Mexico Plant-Based Seafood Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Mexico Plant-Based Seafood Market Summary:

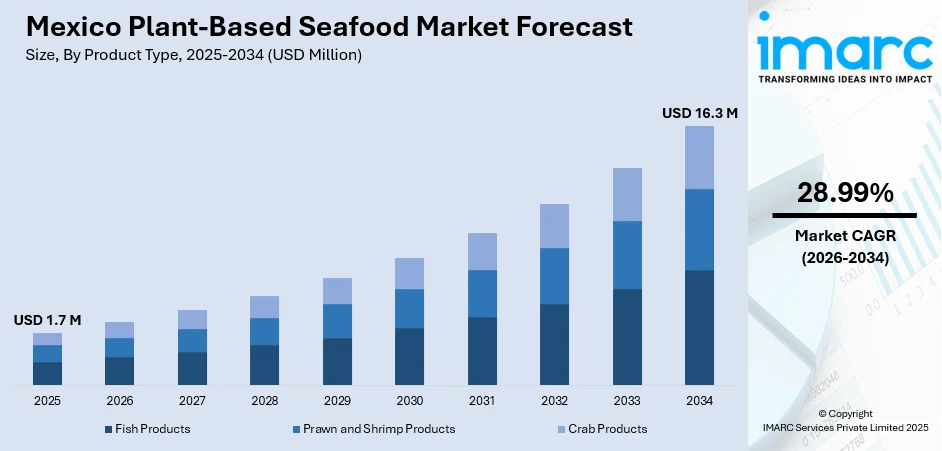

The Mexico plant-based seafood market size was valued at USD 1.7 Million in 2025 and is projected to reach USD 16.3 Million by 2034, growing at a compound annual growth rate of 28.99% from 2026-2034.

The Mexico plant-based seafood market is witnessing substantial growth driven by increasing consumer awareness about environmental sustainability and health benefits associated with plant-based diets. Rising concerns regarding overfishing, marine ecosystem degradation, and mercury contamination in traditional seafood are encouraging Mexican consumers to explore sustainable alternatives. The expanding vegan and flexitarian population, coupled with advancements in food technology that enable realistic seafood textures and flavors, is accelerating market adoption across urban centers and contributing to the overall Mexico plant-based seafood market share.

Key Takeaways and Insights:

- By Product Type: Fish products dominate the market with a share of 50.06% in 2025, driven by widespread consumer familiarity with fish as a dietary staple and the ability of plant-based fish alternatives to closely replicate traditional seafood textures and nutritional profiles.

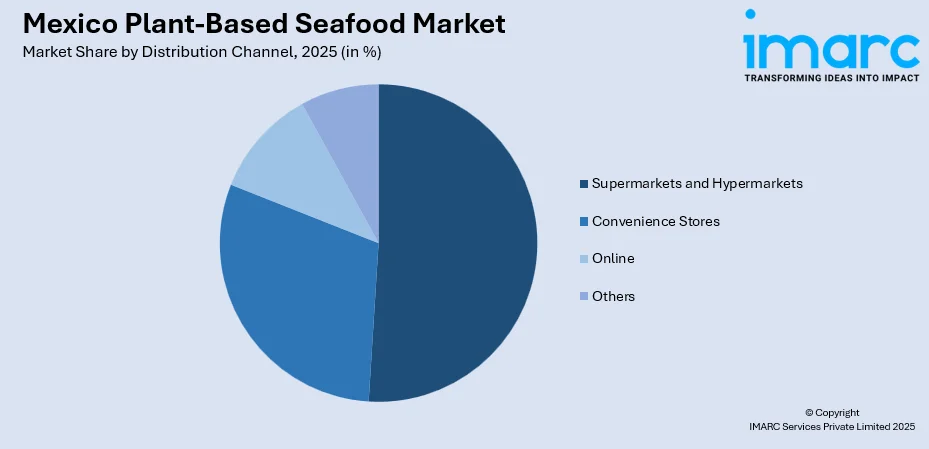

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 50.12% in 2025, owing to extensive shelf space allocation for plant-based products, strategic product placement alongside conventional seafood, and the growing presence of dedicated health food sections in major retail chains.

