Mexico Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2026-2034

Mexico Pet Food Market Summary:

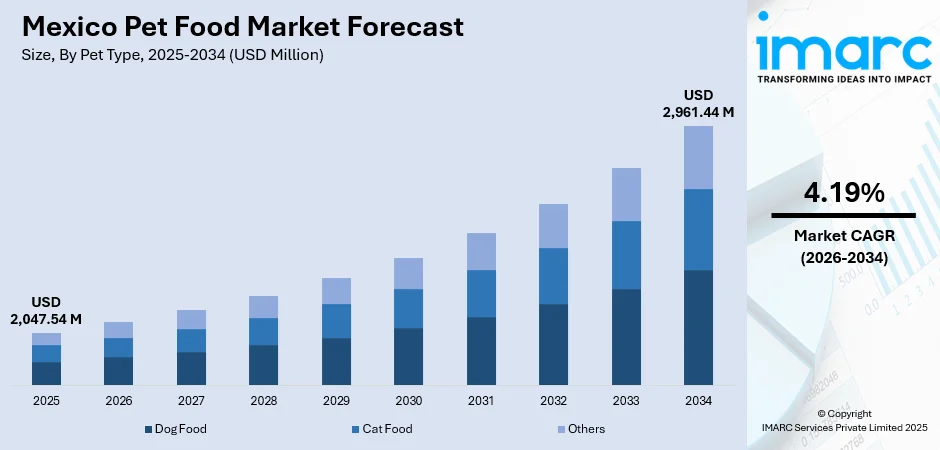

The Mexico pet food market size was valued at USD 2,047.54 Million in 2025 and is projected to reach USD 2,961.44 Million by 2034, growing at a compound annual growth rate of 4.19% from 2026-2034.

The expansion within the pet food industry in Mexico is increasing rapidly due to the growing trend of humanization of pets and rising disposable income among urban households. More and more, pet owners think of their companions as family, and therefore, their demand is shifting to quality and nutritionally balanced food. The growth is further supported by expanding retail infrastructure; diversified channels for product distribution; and lastly, evolution in consumer preferences toward health-focused nutrition for pets.

Key Takeaways and Insights:

- By Pet Type: Dog food dominates the market with a share of 42.05% in 2025, driven by the substantial canine population across Mexican households and the cultural preference for dogs as primary companion animals. The segment benefits from strong demand for both standard and premium formulations catering to diverse breed requirements and life stages.

- By Product Type: Dry pet food leads the market with a share of 57.12% in 2025, owing to its convenience, extended shelf life, and cost-effectiveness compared to wet alternatives. Mexican consumers favor kibble formats for their practicality in storage and serving, while manufacturers continue innovating with enhanced nutritional profiles and functional ingredients.

- By Pricing Type: Mass products dominate the market with a share of 69.9% in 2025, reflecting the price sensitivity of a significant portion of Mexican consumers seeking affordable nutrition for their pets. These value-oriented offerings maintain strong penetration across traditional retail channels and serve the broad base of middle-income pet owners.

- By Ingredient Type: Animal derived leads the market with a share of 64.89% in 2025, as pet owners recognize the importance of protein-rich diets for their companions. The preference stems from established nutritional science supporting meat-based formulations for optimal pet health, muscle development, and overall vitality.

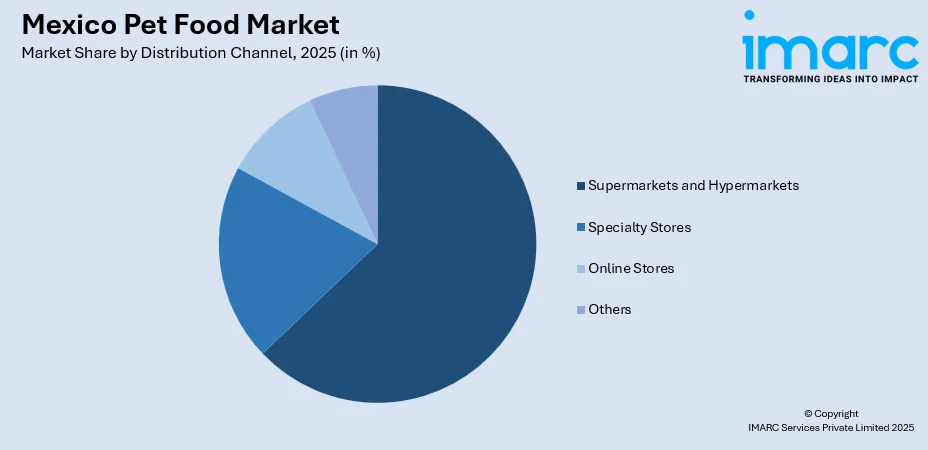

- By Distribution Channel: Supermarkets and hypermarkets dominate the market with a share of 62.7% in 2025, benefiting from their widespread presence, competitive pricing, and one-stop shopping convenience. These retail formats offer extensive product assortments and frequent promotional activities that attract budget-conscious pet owners.

