Mexico Personal Hygiene Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Mexico Personal Hygiene Market Overview:

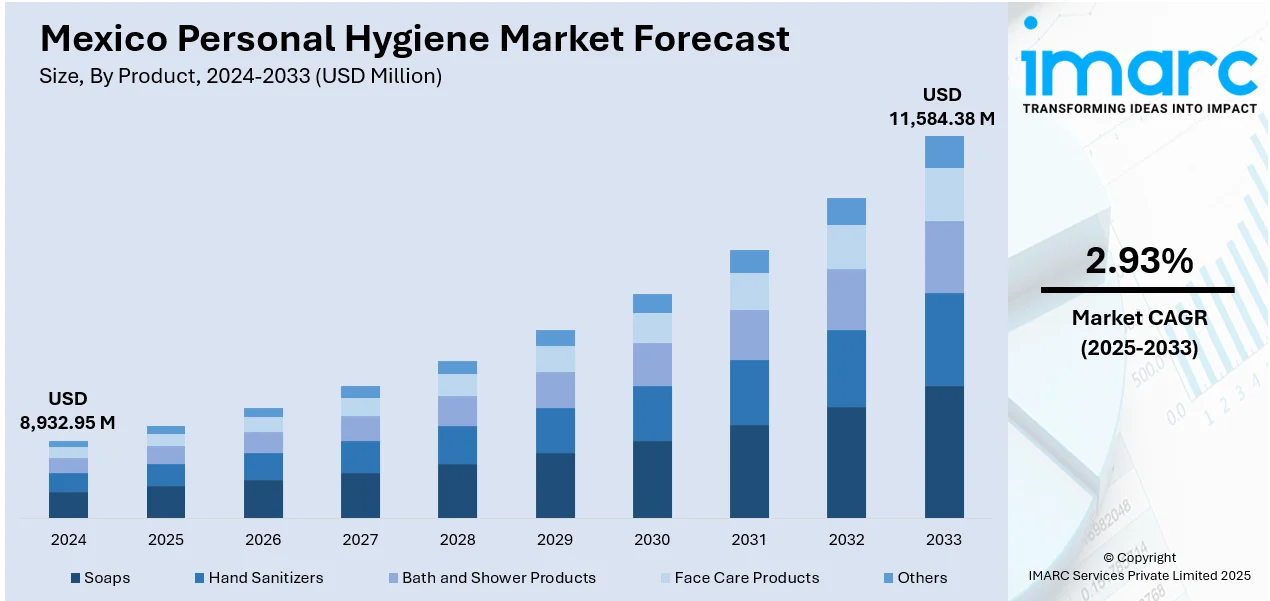

The Mexico personal hygiene market size reached USD 8,932.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,584.38 Million by 2033, exhibiting a growth rate (CAGR) of 2.93% during 2025-2033. The market is driven by rising consumer preference for natural and organic hygiene products, supported by rising health awareness and demand for sustainable, chemical-free alternatives, prompting brands to innovate with eco-friendly formulations. Additionally, the expansion of men’s grooming products is broadening the market’s consumer base and premiumization potential. Growing disposable incomes and e-commerce accessibility further amplify demand, further augmenting the Mexico personal hygiene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,932.95 Million |

| Market Forecast in 2033 | USD 11,584.38 Million |

| Market Growth Rate 2025-2033 | 2.93% |

Mexico Personal Hygiene Market Trends:

Escalating Demand for Natural and Organic Personal Hygiene Products

The market is undergoing a significant transition towards natural and organic products, propelled by a growing consumer consciousness regarding health and environmental issues. Mexico's organic market in 2023 saw a significant increase. Supported by the Mexican government, the organic industry is expected to continue growing in response to accelerating demand for sustainable practices. Such shifts in consumer behavior are contributing to the higher inclusion of organic goods within the mass market. Consumers are becoming more cautious about synthetic ingredients, parabens, and sulfates, leading to a rise in demand for plant-based, biodegradable, and cruelty-free alternatives. Brands are responding by reformulating products with organic aloe vera, coconut oil, and essential oils while emphasizing sustainability in packaging. Additionally, government regulations and certifications, such as COSMOS Organic and ECO-CERT, are gaining importance, helping consumers identify genuine natural products. E-commerce platforms and health-focused retailers are expanding their natural hygiene product offerings, making them more accessible. This trend is particularly strong among millennials and Gen Z consumers, who prioritize ethical consumption. As a result, both local and international brands are investing in eco-friendly innovations to capture this growing segment, further propelling the Mexico personal hygiene market growth.

