Mexico Physical Security Market Size, Share, Trends and Forecast by Component, Enterprise Size, Industry Vertical, and Region, 2025-2033

Mexico Physical Security Market Overview:

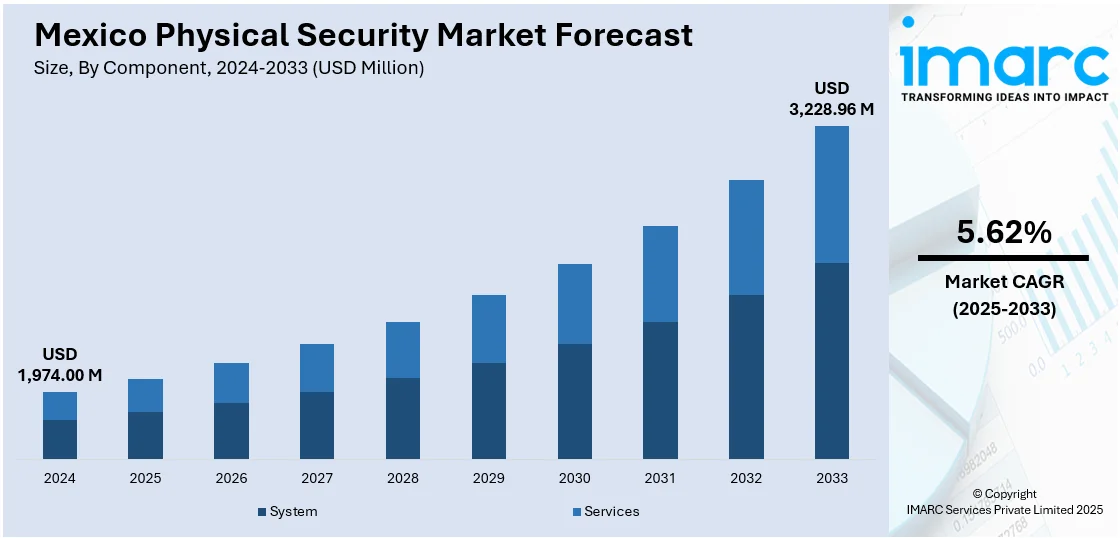

The Mexico physical security market size reached USD 1,974.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,228.96 Million by 2033, exhibiting a growth rate (CAGR) of 5.62% during 2025-2033. The growing crime rates and increasing security threats are offering a favorable market outlook. This trend, coupled with the technological advancements in security systems, is playing a pivotal role in impelling the market growth. Besides this, Government programs and changing regulatory policies pertaining to security are expanding the Mexico physical security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,974.00 Million |

| Market Forecast in 2033 | USD 3,228.96 Million |

| Market Growth Rate 2025-2033 | 5.62% |

Mexico Physical Security Market Trends:

Increasing Crime Rates and Security Threats

Mexico's growing crime rates and increasing security threats are substantially leading to the rise in the need for physical security. The nation is experiencing highly violent crimes and organized crime, such as drug trafficking and theft, which are creating a strong need for all-rounded security solutions. For instance, in 2025, Mexico deported 29 suspected drug traffickers to the United States, including the infamous drug trafficker lord Rafael Caro Quintero. As both individuals and businesses are increasingly confronted with safety issues, the implementation of physical security technologies like surveillance systems, access control, and alarm systems is becoming increasingly important. The public and private sectors are actively investing in technology-based security infrastructures to protect people and assets. This demand is especially visible in urban areas and industrial areas where crime rates are higher. With government efforts to fight crime and enhance security levels, the market is witnessing consistent growth. With Mexico still focusing on safety and security, companies are increasingly adopting sophisticated physical security systems to counter threats and safeguard their operations.

Government Initiatives and Regulatory Frameworks

Government programs and changing regulatory policies pertaining to security are impelling the Mexico physical security market growth. The government is proactively encouraging policies aimed at minimizing criminal activity and enhancing public safety. Through national security programs and law enforcement programs, there is a strong focus on enhancing physical security infrastructure in all sectors, including commercial, residential, and critical infrastructure. Moreover, regulatory agencies are imposing stricter rules and regulations, forcing companies to implement stronger security systems to meet such compliance. This involves deploying biometric authentication, closed-circuit television (CCTV) cameras, and intrusion sensors in vital sectors. As regulations on data privacy, safety, and deployment of security technologies come into play, organizations are becoming dependent on sophisticated physical security solutions to ensure compliance. The IMARC Group predicts that the Mexico video surveillance systems market size is projected to attain USD 3,382 Million by 2033.