- Key Players: The Mexico pet food market exhibits moderate competitive intensity, with established multinational corporations competing alongside regional manufacturers across various price segments. The competitive landscape is characterized by continuous product innovation, strategic manufacturing investments, distribution network expansion, and marketing efforts targeting the growing base of health-conscious pet parents.

To get more information on this market Request Sample

The Mexico pet food industry is transforming as urbanization and lifestyle changes reshape consumer behavior. In May 2025, Petco México recently announced it has facilitated over 100,000 pet adoptions through its “Primero Adopta” campaign, a milestone that has expanded the pool of regular pet food consumers across the country. Pet ownership is rising among millennials and Generation Z, who show strong emotional bonds with companion animals. This pet humanization trend is driving demand for human-grade quality products, including natural ingredients, functional nutrition, and specialized formulations. Market structures are evolving with the expansion of modern retail formats alongside traditional channels. E-commerce is gaining traction in metropolitan areas, improving convenience and product variety, while regional economic differences continue to shape demand patterns across northern, central, and southern Mexico.

Mexico Pet Food Market Trends:

Premiumization and Health-Focused Nutrition

Mexican pet owners are increasingly prioritizing the health and wellness of their companion animals, fueling demand for premium nutrition products. Around 97% of pet owners in Mexico consider health, well-being, and nutritional quality key factors in pet food selection, while nearly 25% of online products highlight functional benefits such as improved digestion or coat health. This shift is driving interest in grain-free, organic, and functional formulations, with pet parents willing to pay more for natural ingredients and transparent sourcing.

Rising Cat Food Segment and Small Pet Adoption

The feline segment is witnessing strong growth as urban lifestyles increasingly favor smaller, low-maintenance pets. In Mexico, the pet cat population rose by about 41.3% between 2017 and 2022, highlighting a sharp increase in feline adoption, particularly in urban households. Apartment residents in major cities prefer cats for their adaptability to limited spaces and lower care needs than dogs. This shift is opening opportunities for cat food manufacturers, spurring innovation in wet food, premium treats, and specialized feline nutrition.

Digital Commerce and Omnichannel Distribution Expansion

The Mexican pet food retail landscape is rapidly shifting toward digital channels as consumers embrace online shopping for convenience, wider selection, and competitive pricing. In 2025, Amazon Mexico’s “Amazon Now,” launched in partnership with Rappi, delivers essentials including pet supplies in under 15 minutes in cities like Mexico City, Guadalajara, and Monterrey, enhancing convenience for busy pet owners. Major retailers are strengthening omnichannel strategies that combine physical stores, digital platforms, subscription deliveries, and improved logistics, further integrating in-store and online experiences for pet food shoppers.

Market Outlook 2026-2034:

The Mexico pet food market is positioned for sustained growth throughout the forecast period, underpinned by favorable demographic trends, rising disposable incomes, and evolving consumer attitudes toward pet care. The continued urbanization of the Mexican population and the strengthening middle class will drive increased spending on pet nutrition and wellness products. Manufacturing capacity expansion and local production investments by industry participants will enhance supply chain efficiency and product availability across distribution channels. The market generated a revenue of USD 2,047.54 Million in 2025 and is projected to reach a revenue of USD 2,961.44 Million by 2034, growing at a compound annual growth rate of 4.19% from 2026-2034.

Mexico Pet Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Pet Type |

Dog Food |

42.05% |

|

Product Type |

Dry Pet Food |

57.12% |

|

Pricing Type |

Mass Products |

69.9% |

|

Ingredient Type |

Animal Derived |

64.89% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

62.7% |

Pet Type Insights:

- Dog Food

- Cat Food

- Others

The dog food dominates with a market share of 42.05% of the total Mexico pet food market in 2025.

The dog food segment leads the Mexican pet food market, driven by strong cultural affinity for dogs. Valued at USD 1,130.8 Million in 2025, the dog food market demonstrates significant demand and economic importance, with growth expected to continue. Dogs are a preferred pet across diverse socioeconomic groups, and the market offers a wide range of products, including dry kibble, wet food, treats, and specialized therapeutic diets catering to various health needs and life stages.

Consumer preferences in the dog food industry are moving towards higher sophistication, as pet caregivers are looking for products catering to their complete nutritional requirements. The trend of switching from homemade foods to packaged pet foods is also on a steep rise as the concept of the right nutrition for canines keeps gaining acceptance. Breed-specific foods, age-specific foods, and functional foods in the areas of joint, digestive, or skin health are other categories in high growth.

Product Type Insights:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

The dry pet food leads with a share of 57.12% of the total Mexico pet food market in 2025.

