Mexico Personal Cloud Market Size, Share, Trends and Forecast by Revenue Type, Hosting Type, End User, and Region, 2026-2034

Mexico Personal Cloud Market Summary:

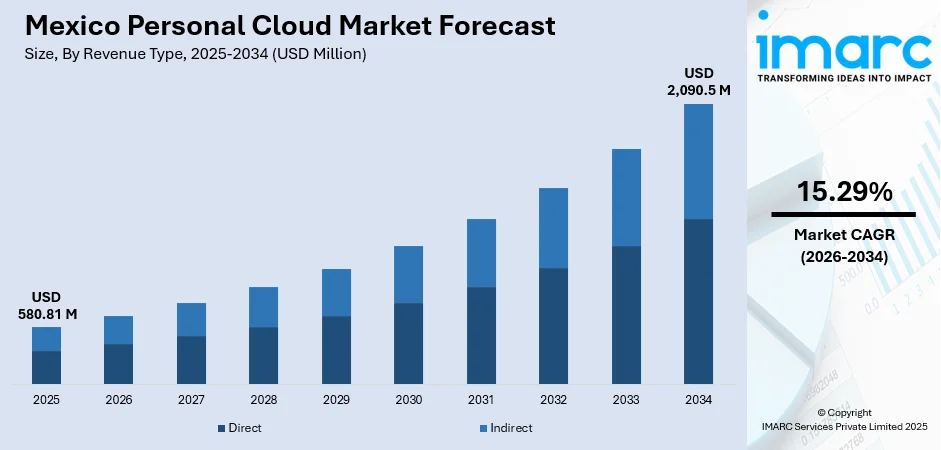

The Mexico personal cloud market size was valued at USD 580.81 Million in 2025 and is projected to reach USD 2,090.5 Million by 2034, growing at a compound annual growth rate of 15.29% from 2026-2034.

The Mexico personal cloud market is experiencing robust expansion, driven by accelerating digital transformation initiatives across consumer and enterprise segments. Rising smartphone penetration and the growing internet connectivity are creating unprecedented demand for accessible data storage solutions. The proliferation of remote work models and bring-your-own-device policies is reshaping how individuals and organizations manage personal data assets. Enhanced cybersecurity awareness and data protection requirements are encouraging users to adopt secure cloud-based storage alternatives, strengthening Mexico personal cloud market share.

Key Takeaways and Insights:

- By Revenue Type: Direct dominates the market with a share of 62% in 2025, owing to consumer preferences for subscription-based models that offer predictable pricing, enhanced feature sets, and seamless integration with existing digital ecosystems.

- By Hosting Type: Service providers lead the market with a share of 75% in 2025, driven by their ability to deliver scalable infrastructure, professional maintenance services, and enterprise-grade security protocols that individual consumers cannot replicate independently.

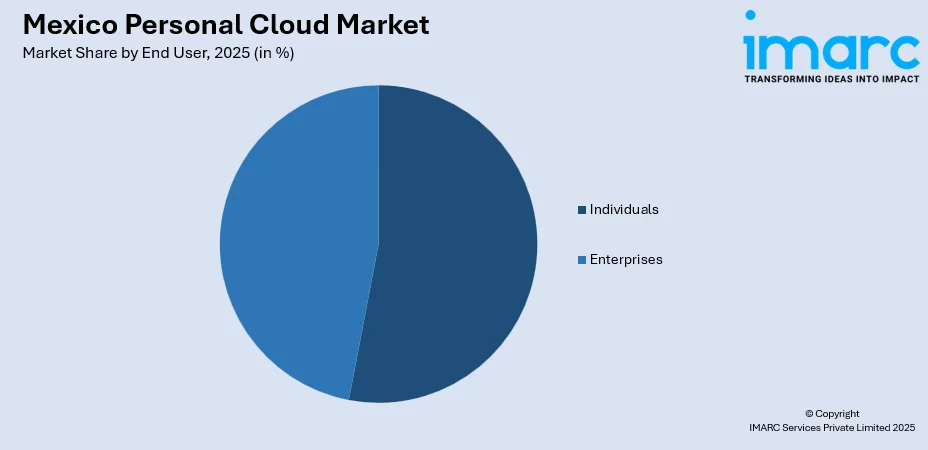

- By End User: Individuals represent the largest segment with a market share of 53% in 2025, reflecting widespread adoption among tech-savvy consumers seeking convenient solutions for storing photos, documents, and multimedia content across multiple devices.

