Mexico Pharmaceutical Labeling Market Size, Share, Trends and Forecast by Label Type, Material, Application, End Use, and Region, 2025-2033

Mexico Pharmaceutical Labeling Market Overview:

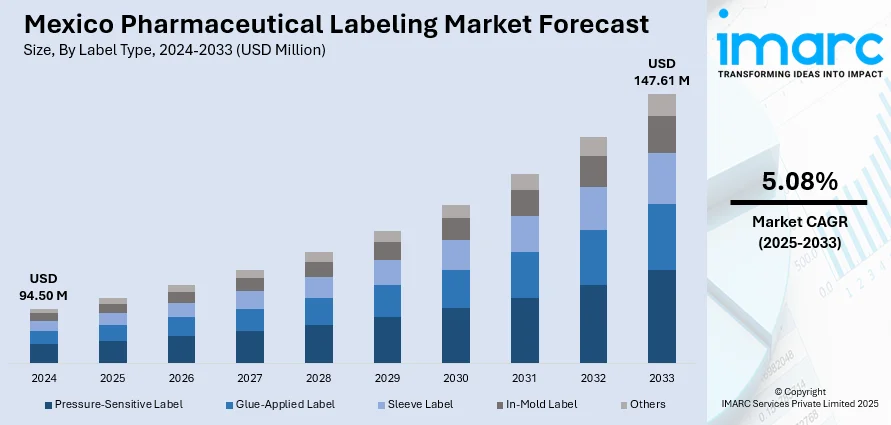

The Mexico pharmaceutical labeling market size reached USD 94.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 147.61 Million by 2033, exhibiting a growth rate (CAGR) of 5.08% during 2025-2033. The increasing regulatory requirements, rising demand for healthcare products, advancements in packaging technology, growing focus on compliance with international standards, such as serialization and traceability, and the expansion of the pharmaceutical industry in the region are among the key factors contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 94.50 Million |

| Market Forecast in 2033 | USD 147.61 Million |

| Market Growth Rate 2025-2033 | 5.08% |

Mexico Pharmaceutical Labeling Market Trends:

Increasing Regulatory Requirements and Compliance

Mexico's pharmaceutical sector is tightening regulations to enhance safety, traceability, and anti-counterfeiting measures. In alignment with global standards, the Mexican government has introduced stricter labeling regulations to improve product transparency, facilitate recalls, and combat counterfeit medicines. The COFEPRIS (Federal Commission for Protection Against Sanitary Risks), which is responsible for drug regulation, has implemented more stringent packaging and labeling guidelines, requiring the inclusion of key details such as ingredient information, batch numbers, expiration dates, and QR codes for authentication. These regulations are driven by the growing demand for safer and more traceable pharmaceutical products. Serialization is also on the rise, with each medicine package receiving a unique identifier to prevent counterfeiting. By 2025, it is anticipated that the majority of pharmaceutical packaging in Mexico will be required to include serial numbers, in compliance with international standards like the Falsified Medicines Directive (FMD). This shift is further accelerating the demand for advanced labeling technologies. Statistical projections indicate that Mexico’s pharmaceuticals market will reach USD 38.5 billion by 2033, exhibiting a growth rate (CAGR) of 6.9% during 2025-2033, with regulatory compliance being a key growth driver.

Advancements in Packaging Technology and Smart Labels

The adoption of advanced packaging technologies and smart labeling solutions is revolutionizing Mexico’s pharmaceutical labeling market. The increasing need for enhanced security, sustainability, and product differentiation is prompting the market to embrace innovations like Radio Frequency Identification (RFID) tags, QR codes, and near-field communication (NFC) technologies. These smart labels allow manufacturers to provide detailed product information, such as production dates, batch numbers, and origins, directly to consumers, thereby improving traceability and boosting consumer trust. Additionally, sustainability has become a key factor in driving demand for eco-friendly labels. Pharmaceutical companies in Mexico are increasingly choosing biodegradable or recyclable materials, spurred by regulatory requirements and heightened consumer awareness about environmental responsibility. Paper-based labels and water-based adhesives, which offer significant environmental benefits, are gaining traction in line with global sustainability trends.