Dry pet food remains the dominant format in Mexico due to its convenience, shelf stability, and cost‑effectiveness. In 2024, Nestlé Purina expanded its Silao, Guanajuato plant with a new production line for dry diets, boosting capacity to meet growing demand. Dry kibble is especially favored by households with multiple pets or those seeking economical yet nutritious options, reinforcing its leading position over wet alternatives in the Mexican pet food market.

The manufacturers of dry food continue to innovate in the category by bringing new products with higher protein content, new ingredients, and more appealing palatability. Premiumization is evident in the category, with consumers upgrading to higher-end offerings with natural ingredients, less filler, and with functional benefits. Innovations in packaging, like re-sealable bags and portion-controlled formats, make life easier while keeping the products fresher, thereby adding momentum for pet owners to be loyal to the brands with repeat buys.

Pricing Type Insights:

- Mass Products

- Premium Products

The mass products dominate with a market share of 69.9% of the total Mexico pet food market in 2025.

The mass consumption products business remains the biggest contributor in terms of market share due to its realization of the economic reality faced by consumers in Mexico and their economic purchasing behavior among pet owners. Nutritional solutions that target price-sensitive consumers in this business provide crucial access to nutrition that pet owners want without breaking their bank accounts in terms of price associated with such products.

Despite the overall dominance that the mass market category holds, the upper category is registering strong growth as rising per capita incomes allow an increasing number of buyers to spend on improved nutrition for their pets. Polarization in the market gives opportunities both in the economy and the upper segments as buyers opt for either the economy or the upper category based on their financial capabilities.

Ingredient Type Insights:

- Animal Derived

- Plant Derived

The animal derived leads with a share of 64.89% of the total Mexico pet food market in 2025.

Animal derived ingredients remain the foundation of Mexican pet food, driven by nutritional benefits and consumer preference. In April 2025, ADM opened a $39 million wet pet food facility in Yecapixtla, Morelos, increasing local production of meat-based formulas for dogs and cats to meet rising demand for high-quality, protein-rich products. Common sources such as chicken, beef, fish, and lamb supply essential amino acids, with Mexican consumers favoring pet foods that highlight recognizable animal proteins.

The ingredient landscape is evolving with increasing attention to protein quality, sourcing transparency, and novel animal proteins. Pet parents are becoming more discerning about ingredient lists, favoring products with named meat sources over generic by-products. Meanwhile, plant-derived ingredients are gaining acceptance as complementary nutrition sources, particularly in premium formulations emphasizing holistic health approaches, driving demand for clean-label products and ethically sourced, traceable ingredients.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The supermarkets and hypermarkets dominate with a market share of 62.7% of the total Mexico pet food market in 2025.

Supermarkets and hypermarkets remain Mexico’s primary pet food distribution channels, benefiting from wide store networks and high foot traffic. According to reports, OXXO expanded its retail presence, boosting visibility and promotions for pet products and capturing sales beyond traditional grocery stores. These formats offer one-stop shopping, competitive pricing, and frequent promotions that appeal to price-conscious consumers, while major retail chains continue expanding pet food assortments to meet growing demand.

The distribution landscape is diversifying with specialty pet stores gaining traction among premium-seeking consumers and online channels experiencing rapid growth. E-commerce platforms are particularly attractive for heavy, bulky pet food purchases, offering home delivery convenience and access to broader product selections. The omnichannel retail environment is creating new opportunities for brands to engage consumers across multiple touchpoints, strengthening customer loyalty and driving repeat purchases across platforms.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The northern part of Mexico is a mature and higher-end pet food market, which is supported by higher disposable incomes, high levels of urbanization, and proximity to American brands. The adoption rate for higher-end dry and wet pet food, and nutrition/diet, is higher owing to humanization and the developed retail and e-commerce infrastructure.

Central Mexico represents the biggest market for consumption of pet foods, led by the presence of large urban populations and the growing rising middle class seeking mid-priced pet foods, along with an interest in fortified and breed-specific pet foods. Supermarkets and pet specialty stores lead the distribution channels.

Southern Mexico’s pet food market is emerging, characterized by low penetration but steady growth potential. Consumers remain price-sensitive, favoring economy brands and homemade alternatives, yet awareness of commercial pet diets is rising. Gradual urbanization and evolving lifestyles are expected to support increased adoption of packaged pet food over time.

Other regions, including smaller states and semi-urban areas, contribute modest but growing demand to Mexico’s pet food market. Consumption is shaped by mixed income levels and limited retail reach, with traditional trade remaining important. Gradual expansion of organized retail and affordable product offerings supports incremental market development.

Market Dynamics:

Growth Drivers:

Why is the Mexico Pet Food Market Growing?

