Mexico Point-of-Care Diagnostics Market Size, Share, Trends and Forecast by Product Type, Platform, Prescription Mode, End-User, and Region, 2025-2033

Mexico Point-of-Care Diagnostics Market Overview:

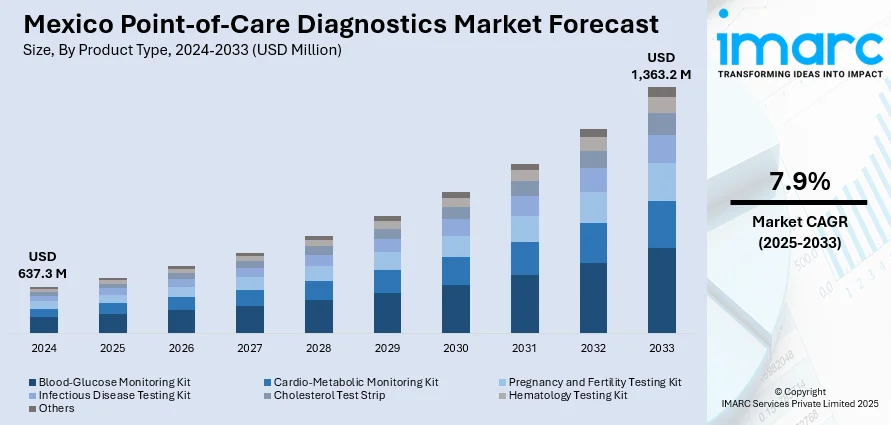

The Mexico point-of-care diagnostics market size reached USD 637.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,363.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.9% during 2025-2033. The market is driven by rising demand for rapid testing, increasing prevalence of chronic and infectious diseases, and expanding healthcare access in rural areas. Technological advancements and government initiatives to improve early diagnosis and disease management further support market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 637.3 Million |

| Market Forecast in 2033 | USD 1,363.2 Million |

| Market Growth Rate 2025-2033 | 7.9% |

Mexico Point-of-Care Diagnostics Market Trends:

Growing Need for Fast, Remote Testing

The increasing requirement for rapid and decentralized testing, particularly in underserved and remote regions, is one of the key factors boosting the Mexico point-of-care market share. Healthcare access disparities across urban and rural zones have prompted a shift towards mobile and on-site testing solutions that can deliver immediate results without centralized laboratory support. Point-of-care (POC) diagnostics address these challenges by enabling clinical personnel to detect and monitor diseases directly at patient locations, reducing the delay associated with sample transportation and laboratory turnaround times. This is particularly critical during outbreaks of infectious diseases or public health emergencies, where timely diagnosis is crucial to containment efforts. In urban regions, rapid testing is gaining preference for use in outpatient departments, emergency rooms, and private practices, enhancing patient throughput and reducing operational load on centralized facilities. Moreover, the push toward localized care delivery models is expected to further reinforce the demand for these diagnostic tools across the country, further propelling the market growth.

Rising Chronic Diseases

Chronic diseases, including diabetes, hypertension, and cardiovascular conditions, are on the rise in Mexico, contributing significantly to national healthcare expenditures and system burden. According to Mexico’s National Institute of Statistics and Geography (INEGI), cardiovascular diseases were the leading cause of death in 2024, responsible for over 100,000 deaths in just the first half of the year. This surpasses fatalities from diabetes, COVID-19, and cancer. The increasing prevalence of these long-term illnesses has led to a heightened need for continuous and real-time diagnostic monitoring to ensure timely clinical intervention and effective disease management, which is further providing a positive Mexico point-of-care market outlook. Point-of-care diagnostics play a critical role in this regard by providing patients and healthcare professionals with immediate results that can influence on-the-spot treatment decisions. In line with this, blood glucose monitors, lipid profile analyzers, and coagulation testing devices are gaining traction for routine use in both clinical and home-based care settings, which is facilitating the market growth. As the healthcare system emphasizes preventive care and self-monitoring, point-of-care technologies are emerging as essential tools to manage patient compliance and reduce hospital readmissions.

Government-Led Initiatives to Strengthen Disease Surveillance

The Mexican government has been actively promoting public health preparedness through improved disease surveillance and diagnostic infrastructure, especially following the lessons learned during the COVID-19 pandemic. Federal programs aimed at expanding healthcare access and early disease detection are driving the procurement and deployment of point-of-care diagnostic tools across primary and secondary care facilities. For instance, in 2024, The Instituto Mexicano del Seguro Social (IMSS) Bienestar program is being expanded to provide free healthcare services to over 53 million uninsured individuals. This includes the completion of previously unfinished hospitals and the establishment of 24/7 surgical teams in 282 rural hospitals to ensure continuous care in remote areas. Health authorities are prioritizing scalable and rapid-testing solutions to monitor infectious disease outbreaks, control endemic conditions, and improve maternal and child health outcomes. Budget allocations toward public sector healthcare have been increasingly directed toward upgrading testing capabilities, with emphasis on portable and low-maintenance diagnostic kits that can function effectively in varied clinical environments. Moreover, the collaborations with international health bodies and private firms to ensure reliable supply chains and training for healthcare workers is another factor accelerating the Mexico point-of-care diagnostics market growth.