- Key Players: The Mexico plant-based seafood market exhibits a moderately fragmented competitive landscape, with international food conglomerates competing alongside regional innovators and foodtech startups. Market participants are leveraging advanced food technologies, strategic retail partnerships, and product diversification strategies to capture growing consumer demand.

To get more information on this market Request Sample

The Mexico plant-based seafood market is experiencing transformative growth as consumers increasingly align food choices with sustainability values and heightened health consciousness. The country's significant coastal fishing industry faces mounting pressure from environmental concerns, including overfishing, marine ecosystem degradation, and pollution, creating favorable conditions for plant-based alternatives. Mexican consumers are particularly receptive to innovative food products that maintain familiar taste profiles while offering enhanced nutritional benefits and reduced environmental impact. The proliferation of plant-based options in restaurant chains, quick-service establishments, and foodservice outlets has normalized these products among mainstream consumers seeking convenient sustainable choices. The market benefits significantly from Mexico's robust retail infrastructure, expanding modern trade networks, and growing e-commerce penetration, enabling wider product accessibility across diverse consumer segments throughout urban and emerging regional markets.

Mexico Plant-Based Seafood Market Trends:

Integration of Artificial Intelligence in Product Development

The Mexico plant-based seafood market is witnessing increasing adoption of artificial intelligence technologies to optimize product development processes and enhance taste replication. Food technology companies are leveraging machine learning algorithms to analyze molecular structures and identify plant-based ingredient combinations that closely mimic traditional seafood characteristics. In June 2024, NotCo inaugurated its NotKitchen facility in Mexico City, combining scientific research with culinary innovation through its AI platform Giuseppe, which analyzes food components across discovery, formulation, and flavor matching stages. This technological advancement has significantly reduced product development timelines while improving sensory accuracy.

Expansion of Clean Label and Minimal Processing Products

Mexican consumers are increasingly demanding plant-based seafood products featuring shorter ingredient lists, natural preservatives, and absence of artificial additives. This clean-label trend reflects broader health consciousness and growing distrust of highly processed foods among health-focused demographics. Manufacturers are responding by formulating products using recognizable whole-food ingredients such as legumes, seaweed, and vegetable proteins. Mexico's NOM-051 front-of-package labeling regulation, which mandates warnings for foods high in calories, sodium, sugar, and fats, has catalyzed industry-wide reformulations toward simpler, healthier formulations that can avoid warning labels and gain consumer trust.

Strategic Foodservice Partnerships and Menu Integration

The Mexico plant-based seafood market is benefiting from expanding collaborations between alternative protein manufacturers and foodservice establishments. Restaurant chains and quick-service operators are increasingly incorporating plant-based seafood options into their menus to cater to environmentally conscious consumers seeking sustainable dining experiences. In February 2024, Better Balance, a plant-based branch of Sigma Alimentos, announced a strategic partnership with New York-based Chunk Foods to develop co-branded plant-based whole cuts specifically targeting the Mexican foodservice sector. Such partnerships are accelerating consumer exposure and normalizing plant-based seafood consumption.

Market Outlook 2026-2034:

The Mexico plant-based seafood market outlook remains highly positive, supported by sustained consumer interest in sustainable food alternatives and continued technological advancements in product development. The expanding vegan and flexitarian population, particularly among younger demographics in urban centers, is expected to drive consistent demand growth throughout the forecast period. Ongoing investments in local manufacturing capabilities, distribution infrastructure, and retail partnerships will enhance product accessibility and affordability, while strategic collaborations between foodtech companies and foodservice establishments will further accelerate mainstream consumer adoption across the country. The market generated a revenue of USD 1.7 Million in 2025 and is projected to reach a revenue of USD 16.3 Million by 2034, growing at a compound annual growth rate of 28.99% from 2026-2034.

Mexico Plant-Based Seafood Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Fish Products | 50.06% |

| Distribution Channel | Supermarkets and Hypermarkets | 50.12% |

Product Type Insights:

- Fish Products

- Prawn and Shrimp Products

- Crab Products

The fish products dominate the Mexico plant-based seafood market with a share of 50.06% in 2025.

