Mexico Pneumatic Equipment Market Size, Share, Trends and Forecast by Type of Equipment, End User Industry, and Region, 2025-2033

Mexico Pneumatic Equipment Market Overview:

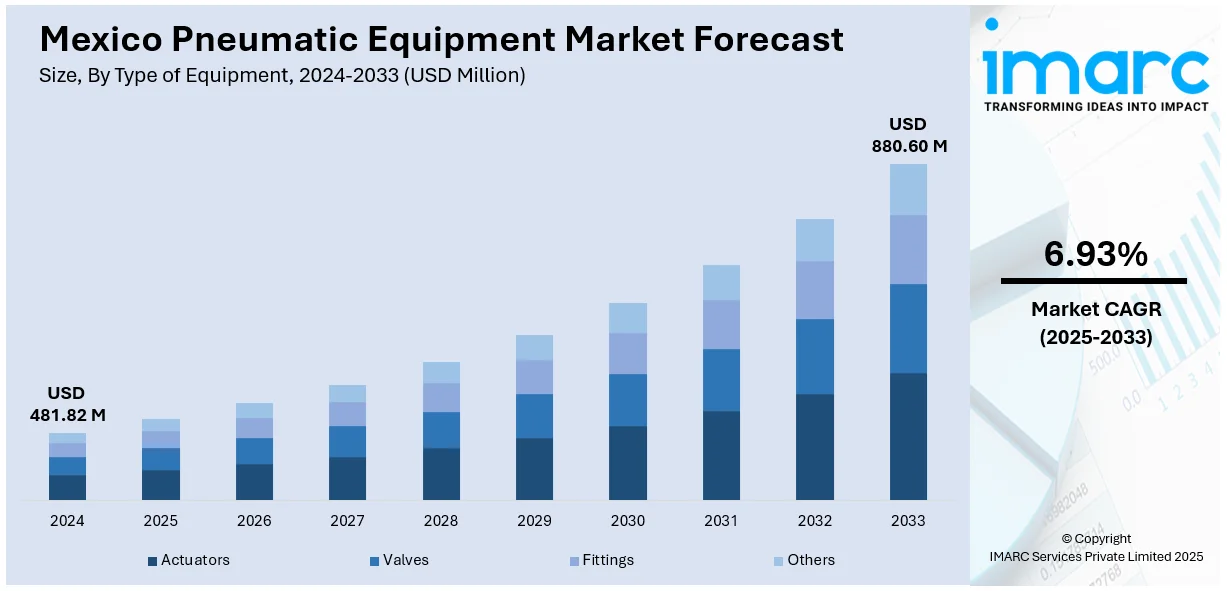

The Mexico pneumatic equipment market size reached USD 481.82 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 880.60 Million by 2033, exhibiting a growth rate (CAGR) of 6.93% during 2025-2033. The increasing focus on energy efficiency and adherence to environmental standards drives the demand for pneumatic components in Mexico. Besides this, the growing innovations in the manufacturing industry, especially in the automotive, aerospace, and electronics sectors, are offering a favorable market outlook. This trend, coupled with the developments in the automotive industry, is expanding the Mexico pneumatic equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 481.82 Million |

| Market Forecast in 2033 | USD 880.60 Million |

| Market Growth Rate 2025-2033 | 6.93% |

Mexico Pneumatic Equipment Market Trends:

Expanding Manufacturing and Industrial Automation

The pneumatic equipment market in Mexico is driven by the heightened innovations in the manufacturing industry, especially in the automotive, aerospace, and electronics sectors. Businesses are investing more in industrial automation to improve productivity, lower the cost of operations, and ensure consistency in the quality of production. Pneumatic systems, as they are inexpensive, reliable, and low-maintenance, are becoming part of automated processes. Pneumatic tools are also used in facilities for operations like material handling, assembly, and packaging, where speed and accuracy are important. The Government is encouraging programs like "Mexico Industry 4.0," which is pushing for intelligent manufacturing processes and the adoption of automation technologies. The trend is drawing foreign direct investment, which is, in turn, is driving the demand for pneumatic components like actuators, valves, compressors, and air treatment units. As manufacturing units continue to incorporate automation solutions, robots are taking a pivotal position in maximizing operational efficiency and fulfilling production requirements. Huayan Robotics, previously Han's Robot, officially launched at FABTECH Mexico 2025 from May 6-8 at Booth 1937. As the top metalworking and manufacturing event in North America, FABTECH provides the perfect venue for Huayan Robotics to introduce its newest developments in industrial automation.

Improvements in Automotive Industry

The rising demand for pneumatics in the automotive sector is propelling the Mexico pneumatic equipment market growth. Large international original equipment manufacturers (OEMs) and tier 1 suppliers are increasing their footprints in areas such as Guanajuato, Puebla, and Nuevo León, where auto manufacturing plant clusters are thriving. These facilities are becoming more dependent on pneumatic systems for applications such as actuating robotic arms, paint spraying, tire inflation, and tool usage in assembly lines. Pneumatics are used because they can perform repetitive functions reliably and handle harsh industrial conditions. Additionally, as Mexico grows its contribution to the North American supply chain under the USMCA pact, localized manufacturing is rising, as is the demand for effective manufacturing support systems. Pneumatic equipment, with its modular form factor and versatility, is widely utilized to provide speed, accuracy, and cost containment in automotive manufacturing phases. Moreover, the Government launched Plan Mexico 2025 which will encourage investment in Mexico by providing tax breaks to corporate businesses, supporting innovation and training tax advantages, and boosting industries that improve regional economies. This will further improve local manufacturing of various equipment like pneumatic systems.

