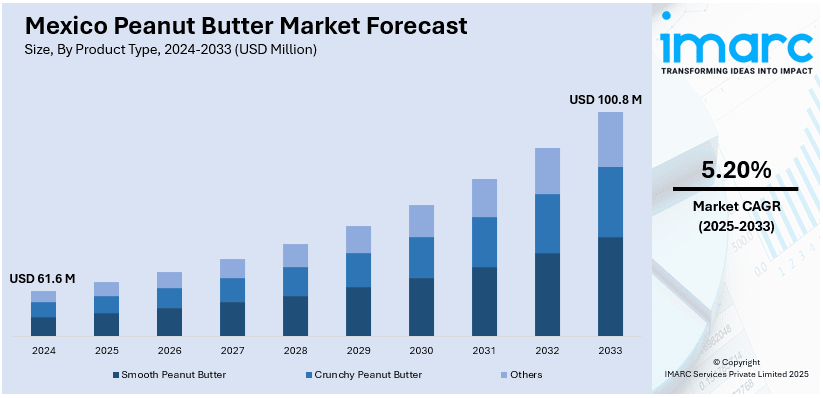

The Mexico peanut butter market size reached USD 61.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 100.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market share is expanding, driven by the rising demand for nutritious and easy-to-consume meal options owing to busy lifestyles, along with the increasing domestic production of peanuts, guaranteeing a reliable and economical supply of raw materials for producers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 61.6 Million |

| Market Forecast in 2033 | USD 100.8 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Peanut Butter Market Trends:

Increasing need for convenient food items

The rising demand for convenient and ready-to-eat (RTE) food products is offering a favorable Mexico peanut butter market outlook. With the growing working population, people have less time to prepare elaborate meals, making peanut butter a preferred choice due to its versatility and long shelf life. According to industry reports, the number of employed individuals in Mexico was recorded at 59,487,546.000 persons in December 2024. Peanut butter can be used as a spread for breakfast, a quick snack, or in smoothies and desserts for individuals with busy schedules. It is rich in protein, healthy fats, and other nutrients that consumers seek, leading to its rising adoption as a go-to food item, especially among athletes and individuals managing balanced diets. The availability of different varieties, including organic, sugar-free, and flavored peanut butter, is attracting a wider consumer base with diverse preferences. The expansion of supermarkets, convenience stores, and e-commerce channels is enhancing the ease of access to peanut butter, making it appealing to a more widespread audience. Food manufacturers are also innovating packaging and portion sizes to entice on-the-go consumers. The growing awareness among the masses about plant-based protein sources is further driving the demand for peanut butter, especially among vegetarians and wellness-oriented individuals. As people continue to prioritize convenience without compromising on nutrition, the market in Mexico is expected to witness sustained growth.

Growing domestic peanut production

The rising domestic peanut production is fueling the Mexico peanut butter market growth. With increased local cultivation, peanut processors can reduce dependency on imports, leading to lower production costs and more competitive pricing for people. According to the US Department of Agriculture, in 2024, the domestic production of peanuts in Mexico reached 85000 Tons. High peanut yield also allows manufacturers to maintain consistent quality, as locally grown peanuts can be sourced fresh and processed efficiently. Farmers are benefiting from government initiatives and improved agricultural techniques, leading to refined outputs and better-quality peanuts, which further support the industry. The availability of fresh peanuts encourages food manufacturers to innovate with new flavors, organic options, and healthier variations to cater to diverse consumer preferences. Additionally, higher domestic production strengthens supply chains and reduces potential disruptions. Local sourcing also aligns with the rising preference for homegrown and sustainably produced food items.

Mexico Peanut Butter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Smooth Peanut Butter

- Crunchy Peanut Butter

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smooth peanut butter, crunchy peanut butter, and others.

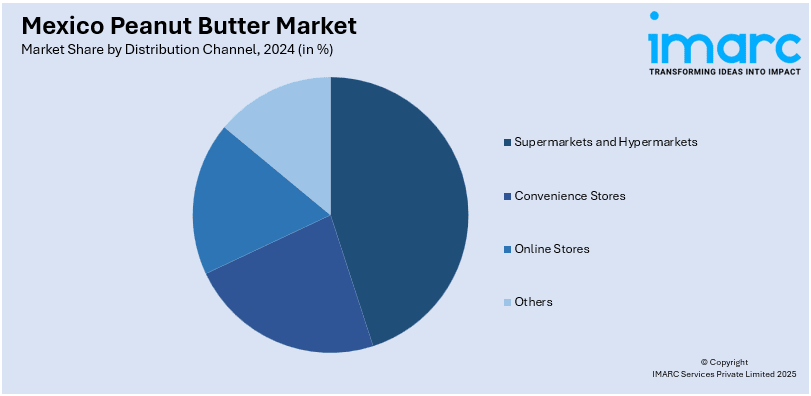

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Peanut Butter Market News:

- In May 2024: H-E-B's bakery announced that it began producing and offering peanut butter cakes for dogs in Mexico. The components of these cakes were banana, peanut butter, and whipped cream.

- In March 2024, Piermont Brands introduced Chica~Chida Peanut Butter Agave Spirit. This groundbreaking item, created in the core of Tequila, Mexico, combined the essence of espadin agave with allergen-free peanut butter extract, providing a smooth and vibrant shot experience that surpassed expectations.

Mexico Peanut Butter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smooth Peanut Butter, Crunchy Peanut Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico peanut butter market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico peanut butter market on the basis of product type?

- What is the breakup of the Mexico peanut butter market on the basis of distribution channel?

- What is the breakup of the Mexico peanut butter market on the basis of region?

- What are the various stages in the value chain of the Mexico peanut butter market?

- What are the key driving factors and challenges in the Mexico peanut butter?

- What is the structure of the Mexico peanut butter market and who are the key players?

- What is the degree of competition in the Mexico peanut butter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico peanut butter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico peanut butter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico peanut butter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)