Plant-based fish products represent the largest segment in Mexico's plant-based seafood market due to the cultural significance of fish in traditional Mexican cuisine and the widespread consumer familiarity with fish-based dishes. Mexican consumers seeking to reduce their environmental footprint while maintaining familiar dietary patterns find plant-based fish alternatives particularly appealing. The segment benefits from continuous improvements in texture replication technologies that enable manufacturers to create products closely mimicking the flaky texture and mild flavor profiles of conventional fish.

The growth trajectory of plant-based fish products in Mexico is supported by expanding retail distribution networks and increasing availability in foodservice establishments. Major supermarket chains are allocating dedicated shelf space for plant-based fish alternatives, positioning these products alongside conventional seafood to facilitate consumer trial and adoption. The segment's appeal extends beyond strict vegans to include flexitarian consumers and health-conscious individuals concerned about mercury contamination and other contaminants found in ocean-caught fish. Product innovation continues to expand the category, with manufacturers introducing plant-based versions of popular Mexican fish preparations including fish tacos, ceviche alternatives, and breaded fish products.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

The supermarkets and hypermarkets lead the Mexico plant-based seafood market with a share of 50.12% in 2025.

Supermarkets and hypermarkets dominate the Mexico plant-based seafood distribution landscape due to their extensive reach, comprehensive product assortments, and strategic placement capabilities. Major retail chains including Walmart de México, Grupo Chedraui, and Organización Soriana have expanded their plant-based product offerings significantly, creating dedicated health food sections that enhance product visibility and consumer accessibility. According to USDA reports on Mexico's retail sector, in 2023 food retail sales in Mexico reached $78.4 Billion, with retail trends including plant-based alternatives for meat and dairy gaining substantial momentum among middle and high-income consumers who frequent modern retail channels.

The supermarket channel's dominance is reinforced by consumer shopping behaviors that favor one-stop grocery destinations for convenient access to diverse product categories. Retailers leverage loyalty programs and targeted digital promotions to drive repeat purchases of plant-based products among mainstream consumers. The channel benefits from sophisticated supply chain infrastructure enabling consistent product availability and freshness maintenance for chilled plant-based seafood items. Strategic merchandising approaches, including placement in both frozen food aisles and fresh seafood sections, maximize consumer exposure and encourage trial among shoppers unfamiliar with plant-based alternatives.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for plant-based seafood, driven by high economic activity, proximity to United States consumer trends, and strong quick-service restaurant presence. Industrial cities like Monterrey exhibit elevated disposable incomes and health-conscious consumer segments receptive to innovative food alternatives.

Central Mexico witnesses high demand for plant-based seafood, anchored by Mexico City's massive consumer base and sophisticated retail infrastructure. The region accounts for over sixty percent of national plant-based food sales, benefiting from concentrated urban populations, higher purchasing power, and extensive modern trade networks facilitating product accessibility.

Southern Mexico presents emerging growth opportunities for plant-based seafood as traditional cuisine remains deeply embedded in regional food culture. The market is witnessing gradual adoption driven by tourism-related exposure to international dietary trends and increasing penetration of modern retail formats in urban centers throughout the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Plant-Based Seafood Market Growing?

Rising Environmental Consciousness and Sustainability Concerns

The Mexico plant-based seafood market is experiencing substantial growth driven by escalating consumer awareness of environmental sustainability issues associated with conventional fishing practices. Mexican consumers are increasingly concerned about overfishing, marine ecosystem degradation, and the broader environmental impact of traditional seafood production on ocean health. These concerns are particularly pronounced among younger demographics who prioritize environmental responsibility in purchasing decisions. The country's extensive coastline and traditional fishing communities have witnessed firsthand the effects of declining fish populations, creating grassroots support for sustainable alternatives.