Technological Advancements in Security Systems

Technological advancements in physical security systems are playing a pivotal role in shaping the current landscape of the market. The rapid development and adoption of cutting-edge technologies, such as machine learning (ML), biometrics, artificial intelligence (AI), and Internet of Things (IoT)-enabled devices are revolutionizing security operations. Companies and government entities are increasingly incorporating these innovations into their security infrastructures to enhance threat detection, monitoring, and response times. AI-powered surveillance cameras, automated alarm systems, and real-time data analytics are becoming integral tools in combating security risks. These technologies are not only improving the efficiency of security operations but also reducing costs over time through automation. The ongoing advancements in cloud-based security management systems are further driving the market by enabling remote monitoring and centralized control. As businesses seek more intelligent and scalable security solutions, the market is witnessing a strong shift towards integrating high-tech physical security systems.

Mexico Physical Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, enterprise size, and industry vertical.

Component Insights:

- System

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes system and services.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

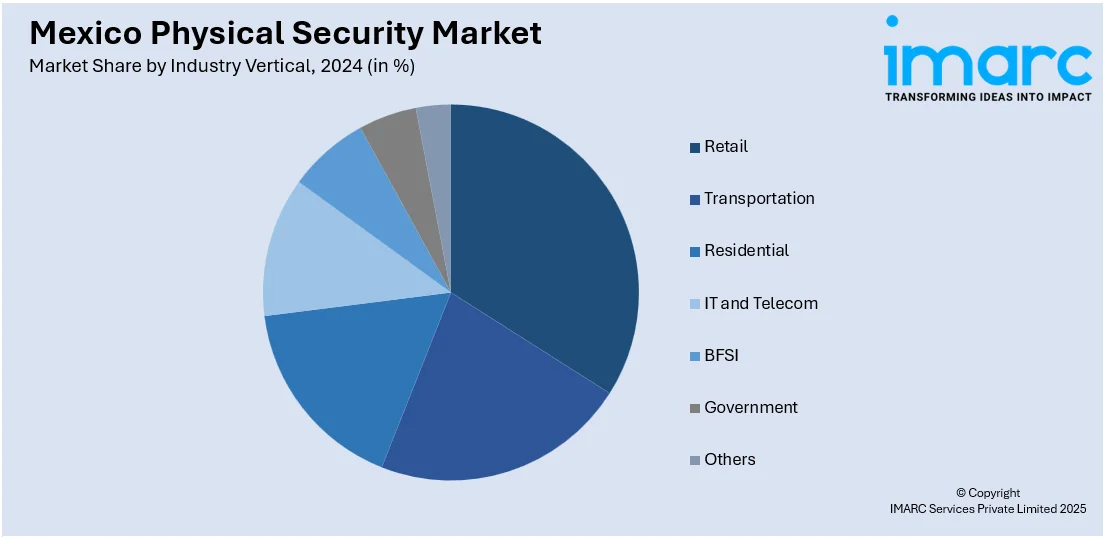

Industry Vertical Insights:

- Retail

- Transportation

- Residential

- IT and Telecom

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes retail, transportation, residential, IT and telecom, BFSI, government, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Physical Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | System, Services |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | Retail, Transportation, Residential, IT and Telecom, BFSI, Government, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico physical security market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico physical security market on the basis of component?

- What is the breakup of the Mexico physical security market on the basis of enterprise size?

- What is the breakup of the Mexico physical security market on the basis of industry vertical?

- What is the breakup of the Mexico physical security market on the basis of region?

- What are the various stages in the value chain of the Mexico physical security market?

- What are the key driving factors and challenges in the Mexico physical security?

- What is the structure of the Mexico physical security market and who are the key players?

- What is the degree of competition in the Mexico physical security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico physical security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico physical security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico physical security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)