Mexico PET Packaging Market Size, Share, Trends and Forecast by Packaging Type, Form, Pack Type, Filling Technology, End User, and Region, 2025-2033

Mexico PET Packaging Market Overview:

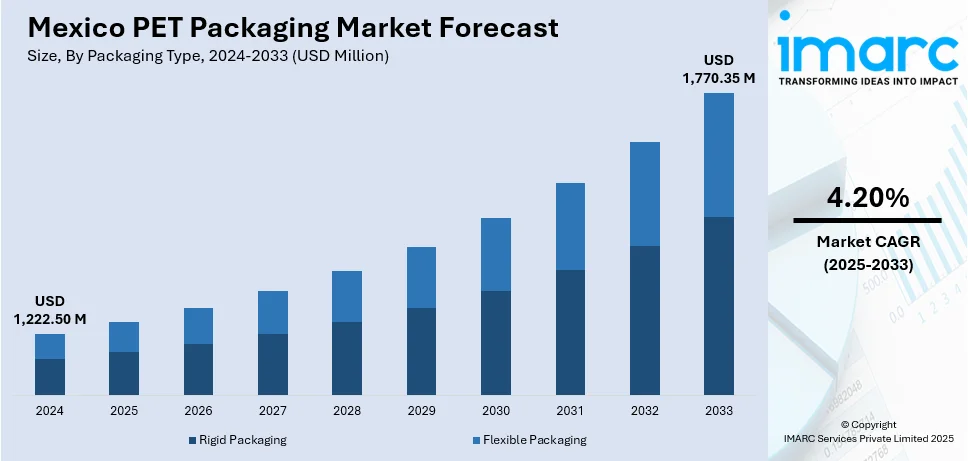

The Mexico PET packaging market size reached USD 1,222.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,770.35 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The market is propelled by the need for eco-friendly and efficient packaging methods across sectors such as beverages, food, and pharmaceuticals. Key reasons include technological changes, ecofriendly considerations, and moving towards recyclable and sustainable material usage, positioning PET packaging highly in demand across a range of applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,222.50 Million |

| Market Forecast in 2033 | USD 1,770.35 Million |

| Market Growth Rate 2025-2033 | 4.20% |

Mexico PET Packaging Market Trends:

Sustainable Innovations Redefining Packaging Standards

The Mexico PET packaging market outlook reflects increasing momentum toward eco-conscious transformation as producers are integrating recyclable content, promoting virgin plastics displacement. For instance, in November 2023, PetStar reported a $167 million capacity expansion of its Toluca, Mexico RPET factory, boosting its capacity from 58 kilotons to 84 kilotons per year by August 2024. Furthermore, consumer demand for sustainable solutions drives the uptake of lightweight, low-impact packaging that minimizes environmental footprint. Regulatory leadership facilitates the shift by building circular economy practices, enhancing design innovation and post-consumer waste use. Research-driven improvements now enhance barrier performance, lengthening shelf life and reducing material use. Climate change awareness is also taking center stage, supporting market alignment with environmental efforts. Innovative packaging forms in Mexico are no longer a choice but strategic necessities, ensuring compliance, customer loyalty, and sustainability. Concurrently, retail and e-commerce markets require sustainable solutions that balance convenience with minimal environmental disruption. With increasing pressure from both sides—policy and preference—sustainability continues to be the determining factor guiding investment, development, and product design throughout this industry, enhancing its competitive worth in local and global environments.

Lightweighting Propelling Material Efficiency

Lightweighting remains a key trend in Mexico PET packaging market growth, where efficiency converges with changing environmental imperatives. Polymer engineering developments enable producers to save weight without compromising on structural toughness, contributing to reduced logistics costs and lower carbon emissions. The trend complies with regulations and helps companies meet sustainability standards. Moreover, light-weight PET forms meet growing demand in beverages and FMCG where volume efficiency continues to be an important consideration. The strategy enhances improved resin management, optimizing throughput and resource efficiency. Refinement of design facilitates ergonomic handling, shelf presentation, and transportability, making it extremely appealing to diverse stakeholders. Downgauging without sacrificing durability also increases recyclability and encourages efficient recovery processes. As the needs of consumers and industrial packaging evolve toward lighter, more environmentally friendly formats, this trend provides scalability and performance. By weight optimization, the PET industry is providing more sustainable, responsive, and cost-efficient solutions—informing future strategies in production, logistics, and lifecycle planning.