- Key Players: Leading market participants are intensifying competition through expanded storage offerings, enhanced collaboration features, and integration of artificial intelligence (AI) capabilities. Strategic investments in local data center infrastructure, competitive pricing strategies, and partnerships with telecommunications providers are enabling market leaders to strengthen their positions across Mexico's personal cloud landscape.

To get more information on this market Request Sample

The Mexico personal cloud market is advancing, as digital infrastructure investments reshape the national technology landscape. Major hyperscale providers are establishing cloud regions within the country to deliver low-latency services and meet data residency requirements. In December 2024, Google Cloud inaugurated its Querétaro, projected to contribute over USD 11 Billion to Mexico's GDP and create 100,000 jobs by 2030. Consumer adoption is accelerating, as smartphone penetration is increasing, driving the demand for seamless data synchronization across devices. Enterprise mobility trends and flexible work arrangements are encouraging organizations to support personal cloud solutions that enable productivity beyond traditional office environments. Government initiatives promoting digital transformation are creating favorable conditions for market expansion, while enhanced cybersecurity frameworks are building consumer confidence in cloud-based storage alternatives.

Mexico Personal Cloud Market Trends:

Hyperscale Data Center Expansion Across Strategic Regions

Mexico is witnessing unprecedented data center investments from global technology giants establishing cloud regions to serve domestic and regional markets. Querétaro has emerged as the epicenter of this transformation, holding 65% of the country's installed capacity and drawing in hyperscale initiatives from top suppliers. The establishment of multiple availability zones enables personal cloud services to deliver enhanced reliability and reduced latency for end users. This infrastructure buildout is democratizing access to enterprise-grade storage capabilities for individual consumers and small businesses.

Integration of AI in Personal Cloud Services

Personal cloud providers are embedding AI capabilities to enhance user experiences through intelligent organization, automated tagging, and predictive content management. Machine learning (ML) algorithms are enabling advanced search functionalities that help users locate specific files across vast storage libraries instantly. As per IMARC Group, the Mexico ML market size reached USD 465.0 Million in 2024. AI-powered security features are strengthening threat detection and protecting personal data against unauthorized access. These technological advancements are differentiating premium service tiers and driving Mexico personal cloud market growth.

Rising Emphasis on Data Privacy and Security Compliance

Heightened awareness about data protection requirements is influencing consumer preferences towards personal cloud solutions offering robust privacy controls and encryption standards. Mexico's new Federal Law on Protection of Personal Data, effective March 2025, is establishing stringent requirements for personal data handling that impact cloud service delivery. Enhanced transparency regarding data storage locations and processing practices is becoming a competitive differentiator. Providers implementing advanced security measures and compliance certifications are gaining consumer trust and market positioning.

Market Outlook 2026-2034:

The Mexico personal cloud market is positioned for sustained expansion, as digital adoption accelerates across demographic segments and use cases multiply. Increasing data generation from smartphones, connected devices, and digital applications is creating persistent demand for scalable storage solutions. The market generated a revenue of USD 580.81 Million in 2025 and is projected to reach a revenue of USD 2,090.5 Million by 2034, growing at a compound annual growth rate of 15.29% from 2026-2034. Continued infrastructure investments, evolving consumer expectations, and enterprise adoption are expected to sustain growth momentum throughout the forecast period.

Mexico Personal Cloud Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Revenue Type | Direct | 62% |

| Hosting Type | Service Providers | 75% |

| End User | Individuals | 33% |

Revenue Type Insights:

- Direct

- Indirect

Direct dominates with a market share of 62% of the total Mexico personal cloud market in 2025.

The direct revenue segment encompasses subscription-based services where consumers purchase storage plans directly from cloud providers through digital platforms and mobile applications. This model offers transparent pricing structures, flexible upgrade paths, and seamless account management that appeals to Mexican consumers seeking straightforward solutions. In January 2025, Amazon Web Services, the cloud services arm of Amazon, announced a USD 5 Billion investment over 15 years to establish a new digital region in Querétaro, significantly expanding direct service accessibility for personal cloud users across Mexico.

