Mexico Personal Protective Equipment Market Size, Share, Trends and Forecast by Equipment Type, End Use Industry, and Region, 2025-2033

Mexico Personal Protective Equipment Market Overview:

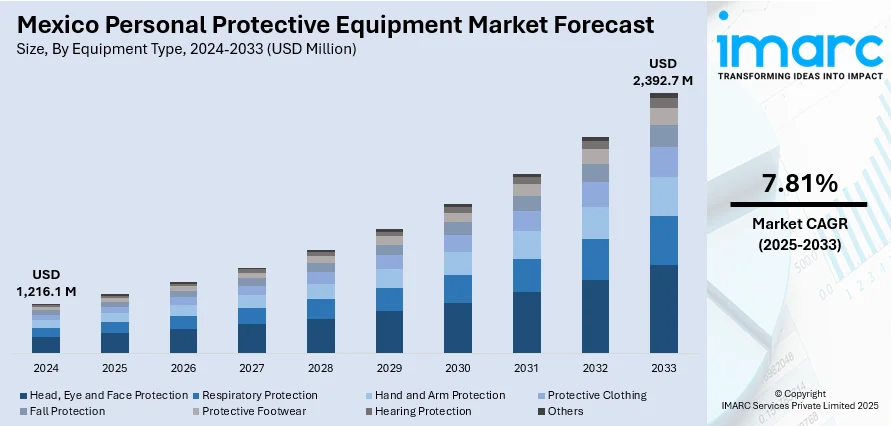

The Mexico personal protective equipment market size reached USD 1,216.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,392.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.81% during 2025-2033. The market forecast indicates steady growth, boosted by rising safety legislation, medical investment, and manufacturing activity, with rising demand for high-quality, compliant equipment throughout construction, manufacturing, and medical industries nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,216.1 Million |

| Market Forecast in 2033 | USD 2,392.7 Million |

| Market Growth Rate 2025-2033 | 7.81% |

Mexico Personal Protective Equipment Market Trends:

Growing Emphasis on Workplace Safety Regulations

Mexico has seen a growing focus over the last few years on enhancing workplace safety standards in most sectors, such as manufacturing, mining, and construction. Regulators have increasingly moved towards adopting international safety standards, pushing for more rigorous compliance with occupational health and safety standards. For instance, in March 2025, Mexico issued NOM-017-STPS-2024 on requiring PPE standards for the selection, use, and maintenance of equipment such as masks, gloves, and shields to minimize workplace health hazards. Moreover, this has fueled demand for quality personal protective equipment (PPE), including helmets, gloves, safety goggles, and respiratory protection. The heightened concern for employee well-being and accident prevention has specifically accelerated in sectors where employees are exposed to physical, chemical, or biological risks. Additionally, the intensifying industrial presence of the country further drives the demand for strong safety procedures. The Mexico personal protective equipment market growth show steady progress, supported by growing investment in infrastructure and industry expansion. Consequently, local suppliers and manufacturers are also improving product compliance with design requirements and certification in order to offer a stable source of effective safety equipment to provide for the developing needs of both employers and authorities.

Increased Adoption of Technologically Advanced PPE

Technological integration is transforming the Mexico personal protective equipment market, with technological innovations that seek to enhance functionality while delivering greater comfort. Sophisticated materials providing greater durability, breathability, and ergonomic comfort are now becoming typical in contemporary PPE. Additionally, intelligent protective equipment that features sensors to track environmental dangers, biometric information, or present location is being introduced progressively across high-risk sectors. These technologies not only enhance safety results but also drive operational effectiveness by supporting preventive maintenance and responsive action to unsafe situations. This transition is in the larger national interest of digitalization and modernization of workplaces. This Mexico personal protective equipment market outlook aligns with this transformation, showing a demand for solutions integrating protection with real-time data and communications technologies. The trend is particularly evident in industries like oil and gas, aerospace, and logistics, where the complexities of operations require sophisticated safety systems and ongoing risk assessment.

