Mexico Pet Care Products Market Size, Share, Trends and Forecast by Pet Type, Type, and Region, 2026-2034

Mexico Pet Care Products Market Size and Share:

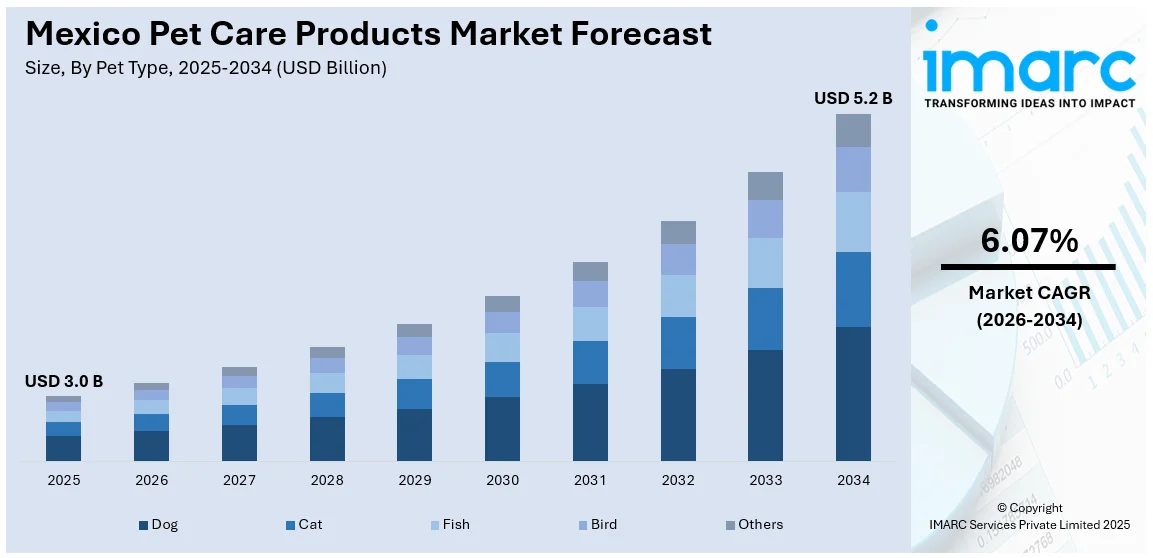

The Mexico pet care products market size was valued at USD 3.0 Billion in 2025. Looking forward, the market is expected to reach USD 5.2 Billion by 2034, exhibiting a CAGR of 6.07% during 2026-2034. The market is fueled by the pet humanization trend, with pets being treated as members of the family. Urbanization, increased disposable incomes, and rising pet health awareness are leading owners to invest in high-quality pet grooming, hygiene, and wellness products. Growth in organized retail and online shopping platforms has also increased the availability of pet care products across the country. With pet ownership continuing its growth trajectory, these factors combine to expand Mexico pet care products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.0 Billion |

| Market Forecast in 2034 | USD 5.2 Billion |

| Market Growth Rate 2026-2034 | 6.07% |

Mexico's fast urbanization and shifting lifestyles, which have raised pet adoption rates in major cities, are driving the industry. Pet owners are now able to spend more on high-end goods, such as specialist nutrition and grooming items, thanks to rising disposable income levels. Social media's effect has also been very important in teaching pet owners about healthy eating, correct care, and health management techniques. Additionally, the growing awareness about zoonotic diseases and preventive healthcare measures has accelerated demand for veterinary-grade products and supplements.

To get more information on this market Request Sample

The Mexico pet care products market growth is further supported by strategic investments from major international companies establishing local manufacturing facilities. The expansion of modern retail channels, including e-commerce platforms and specialty pet stores, has improved product accessibility across different income segments. Additionally, government programs that support animal care and responsible pet ownership have improved the regulatory climate. Tech-savvy customers are drawn to pet care goods that include technology, such as smart feeders and health monitoring equipment. Moreover, the increasing humanization of pets, where animals are considered family members, has elevated spending patterns on premium nutrition, healthcare, and comfort products.

Mexico Pet Care Products Market Trends:

Growth in Pet Food Manufacturing Capacity

The pet care products market in Mexico is seeing strong growth, fueled by major investments in local production. A recent expansion in pet food manufacturing in Silao is set to position the country as a key hub for pet food production in Latin America. The investment aims to increase the production capacity for both wet and dry pet food, ensuring better access to high-quality products across the region. This move also highlights Mexico's importance as a major market for pet care, with growing consumer demand for premium pet food options. The expansion supports increased market availability and creates new employment opportunities, strengthening local economies while enhancing overall production efficiency and regional market positioning. These factors are intensifying the Mexico pet care products market demand. For example, in May 2024, Nestlé Purina invested CHF 200 Million to expand its pet food plant in Silao, Mexico, making it the largest pet food facility in Latin America. This expansion adds lines for both wet and dry pet food. Mexico is Purina's largest market in the region, representing 45% of sales in Latin America. The expansion would create 94 new jobs and support Nestlé's growth strategy in the region while enhancing local operations.

