Mexico POS Device Market Size, Share, Trends and Forecast by Component, Terminal Type, Industry Vertical, and Region, 2025-2033

Mexico POS Device Market Overview:

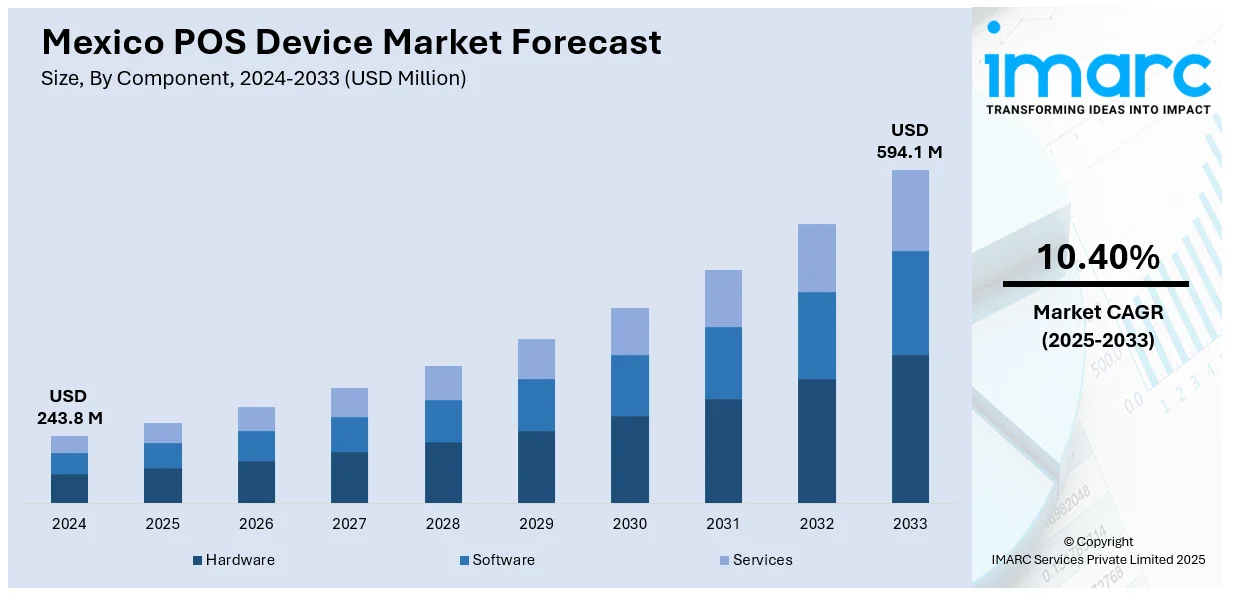

The Mexico POS device market size reached USD 243.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 594.1 Million by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033. Growth of e-commerce, increasing demand for contactless payments, rising adoption of digital payment solutions, government initiatives promoting digitalization, and the expansion of small and medium-sized enterprises (SMEs) embracing POS technology for efficient transactions are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 243.8 Million |

| Market Forecast in 2033 | USD 594.1 Million |

| Market Growth Rate 2025-2033 | 10.40% |

Mexico POS Device Market Trends:

Rising Preference for Self-Service Solutions

Retailers in Mexico are steadily shifting toward self-service point-of-sale systems to meet growing consumer expectations for speed, efficiency, and autonomy. This shift is particularly visible in grocery and high-volume retail settings, where minimizing checkout time and enhancing overall in-store experience are key priorities. The adoption of these systems supports better staff utilization, reducing dependence on traditional cashier setups while allowing retailers to serve more customers with fewer delays. These setups are also appealing to younger, tech-aware shoppers who value control and convenience during purchases. The broader move toward digital integration in physical retail spaces is accelerating the deployment of such solutions. This shift reflects a wider pattern of modernizing payment infrastructure and adapting to changing consumer behavior within the Mexican market. For example, in February 2024, Chedraui, one of Mexico's leading grocery retailers, expanded the adoption of Toshiba's Self Checkout System 7 across its stores. This move aims to enhance customer experience by offering more efficient and intuitive self-service options. The rollout, nearly completed in late 2023, was supported by partners Rhiscom and LODES Consultores. This initiative reflects the growing trend of self-checkout adoption in Mexico's POS device market.

Integrated Payment Solutions Gaining Ground in Hospitality

Hotels and hospitality businesses in Mexico are increasingly turning to integrated point-of-sale and property management systems to simplify operations and deliver smoother guest experiences. These unified platforms help manage bookings, payments, and service requests through a single interface, improving operational efficiency and security. With more travelers expecting seamless, contactless transactions, establishments are investing in solutions that combine convenience with real-time processing. The shift also supports better data synchronization and analytics, enabling businesses to respond quickly to guest needs and preferences. As digital payment usage grows across Latin America, the demand for such connected systems is rising. This movement marks a shift in how hospitality providers approach technology, with a focus on speed, reliability, and a more personalized service experience. For instance, in August 2024, Shiji and FreedomPay partnered to introduce integrated POS and PMS solutions in Mexico's hospitality sector. This collaboration aims to streamline operations, enhance security, and improve guest experiences by addressing the growing demand for contactless payment technologies. As digital payment volumes in Latin America are projected to quadruple by 2027, this initiative positions both companies to meet the evolving needs of the market.

