Mexico Perfume Market Size, Share, Trends and Forecast by Perfume Type, Category, and Region, 2025-2033

Mexico Perfume Market Overview:

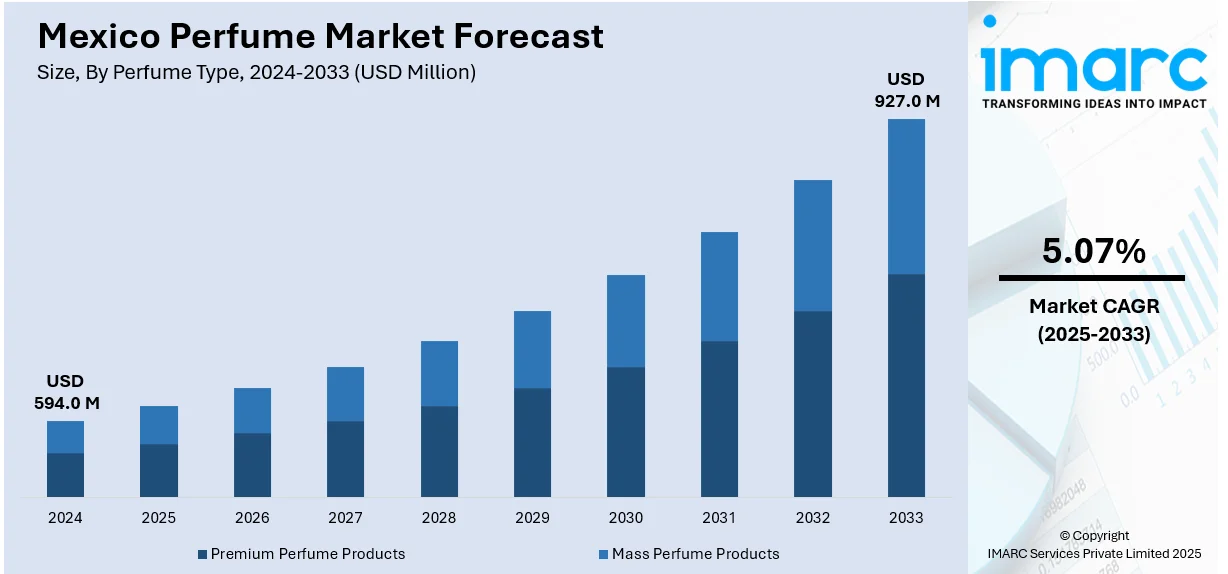

The Mexico perfume market size reached USD 594.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 927.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.07% during 2025-2033. The market outlook is driven by rising disposable incomes, increasing consumer preference for premium and culturally resonant fragrances, and the influence of social media on purchasing behavior. Additionally, growing e-commerce penetration and the emergence of local artisanal brands reflecting indigenous heritage are boosting market demand and product diversification.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 594.0 Million |

| Market Forecast in 2033 | USD 927.0 Million |

| Market Growth Rate 2025-2033 | 5.07% |

Mexico Perfume Market Trends:

Expansion of Luxury Perfume Market

Mexico's luxury perfume market is growing, fueled by an expanding middle and upper-middle class with increasing disposable incomes. Consumers are being drawn to prestige brands focusing on uniqueness, handcrafted quality, and custom fragrance profiles. International luxury players like Le Labo and niche perfumers are entering Mexico with region-specific products, such as city-launch only offerings like Coriandre 39 for Mexico City. Local high-end brands are also on the rise, producing products that merge conventional aspects with luxury designs. This change is due to a consumer market that prizes status, experience, and craftsmanship in perfume. Designers and retailers are taking advantage of this by improving in-store experiences and online branding to attract sophisticated, high-end Mexican customers.

Growth of E-commerce and Digital Engagement

Digital transformation is significantly reshaping the marketing and sales landscape of perfumes in Mexico, driven by growing internet access and smartphone usage further impelling the Mexico perfume market share. With e-commerce now reaching 70% penetration among adults and a market value of $97 billion in 2024, more consumers are shifting to online platforms to purchase fragrances. Advanced digital tools such as virtual scent profiling, along with user-generated reviews and influencer endorsements, are playing a vital role in influencing consumer choices. Social media platforms like Instagram and TikTok have become powerful channels for enhancing brand visibility, particularly among younger demographics. Fragrance brands are actively leveraging influencer partnerships, livestream product launches, and targeted digital campaigns to drive engagement and sales. This digital shift expands accessibility across urban and rural areas and allows niche and independent brands to reach consumers without physical retail spaces. As a result, digital engagement has become a critical strategy for both established and emerging players in Mexico’s perfume market.

