Mexico Pouches Market Size, Share, Trends and Forecast by Material, Treatment Type, Product, Closure Type, End Use, and Region, 2025-2033

Mexico Pouches Market Overview:

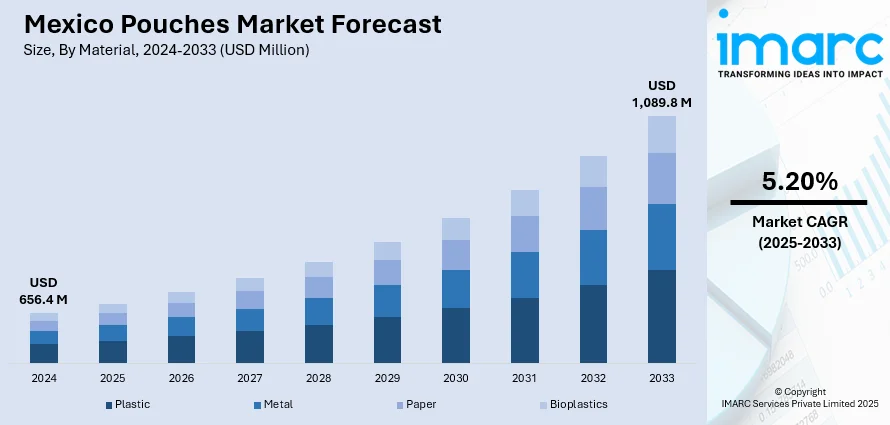

The Mexico pouches market size reached USD 656.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,089.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. Rising demand for ready-to-eat (RTE) foods, rapid urbanization, packaging innovation, health-conscious consumption, retail growth, lightweight logistics, e-commerce expansion, non-food applications, eco-friendly material development are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 656.4 Million |

| Market Forecast in 2033 | USD 1,089.8 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Pouches Market Trends:

Growth in Demand for Single-Serve and Ready-to-Eat Food Products

The rising popularity of single-serve and ready-to-eat (RTE) food formats is one of the key factors supporting the Mexican pouch packaging market growth. As consumer preferences shift toward convenience-driven products, especially in urban and semi-urban regions, food brands are increasingly adopting pouches for soups, sauces, snacks, and beverages. These products are designed for quick consumption without the need for additional preparation, which aligns with the evolving lifestyle patterns of Mexico’s working-class population and younger demographics. Additionally, the ability of pouches to preserve freshness and extend shelf life without bulky rigid packaging makes them particularly suitable for such food categories. In line with this, key manufacturers are also leveraging this format to launch portion-controlled variants that meet consumer demand for health-focused eating, which is stimulating the market growth.

Increasing Urbanization and Busier Lifestyles

Urbanization across Mexico has accelerated the demand for packaging solutions that cater to time-constrained consumers. With more individuals relocating to cities for employment and education, eating habits are shifting toward packaged, portable food options that support on-the-go consumption. Pouches, particularly those with spouts or easy-tear features, offer practical advantages in this context, allowing consumers to access products such as beverages, yogurts, and nutritional supplements with minimal effort. Moreover, smaller household sizes in urban areas are influencing demand for compact, resealable pouches that reduce food waste and enable portion control, which is another factor boosting the Mexican pouch packaging market share.

Investments in Food Processing and Packaging Innovation

As per the Mexico pouch market forecast, the growing investments in the country’s food processing and packaging sectors is fostering the market growth. As manufacturers aim to enhance production efficiency and reduce material costs, flexible packaging formats like pouches have become a focal point of technological upgrades. Companies are adopting high-speed form-fill-seal machines, automated pouch-making equipment, and digitally printed film technologies to support customized and scalable production. Additionally, food processors are integrating multilayer barrier films to improve oxygen and moisture resistance, which enhances product preservation and shelf stability. Government incentives for industrial modernization and foreign direct investments in Mexico’s manufacturing infrastructure are further catalyzing innovation in packaging formats. For instance, in 2025, the Mexican government introduced a fiscal stimulus package in January 2025, allocating approximately USD 1.75 billion to support new investments and workforce training. Key incentives include immediate tax deductions for fixed asset investments made between the effective date of the decree and September 30, 2030, aiming to boost capital formation and attract long-term foreign and domestic investors.