Expansion of Innovative Pet Care Products

In Mexico, the market is expanding with the introduction of innovative pet solutions, reflecting the growing demand for advanced pet care technologies. New offerings, such as smart self-cleaning litter boxes, high-speed pet dryers, and grooming systems, are now available in both physical stores and online platforms. This expansion aligns with the country's increasing urbanization, changing lifestyles, and heightened awareness about pet health and wellness. Mexico is a highly urbanized country with nearly 80% of its population living in urban areas. The availability of these advanced products caters to a growing consumer base seeking convenience and quality care solutions for their pets. This shift toward high-tech, efficient pet care products is reshaping the market, providing consumers with smarter options to manage their pets' needs while enhancing the overall pet care experience in Mexico. For instance, in April 2025, Neakasa launched its pet care products in Mexico through a partnership with Liverpool, making its range available both in-store and online. The product lineup includes smart solutions like the M1 open-top self-cleaning cat litter box, pet grooming systems, and high-speed pet dryers. This expansion aligns as per the Mexico growing pet care market analysis, driven by increasing urbanization, evolving lifestyles, and a greater focus on pet health and wellness.

Mexico Pet Care Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Mexico pet care products market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on pet type and type.

Analysis by Pet Type:

- Dog

- Cat

- Fish

- Bird

- Others

Dogs lead the pet care market in Mexico, with the most significant number of pet ownership and pet food consumption. They are driven by demand for dry food, treats, premium nutrition, therapeutic diets, and accessories. Owners are increasingly investing in quality, wellness, and breed‑focused products. Growth is consistent, facilitated by increasing incomes, pet humanization, and growing retail/e‑commerce channels.

Cats constitute the second large segment, having higher growth than dogs in some sub‑markets (notably cities). The drivers are rising cat adoption, demand for premium cat food (wet, premium, functional) and associated items such as litter and odor control. Cats are more suitable in smaller living environments. Internet retailing and new retail formats are broadening availability of new cat care products.

Fish is a niche yet stable product within "others" in the Mexican pet care market. Their customer base is hobbyists or aquarium enthusiasts. Products are food (flakes, pellets), water treatment, tanks and accessories. Growth is slower than for dogs or cats yet incremental demand exists for quality and specialty products (e.g. ornamental fish, specialty food).

Birds are another small yet regular segment within the "other pets" space. Products emphasize seed formulas, cages and aviaries, perches, toys, and general health care. Bird owners want low-maintenance pets, so cost and convenience matter. Growth is slow; high-end and specialty bird products have limited yet increasing demand as pet owners become increasingly sophisticated.

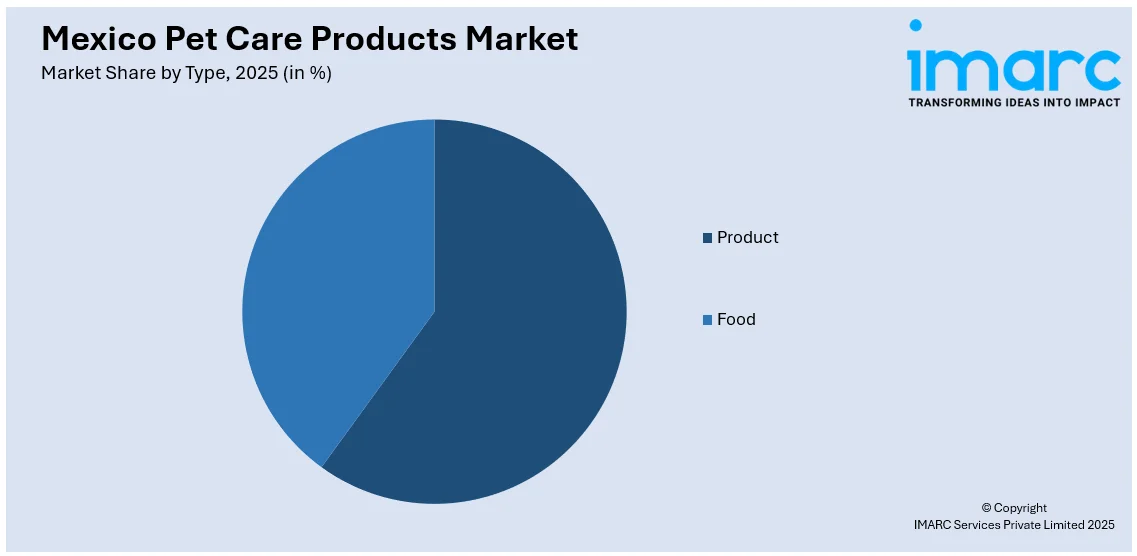

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Product

- Pet Litter

- Pet Grooming Products

- Fashion, Toys, and Accessories

- Food

- Dry Food

- Wet/Canned

- Treats/Snacks

Pet non-food products are a significant segment of Mexico's pet care industry. As per the Mexico pet care products market forecast, cat litter is becoming more necessary in urban home cat families; purchasers are concerned with odor control, disposal convenience, and environmental responsibility. Grooming products (shampoos, conditioners, brushes, etc.) are aided by growing pet humanization and attention to wellness and beauty. Fashion, accessories, and toys (leashes, beds, apparel, playthings) attract expressive owners and are prestige or gift purchases, expanding through e‑commerce and specialty channels.