Rising Focus on Energy Efficiency and Environmental Regulations

Pneumatic equipment demand in Mexico is driven by an increasing focus on energy efficiency and adherence to environmental standards. Industrial players are investing in modern pneumatic systems that consume less compressed air and operate with minimal energy wastage. Traditional pneumatic systems are being upgraded or replaced with energy-optimized models featuring smart monitoring systems, leak detection, and demand-based air compression. Environmental agencies and government bodies are also enforcing regulations that require reduced emissions and higher energy efficiency in manufacturing practices. This regulatory pressure is encouraging companies to adopt pneumatic tools that support sustainable production methods. Additionally, Mexico’s commitment to international climate agreements is incentivizing industries to lower their carbon footprint, and energy-efficient pneumatics serve as a viable solution in this context. The integration of Internet of Things (IoT)-enabled pneumatic devices is further enhancing operational transparency and control, enabling businesses to monitor and manage energy consumption more effectively.

Mexico Pneumatic Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of equipment and end user industry.

Type of Equipment Insights:

- Actuators

- Valves

- Fittings

- Others

The report has provided a detailed breakup and analysis of the market based on the type of equipment. This includes actuators, valves, fittings, and others.

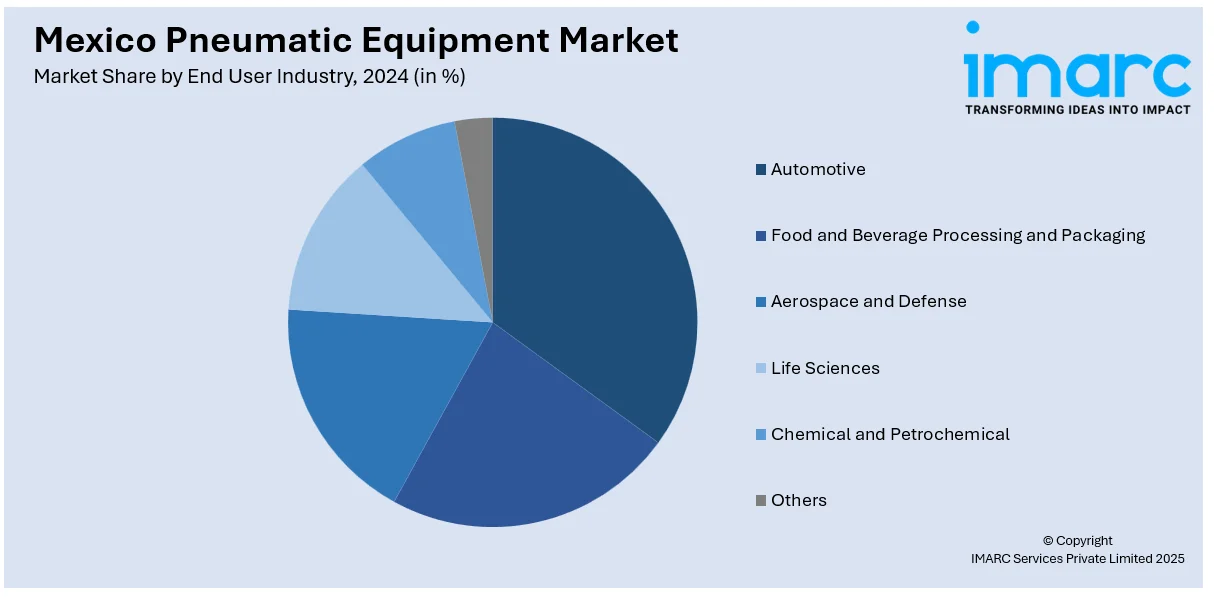

End User Industry Insights:

- Automotive

- Food and Beverage Processing and Packaging

- Aerospace and Defense

- Life Sciences

- Chemical and Petrochemical

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes automotive, food and beverage processing and packaging, aerospace and defense, life sciences, chemical and petrochemical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pneumatic Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Equipment Covered | Actuators, Valves, Fittings, Others |

| End User Industries Covered | Automotive, Food and Beverage Processing and Packaging, Aerospace and Defense, Life Sciences, Chemical and Petrochemical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pneumatic equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pneumatic equipment market on the basis of type of equipment?

- What is the breakup of the Mexico pneumatic equipment market on the basis of end user industry?

- What is the breakup of the Mexico pneumatic equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico pneumatic equipment market?

- What are the key driving factors and challenges in the Mexico pneumatic equipment market?

- What is the structure of the Mexico pneumatic equipment market and who are the key players?

- What is the degree of competition in the Mexico pneumatic equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pneumatic equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pneumatic equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pneumatic equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)