Mexico Pharmaceutical Filtration Market Size, Share, Trends and Forecast by Product, Technique, Application, Scale of Operation, and Region, 2025-2033

Mexico Pharmaceutical Filtration Market Overview:

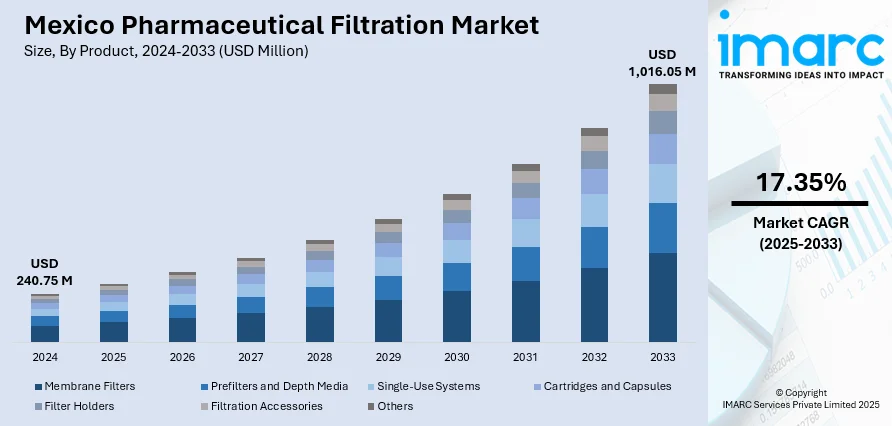

The Mexico pharmaceutical filtration market size reached USD 240.75 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,016.05 Million by 2033, exhibiting a growth rate (CAGR) of 17.35% during 2025-2033. The market is seeing rapid growth as a result of expanding biopharmaceutical production, mounting regulatory compliance demands, and growing acceptance of high-performance filtration technology. Membrane filters are proving to be the most popular product category, evidence of a move towards high-efficiency purification technology. The market is also backed by research and development investment and growth in demand for sterile and high-quality drug products. These factors combined contribute to the changing picture of the Mexico pharmaceutical filtration market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 240.75 Million |

| Market Forecast in 2033 | USD 1,016.05 Million |

| Market Growth Rate 2025-2033 | 17.35% |

Mexico Pharmaceutical Filtration Market Trends:

Advancements in Filtration Technologies

The Mexico pharmaceutical filtration market is growing at a fast pace fueled by advancements in filtration technology. Technologies like microfiltration, ultrafiltration, and nanofiltration are leading the way in this change, and they are offering increased efficiency and reliability for the filtration of pharmaceutical goods. For instance, in June 2024, Cytiva's Supor Prime sterilizing-grade filters, provided upgraded filtration for high-concentration biologics to increase yield, lower cost, and provide environmentally friendly, scalable solutions for biologic drug developers in pharmaceutical manufacturing. Moreover, these technologies allow the elimination of even the most minute particles and impurities, which is imperative in the manufacture of biologics and vaccines that have high levels of purity required of them. The evolution of membrane filtration systems, especially with enhanced permeability and selectivity, has even accelerated their use in different phases of pharmaceutical manufacturing. These innovations not only add to the efficiency of the manufacturing process but also to adherence to rigorous regulatory requirements, increasing product safety. Consequently, these technological advancements will be instrumental in driving Mexico's pharmaceutical filtration market share, laying the ground for long-term growth in the years to come.

Rising Demand for Biologics and Vaccines

The increasing demand for vaccines and biologics is one of the main drivers for the growth of the pharmaceutical filtration market in Mexico. As the world's healthcare environment is trending towards more biologically oriented therapies and vaccines, the pharmaceutical industry is increasingly being pressured to achieve high levels of purity, sterility, and contamination control. Filtration technology plays an imperative role at each step involved in the development, production, formulation, and filling of vaccines and biologics, with every impurity at any such step undermining the effectiveness and quality of the products. As per the sources, in January of 2025, Mexico's Ministry of Health procured essential medicines for the period 2025-2026, emphasizing the importance of effective pharmaceutical filtration solutions to guarantee safe, effective delivery to healthcare institutions. Furthermore, the introduction of mRNA-based vaccines and new, advanced vaccines further emphasizes the imperative of strong filtration technologies ensuring that dangerous contaminants be eliminated. As Mexico further develops its capability for vaccine and biologic production, the need for advanced filtration systems is likely to increase substantially, thereby adding to Mexico's growing market share of pharmaceutical filtration. This is a trend likely to influence the market direction, catalyzing investment and innovation in filtration technology.

Stricter Regulatory Requirements and Quality Control

Stricter regulatory requirements are leading the way in the demand for sophisticated filtration systems in Mexico's pharmaceutical industry. Regulatory agencies, including the U.S. FDA and European Medicines Agency, have stricter standards for the manufacture of pharmaceuticals, biologics, and vaccines, especially with regard to product purity and control of contamination. These regulations require the use of extremely efficient filtration systems to guarantee that pharmaceutical products are up to standards in terms of efficacy and safety. With these regulations changing continually, Mexican manufacturers are relying more and more on advanced filtration technology to help meet these high standards, which guarantee the quality of their products. This trend is boosting the use of specialty filtration solutions, including sterile filtration and virus filtration, that are essential to satisfy the strict requirements of the pharmaceutical sector. Therefore, Mexico pharmaceutical filtration market share will increase, fueled by increasing demand for regulatory compliance and better-quality control procedures.

