Mexico Power Cable Accessories Market Size, Share, Trends and Forecast by Product Type, Voltage Range, End Use Industry, and Region, 2025-2033

Mexico Power Cable Accessories Market Overview:

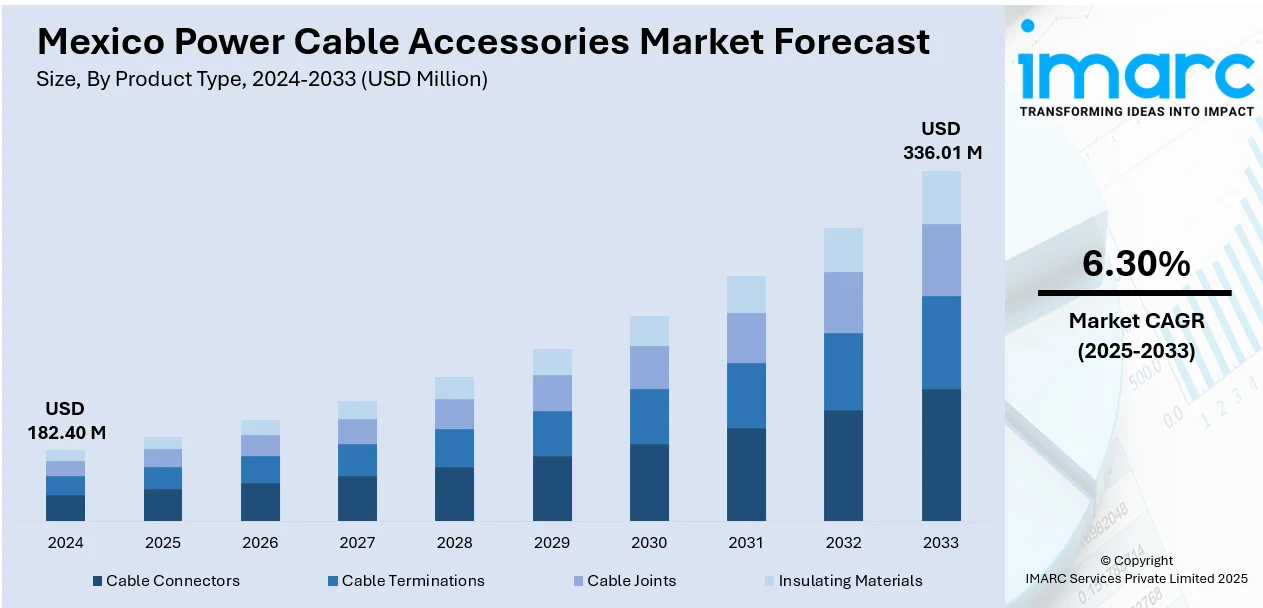

The Mexico power cable accessories market size reached USD 182.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 336.01 Million by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is driven by infrastructure upgrades, renewable energy integration, and rising electricity demand. Ongoing grid modernization supports urban and industrial growth, requiring advanced, reliable accessories. The shift toward solar and wind energy increases the need for specialized components that can handle diverse conditions and remote installations. Additionally, the growth of electric vehicles (EVs) and digital technologies puts pressure on power networks, further boosting Mexico power cable accessories market share for durable, efficient accessories to ensure safe and continuous energy distribution across all sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 182.40 Million |

| Market Forecast in 2033 | USD 336.01 Million |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Power Cable Accessories Market Trends:

Infrastructure Expansion & Grid Modernization

Mexico is undergoing a broad transformation in its power infrastructure, driven by rising investments in transportation, industrial zones, and urban development. This shift has led to significant demand for modern, reliable electrical systems, prompting the creation of new power lines, substations, and the modernization of aging grids. In line with this, the government’s PRODESEN plan allocated USD 247 million in 2023 for grid distribution upgrades, doubling to USD 494 million in 2024 to support smart grid integration and substation automation. These initiatives require advanced power cable accessories that ensure safe, efficient, and uninterrupted electricity flow. As smart technologies become central to grid systems, there is growing need for components that support digital communication, monitoring, and enhanced durability. This transformation is not only improving grid performance and resilience but also fueling Mexico power cable accessories market growth, supported by both public-sector investments and private infrastructure expansion.

To get more information on this market, Request Sample

Surging Electricity Demand & EV Infrastructure

The growing demand for electricity in Mexico is being fueled by rapid urbanization, industrial development, and the increasing use of modern technologies. At the same time, the country is embracing EVs as part of its broader sustainability goals. Together, these trends are putting pressure on the existing power grid and calling for a significant upgrade in electrical distribution systems. Cable accessories play a crucial role in enabling these changes, as they support connections across residential, commercial, and industrial settings. In particular, the rollout of EV charging stations and renewable-powered transport hubs requires durable and efficient cable accessory solutions. As more devices, homes, and vehicles depend on electric power, the supporting infrastructure must evolve to handle increased loads safely driving a consistent need for innovation and reliability in the power cable accessories market.

