Mexico Pipes and Fittings Market Size, Share, Trends and Forecast by Type, Technology, Application, Vertical, and Region, 2025-2033

Mexico Pipes and Fittings Market Overview:

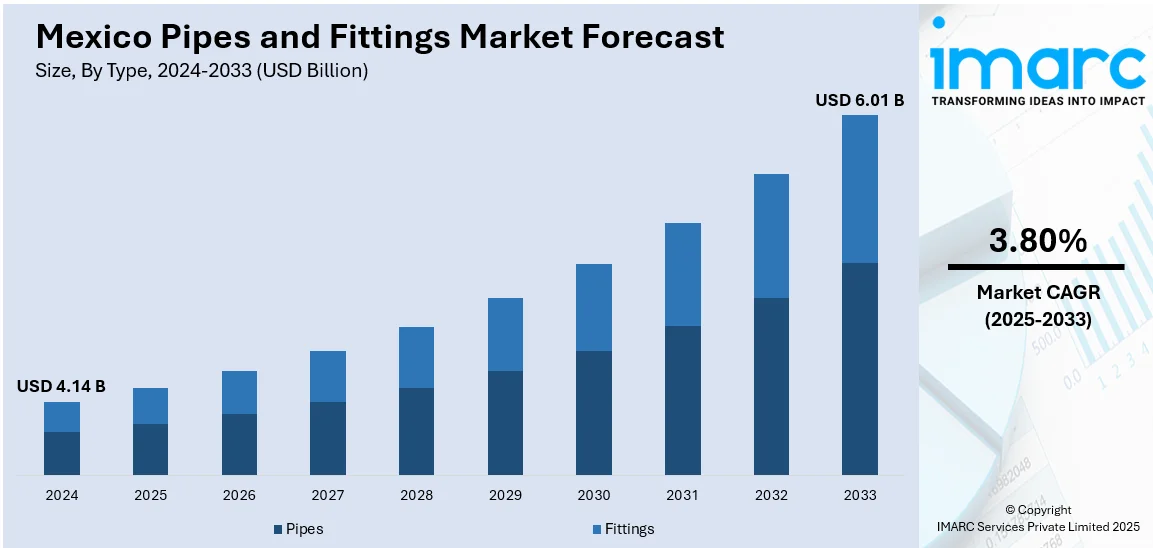

The Mexico pipes and fittings market size reached USD 4.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.01 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is driven by increased infrastructure development, heightened application of plastic pipes in water management, and growing industrial usage. Investments in sanitation, manufacturing, and housing by the public and private sector are propelling demand for corrosion-resistant, cost-effective, and long-lasting piping systems. Technological advancements as well as regulatory requirements are prompting usage of high-performance fittings among industries. These changing demands and modernization drives continue to consolidate the industry, with a larger contribution from the Mexico pipes and fittings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.14 Billion |

| Market Forecast in 2033 | USD 6.01 Billion |

| Market Growth Rate 2025-2033 | 3.80% |

Mexico Pipes and Fittings Market Trends:

Rise in the Adoption of Plastic Pipe for Water and Sewerage Infrastructure

Plastic pipe systems are gaining popularity in Mexico because of their flexibility, resistance to corrosion, and cost-effectiveness, particularly for large diameter water supply and sewerage schemes. Polyvinyl chloride (PVC), high-density polyethylene (HDPE), and cross-linked polyethylene (PEX) are considerably used in residential and municipal uses due to their light weight and ease of handling. Mexico's increasing urban population and the government's initiative towards enhancing public hygiene and access to potable water are the major impulses for this changeover. Furthermore, plastic pipes are durable for a longer period and require less maintenance than metal alternatives. Their accelerating application in rural water supply and wastewater treatment is a function of changing infrastructure demands. Advances in extrusion technology and fabrication processes have also improved their pressure resistance and durability. These combined factors highlight Mexico pipes and fittings market expansion, with plastic-based offerings dominating new construction and renovation work nationwide.

To get more information on this market, Request Sample

Growth of Industrial Uses Drives Demand for Specialized Fittings

Industrial applications like oil and gas, petrochemicals, power generation, and food processing increasingly depend upon high-performance piping systems in Mexico. This developing trend is creating demand for special fittings such as adaptors, valves, elbows, reducers, and unions that facilitate operational safety, pressure maintenance, and process efficiency. As industrial parks develop in northern and central areas, pipeline networks with strong and precision-engineered components show a significant rise. Improved manufacturing capacity and compliance with global quality standards are driving the uptake of fittings suitable for high-temperature and corrosive conditions. Increased manufacturing capacity in Mexico and boosting export of industrial products are also supporting installation of long-lasting piping systems. These changing uses reflect emerging Mexico pipes and fittings market trends, as the sector undergoes a shift towards application-specific and performance-oriented fitting products catering to sectoral requirements in industrial environments.

