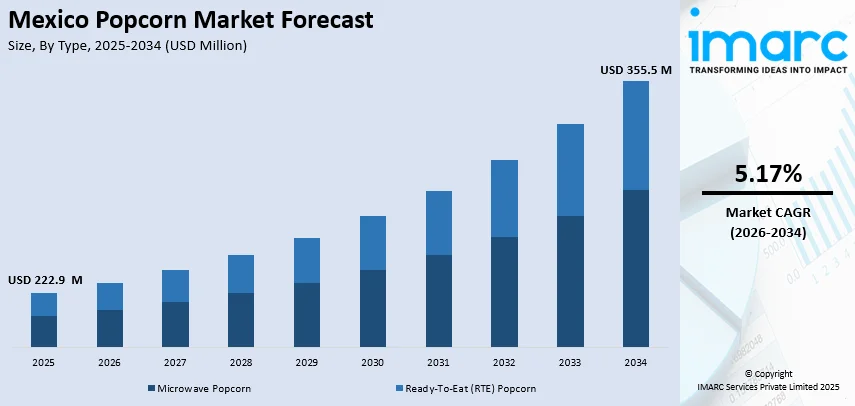

Mexico Popcorn Market Size, Share, Trends and Forecast by Type, Distribution Channel, End Consumer, and Region, 2026-2034

Mexico Popcorn Market Overview:

The Mexico popcorn market size reached USD 222.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 355.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.17% during 2026-2034. Rising demand for healthy snacks, rapid urbanization, growing younger consumer base, retail modernization, surging product cinema consumption, innovation in flavor profiles, clean-label preferences, rapid e-commerce expansion, and premium product positioning are some of the factors supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 222.9 Million |

| Market Forecast in 2034 | USD 355.5 Million |

| Market Growth Rate 2026-2034 | 5.17% |

Mexico Popcorn Market Trends:

Rising Demand for Convenient and Healthier Snack Alternatives

Changing preferences towards healthier lifestyle-based convenient snacking products constitute one of the primary factors supporting the Mexico popcorn market growth. Consumer perceptions of popcorn as an alluring low-calorie, fiber-rich alternative and growing awareness regarding the health risks of excessive consumption of sugar, oil, and artificial additives have surged the demand for clean label ingredients with minimal processing, which is another factor propelling the market growth. There has been a noticeable increase in demand for low-fat, gluten-free, and non-genetically modified organisms (GMO) popcorn options in both physical retail and online channels, which is accelerating the market growth. Moreover, key market players are actively launching pre-packed variants to provide portion control, nutritional labeling, and resealable packs, which is fueling the market growth. Apart from this, the burgeoning per capita income, emerging health and wellness campaigns, and changing dietary habits among urban populations are stimulating the market growth.

Urbanization and Younger Demographic Driving Flavored Popcorn Demand

Rapid urbanization and growing strength of a young, globally oriented consumer base are shaping the Mexico popcorn market outlook. This is further supported by the rising demand for gourmet and flavored popcorn. Millennials and Gen Z consumer base, particularly in metropolitan cities like Mexico City, Guadalajara, and Monterrey, are actively searching for new snacking experiences. The consumer base is highly responsive to product innovation, such as fresh combinations like jalapeño cheese, chili-lime, chocolate drizzle, or caramel-sea salt. Moreover, the escalating demand for premium, hand-prepared, and specialty popcorn products and easy product availability at snack stores and gourmet stalls are fostering the market growth. In line with this, key market players are capitalizing on the opportunity by launching seasonal flavors and attractive packaging themes, which is facilitating the market growth.

Expanding Retail Infrastructure Improving Product Accessibility

The rapid expansion of modern retail infrastructure in Mexico, especially, the growth of supermarkets, hypermarkets, and convenience chains, has significantly improved consumer access to a wide variety of popcorn products, which is boosting Mexico popcorn market share. Leading chain retailers are investing heavily in national logistical networks and in-store shelf placement, creating an easier path for consumers to find and purchase packaged popcorn. For instance, in 2025, Walmart announced a record investment exceeding USD 6 billion for the year, tripling its previous year's expenditure. This capital is earmarked for opening new stores and constructing two distribution centers, aiming to create approximately 5,500 direct jobs. In line with this, the growth of organized retail has increased visibility of premium and imported popcorn brands, enabling consumers access to a wide range of products, which is propelling the market growth. Moreover, promotional initiatives, including in-store sampling, discounts, and prominent positioning, and improved retail penetration is seen in rural and semi-urban regions are providing a positive environment for the market growth.

Mexico Popcorn Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, distribution channel, and end consumer.

Type Insights:

To get more information on this market Request Sample

- Microwave Popcorn

- Ready-To-Eat (RTE) Popcorn

The report has provided a detailed breakup and analysis of the market based on the type. This includes microwave popcorn and ready-to-eat (RTE) popcorn.

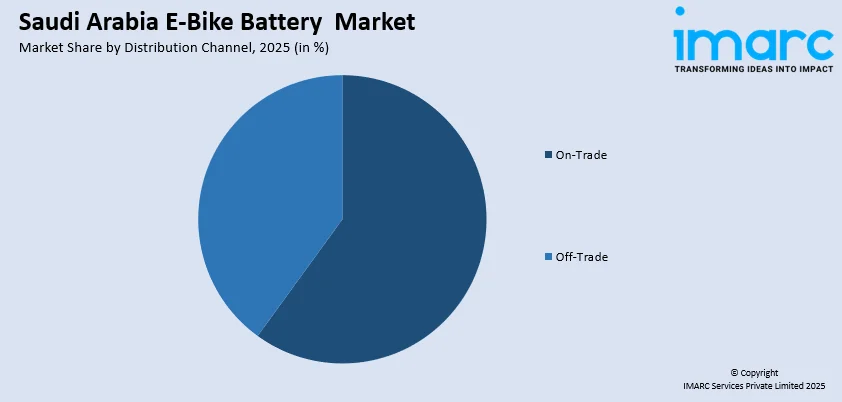

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channel

- Other

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes cover on-trade and off-trade (supermarkets and hypermarkets, convenience stores, online channel, and other).

End Consumer Insights:

- Households

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end consumer. This includes households and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Popcorn Market News:

- In July 2024 – G.H. Cretors, a premium gourmet popcorn brand, has partnered with iconic chili-lime seasoning company Tajín to launch a bold new flavor that brings together the best of both brands. The limited-edition product features handcrafted kettle popcorn infused with Tajín’s signature tangy and mildly spicy seasoning, delivering a distinctive and flavorful snacking experience.

Mexico Popcorn Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Microwave Popcorn, Ready-To-Eat (RTE) Popcorn |

| Distribution Channels Covered |

|

| End Consumers Covered | Households, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico popcorn market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico popcorn market on the basis of type?

- What is the breakup of the Mexico popcorn market on the basis of distribution channel?

- What is the breakup of the Mexico popcorn market on the basis of end consumer?

- What is the breakup of the Mexico popcorn market on the basis of region?

- What are the various stages in the value chain of the Mexico popcorn market?

- What are the key driving factors and challenges in the Mexico popcorn?

- What is the structure of the Mexico popcorn market and who are the key players?

- What is the degree of competition in the Mexico popcorn market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico popcorn market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico popcorn market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico popcorn industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)