Mexico Pharmaceutical Packaging Market Size, Share, Trends and Forecast by Material, Product, End User, and Region, 2025-2033

Mexico Pharmaceutical Packaging Market Overview:

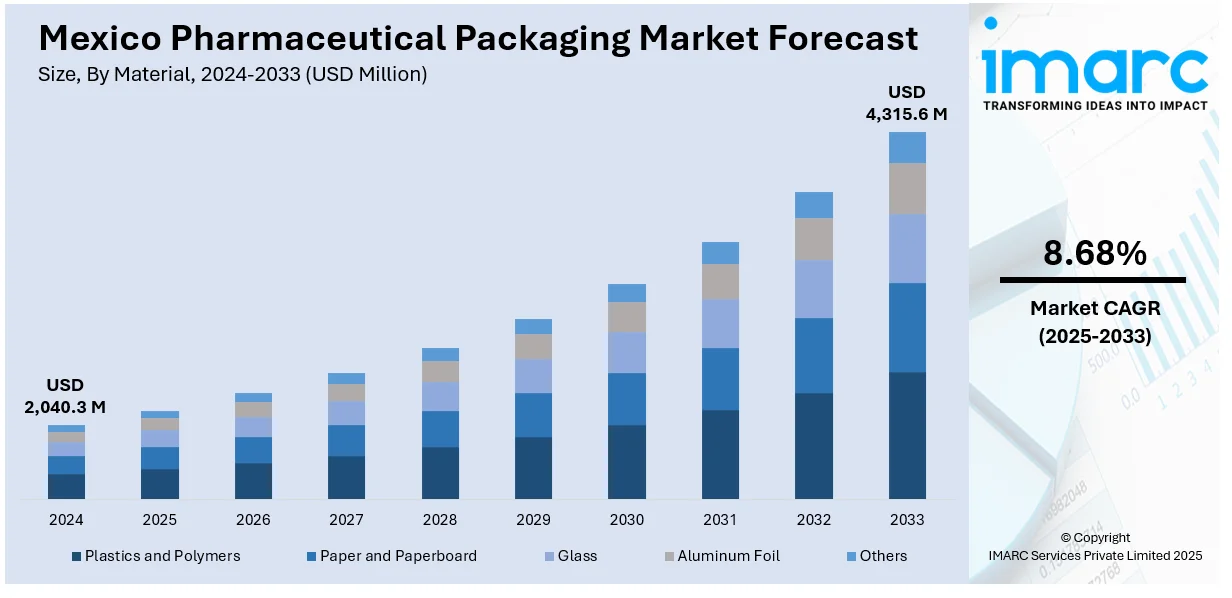

The Mexico pharmaceutical packaging market size reached USD 2,040.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,315.6 Million by 2033, exhibiting a growth rate (CAGR) of 8.68% during 2025-2033. The continued growth of Mexico’s pharmaceutical sector, alongside the expansion of e-commerce and digital pharmacy services, is catalyzing the demand for advanced, compliant, and patient-centric packaging solutions that ensure product integrity, facilitate efficient distribution, and align with evolving healthcare delivery requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,040.3 Million |

| Market Forecast in 2033 | USD 4,315.6 Million |

| Market Growth Rate 2025-2033 | 8.68% |

Mexico Pharmaceutical Packaging Market Trends:

Growing Pharmaceutical Industry and Healthcare Expansion

Mexico’s burgeoning pharmaceutical industry is increasing the need for innovative packaging solutions, fueled by an expanding healthcare system and changing demographics. The growth in population, along with a consistent rise in the elderly demographic, is leading to higher usage of both prescription and non-prescription medications. As reported by the Pan American Health Organization (PAHO), people aged 65 and older represented 8.2% of Mexico’s population in 2024, illustrating a significant demographic change that leads to heightened pharmaceutical demands. This trend is further supported by increasing incidences of chronic illnesses and continuous public health efforts focused on enhancing access to medical care. In reaction, pharmaceutical firms are focusing on packaging advancements that promote drug safety, extend shelf life, and improve usability, especially for senior citizens. The rise in local drug production and the proliferation of contract packaging services are further catalyzing the demand for regional packaging materials, prompting investments in scalable and compliant packaging solutions. While Mexico enhances its healthcare infrastructure and harmonizes production practices with internationals standards, the pharmaceutical packaging sector is progressing to fulfill the demand for safe, efficient, and regulatory-compliant solutions for an expanding variety of therapeutic products.

Growth of E-commerce and Digital Pharmacies

The emergence of e-commerce platforms and online pharmacies in Mexico is creating new demands and expectations for pharmaceutical packaging. With an increasing number of individuals utilizing digital platforms to buy medications, packaging needs to be enhanced not only for delivery but also for safety and user experience. Mexico’s e-commerce sector is projected to expand from USD 47.5 billion in 2024 to USD 176.6 billion by 2033, which is catalyzing the demand for packaging solutions that maintain product integrity during transportation. This encompasses tamper-resistant seals, protective padding, and compact, efficient designs to lower shipping expenses while guaranteeing the medication arrives undamaged. Furthermore, packaging should provide straightforward and easily comprehensible instructions for use, eliminating the necessity for in-person pharmacist assistance. E-commerce logistics require packaging that adjusts to different environmental factors, maintaining product quality despite temperature fluctuations or harsh handling. As returns management and regulatory compliance become increasingly intricate in the digital realm, pharmaceutical packaging firms are also implementing intelligent tracking systems and sturdy materials to address these issues. Additionally, as digital health solutions and home delivery services become more popular, packaging needs to accommodate direct-to-consumer (D2C) models, balancing affordability with brand uniqueness. With the ongoing growth of the e-commerce industry in Mexico, packaging is becoming more vital for maintaining logistical efficiency, fostering user trust, and providing a smooth user experience, which is ultimately transforming the focus in pharmaceutical packaging design and manufacturing.

