Mexico Polyols Market Size, Share, Trends and Forecast by Type, Application, Industry, and Region, 2025-2033

Mexico Polyols Market Overview:

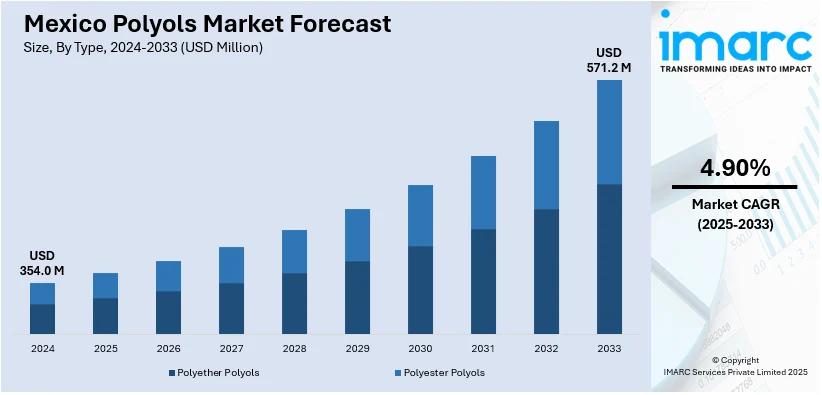

The Mexico polyols market size reached USD 354.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 571.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. Increasing demand in industries like construction, automotive, and furniture are some of the factors propelling the growth of the market. Polyols are essential for producing polyurethane foams, coatings, adhesives, and elastomers. Growth is further fueled by urbanization, rising disposable income, and the expansion of the manufacturing sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 354.0 Million |

| Market Forecast in 2033 | USD 571.2 Million |

| Market Growth Rate 2025-2033 | 4.90% |

Mexico Polyols Market Trends:

Growing Demand for Low-Emission Additives in Polyol Applications

Mexico’s polyols market is witnessing greater interest in advanced additive technologies that support cleaner manufacturing and improved product performance. With rising environmental standards and increased scrutiny on indoor air quality, especially in sectors like automotive interiors, producers are adopting solutions that reduce VOC emissions and eliminate harmful components such as aromatic amines. These additives not only enhance safety but also meet global regulatory requirements, making them increasingly attractive in Mexico's evolving polyurethane landscape. Their compatibility with existing foam and polyol systems makes integration feasible without major reformulations. The shift reflects a broader push towards sustainable inputs that improve end-product reliability while addressing environmental and health concerns, critical factors for domestic manufacturers aiming to stay competitive in regional and international markets. For example, at CHINAPLAS 2024 in Shanghai, BASF introduced Irgastab PUR 71, a new antioxidant and anti-scorch additive for polyols and polyurethane foams. Designed without aromatic amines, it reduces emissions and enhances air quality in applications like automotive interiors. This innovation aligns with global sustainability trends, offering polyol and foam producers in Mexico a competitive advantage.

Rising Preference for Certified Sustainable Polyol Inputs

Producers in Mexico are increasingly seeking certified raw materials to meet growing sustainability benchmarks in polyurethane manufacturing. With ISCC PLUS-certified inputs now more accessible across North America, manufacturers can align their supply chains with global environmental protocols. These certifications validate traceability and responsible sourcing, offering assurance to downstream users and end consumers. The shift is particularly relevant for sectors such as construction, automotive, and consumer goods, where pressure to reduce environmental impact is intensifying. Certified polyols also help companies position themselves for export opportunities, regulatory compliance, and corporate sustainability goals. As material standards tighten and demand for eco-conscious solutions grows, the availability of third-party-verified inputs is becoming an important differentiator in the polyols market across Mexico and neighboring regions. For instance, in January 2024, Dow announced achieving ISCC PLUS certification for its polyols and PO/PG manufacturing facility in Texas, enhancing its sustainable product offerings in the North American market, including Mexico.

Mexico Polyols Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and industry.

Type Insights:

- Polyether Polyols

- Polyester Polyols

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyether polyols and polyester polyols.

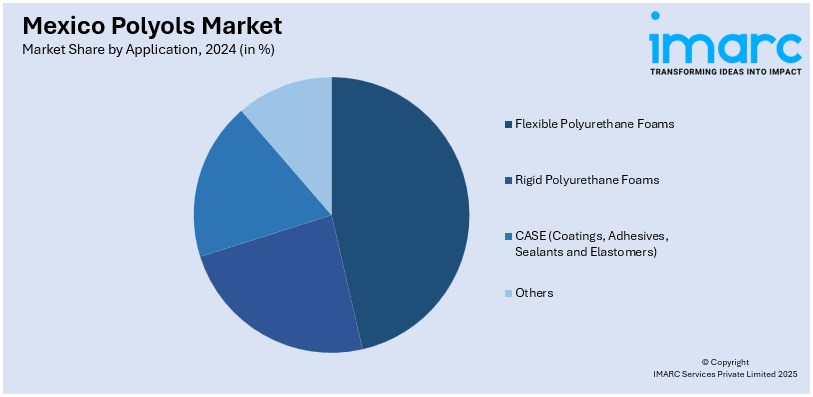

Application Insights:

- Flexible Polyurethane Foams

- Rigid Polyurethane Foams

- CASE (Coatings, Adhesives, Sealants and Elastomers)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes flexible polyurethane foams, rigid polyurethane foams, CASE (coatings, adhesives, sealants and elastomers), and others.

Industry Insights:

- Carpet Backing

- Packaging

- Furniture

- Automotive

- Building and Construction

- Electronics

- Footwear

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes carpet backing, packaging, furniture, automotive, building and construction, electronics, footwear, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Polyols Market News:

- In March 2025, Gantrade Corporation partnered with Cromogenia Units to introduce ROPOL polycarbonate polyols to the North American market. These advanced polyols offer exceptional durability, chemical resistance, and thermal stability, making them suitable for demanding applications such as automotive interiors, medical devices, and industrial coatings. Their performance attributes align with the needs of Mexico's polyurethane sector, providing manufacturers with enhanced material solutions.

Mexico Polyols Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyether Polyols, Polyester Polyols |

| Applications Covered | Flexible Polyurethane Foams, Rigid Polyurethane Foams, CASE (Coatings, Adhesives, Sealants and Elastomers), Others |

| Industries Covered | Carpet Backing, Packaging, Furniture, Automotive, Building and Construction, Electronics, Footwear, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico polyols market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico polyols market on the basis of type?

- What is the breakup of the Mexico polyols market on the basis of application?

- What is the breakup of the Mexico polyols market on the basis of industry?

- What are the various stages in the value chain of the Mexico polyols market?

- What are the key driving factors and challenges in the Mexico polyols market?

- What is the structure of the Mexico polyols market and who are the key players?

- What is the degree of competition in the Mexico polyols market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico polyols market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico polyols market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico polyols industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)