Mexico Pharmaceutical Labeling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on label type, material, application, and end use.

Label Type Insights:

- Pressure-Sensitive Label

- Glue-Applied Label

- Sleeve Label

- In-Mold Label

- Others

The report has provided a detailed breakup and analysis of the market based on the label type. This includes pressure-sensitive label, glue-applied label, sleeve label, in-mold label, and others.

Material Insights:

- Paper

- Polymer Film

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes paper, polymer film, and others.

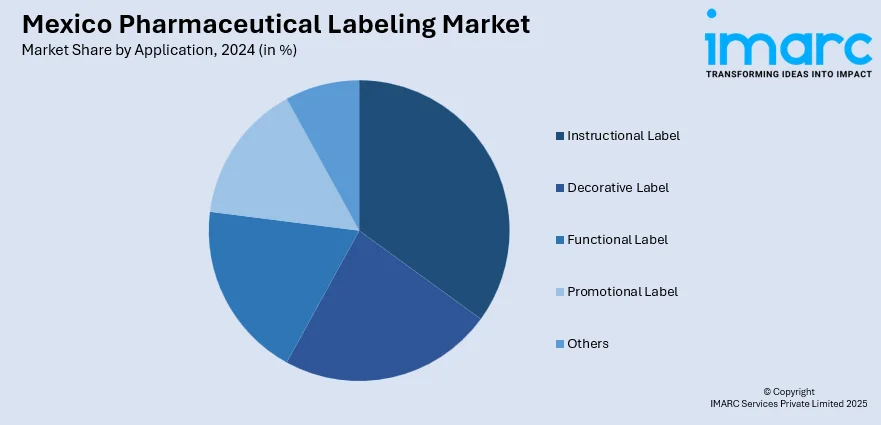

Application Insights:

- Instructional Label

- Decorative Label

- Functional Label

- Promotional Label

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes instructional label, decorative label, functional label, promotional label, and others.

End Use Insights:

- Bottles

- Blister Packs

- Parenteral Containers

- Pre-Fillable Syringes

- Pre-Fillable Inhalers

- Pouches

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, pouches, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pharmaceutical Labeling Market News:

- December 2024: TOPPAN Holdings Inc. announced its agreement to acquire Sonoco Products Company's Thermoformed & Flexible Packaging (TFP) business for approximately USD 1.8 billion. This strategic move aimed to bolster TOPPAN's global footprint in sustainable packaging, particularly in the Americas. It also presented opportunities to enhance pharmaceutical labeling solutions through advanced flexible packaging technologies.

- April 2024: ProMach's ID Technology acquired Etiflex, a Mexican producer of pressure-sensitive and RFID labels. This acquisition enhanced ProMach's labeling and coding capabilities throughout North America and marked its first acquisition in the Mexican market.

Mexico Pharmaceutical Labeling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Label Types Covered | Pressure-Sensitive Label, Glue-Applied Label, Sleeve Label, In-Mold Label, Others |

| Materials Covered | Paper, Polymer Film, Others |

| Applications Covered | Instructional Label, Decorative Label, Functional Label, Promotional Label, Others |

| End Uses Covered | Bottles, Blister Packs, Parenteral Containers, Pre-Fillable Syringes, Pre-Fillable Inhalers, Pouches, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pharmaceutical labeling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pharmaceutical labeling market on the basis of label type?

- What is the breakup of the Mexico pharmaceutical labeling market on the basis of material?

- What is the breakup of the Mexico pharmaceutical labeling market on the basis of application?

- What is the breakup of the Mexico pharmaceutical labeling market on the basis of end use?

- What are the various stages in the value chain of the Mexico pharmaceutical labeling market?

- What are the key driving factors and challenges in the Mexico pharmaceutical labeling?

- What is the structure of the Mexico pharmaceutical labeling market and who are the key players?

- What is the degree of competition in the Mexico pharmaceutical labeling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pharmaceutical labeling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pharmaceutical labeling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pharmaceutical labeling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)