Government Infrastructure Initiatives Facilitating Piping System Upgradation

Government investments in housing, sanitation, and urban renewal are having a strong impact on the fitment of innovative pipes and fittings in Mexico. Municipal water system expansion, low-income housing initiatives, and public transportations are all creating demand for long-lasting and efficient fluid handling systems. High-pressure metallic pipes and reinforced plastic pipes used as alternatives for household usage are gaining popularity, depending on the needs of applications. For instance, in December 2023, ASC Engineered Solutions introduced SCI Press carbon steel press fittings in more than 400 SKUs for plumbing and mechanical applications with simple installation and IAPMO and ASME compliance. Moreover, the effort at modernization also includes retrofitting existing pipelines with materials that can meet sustainability and efficiency standards. These programs are designed to promote enhanced water conservation, energy savings, and public health benefits through upgraded pipeline integrity. Increased environmental compliance and resource management needs are also prompting mounted standards in the selection of materials and system design. These national infrastructure programs are key drivers of Mexico pipes and fittings market growth as investment in trusted fluid transport systems becomes a priority for overall economic development purposes.

Mexico Pipes and Fittings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, application, and vertical.

Type Insights:

- Pipes

- Plastic Pipes

- Metallic Pipes

- Others

- Fittings

- Elbow

- Reducer

- Tee Type

- Cross Type

- Coupling

- Union

- Adaptor

- Valve

- Cap

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pipes (plastic pipes, metallic pipes, and others) and fittings (elbow, reducer, tee type, cross type, coupling, union, adaptor, valve, cap, and others).

Technology Insights:

- Compression Molding

- Injection Molding

- Thermoforming

- Extrusion

- Electro Fusion

- Fabricated

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes compression molding, injection molding, thermoforming, extrusion, electro fusion, fabricated, and others.

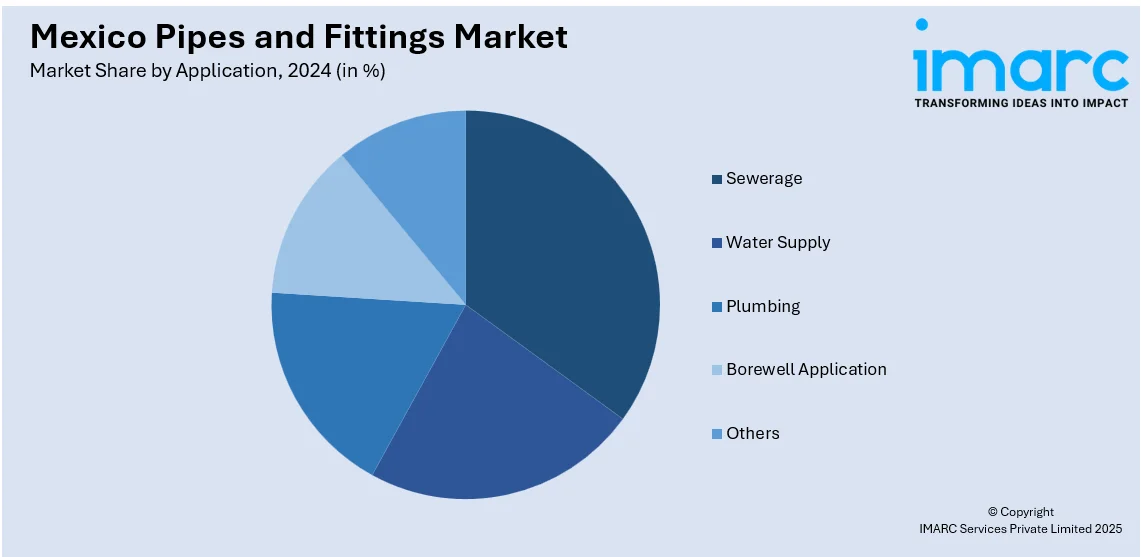

Application Insights:

- Sewerage

- Water Supply

- Plumbing

- Borewell Application

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes sewerage, water supply, plumbing, borewell application, and others.

Vertical Insights:

- Chemical and Petrochemical

- Residential

- Commercial

- Transportation

- Municipal

- Food and Beverage

- Oil and Gas

- Power

- Process Instrumentation

- Semiconductor

- Irrigation

- HVAC

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes chemical and petrochemical, residential, commercial, transportation, municipal, food and beverage, oil and gas, power, process instrumentation, semiconductor, irrigation, HVAC, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pipes and Fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Technologies Covered | Compression Molding, Injection Molding, Thermoforming, Extrusion, Electro Fusion, Fabricated, Others |

| Applications Covered | Sewerage, Water Supply, Plumbing, Borewell Application, Others |

| Verticals Covered | Chemical and Petrochemical, Residential, Commercial, Transportation, Municipal, Food and Beverage, Oil and Gas, Power, Process Instrumentation, Semiconductor, Irrigation, HVAC, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pipes and fittings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pipes and fittings market on the basis of type?

- What is the breakup of the Mexico pipes and fittings market on the basis of technology?

- What is the breakup of the Mexico pipes and fittings market on the basis of application?

- What is the breakup of the Mexico pipes and fittings market on the basis of vertical?

- What is the breakup of the Mexico pipes and fittings market on the basis of region?

- What are the various stages in the value chain of the Mexico pipes and fittings market?

- What are the key driving factors and challenges in the Mexico pipes and fittings?

- What is the structure of the Mexico pipes and fittings market and who are the key players?

- What is the degree of competition in the Mexico pipes and fittings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pipes and fittings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pipes and fittings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pipes and fittings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)