Mexico POS Device Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, terminal type, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Terminal Type Insights:

- Fixed POS Terminals

- Mobile POS Terminals

A detailed breakup and analysis of the market based on the terminal type have also been provided in the report. This includes fixed POS terminals and mobile POS terminals.

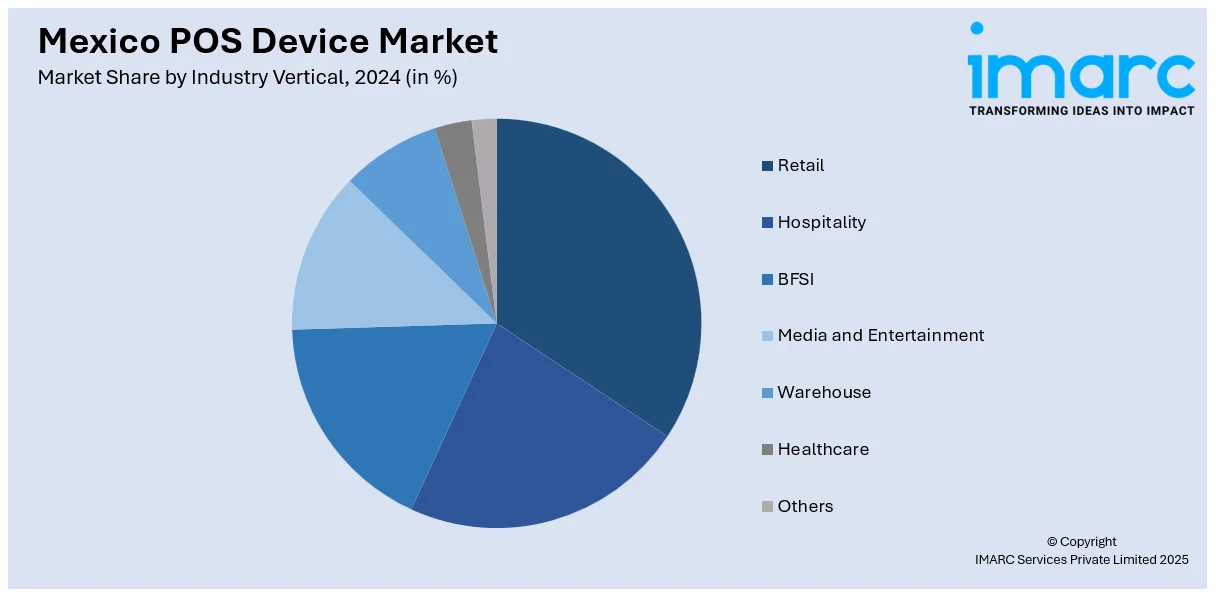

Industry Vertical Insights:

- Retail

- Hospitality

- BFSI

- Media and Entertainment

- Warehouse

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes retail, hospitality, BFSI, media and entertainment, warehouse, healthcare, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico POS Device Market News:

- In March 2025, Ingenico introduced the AXIUM CX9000, an all-in-one POS device designed for retail environments. Operating on Android 14, it features a 15.6-inch touchscreen and an 8-inch customer-facing display. The system supports various payment methods, integrates with inventory management, and offers a plug-and-play setup. Its compact design aims to streamline checkout processes and enhance customer interactions.

- In September 2024, Mexican fintech Clip launched a digital wallet tailored for SMEs, aiming to enhance digital payment adoption in Mexico. This initiative follows a USD 100 Million funding round to expand offerings, including an enhanced POS system for larger businesses. By the end of 2022, non-bank aggregators like Clip accounted for 74% of payment terminals in Mexico, indicating a significant shift toward digital transactions.

Mexico POS Device Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Terminal Types Covered | Fixed POS Terminals, Mobile POS Terminals |

| Industry Verticals Covered | Retail, Hospitality, BFSI, Media and Entertainment, Warehouse, Healthcare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico POS device market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico POS device market on the basis of component?

- What is the breakup of the Mexico POS device market on the basis of terminal type?

- What is the breakup of the Mexico POS device market on the basis of industry vertical?

- What is the breakup of the Mexico POS device market on the basis of region?

- What are the various stages in the value chain of the Mexico POS device market?

- What are the key driving factors and challenges in the Mexico POS device market?

- What is the structure of the Mexico POS device market and who are the key players?

- What is the degree of competition in the Mexico POS device market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico POS device market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico POS device market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico POS device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)