Mexico Pharmaceutical Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, product, and end user.

Material Insights:

- Plastics and Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polystyrene (PS)

- Others

- Paper and Paperboard

- Glass

- Aluminum Foil

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastics and polymers (polyvinyl chloride (PVC), polypropylene (PP), polyethylene terephthalate (PET), polyethylene (PE), polystyrene (PS), and others), paper and paperboard, glass, aluminum foil, and others.

Product Insights:

- Primary

- Plastic Bottles

- Caps and Closures

- Parenteral Containers

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes primary (plastic bottles, caps and closures, parenteral containers, blister packs, prefillable inhalers, pouches, medication tubes, and others), secondary (prescription containers and pharmaceutical packaging accessories), and tertiary.

End User Insights:

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

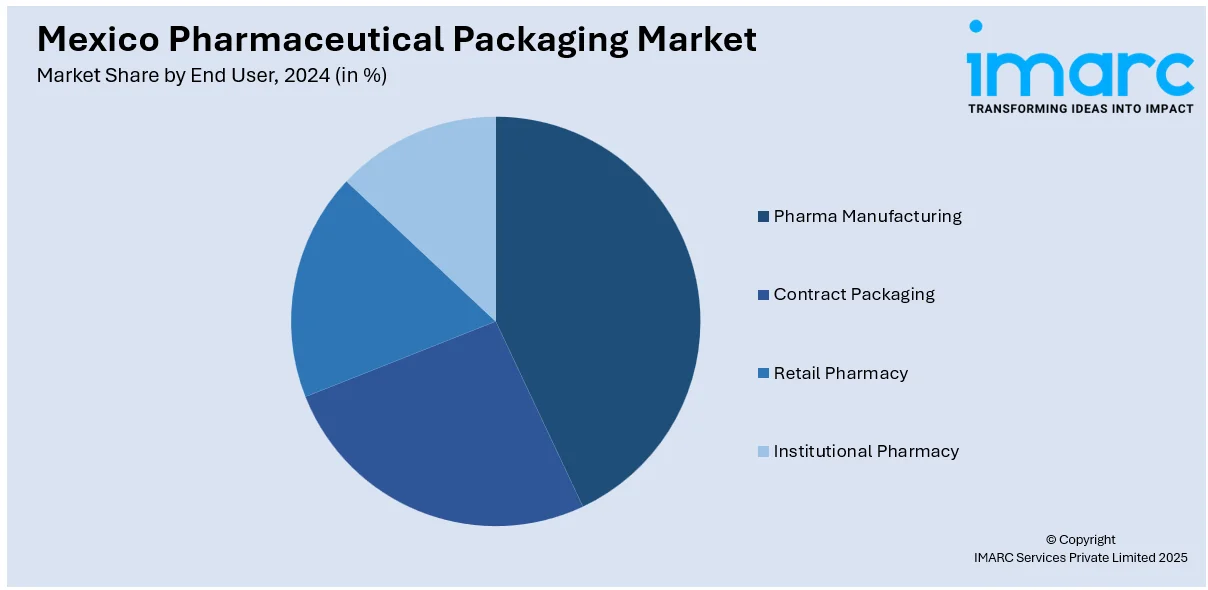

The report has provided a detailed breakup and analysis of the market based on the end user. This includes pharma manufacturing, contract packaging, retail pharmacy, and institutional pharmacy.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pharmaceutical Packaging Market News:

- In May 2024, Gerresheimer announced the expansion of its syringe manufacturing facility in Querétaro, Mexico, with a €100 million investment. The new 7,500m² building was planned to boost production of ready-to-fill (RTF) syringes for the North American market starting in Q2 2025. The project was expected to create around 270 new jobs.

Mexico Pharmaceutical Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered |

|

| Products Covered |

|

| End Users Covered | Pharma Manufacturing, Contract Packaging, Retail Pharmacy, Institutional Pharmacy |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pharmaceutical packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pharmaceutical packaging market on the basis of material?

- What is the breakup of the Mexico pharmaceutical packaging market on the basis of product?

- What is the breakup of the Mexico pharmaceutical packaging market on the basis of end user?

- What is the breakup of the Mexico pharmaceutical packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico pharmaceutical packaging market?

- What are the key driving factors and challenges in the Mexico pharmaceutical packaging market?

- What is the structure of the Mexico pharmaceutical packaging market and who are the key players?

- What is the degree of competition in the Mexico pharmaceutical packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pharmaceutical packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pharmaceutical packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pharmaceutical packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)