Rising Demand from the Healthcare and Pharmaceutical Sector

Mexico's pharmaceutical and healthcare sectors have become key drivers of increasing demand for personal protective equipment consumption. With public and private investments in medical facilities, there has been a simultaneous need for high-quality PPE, including disposable gloves, face shields, surgical gowns, and respiratory protection equipment. This growth is not just due to recent public health occurrences but also because of the ongoing requirement for infection control and workplace safety in healthcare settings. Clinics, labs, and pharma units need regular PPE usage to uphold hygiene levels and protect patients and professionals alike. The Mexico personal protective equipment market share is facilitated by this consistent growth pattern underpinned by government policies aiming to enhance the accessibility and quality of healthcare. According to the sources, in April 2024, Ansell made its US$640 million purchase of Kimberly-Clark's Personal Protective Equipment business, adding to its worldwide PPE portfolio with Kimtech™ and KleenGuard™ branded gloves, clothing, and eyewear. Moreover, this trend highlights the continued adoption of best practices in biosafety and sterile operations, ensuring a consistent and reliable demand for personal protective equipment (PPE) within a sector that is critical to both national health and economic stability.

Mexico Personal Protective Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on equipment type and end use industry.

Equipment Type Insights:

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Protective Footwear

- Hearing Protection

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes head, eye and face protection, respiratory protection, hand and arm protection, protective clothing, fall protection, protective footwear, hearing protection, and others.

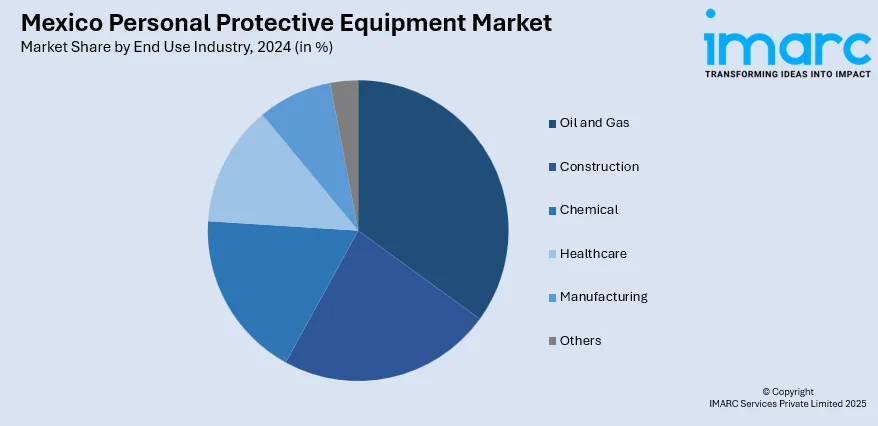

End Use Industry Insights:

- Oil and Gas

- Construction

- Chemical

- Healthcare

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, construction, chemical, healthcare, manufacturing, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Personal Protective Equipment Market News:

- In November 2024, Honeywell reported the sale of its Personal Protective Equipment business to Protective Industrial Products for $1.325 billion. The sale comprises a worldwide portfolio of industrial safety products, including protective gloves, helmets, goggles, and respiratory protection, strengthening PIP's position in the global PPE market.

- In March 2023, StorageTech successfully provided a large quantity of high-standard valves and safety gear to Mexico's Dos Bocas Refinery Project of PEMEX. Our products play a critical part in solving the energy crisis in Mexico, participating in the country's largest refinery project for oil.

Mexico Personal Protective Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Head, Eye and Face Protection, Respiratory Protection, Hand and Arm Protection, Protective Clothing, Fall Protection, Protective Footwear, Hearing Protection, Others |

| End Use Industries Covered | Oil and Gas, Construction, Chemical, Healthcare, Manufacturing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico personal protective equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico personal protective equipment market on the basis of equipment type?

- What is the breakup of the Mexico personal protective equipment market on the basis of end use industry?

- What is the breakup of the Mexico personal protective equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico personal protective equipment market?

- What are the key driving factors and challenges in the Mexico personal protective equipment?

- What is the structure of the Mexico personal protective equipment market and who are the key players?

- What is the degree of competition in the Mexico personal protective equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico personal protective equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico personal protective equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico personal protective equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)