Mexico Plumbing Fixtures Market Size, Share, Trends and Forecast by Product, Location, Application, Distribution Channel, End User, and Region, 2025-2033

Mexico Plumbing Fixtures Market Overview:

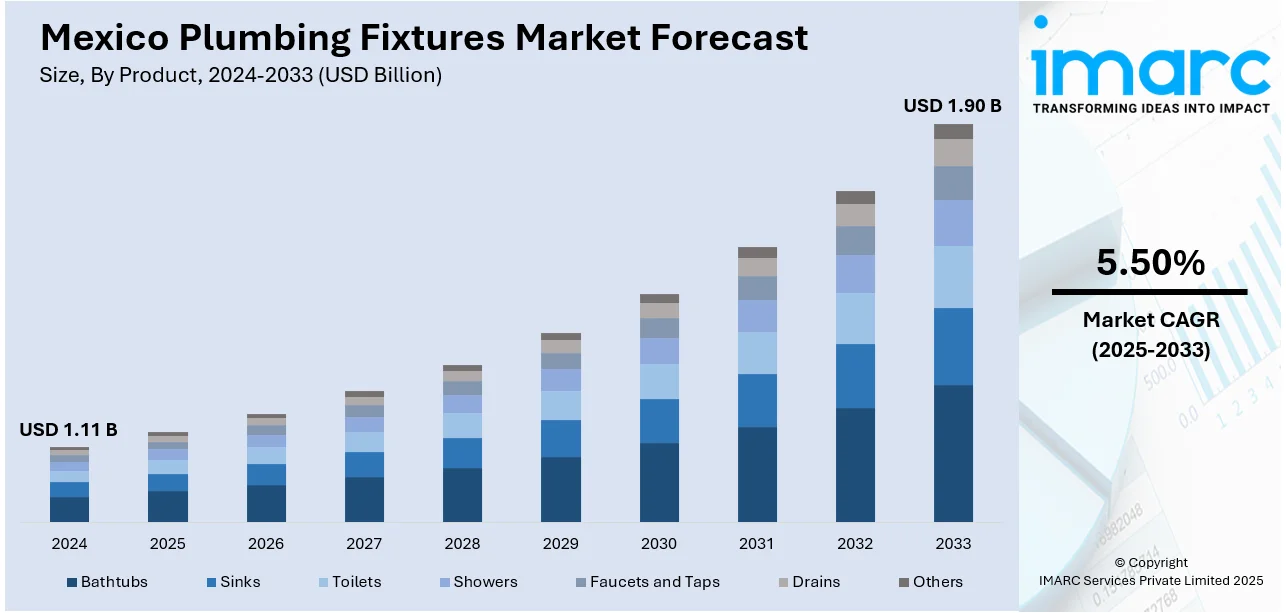

The Mexico plumbing fixtures market size reached USD 1.11 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.90 Billion by 2033, exhibiting a growth rate (CAGR) of 5.50% during 2025-2033. Rising residential and commercial construction, increasing urbanization, expanding tourism sector, and improved access to clean water infrastructure are some of the factors contributing to Mexico plumbing fixtures market share. Government initiatives for affordable housing and growing consumer preference for modern bathroom and kitchen fittings also contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.11 Billion |

| Market Forecast in 2033 | USD 1.90 Billion |

| Market Growth Rate 2025-2033 | 5.50% |

Mexico Plumbing Fixtures Market Trends:

Emphasis on Compliance and Quality Assurance

Mexico’s plumbing fixtures market is placing greater importance on meeting official standards and certification requirements. Updated regulations now cover a wider range of sanitary products, encouraging manufacturers to align more closely with national guidelines. This focus on compliance supports smoother integration into ongoing residential and commercial projects. As development continues across the country, certified products are gaining preference for their assurance of performance and reliability. Adhering to revised technical standards helps ensure public confidence in product safety while also simplifying approval processes. The push toward formal certification reflects a broader shift toward structured quality control and regulatory clarity in the market, fostering a more organized and dependable supply environment for plumbing products across a range of construction applications. These factors are intensifying the Mexico plumbing fixtures market growth. For example, in February 2024, ICC-ES expanded its accreditation to certify plumbing products in Mexico under the updated NOM-002-CONAGUA-2021 standard. Key items like flushometers, toilets, and flush valves became eligible for certification. This supported manufacturers in meeting mandatory standards as residential and commercial development grew. ICC-ES helped companies align with evolving regulations and gain trust among local code officials, reinforcing compliance in Mexico’s plumbing fixtures market.

