Mexico Powder Coating Equipment Market Size, Share, Trends and Forecast by Resin Type, Component, End-Use Industry, and Region, 2025-2033

Mexico Powder Coating Equipment Market Overview:

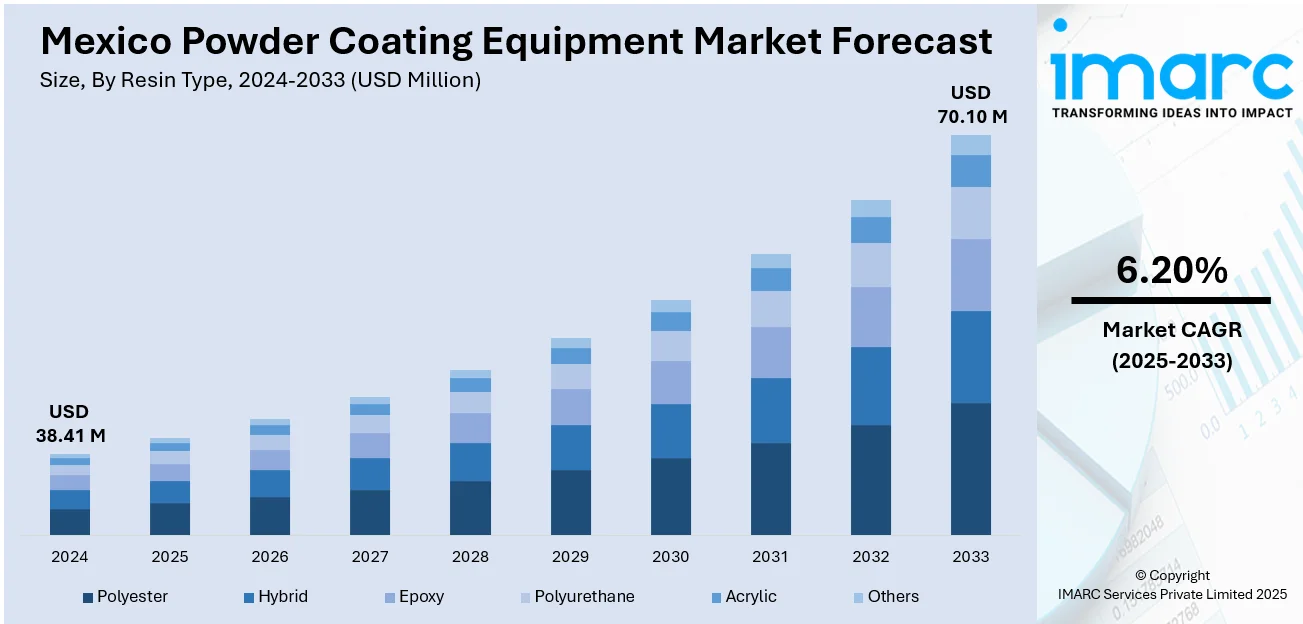

The Mexico powder coating equipment market size reached USD 38.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 70.10 Million by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is driven by Mexico’s expanding automotive and metal manufacturing sectors that require durable, corrosion-resistant finishes for export-oriented production. Rising environmental consciousness, supported by regulatory frameworks, is encouraging industries to adopt sustainable powder coating systems for operational and ecological benefits. Technological innovations in equipment design and increasing demand for customized finishes are creating new opportunities, further augmenting the Mexico powder coating equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.41 Million |

| Market Forecast in 2033 | USD 70.10 Million |

| Market Growth Rate 2025-2033 | 6.20% |

Mexico Powder Coating Equipment Market Trends:

Expanding Automotive and Manufacturing Base in Mexico

Mexico’s role as a major automotive production hub is a primary driver of demand for powder coating equipment. Numerous global automakers and parts suppliers operate manufacturing plants across key states, including Nuevo León, Guanajuato, and Puebla, where powder coating is essential for metal parts and vehicle components. On March 14, 2025, Neuce, the world’s second-largest producer of powder coatings, announced an investment of USD 600 Million for the construction of a new coatings plant in Tlaxcala, Mexico. The facility will include 10 production lines, each with a capacity of 280 tons per day, and is expected to generate 120 direct and 350 indirect jobs, with operations commencing by the end of 2025. Powder coating provides superior corrosion resistance and aesthetic quality, aligning with the automotive sector’s need for durable finishes. Beyond vehicles, Mexico’s broader metal fabrication industry—serving sectors such as appliances, construction, and heavy machinery—also benefits from powder coating’s operational efficiencies and material savings. SMEs and contract manufacturers increasingly prefer powder coating for producing cost-effective, scratch-resistant finishes on machinery and fabricated products. As export-oriented manufacturing continues to grow under USMCA trade frameworks, businesses seek to enhance product quality through advanced finishing processes. These developments are collectively strengthening Mexico powder coating equipment market growth as local and international firms invest in production optimization.

