Mexico Pneumatic Tools Market Size, Share, Trends and Forecast by Type, Application, End-Use, and Region, 2025-2033

Mexico Pneumatic Tools Market Overview:

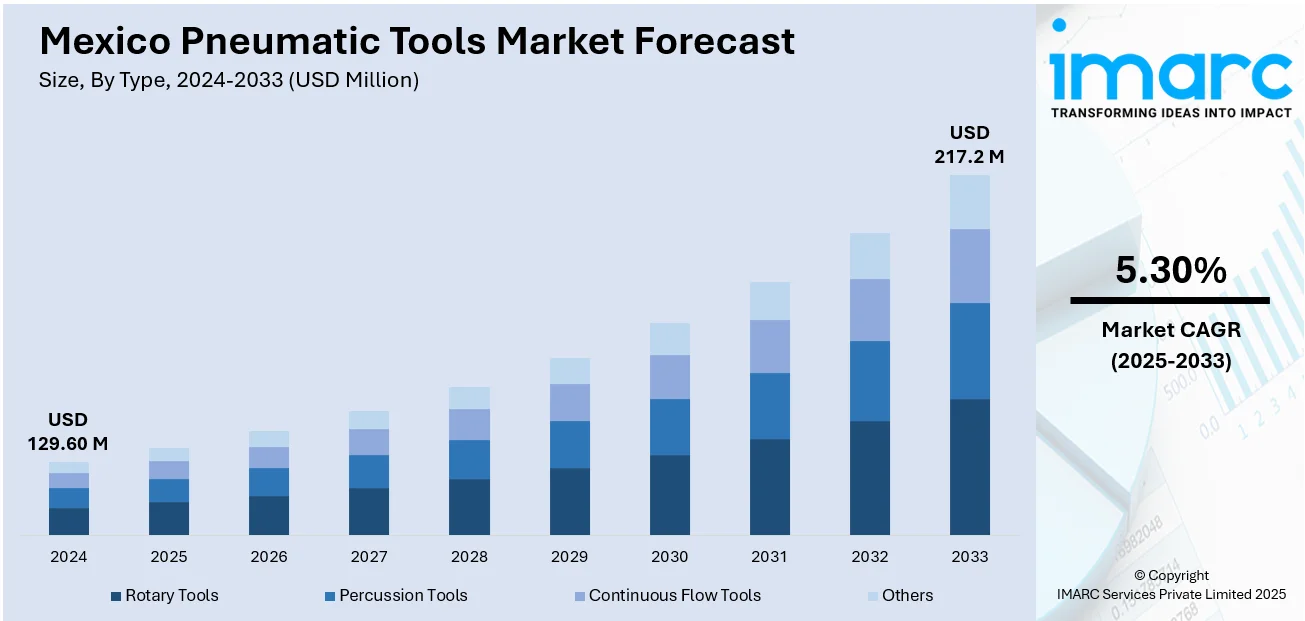

The Mexico pneumatic tools market size reached USD 129.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 217.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market is driven by the increasing adoption of energy-efficient pneumatic tools, supported by stricter sustainability regulations and cost-saving demands across automotive, construction, and manufacturing sectors. The expansion of Mexico’s automotive and aerospace industries, fueled by nearshoring trends, is accelerating demand for high-performance pneumatic tools in assembly and precision applications. Additionally, technological advancements, such as IoT-enabled smart systems and ergonomic designs, are further augmenting the Mexico pneumatic tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 129.60 Million |

| Market Forecast in 2033 | USD 217.2 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Pneumatic Tools Market Trends:

Increasing Adoption of Energy-Efficient Pneumatic Tools in Mexico

The market is witnessing a growing demand for energy-efficient models due to rising operational costs and environmental concerns. In 2023, the total energy consumption of Mexico amounted to 8.45 exajoules and was fueled chiefly by oil (45.4%) and gas (41.5%). 374.62 TWh were generated through electricity, with fossil fuels contributing 80%. Proven reserves in Mexico for oil amount to 5.978 billion barrels and for natural gas amount to 12.297 Tcf, making the nation the third largest in Latin America in oil potential. This tremendous need for fuel and energy infrastructure provides significant growth opportunities for the pneumatic tools sector in both industrial and energy markets across the country. Manufacturers are focusing on developing tools with improved air compression efficiency, reducing energy consumption while maintaining high performance. Industries such as automotive, construction, and manufacturing are leading this shift, as they seek to lower electricity expenses and comply with stricter sustainability regulations. Additionally, advancements in pneumatic tool design, such as lightweight materials and ergonomic features, are enhancing productivity and reducing worker fatigue, further driving adoption. Companies are also investing in smart pneumatic systems with IoT-enabled sensors to monitor air pressure and leakage, optimizing energy use. As Mexican industries continue to prioritize cost-effective and eco-friendly solutions, the demand for energy-efficient pneumatic tools is expected to rise steadily, shaping market growth in the coming years.