Growing Health Awareness and Dietary Shift Trends

The expansion of the Mexico plant-based seafood market is significantly influenced by increasing health consciousness among Mexican consumers and the growing prevalence of lifestyle-related diseases. Mexico ranks among countries with highest obesity rates, nearly one in three adults are obese, according to OECD statistics, prompting consumers to seek healthier dietary alternatives that offer nutritional benefits without associated health risks. Plant-based seafood products appeal to health-focused consumers by providing protein and essential nutrients while eliminating concerns about mercury contamination, excessive cholesterol, and saturated fats commonly associated with traditional seafood consumption. The rising flexitarian movement, characterized by consumers reducing rather than eliminating animal products, has created substantial demand for high-quality plant-based alternatives that maintain familiar taste profiles.

Technological Advancements in Food Processing and Product Innovation

The Mexico plant-based seafood market growth is accelerated by continuous technological advancements enabling manufacturers to create products that closely replicate traditional seafood characteristics. Innovations in extrusion technology, fermentation processes, and ingredient formulation have dramatically improved the sensory attributes of plant-based seafood alternatives, including texture, appearance, and flavor profiles. These technological improvements have expanded consumer acceptance beyond strict vegans to mainstream populations seeking convenient sustainable options. Food technology companies operating in Mexico are investing significantly in research and development to optimize production efficiency and enhance product quality. The application of artificial intelligence in recipe development has substantially reduced innovation timelines while improving accuracy in replicating traditional seafood experiences.

Market Restraints:

What Challenges the Mexico Plant-Based Seafood Market is Facing?

Price Premium Over Conventional Seafood Products

The Mexico plant-based seafood market faces significant challenges related to the price premium of alternative products compared to conventional seafood options. Higher production costs associated with specialized ingredients, advanced processing technologies, and limited economies of scale result in retail prices that exceed traditional seafood counterparts, limiting adoption among price-sensitive consumer segments.

Consumer Perception and Taste Acceptance Barriers

The Mexico plant-based seafood market encounters resistance from consumers skeptical about the taste and texture quality of alternative products compared to traditional seafood. Deep-rooted cultural preferences for authentic seafood experiences, particularly in the coastal regions with strong fishing traditions, create adoption barriers requiring extensive consumer education and product sampling initiatives.

Limited Product Variety and Distribution Infrastructure

The Mexico plant-based seafood market growth is constrained by relatively limited product variety compared to the diverse range of traditional seafood options available to consumers. Distribution infrastructure challenges in smaller cities and rural areas further restrict market penetration, as cold chain requirements for fresh plant-based products demand sophisticated logistics capabilities.

Competitive Landscape:

The Mexico plant-based seafood market exhibits a moderately fragmented competitive landscape characterized by participation from international food conglomerates, regional manufacturers, and innovative foodtech startups. Market participants compete through product innovation, strategic retail partnerships, and brand differentiation strategies targeting diverse consumer segments. International players leverage established brand recognition and extensive distribution networks while local innovators capitalize on cultural insights and agile product development capabilities. The competitive environment is intensifying as major food corporations expand their plant-based portfolios through acquisitions and internal development initiatives. Companies are increasingly focusing on improving taste profiles, enhancing nutritional content, and achieving price parity with conventional seafood to capture mainstream consumer adoption.

Mexico Plant-Based Seafood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fish Products, Prawn and Shrimp Products, Crab Products |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico plant-based seafood market size was valued at USD 1.7 Million in 2025.

The Mexico plant-based seafood market is expected to grow at a compound annual growth rate of 28.99% from 2026-2034 to reach USD 16.3 Million by 2034.

Fish products dominated the Mexico plant-based seafood market with approximately 50.06% share in 2025, driven by widespread consumer familiarity with fish as a dietary staple and superior texture replication capabilities in plant-based fish alternatives.

Key factors driving the Mexico plant-based seafood market include rising environmental consciousness regarding overfishing and marine ecosystem degradation, growing health awareness prompting dietary shifts toward sustainable alternatives, and technological advancements enabling realistic seafood texture and flavor replication.

Major challenges include price premiums over conventional seafood products limiting mass-market adoption, consumer perception barriers regarding taste and texture quality, limited product variety compared to traditional seafood options, and distribution infrastructure constraints in smaller cities and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)