Technological Integration Increasing Functionality

Smart manufacturing methods and digital technology are revolutionizing operational dynamics within Mexico PET packaging market share, providing unprecedented levels of customization, quality control, and flexibility. For instance, in June 2024, PET Technologies officially presented its APF-Max 3U universal blow molding machine at EXPO PACK México, demonstrating flexible PET bottle manufacturing capabilities from 0.1 to 8.0 liters. Moreover, automation, robotics, and real-time monitoring integration facilitate greater precision and less human error during production. PET applications are also being helped by intelligent packaging technologies that enhance traceability, consumer engagement, and product integrity. These innovations address increasing marketplace demands for safety, transparency, and usability. Printing breakthroughs, smart sensors, and newer labeling techniques further enhance product attractiveness and use convenience. Energy-efficient systems and high-speed equipment drive productivity while reducing operational footprints, enabling sustainable output in volume. Further, digital twin technologies and predictive maintenance equipment guarantee system continuity, maximizing equipment life and minimizing waste. As the market becomes more digitized, participants embracing these solutions are well placed to achieve global standards. Through smart integration, the PET packaging market is becoming highly responsive, flexible, and in line with the changing needs of contemporary Mexican consumers.

Mexico PET Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on packaging type, form, pack type, filling technology, and end user.

Packaging Type Insights:

- Rigid Packaging

- Flexible Packaging

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes rigid packaging and flexible packaging.

Form Insights:

- Amorphous PET

- Crystalline PET

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes amorphous PET and crystalline PET.

Pack Type Insights:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

A detailed breakup and analysis of the market based on the pack type have also been provided in the report. This includes bottles and jars, bags and pouches, trays, lids/caps and closures, and others.

Filling Technology Insights:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

The report has provided a detailed breakup and analysis of the market based on the filling technology. this includes hot fill, cold fill, aseptic fill, and others.

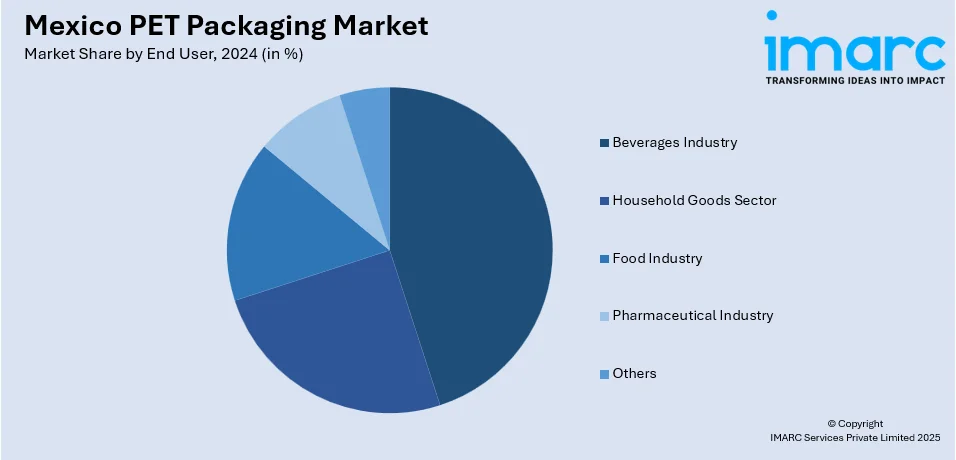

End User Insights:

- Beverages Industry

- Bottled Water

- Carbonated Soft Drinks

- Milk and Dairy Products

- Juices

- Beer

- Others

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes beverages industry (bottled water, carbonated soft drinks, milk and dairy products, juices, beer, and others), household goods sector, food industry, pharmaceutical industry, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico PET Packaging Market News:

- In January 2025, Indorama Ventures partnered with Vida Circular to transform Mexico's plastics sector. The partnership is centered on post-consumer recycling of PET using innovative technologies to enable a circular economy. The partnership also highlights environmental learning to sensitise people on sustainable plastic management practices.

Mexico PET Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Rigid Packaging, Flexible Packaging |

| Forms Covered | Amorphous PET, Crystalline PET |

| Pack Types Covered | Bottles and Jars, Bags and Pouches, Trays, Lids/Caps and Closures, Others |

| Filling Technologies Covered | Hot Fill, Cold Fill, Aseptic Fill, Others |

| End Users Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico PET packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico PET packaging market on the basis of packaging type?

- What is the breakup of the Mexico PET packaging market on the basis of form?

- What is the breakup of the Mexico PET packaging market on the basis of pack type?

- What is the breakup of the Mexico PET packaging market on the basis of filling technology?

- What is the breakup of the Mexico PET packaging market on the basis of end user?

- What is the breakup of the Mexico PET packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico PET packaging market?

- What are the key driving factors and challenges in the Mexico PET packaging?

- What is the structure of the Mexico PET packaging market and who are the key players?

- What is the degree of competition in the Mexico PET packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico PET packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico PET packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico PET packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)