To get more information on this market, Request Sample

Rising Demand for Smart and Design-Centric Fixtures

The plumbing fixtures market in Mexico is seeing increased interest in connected and visually distinctive products. Homeowners are choosing faucets with features like voice control, touchless activation, and app-based water monitoring, reflecting a shift toward convenience and digital integration. Alongside functionality, there is strong appeal for bold finishes such as matte black and brushed brass, paired with clean, minimalist designs. These preferences are influencing product development and driving demand for fixtures that balance performance with aesthetic appeal. With a significant portion of smart and design-forward products being assembled locally, Mexico is becoming an important base for manufacturing and innovation. This shift supports both domestic demand and export potential, reinforcing the country’s role in the evolving landscape of kitchen and bathroom solutions. For instance, as per industry reports, Mexico’s plumbing fixtures market is growing with rising demand for smart, stylish solutions. Homeowners are embracing voice-activated and app-connected faucets, such as Moen’s Smart Water Network and Flo Smart Water Monitor & Shutoff, and Delta Faucet’s Touch2O and VoiceIQ technologies. Matte black, brushed brass, and minimalist designs are also trending. With many smart and design-focused products assembled in Mexico, the country is playing a key role in driving innovation.

Mexico Plumbing Fixtures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, location, application, distribution channel, and end user.

Product Insights:

- Bathtubs

- Sinks

- Toilets

- Showers

- Faucets and Taps

- Drains

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bathtubs, sinks, toilets, showers, faucets and taps, drains, and others.

Location Insights:

- Bathroom

- Kitchen

- Others

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes bathroom, kitchen, and others.

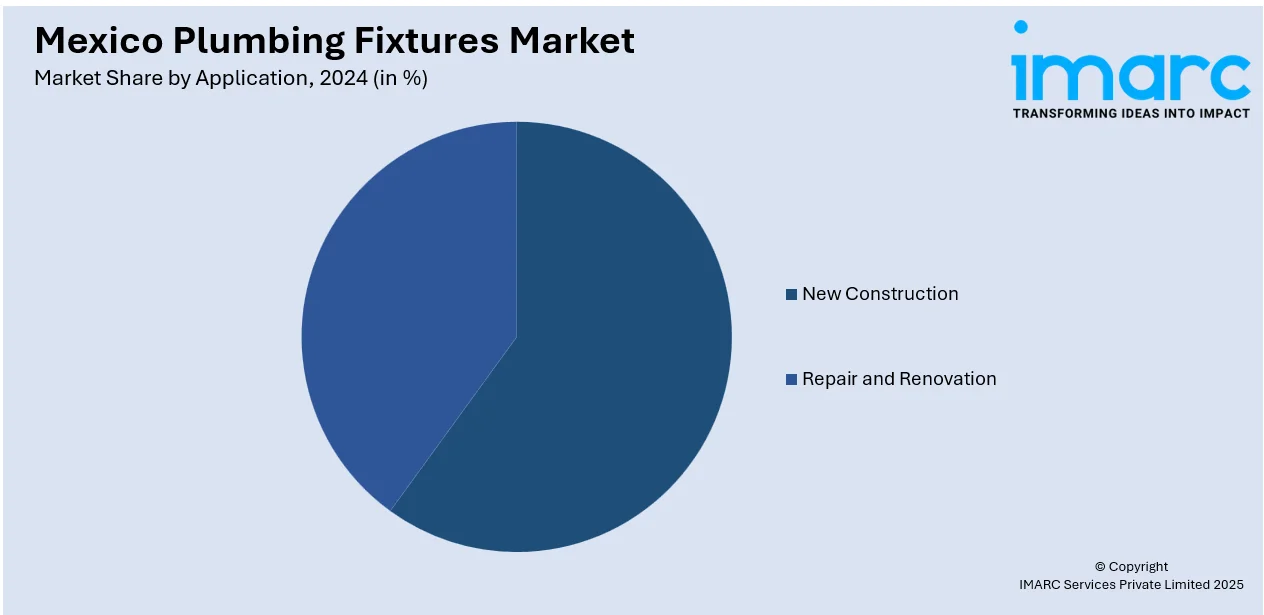

Application Insights:

- New Construction

- Repair and Renovation

The report has provided a detailed breakup and analysis of the market based on the application. This includes new construction and repair and renovation.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Plumbing Fixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bathtubs, Sinks, Toilets, Showers, Faucets and Taps, Drains, Others |

| Locations Covered | Bathroom, Kitchen, Others |

| Applications Covered | New Construction, Repair and Renovation |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico plumbing fixtures market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico plumbing fixtures market on the basis of product?

- What is the breakup of the Mexico plumbing fixtures market on the basis of location?

- What is the breakup of the Mexico plumbing fixtures market on the basis of application?

- What is the breakup of the Mexico plumbing fixtures market on the basis of distribution channel?

- What is the breakup of the Mexico plumbing fixtures market on the basis of end user?

- What is the breakup of the Mexico plumbing fixtures market on the basis of region?

- What are the various stages in the value chain of the Mexico plumbing fixtures market?

- What are the key driving factors and challenges in the Mexico plumbing fixtures market?

- What is the structure of the Mexico plumbing fixtures market and who are the key players?

- What is the degree of competition in the Mexico plumbing fixtures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico plumbing fixtures market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico plumbing fixtures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico plumbing fixtures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)