Embrace of Indigenous Scents and Cultural Heritage

Perfume brand in Mexico is increasingly drawing inspiration from native botanicals and cultural traditions to craft unique, locally resonant fragrances. This trend is part of a broader appreciation for heritage and authenticity. Brands like House of Bō and Xinú highlight indigenous ingredients such as copal, agave, and native florals in their formulations. They often incorporate artisan-crafted packaging, like sculpted stone bottle caps, which reflects Mexican craftsmanship. Consumers, especially the younger demographic, are seeking fragrances that tell a story and express identity. By fusing modern perfumery techniques with ancestral elements, these brands are positioning themselves both locally and globally as distinctive, culturally-rooted alternatives to mainstream fragrances, contributing to a more diversified and meaningful Mexico perfume market growth.

Mexico Perfume Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on perfume type and category.

Perfume Type Insights:

- Premium Perfume Products

- Mass Perfume Products

The report has provided a detailed breakup and analysis of the market based on the perfume type. This includes premium perfume products and mass perfume products.

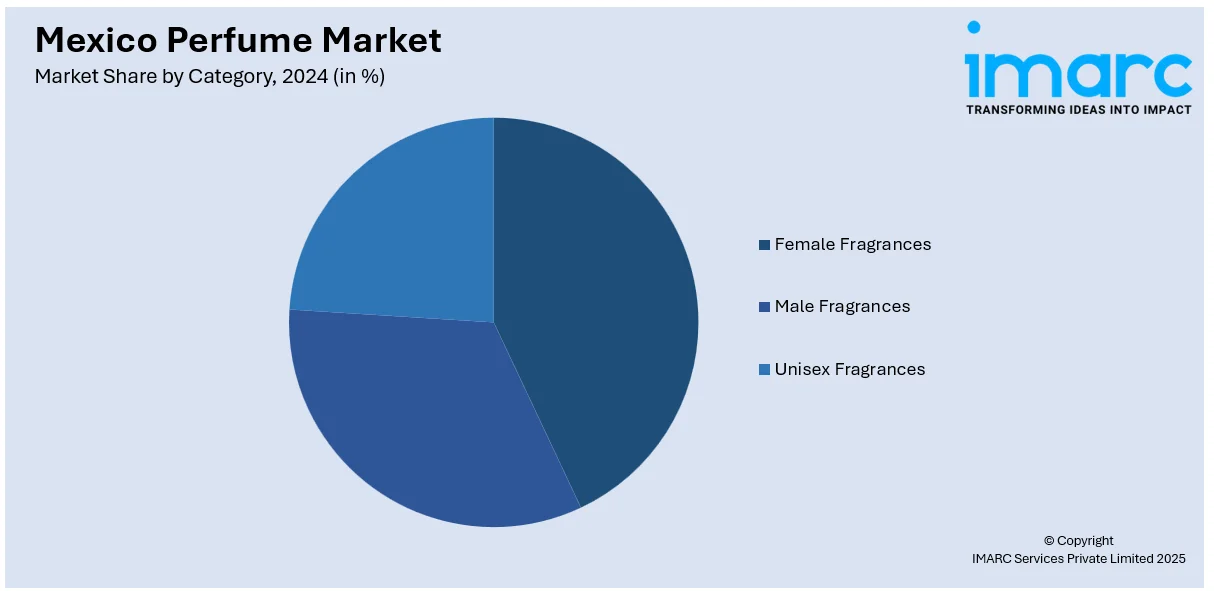

Category Insights:

- Female Fragrances

- Male Fragrances

- Unisex Fragrances

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes female fragrances, male fragrances, and unisex fragrances.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Perfume Market News:

- In November 2024, Givaudan expanded its production facility in Pedro Escobedo, Mexico, as part of its 2025 strategy to strengthen its position in Latin America. The expansion doubles its encapsulation technology production capacity, now accounting for 40% of Givaudan’s global output in this area. This move supports rising regional and global demand, reinforcing Givaudan’s leadership in the fragrance and beauty market while advancing its growth strategy with purpose.

Mexico Perfume Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Perfume Types Covered | Premium Perfume Products, Mass Perfume Products |

| Categories Covered | Female Fragrances, Male Fragrances, Unisex Fragrances |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico perfume market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico perfume market on the basis of perfume type?

- What is the breakup of the Mexico perfume market on the basis of category?

- What is the breakup of the Mexico perfume market on the basis of region?

- What are the various stages in the value chain of the Mexico perfume market?

- What are the key driving factors and challenges in the Mexico perfume market?

- What is the structure of the Mexico perfume market and who are the key players?

- What is the degree of competition in the Mexico perfume market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico perfume market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico perfume market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico perfume industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)