Renewable Energy Integration

Another significant Mexico power cable accessories market trend is the growing emphasis on diversifying the country's energy mix by expanding the use of renewable sources such as solar and wind. This shift brings a demand for more complex and durable power cable accessories, as renewable energy projects require extensive cabling to connect remote generation sites to the national grid. Renewable energy systems also require accessories that can withstand environmental stress and provide long-term reliability. As developers and utility providers work to bring more clean energy projects online, they rely on specialized cable components to manage energy flow safely and efficiently. Additionally, integrating these sources into the main power grid requires careful management of energy loads and distribution further increasing the need for high-quality accessories. The trend toward renewables is not only environmentally driven but also a practical push to strengthen the country’s energy independence and system flexibility.

Mexico Power Cable Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, voltage range, and end use industry.

Product Type Insights:

- Cable Connectors

- Cable Terminations

- Cable Joints

- Insulating Materials

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cable connectors, cable terminations, cable joints, and insulating materials.

Voltage Range Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage range have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

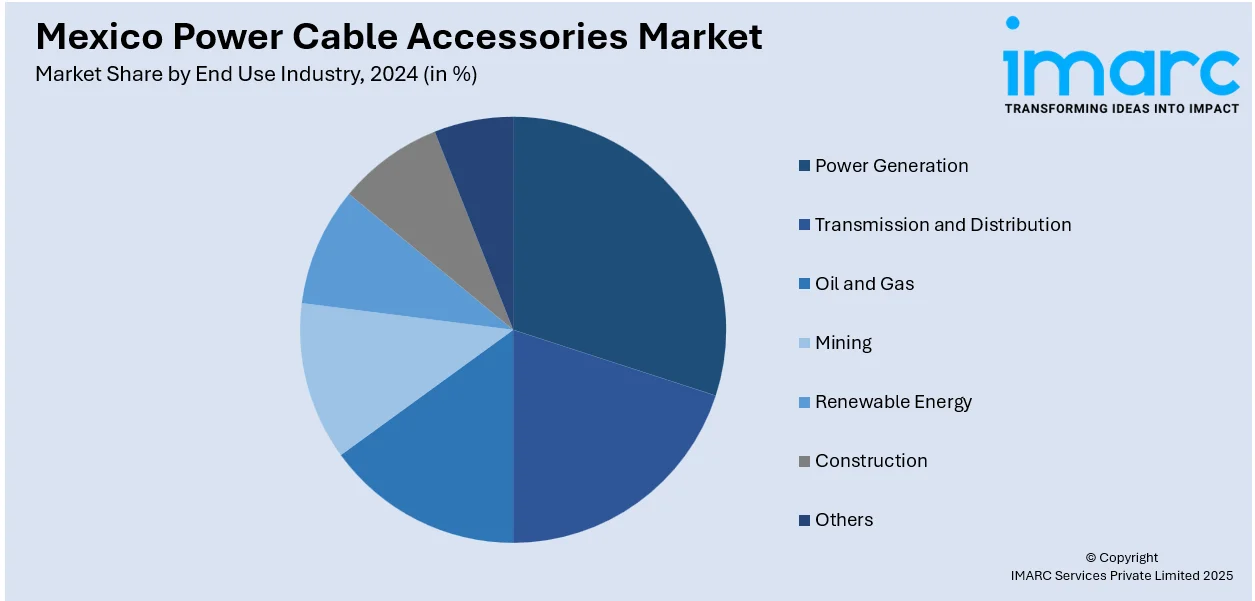

End Use Industry Insights:

- Power Generation

- Transmission and Distribution

- Oil and Gas

- Mining

- Renewable Energy

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes power generation, transmission and distribution, oil and gas, mining, renewable energy, construction, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Power Cable Accessories Market News:

- In November 2024, G&W Electric opened a new, significantly larger manufacturing facility in San Luis Potosí, Mexico, quadrupling its production capacity to meet rising global demand for power solutions. This expansion supports markets across Latin America and beyond, enhances coordination with global teams, and boosts new product development capabilities. The facility also promotes job creation and reinforces G&W Electric’s commitment to long-term growth and innovation in the energy sector.

Mexico Power Cable Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cable Connectors, Cable Terminations, Cable Joints, Insulating Materials |

| Voltage Ranges Covered | Low Voltage, Medium Voltage, High Voltage |

| End Use Industries Covered | Power Generation, Transmission and Distribution, Oil and Gas, Mining, Renewable Energy, Construction, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico power cable accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico power cable accessories market on the basis of product type?

- What is the breakup of the Mexico power cable accessories market on the basis of voltage range?

- What is the breakup of the Mexico power cable accessories market on the basis of end use industry?

- What is the breakup of the Mexico power cable accessories market on the basis of region?

- What are the various stages in the value chain of the Mexico power cable accessories market?

- What are the key driving factors and challenges in the Mexico power cable accessories market?

- What is the structure of the Mexico power cable accessories market and who are the key players?

- What is the degree of competition in the Mexico power cable accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico power cable accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico power cable accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico power cable accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)