Direct revenue models enable providers to maintain closer relationships with end users, facilitating personalized service delivery and rapid feature deployment. Consumer preference for subscription transparency and control over storage allocations continues strengthening this segment's market leadership. The elimination of intermediary costs allows competitive pricing that drives adoption among price-sensitive individual users. Enhanced customer support channels and integrated ecosystem benefits further reinforce the direct revenue model's dominance within the market.

Hosting Type Insights:

- Service Providers

- Consumers

Service providers lead with a share of 75% of the total Mexico personal cloud market in 2025.

Service provider-hosted personal cloud solutions offer consumers access to enterprise-grade infrastructure without requiring technical expertise or capital investment in hardware. These platforms deliver automatic backup functionality, cross-device synchronization, and collaborative sharing capabilities that define modern personal cloud experiences.

The service provider segment benefits from economies of scale that enable competitive pricing while delivering superior reliability and security compared to consumer-managed alternatives. Professional maintenance, continuous software updates, and redundant data storage across multiple facilities provide peace of mind for users storing valuable personal content. Integration with productivity applications, social platforms, and device ecosystems creates compelling value propositions that sustain service provider dominance. Mobile-first user behaviors continue to drive preference for professionally managed cloud storage solutions.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individuals

- Enterprises

Individuals exhibit a clear dominance with a 53% share of the total Mexico personal cloud market in 2025.

Individual consumers constitute the foundational user base for personal cloud services in Mexico, leveraging storage solutions for photographs, videos, documents, and digital memories. The proliferation of high-resolution smartphone cameras has dramatically increased personal data generation, creating continuous demand for expanded storage capacity. According to 2024 ENDUTIH, smartphone usage among Mexican internet users reached 97.2%, with average daily internet consumption exceeding 4.4 hours, generating substantial personal data requiring cloud storage solutions.

Individual users increasingly value seamless multi-device access that enables content consumption and creation across smartphones, tablets, and personal computers. Freemium models have effectively introduced millions of Mexican consumers to personal cloud benefits, with conversion to premium tiers following as storage requirements expand. Social sharing features and collaborative capabilities are enhancing personal cloud utility beyond simple storage. The growing digital lifestyle adoption among younger demographics is establishing long-term usage patterns that sustain individual segment leadership.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico benefits from strong economic activity and proximity to United States markets, driving technology adoption and personal cloud usage among digitally connected populations. Industrial centers in Monterrey and border cities demonstrate elevated smartphone penetration and digital service consumption. Central Mexico anchors market activity through concentration of population and economic activity in the Mexico City metropolitan area, where internet penetration is high.

Central Mexico hosts major business hubs, universities, and technology-savvy users who rely heavily on cloud storage for work, education, and personal data management. Higher smartphone penetration, along with growing remote work and online learning adoption, drives consistent demand. Strong presence of service providers and better network reliability further reinforce Central Mexico’s market leadership.

Southern Mexico presents emerging growth opportunities, as digital infrastructure investments expand connectivity to underserved regions. States, including Chiapas, Oaxaca, and Guerrero, demonstrate increasing internet adoption that creates new addressable markets for personal cloud services. Government digital inclusion initiatives are accelerating connectivity improvements that support market expansion across all regions. The geographic distribution of data center investments is enhancing service quality nationwide while supporting data residency preferences.

Market Dynamics:

Growth Drivers:

Why is the Mexico Personal Cloud Market Growing?

Accelerating Smartphone Penetration and Mobile Data Generation

The proliferation of smartphones across Mexican demographics is fundamentally reshaping personal data generation patterns and storage requirements. High-resolution cameras, video recording capabilities, and multimedia applications are creating exponential growth in personal content that exceeds device storage limitations. Automatic photo backup features integrated into operating systems are introducing millions of users to cloud storage benefits organically. Mexico's internet user base reached 107.3 Million in January 2024, representing 83.2% population penetration that provides substantial addressable market for personal cloud services. The average Mexican internet user spends significant daily hours engaged with digital content and applications, generating continuous data streams requiring persistent storage solutions. Mobile-first user behaviors are driving preference for cloud solutions that enable seamless content access across multiple devices and locations.