Mexico Pouches Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, treatment type, product, closure type, and end use.

Material Insights:

- Plastic

- Metal

- Paper

- Bioplastics

The report has provided a detailed breakup and analysis of the market based on material. This includes plastic, metal, paper, and bioplastics.

Treatment Type Insights:

- Standard

- Aseptic

- Retort

- Hot-fill

A detailed breakup and analysis of the market based on treatment type have also been provided in the report. This includes standard, aseptic, retort, and hot-fill.

Product Insights:

- Flat

- Stand-up

The report has provided a detailed breakup and analysis of the market based on product. This includes flat and stand-up.

Closure Type Insights:

- Tear Notch

- Zipper

- Spout

A detailed breakup and analysis of the market based on closure type have also been provided in the report. This includes tear notch, zipper, and spout.

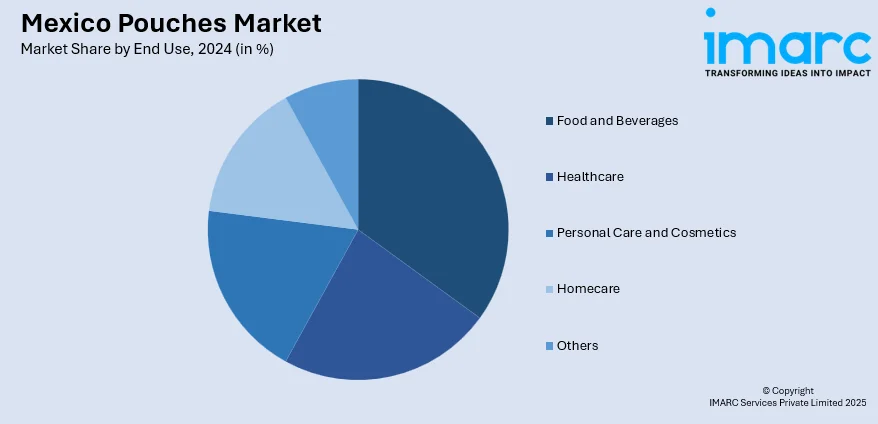

End Use Insights:

- Food and Beverages

- Healthcare

- Personal Care and Cosmetics

- Homecare

- Others

The report has provided a detailed breakup and analysis of the market based on end use. This includes food and beverages, healthcare, personal care and cosmetics, homecare, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pouches Market News:

- In 2024, Nefab invested in expanding its industrial packaging operations across Mexico, including cities like Guadalajara and Ciudad Juarez. The company introduced eco-friendly packaging alternatives such as FiberFlute and returnable thermoformed solutions, addressing customer demands and environmental concerns.

- In 2024, At EXPO PACK Mexico, APP Group unveiled two new sustainable food packaging products: Foopak Anchor Bio and Foopak Natural Grease Resistant. These plastic-free, compostable solutions are designed for direct food contact, catering to the growing demand for eco-friendly packaging in the region.

Mexico Pouches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Metal, Paper, Bioplastics |

| Treatment Types Covered | Standard, Aseptic, Retort, Hot-fill |

| Products Covered | Flat, Stand-up |

| Closure Types Covered | Tear Notch, Zipper, Spout |

| End Uses Covered | Food and Beverages, Healthcare, Personal Care and Cosmetics, Homecare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pouches market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pouches market on the basis of material?

- What is the breakup of the Mexico pouches market on the basis of treatment type?

- What is the breakup of the Mexico pouches market on the basis of product?

- What is the breakup of the Mexico pouches market on the basis of closure type?

- What is the breakup of the Mexico pouches market on the basis of end use?

- What is the breakup of the Mexico pouches market on the basis of region?

- What are the various stages in the value chain of the Mexico pouches market?

- What are the key driving factors and challenges in the Mexico pouches market?

- What is the structure of the Mexico pouches market and who are the key players?

- What is the degree of competition in the Mexico pouches market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pouches market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pouches market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pouches industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)