Food is the center of Mexico's pet food market. Dry food leads by volume and value, enjoyed for its convenience, shelf life, and economy. Wet or canned food is a smaller yet premium niche, valued for palatability, moisture, and variety. Treats and snacks are high‑growing: used as rewards, training treats, or for special occasions. Healthier, functional and premium treat options are gaining popularity among responsible pet owners.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits robust growth in pet care as a result of increasing urbanization and disposable income. Border towns and industrial cities such as Monterrey and Tijuana underpin demand for premium pet goods. Trends are shaped by access to U.S. markets as well as imports. Here, consumers are more exposed to modern retail and online shopping, which drives more advanced adoption of specialist food, grooming, and accessories.

Central Mexico, which is Mexico City and neighboring states, is the biggest and most variegated pet care market. Its high population density and mixed levels of income sustain an extensive product range from economy to premium. Urban lifestyles enhance consumer demand for easy-to-use pet food, grooming, and hygiene products. Contemporary retail, veterinary clinics, and pet specialty stores are strongly clustered here, as observed through Mexico pet care products market trends.

Southern Mexico, though still emerging in pet care, is seeing steady expansion. Pet ownership is growing, though expenditure remains lower than in the north and center. Traditional markets are robust, though modern retail is growing slowly. There are opportunities in economy-priced pet food, simple grooming, and education about pet health. Regional development initiatives can spur growth in underserved regions.

Competitive Landscape:

The Mexico pet care market outlook is distinguished by a highly dynamic competitive landscape with both incumbent multinational giants and upstart local firms. The market dynamics demonstrate a mix of international industry titans, which take advantage of economies of scale, sophisticated research and development, and large distribution channels, and innovative local players that provide niche-oriented products targeted to domestic tastes and cultural requirements. Competition is strong through strategic acquisitions and mergers, with bigger players buying smaller, niche brands to diversify their product offerings and tap into niche market segments. Technological innovation is a major differentiator, with firms investing in product R&D, intelligent packaging technologies, and digital marketing initiatives to connect with tech-enabled consumers. Policies by the government for animal welfare and food safety standards are influencing competitive strategies so that companies need to spend on compliance mechanisms and quality systems. Strategic alliances between multinational brands and local distributors are prevalent, facilitating quicker market entry and better knowledge of regional consumer tastes while minimizing business risks and regulatory compliance.

The report provides a comprehensive analysis of the competitive landscape in the Mexico pet care products market with detailed profiles of all major companies.

Mexico Pet Care Products News:

- July 2025: Petco Mexico, a renowned provider of various pet care products, including pet food and accessories, announced that it has selected RELEX Solutions to improve its supply network operations, forecasting, and replenishment processes. RELEX's cutting-edge AI-powered technology will help Petco Mexico maximize inventory, enhance seasonal planning, and guarantee consistent availability of products.

- May 2025: Kimberly-Clark de Mexico announced the launch of two new pet food brands, one marketed for the premium segment and the other targeting the value category. This venture into the pet food industry is part of the company’s ongoing diversification strategies.

- May 2025: Petco México announced a major milestone of 100,000 successful pet adoptions since the launch of its “Primero Adopta” campaign in 2013. This achievement highlights a significant trend, as each adoption brings a new pet into the formal care system, driving demand for pet food and supplies. With over 20 Million stray dogs in Mexico, encouraging adoption supports animal welfare and expands the pet care market.

- April 2025: ADM opened its first wet pet food manufacturing facility in Yecapixtla, Morelos, Mexico. The USD 39 Million investment includes three production lines dedicated to the Ganador and Minino brands. ADM has been expanding its presence in Mexico's pet food market since 2008, with recent investments in production lines and a Macro Distribution Center, solidifying its position as a key player in the local pet food industry.

- February 2025: Hartz Mountain, in partnership with Petco Mexico, announced the launch of a new line of lickable cat treats for the Mexican market. With this launch, Hartz aims to further expand its footprint in Mexico.

Mexico Pet Care Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dog, Cat, Fish, Bird, Others |

| Types Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pet care products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pet care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pet care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Mexico pet care products market was valued at USD 3.0 Billion in 2025.

The Mexico pet care products market is projected to exhibit a CAGR of 6.07% during 2026-2034, reaching a value of USD 5.2 Billion by 2034.

Rising pet ownership rates, expanding pet wellness and health consciousness, rising urban disposable incomes, and the shift toward high-end, natural, and specialty products are the main factors propelling the industry. Additionally, urbanization, social media influence on pet care education, and the humanization of pets are further propelling market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)