Enterprise Mobility and Remote Work Adoption

The transformation of workplace models, following global shifts towards remote and hybrid arrangements, has elevated personal cloud importance for productivity and collaboration. As per the IPSOS study conducted in 2024, based on 2,400 employees across 4 Latin American countries including Mexico, 57% of participants indicated a wish to reduce their office hours, highlighting a demand for greater flexibility. Bring-your-own-device policies are blurring boundaries between personal and professional data management, increasing individual reliance on cloud storage solutions. Organizations are increasingly supporting employee use of personal cloud services for document access and file sharing across distributed work environments. This convergence of personal and professional needs is expanding use cases and driving premium tier adoption among working professionals. Cloud-based collaboration features enable seamless document sharing and joint editing that support modern work requirements. The normalization of flexible work arrangements is establishing persistent demand patterns that sustain market growth beyond temporary circumstances.

Broadening of Data Centers

The broadening of data centers is driving the market expansion by improving storage capacity, service reliability, and data access speeds for individual users. Expansion of local data center infrastructure reduces latency and enhances performance, making personal cloud services more responsive and convenient for everyday use. Greater data localization also builds user trust by improving data security, backup reliability, and service continuity. As providers scale facilities, they can offer affordable storage plans, seamless synchronization across devices, and advanced features such as automatic backups and file sharing. Data center growth also supports rising smartphone usage, digital content creation, and remote work needs. As per IMARC Group, the Mexico digital content creation market size reached USD 312.59 Million in 2025. With stronger infrastructure in place, personal cloud services become more accessible, scalable, and dependable, encouraging wider adoption among consumers across urban and semi-urban regions in Mexico.

Market Restraints:

What Challenges the Mexico Personal Cloud Market is Facing?

Digital Divide and Connectivity Disparities

Significant disparities in internet infrastructure quality and availability across Mexican regions limit personal cloud adoption in underserved areas. Rural communities and economically disadvantaged populations face connectivity challenges that impede cloud service accessibility. Broadband speed limitations in certain regions impact user experiences with data-intensive cloud applications, potentially discouraging adoption.

Price Sensitivity Among Consumer Segments

Economic constraints influence willingness to pay for premium cloud storage services among price-conscious Mexican consumers. Competition from free tier offerings creates challenges for monetization as users resist upgrading to paid subscriptions. The availability of alternative local storage options including external drives provides lower-cost alternatives for budget-constrained users.

Data Security and Privacy Concerns

The growing awareness about data breaches and unauthorized access incidents creates hesitation among potential users considering cloud storage adoption. Concerns regarding data sovereignty and storage location transparency influence consumer trust in international service providers. Evolving regulatory requirements add complexity to compliance obligations that impact service delivery and user confidence.

Competitive Landscape:

The Mexico personal cloud market features intense competition among global technology giants and regional providers seeking to capture the growing consumer demand. Market leaders are differentiating through expanded storage allocations, enhanced security features, and integration with broader digital ecosystems. Strategic partnerships with telecommunications providers are enabling bundled offerings that expand market reach. Competitive pricing strategies and promotional campaigns are driving user acquisition while premium feature sets target conversion to paid tiers. Investments in AI capabilities and collaborative tools are reshaping competitive dynamics. Local infrastructure presence is becoming increasingly important for service quality and regulatory compliance, influencing market positioning strategies.

Recent Developments:

- In November 2025, Santander México finalized a complete migration by transferring its whole technological infrastructure to its cloud platform, Gravity. The migration intended to improve customer satisfaction by providing quicker processes and innovative digital features.

Mexico Personal Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Types Covered | Direct, Indirect |

| Hosting Types Covered | Service Providers, Consumers |

| End Users Covered | Individuals, Enterprises |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico personal cloud market size was valued at USD 580.81 Million in 2025.

The Mexico personal cloud market is expected to grow at a compound annual growth rate of 15.29% from 2026-2034 to reach USD 2,090.5 Million by 2034.

Service providers dominated the market with a share of 75%, driven by their ability to deliver scalable infrastructure, professional maintenance services, and enterprise-grade security protocols.

Key factors driving the Mexico personal cloud market include accelerating smartphone penetration, enterprise mobility adoption, strategic infrastructure investments by global technology providers, rising data generation, and growing emphasis on data security and privacy compliance.

Major challenges include digital divide and connectivity disparities across regions, price sensitivity among consumer segments, data security and privacy concerns, limited awareness in rural areas, and competition from alternative local storage solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)