To get more information on this market, Request Sample

Expansion of Automotive and Manufacturing Sectors Boosting Pneumatic Tool Demand

The rapid growth of the automotive and manufacturing industries is significantly driving the Mexico pneumatic tools market growth. As a key global automotive production hub, Mexico attracts major automakers and suppliers, increasing the need for reliable, high-performance pneumatic tools in assembly lines and maintenance operations. In May 2025, Mexico's automotive production decreased by 2% from the previous year to 358,209 units, following a 9.1% decline in April. The decline affects major brands such as Mazda and Stellantis, but companies including Toyota and General Motors have reported growth in production. The shift in production figures comes amid the constant demand for precision tools, particularly pneumatic tools, to maintain equipment efficiency in Mexico's automotive sector. The rise of nearshoring, where companies relocate production closer to the U.S., has further accelerated industrial activity, enhancing tool demand. Additionally, the aerospace and electronics manufacturing sectors are expanding, requiring precision pneumatic tools for intricate tasks. Local tool suppliers are partnering with international brands to offer advanced products, while rental and leasing services are gaining traction among small and medium enterprises (SMEs) looking for cost-effective solutions. With Mexico’s industrial sector projected to grow, the pneumatic tools market is set to benefit from sustained demand, particularly in high-precision and heavy-duty applications.

Mexico Pneumatic Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end-use.

Type Insights:

- Rotary Tools

- Percussion Tools

- Continuous Flow Tools

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes rotary tools, percussion tools, continuous flow tools, and others.

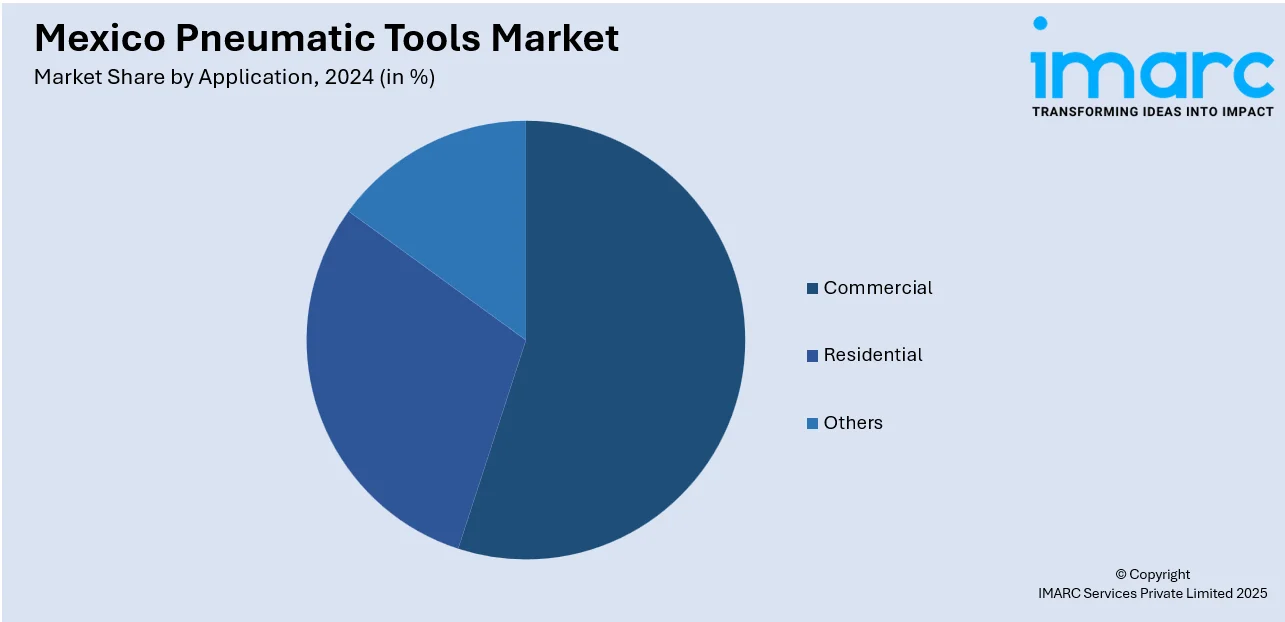

Application Insights:

- Commercial

- Residential

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, and others.

End-Use Insights:

- Manufacturing Industry

- Automotive Industry

- Construction Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes manufacturing industry, automotive industry, construction industry, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pneumatic Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rotary Tools, Percussion Tools, Continuous Flow Tools, Others |

| Applications Covered | Commercial, Residential, Others |

| End-Uses Covered | Manufacturing Industry, Automotive Industry, Construction Industry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pneumatic tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pneumatic tools market on the basis of type?

- What is the breakup of the Mexico pneumatic tools market on the basis of application?

- What is the breakup of the Mexico pneumatic tools market on the basis of end-use?

- What is the breakup of the Mexico pneumatic tools market on the basis of region?

- What are the various stages in the value chain of the Mexico pneumatic tools market?

- What are the key driving factors and challenges in the Mexico pneumatic tools market?

- What is the structure of the Mexico pneumatic tools market and who are the key players?

- What is the degree of competition in the Mexico pneumatic tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pneumatic tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pneumatic tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pneumatic tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)