Rising Pet Humanization and Emotional Bonding

Animal‑derived ingredients remain central to Mexican pet food, driven by both nutritional science and consumer preference. The 2025 Mexican pet care report highlights the trend of pet humanization, where owners increasingly treat pets as family, prioritizing high-quality, natural, and specialized nutrition. This shift encourages brands to emphasize recognizable animal proteins such as chicken, beef, fish, and lamb, which supply essential amino acids and nutrients. Mexican consumers show a strong preference for pet foods that feature these familiar animal-based ingredients as primary components, aligning with health and quality expectations.

Urbanization and Changing Household Structures

Mexico’s urbanization is reshaping pet ownership and driving growth in the pet food market. INEGI data shows that about 69.8% of Mexican households now own a pet, particularly in major cities like Mexico City, concentrating demand for pet products. Migration to metropolitan areas such as Guadalajara and Monterrey has created affluent, accessible consumer bases. Urban living favors cats and small dog breeds, while nuclear and single-person households increasingly treat pets as companions, driving demand for convenient, high-quality, and value-oriented pet food options.

Expanding Middle Class and Discretionary Spending Power

Mexico’s urbanization is reshaping pet ownership and driving pet food market growth. In December 2024, the country enshrined animal protection and care into its constitution, mandating proper treatment and conservation of animals, a landmark move supporting responsible ownership and adoption initiatives. Migration to metropolitan areas like Mexico City, Guadalajara, and Monterrey has created affluent, concentrated consumer bases with access to modern retail. Urban living favors cats and small dogs, while nuclear and single-person households increasingly treat pets as companions, driving demand for convenient, high-quality, and value-oriented pet food.

Market Restraints:

What Challenges the Mexico Pet Food Market is Facing?

Economic Volatility and Inflationary Pressures

Economic uncertainty and inflationary pressures present ongoing challenges for the Mexico pet food market, affecting both consumer purchasing power and manufacturer operating costs. Price-sensitive consumers may reduce spending on premium products or seek more economical alternatives during periods of economic stress, potentially impacting market value growth despite volume stability, prompting companies to emphasize value offerings, smaller pack sizes, and cost-efficient product positioning strategies.

Competition from Homemade Pet Food

Traditional practices of feeding pets homemade food or table scraps remain prevalent in certain segments of Mexican society, particularly in rural and semi-urban areas. This cultural preference creates barriers to commercial pet food adoption and limits market penetration among households that perceive home-prepared meals as more natural or economical options for their pets.

Limited Awareness in Rural Markets

Geographic disparities in pet care awareness and retail infrastructure create uneven market development across Mexico. Rural and remote communities often lack access to specialized pet food products and educational resources regarding proper pet nutrition, limiting market expansion beyond established urban centers and creating underserved potential consumer segments, encouraging gradual opportunities for outreach programs, distribution expansion, and targeted awareness initiatives.

Competitive Landscape:

The Mexico pet food market exhibits a moderately consolidated competitive structure with established multinational corporations commanding significant market presence alongside regional manufacturers and emerging brands. The competitive landscape is characterized by continuous product innovation focused on premiumization, health benefits, and ingredient transparency. Market participants employ diverse strategies including manufacturing capacity expansion, distribution network development, and targeted marketing campaigns to capture growing consumer demand. Competition intensifies across price segments as value-oriented brands defend market share while premium players pursue health-conscious consumers willing to invest in superior nutrition. Strategic partnerships with retailers, veterinary endorsements, and digital marketing initiatives are becoming increasingly important competitive differentiators in the evolving marketplace.

Recent Developments:

- In October 2025, Grupo Sesajal officially launched NUBAC, a new pet food brand in Mexico focused on innovation and high nutritional quality. The company emphasizes advanced production technology and balanced formulations for multiple animal species, strengthening domestic competition and innovation within Mexico’s expanding pet food industry.

Mexico Pet Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered |

Dog Food, Cat Food, Others |

| Product Types Covered | Dry Pet Food, Wet And Canned Pet Food, Snacks And Treats |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico pet food market size was valued at USD 2,047.54 Million in 2025.

The Mexico pet food market is expected to grow at a compound annual growth rate of 4.19% from 2026-2034 to reach USD 2,961.44 Million by 2034.

Dog food dominated the Mexico pet food market with a share of 42.05%, driven by the substantial canine population and strong cultural preference for dogs as primary companion animals across Mexican households.

Key factors driving the Mexico pet food market include rising pet humanization trends, increasing urbanization and changing household structures, expanding middle-class purchasing power, growing awareness of pet nutrition, and evolving consumer preferences toward premium and health-focused products.

Major challenges include economic volatility and inflationary pressures affecting consumer spending power, competition from homemade pet food in traditional households, limited awareness and retail infrastructure in rural markets, and price sensitivity among value-oriented consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)