To get more information on this market, Request Sample

Increasing Focus on Men’s Grooming and Premium Hygiene Products

The men’s grooming segment in Mexico is expanding rapidly, fueled by changing gender norms and rising male interest in self-care. Traditionally, the personal hygiene market catered primarily to women, but brands are now launching specialized products for men, including beard care, facial cleansers, and premium deodorants. Social media and influencer marketing have played a crucial role in normalizing male grooming routines, driving demand for high-quality, gender-specific hygiene solutions. In Mexico, 66% of shoppers have made influenced purchases based on recommendations from influencers, and 64% prefer influencer content compared to traditional advertisements. The shopping trend via social media is growing, as 51% of Mexicans utilize the shopping functionalities provided on these platforms, specifically among young buyers aged 18-29, who are 2.3 times more likely to make purchases via social media than their US counterparts. These trends indicate the growing importance of influencer marketing in shaping consumer buying behavior, particularly in the hygiene products sector. Furthermore, urban professionals are increasingly opting for premium and imported hygiene products, such as luxury soaps, exfoliating scrubs, and fragrance-based body washes. This trend aligns with inflating disposable income levels and a rising middle class seeking sophisticated personal care experiences. Multinational companies are capitalizing on this shift by introducing premium men’s lines, while local brands are enhancing product formulations to compete. As male grooming becomes mainstream, retailers are dedicating more shelf space to these products, indicating sustained growth in this segment.

Mexico Personal Hygiene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Soaps

- Hand Sanitizers

- Bath and Shower Products

- Face Care Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes soaps, hand sanitizers, bath and shower products, face care products, and others.

Gender Insights:

- Unisex

- Male

- Female

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes unisex, male, and female.

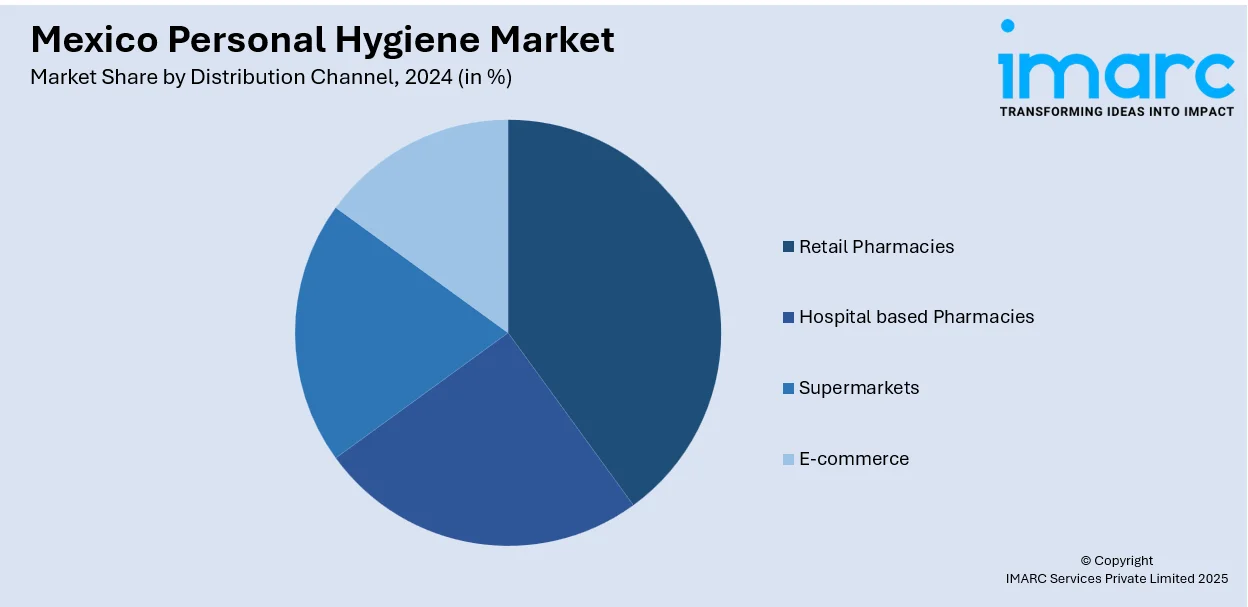

Distribution Channel Insights:

- Retail Pharmacies

- Hospital based Pharmacies

- Supermarkets

- E-commerce

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies, hospital based pharmacies, supermarkets, and e-commerce.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Personal Hygiene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Soaps, Hand Sanitizers, Bath and Shower Products, Face Care Products, Others |

| Genders Covered | Unisex, Male, Female |

| Distribution Channels Covered | Retail Pharmacies, Hospital based Pharmacies, Supermarkets, E-commerce |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico personal hygiene market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico personal hygiene market on the basis of product?

- What is the breakup of the Mexico personal hygiene market on the basis of gender?

- What is the breakup of the Mexico personal hygiene market on the basis of distribution channel?

- What is the breakup of the Mexico personal hygiene market on the basis of region?

- What are the various stages in the value chain of the Mexico personal hygiene market?

- What are the key driving factors and challenges in the Mexico personal hygiene market?

- What is the structure of the Mexico personal hygiene market and who are the key players?

- What is the degree of competition in the Mexico personal hygiene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico personal hygiene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico personal hygiene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico personal hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)