Mexico Pharmaceutical Filtration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technique, application, and scale of operation.

Product Insights:

- Membrane Filters

- MCE Membrane Filters

- Coated Cellulose Acetate Membrane Filters

- PTFE Membrane Filters

- Nylon Membrane Filters

- PVDF Membrane Filters

- Others

- Prefilters and Depth Media

- Glass Fiber Filters

- PTFE Fiber Filters

- Single-Use Systems

- Cartridges and Capsules

- Filter Holders

- Filtration Accessories

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes membrane filters (MCE membrane filters, coated cellulose acetate membrane filters, PTFE membrane filters, nylon membrane filters, PVDF membrane filters, and others), prefilters and depth media (glass fiber filters and PTFE fiber filters), single-use systems, cartridges and capsules, filter holders, filtration accessories, and others.

Technique Insights:

- Microfiltration

- Ultrafiltration

- Crossflow Filtration

- Nanofiltration

- Others

A detailed breakup and analysis of the market based on the technique have also been provided in the report. This includes microfiltration, ultrafiltration, crossflow filtration, nanofiltration, and others.

Application Insights:

- Final Product Processing

- Active Pharmaceutical Ingredient Filtration

- Sterile Filtration

- Protein Purification

- Vaccines and Antibody Processing

- Formulation and Filling Solutions

- Viral Clearance

- Raw Material Filtration

- Media Buffer

- Pre-Filtration

- Bioburden Testing

- Cell Separation

- Water Purification

- Air Purification

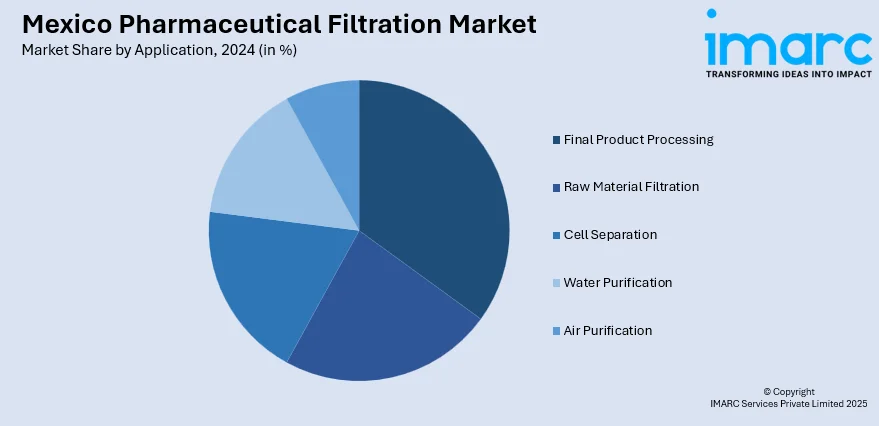

The report has provided a detailed breakup and analysis of the market based on the application. This includes final product processing (active pharmaceutical ingredient filtration, sterile filtration, protein purification, vaccines and antibody processing, formulation and filling solutions, and viral clearance), raw material filtration (media buffer, pre-filtration, and bioburden testing), cell separation, water purification, and air purification.

Scale of Operation Insights:

- Manufacturing Scale

- Pilot-Scale

- Research and Development Scale

A detailed breakup and analysis of the market based on the scale of operation have also been provided in the report. This includes manufacturing scale, pilot-scale, and research and development scale.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pharmaceutical Filtration Market News:

- In October 2024, Asahi Kasei Medical released the Planova™ FG1, a next-generation virus removal filter. With sevenfold greater flux, it greatly improves productivity, lowers filtration time, and accommodates the increasing demand for biopharmaceuticals, such as monoclonal antibodies, making more efficient and safer manufacturing possible.

Mexico Pharmaceutical Filtration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Techniques Covered | Microfiltration, Ultrafiltration, Crossflow Filtration, Nanofiltration, Others |

| Applications Covered |

|

| Scale of Operations Covered | Manufacturing Scale, Pilot-Scale, Research and Development Scale |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pharmaceutical filtration market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pharmaceutical filtration market on the basis of product?

- What is the breakup of the Mexico pharmaceutical filtration market on the basis of technique?

- What is the breakup of the Mexico pharmaceutical filtration market on the basis of application?

- What is the breakup of the Mexico pharmaceutical filtration market on the basis of scale of operation?

- What is the breakup of the Mexico pharmaceutical filtration market on the basis of region?

- What are the various stages in the value chain of the Mexico pharmaceutical filtration market?

- What are the key driving factors and challenges in the Mexico pharmaceutical filtration?

- What is the structure of the Mexico pharmaceutical filtration market and who are the key players?

- What is the degree of competition in the Mexico pharmaceutical filtration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pharmaceutical filtration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pharmaceutical filtration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pharmaceutical filtration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)