Mexico Personal Finance Software Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Mexico Personal Finance Software Market Overview:

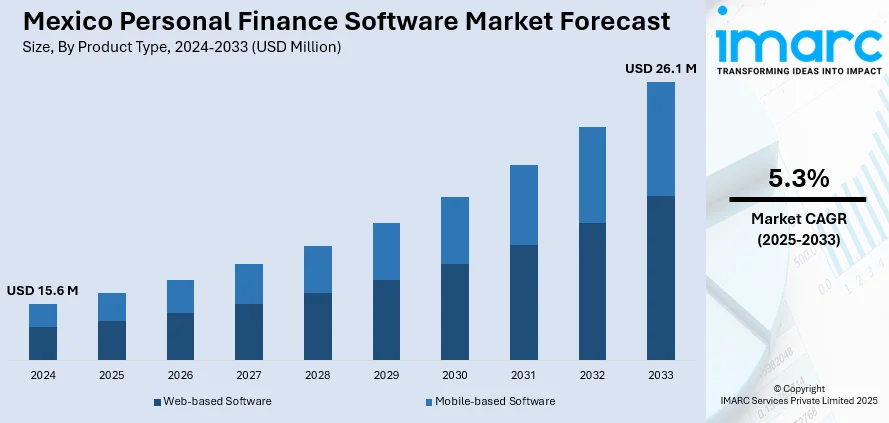

The Mexico personal finance software market size reached USD 15.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 26.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033. The market share is expanding, driven by the rising Internet access, which is encouraging more people to turn to digital tools, along with the ongoing efforts by app developers to improve features based on local needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.6 Million |

| Market Forecast in 2033 | USD 26.1 Million |

| Market Growth Rate 2025-2033 | 5.3% |

Mexico Personal Finance Software Market Trends:

Low banking penetration

The low banking penetration is offering a favorable Mexico personal finance software market outlook. A large part of the population in the country does not use traditional banking services, which creates a gap in financial management and access. The World Bank reported that 51% of the Mexican population did not have a bank account in 2024. People are looking for easier and more flexible ways to handle their money without relying on banks. This is where personal finance software steps in. These tools help users track their income, manage expenses, set savings goals, and plan for future needs. For many, it is a simple way to gain control over their finances without needing a bank account. As Internet access is spreading, more people are turning to digital tools to fill that gap. Personal finance apps also aid in building financial literacy by offering insights and tips on budgeting and saving. This appeals especially to younger generations who prefer digital-first solutions. Moreover, with cash still widely utilized in many areas, people need tools that can assist them in monitoring spending manually or through web transactions. As trust in traditional banking remains low for some, software offers an alternative that feels more personal and accessible. Overall, low banking penetration encourages the adoption of tech-based financial solutions, helping the personal finance software market grow steadily across Mexico.

Rising smartphone usage

The increasing utilization of smartphones is fueling the Mexico personal finance software market growth. As per industry reports, in 2024, 61.5% of the population in Mexico accessed smartphones, equating to 78.37 Million individuals. As more people are relying on smartphones, managing money has become easier and more convenient through apps. These devices allow people to track spending, set budgets, check balances, and plan savings anytime and anywhere. For many, especially younger generations, smartphones are the main tool for daily tasks, including financial ones. With user-friendly designs and features, personal finance apps attract people who may not be familiar with traditional banking or finance tools. Increased mobile connectivity also supports this trend, making financial services more accessible in remote or underserved areas. People enjoy the control and real-time updates that finance apps offer, and this builds confidence in managing their money. App developers continue to refine features based on local needs, such as support for cash tracking or bilingual options. As smartphone adoption keeps rising, the demand for digital tools is increasing, helping the personal finance software market expand steadily across the country.

Mexico Personal Finance Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Web-based Software

- Mobile-based Software

The report has provided a detailed breakup and analysis of the market based on the product type. This includes web-based software and mobile-based software.

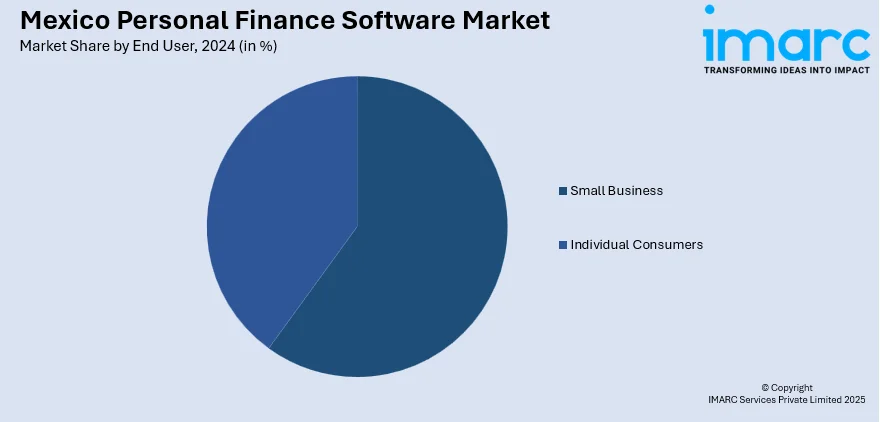

End User Insights:

- Small Business

- Individual Consumers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small business and individual consumers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Personal Finance Software Market News:

- In November 2024, Santander began launching its digital Openbank in Mexico, featuring a website and a mobile application. It introduced a new digital choice for Santander, which provided app-oriented financial services. Clients who were registered for the waiting list were the first to access Openbank.

- In March 2024, Creo Solutions, a prominent Mexican fintech firm, introduced Booya, a novel online lending platform aimed at assisting the nation's underbanked individuals. It sought to improve financial inclusion by offering quick, accessible, and adaptable credit options. It aimed to provide personal loans with micro installments for durations of up to 12 months, with amounts varying from 300 to 30,000 pesos per credit. The company also intended to broaden its services by adding ‘Buy Now, Pay Later (BNPL)’ solutions, thereby enhancing accessibility to digital financial resources.

Mexico Personal Finance Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Web-based Software, Mobile-based Software |

| End Users Covered | Small Business, Individual Consumers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico personal finance software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico personal finance software market on the basis of product type?

- What is the breakup of the Mexico personal finance software market on the basis of end user?

- What is the breakup of the Mexico personal finance software market on the basis of region?

- What are the various stages in the value chain of the Mexico personal finance software market?

- What are the key driving factors and challenges in the Mexico personal finance software market?

- What is the structure of the Mexico personal finance software market and who are the key players?

- What is the degree of competition in the Mexico personal finance software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico personal finance software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico personal finance software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico personal finance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)