Mexico Point-of-Care Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, platform, prescription mode, and end-user.

Product Type Insights:

- Blood-Glucose Monitoring Kit

- Cardio-Metabolic Monitoring Kit

- Pregnancy and Fertility Testing Kit

- Infectious Disease Testing Kit

- Cholesterol Test Strip

- Hematology Testing Kit

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes blood-glucose monitoring kit, cardio-metabolic monitoring kit, pregnancy and fertility testing kit, infectious disease testing kit, cholesterol test strip, hematology testing kit, and others.

Platform Insights:

- Lateral Flow Assays

- Dipsticks

- Microfluidics

- Molecular Diagnostics

- Immunoassays

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes lateral flow assays, dipsticks, microfluidics, molecular diagnostics, and immunoassays.

Prescription Mode Insights:

- Prescription-Based Testing

- OTC Testing

The report has provided a detailed breakup and analysis of the market based on the prescription mode. This includes prescription-based testing and OTC testing.

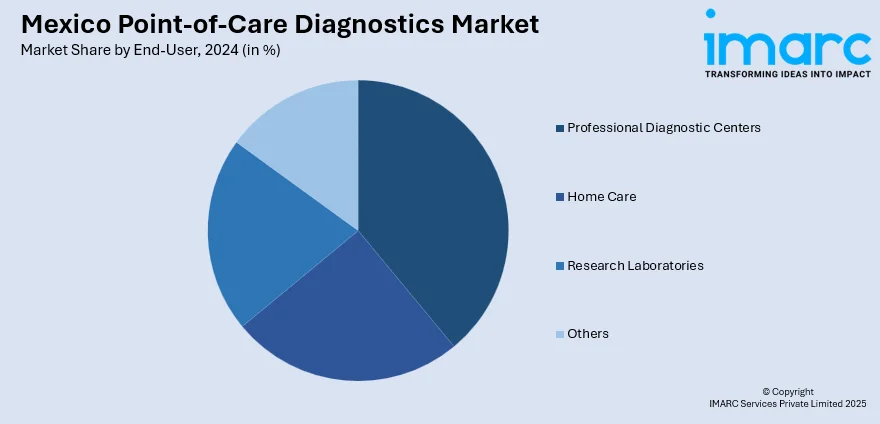

End-User Insights:

- Professional Diagnostic Centers

- Home Care

- Research Laboratories

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes professional diagnostic centers, home care, research laboratories, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Point-of-Care Diagnostics Market News:

- In 2024, the government of Mexico launched the ‘door-to-door’ healthcare program for seniors deploys medical teams to visit elderly individuals at home. The initiative focuses on providing health assessments, early disease detection, and basic medical care, improving access to point-of-care services for vulnerable, often immobile populations across rural and underserved communities.

Mexico Point-of-Care Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blood-Glucose Monitoring Kit, Cardio-Metabolic Monitoring Kit, Pregnancy and Fertility Testing Kit, Infectious Disease Testing Kit, Cholesterol Test Strip, Hematology Testing Kit, Others |

| Platforms Covered | Lateral Flow Assays, Dipsticks, Microfluidics, Molecular Diagnostics, Immunoassays |

| Prescription Modes Covered | Prescription-Based Testing, OTC Testing |

| End-Users Covered | Professional Diagnostic Centers, Home Care, Research Laboratories, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico point-of-care diagnostics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico point-of-care diagnostics market on the basis of product type?

- What is the breakup of the Mexico point-of-care diagnostics market on the basis of platform?

- What is the breakup of the Mexico point-of-care diagnostics market on the basis of prescription mode?

- What is the breakup of the Mexico point-of-care diagnostics market on the basis of end-user?

- What is the breakup of the Mexico point-of-care diagnostics market on the basis of region?

- What are the various stages in the value chain of the Mexico point-of-care diagnostics market?

- What are the key driving factors and challenges in the Mexico point-of-care diagnostics market?

- What is the structure of the Mexico point-of-care diagnostics market and who are the key players?

- What is the degree of competition in the Mexico point-of-care diagnostics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico point-of-care diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico point-of-care diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico point-of-care diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)