To get more information on this market, Request Sample

Technological Advancements and Expanding Customization Needs

Technology upgrades in powder coating equipment are driving efficiency and customization in Mexico’s finishing industry. New-generation powder coating systems now feature computerized controls, advanced spray guns with variable output, and closed-loop powder recovery units, reducing waste and increasing precision. Automation is gaining traction in larger facilities, where conveyorized powder coating lines streamline high-volume production. On January 19, 2023, ABB inaugurated the Mexico Technology and Engineering Center (MXTEC) in Mérida, Yucatán, to strengthen its support for process industries across North America. Backed by an initial investment of USD 1 million, the center is designed to boost ABB’s capabilities in automation, electrical systems, and software engineering. It will primarily serve industries such as mining, pulp and paper, and battery production, with plans to expand engineering capacity by 25% and enhance project execution efficiency. The ability to quickly change colors and adjust powder flow supports manufacturers catering to varied customer needs, especially in industries such as furniture, appliances, and decorative metalwork. Growing consumer demand for customized products with unique color schemes or textured finishes further motivates businesses to invest in flexible coating setups. Equipment vendors are increasingly offering modular systems that allow scalable upgrades based on production growth. Local distributors collaborate with global technology providers to introduce cutting-edge machinery tailored to the specific demands of Mexican manufacturers. This integration of innovation and customization potential is advancing operational capabilities, encouraging broader adoption of powder coating equipment across sectors.

Mexico Powder Coating Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on resin type, component, and end-use industry.

Resin Type Insights:

- Polyester

- Hybrid

- Epoxy

- Polyurethane

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyester, hybrid, epoxy, polyurethane, acrylic, and others.

Component Insights:

- Kneader

- Extruder

- Cooling Equipment

- Grinder

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes kneader, extruder, cooling equipment, grinder, and others.

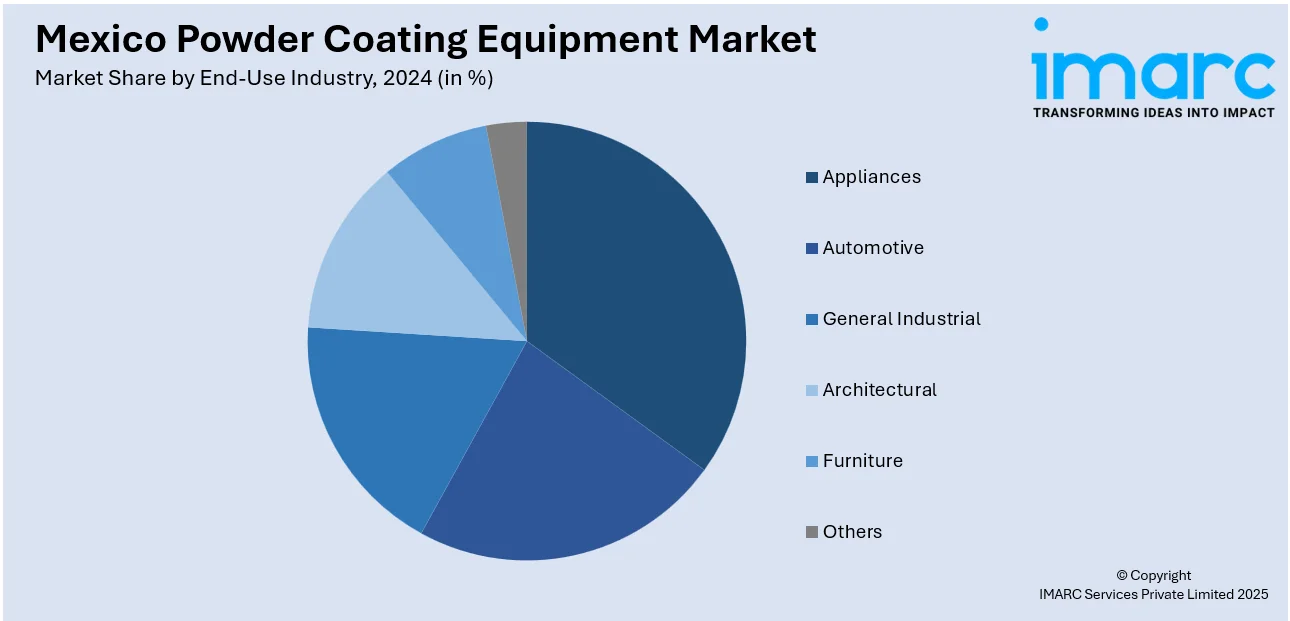

End-Use Industry Insights:

- Appliances

- Automotive

- General Industrial

- Architectural

- Furniture

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes appliances, automotive, general industrial, architectural, furniture, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Powder Coating Equipment Market News:

- On March 12, 2024, WEG announced an investment of R$100 million (approx. USD 20.4 Million) to construct a new industrial liquid paints factory in Atotonilco de Tula, Mexico. The 5,300 m² (57,000 ft²) facility is expected to be operational by early 2026 and will significantly expand WEG Coatings’ production capacity to meet growing demand in North and Central America. This investment complements WEG’s existing powder coatings operations in Mexico and reinforces its strategic positioning in the regional coatings market with a focus on efficiency and sustainability.

Mexico Powder Coating Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyester, Hybrid, Epoxy, Polyurethane, Acrylic, Others |

| Components Covered | Kneader, Extruder, Cooling Equipment, Grinder, Others |

| End-Use Industries Covered | Appliances, Automotive, General Industrial, Architectural, Furniture, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico powder coating equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico powder coating equipment market on the basis of resin type?

- What is the breakup of the Mexico powder coating equipment market on the basis of component?

- What is the breakup of the Mexico powder coating equipment market on the basis of end-use industry?

- What is the breakup of the Mexico powder coating equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico powder coating equipment market?

- What are the key driving factors and challenges in the Mexico powder coating equipment market?

- What is the structure of the Mexico powder coating equipment market and who are the key players?

- What is the degree of competition in the Mexico powder coating equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico powder coating equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico powder coating equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico powder coating equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)