Mexico Power Rental Market Size, Share, Trends and Forecast by Fuel Type, Equipment Type, Power Rating, Application, End Use Industry, and Region, 2025-2033

Mexico Power Rental Market Overview:

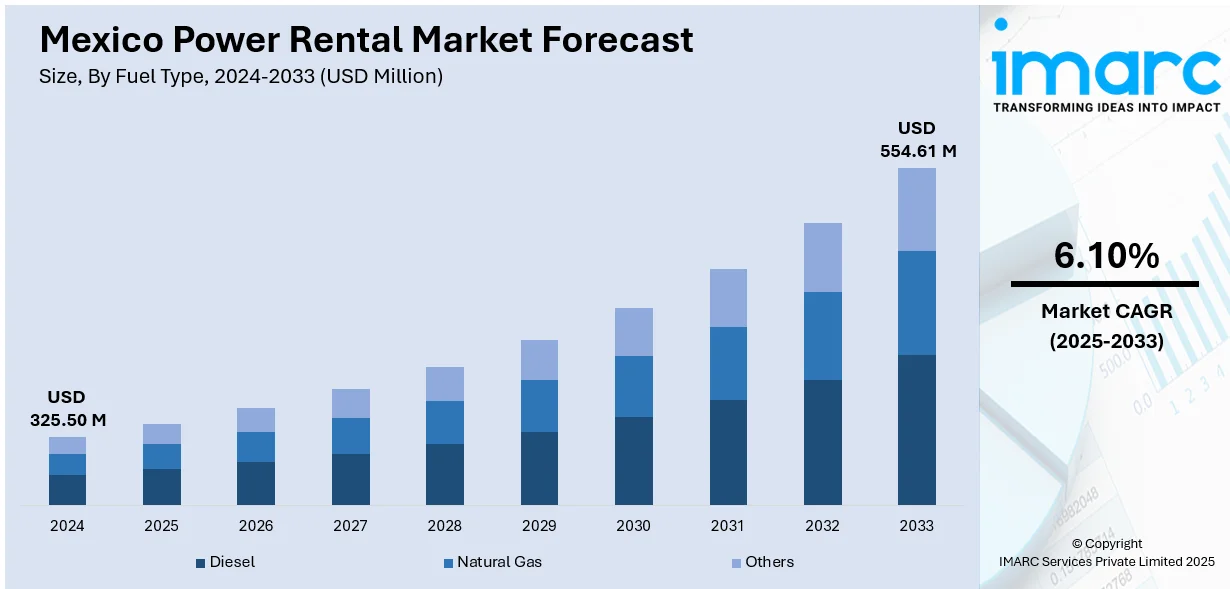

The Mexico power rental market size reached USD 325.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 554.61 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The extensive infrastructure and industrial expansion, especially in construction, mining, and oil and gas sectors, the aging grid assets, frequent natural disasters demanding backup power, and a strategic shift toward cleaner fuel generators, digital remote monitoring, and hybrid rental solutions are propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 325.50 Million |

| Market Forecast in 2033 | USD 554.61 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Mexico Power Rental Market Trends:

Infrastructure and Industrial Expansion Driving Heavy Temporary Power Demand

Mexico’s thriving construction, mining, and oil and gas sectors have driven heavy reliance on rental generators for baseload and standby power in regions where grid capacity lags. New processing plants and expansions of existing ones have proliferated in remote areas without reliable utility access. In 2024, the Mexico construction equipment market reached USD 1.5 billion and is projected to hit USD 2.0 billion by 2033, equating to a 3.23% CAGR from 2025 to 2033, underscoring the scale of ongoing infrastructure projects. Businesses also contend with planned and unplanned outages, such as the 21 TWh of controlled cuts by CENACE in 2021, intensifying the need for uninterrupted power via rentals. Concurrently, urban festivals and large-scale events are boosting short-term demand for high-capacity generator fleets to support lighting, audio-visual systems, and logistics. As permanent grid upgrades continue to trail demand, rental power solutions remain the most flexible and cost-effective option.

To get more information on this market, Request Sample

Shift to Cleaner Fuel, Hybrid Systems & Digital Remote Monitoring

In response to stringent environmental regulations and growing corporate ESG mandates, Mexico's power rental industry is witnessing a notable transition toward cleaner and smarter energy solutions. With over 75% of the country's electricity still derived from fossil fuels, there is increasing demand for lower-emission alternatives. Rental operators are experiencing a surge in interest for natural gas-fueled generators, supported by Mexico’s domestic gas reserves, as well as solar-augmented systems. This shift mirrors global trends favoring renewable integration in temporary power applications. Simultaneously, the deployment of Internet-of-Things (IoT)-enabled remote monitoring and advanced data analytics is optimizing fuel usage, predicting maintenance, and ensuring compliance, thereby reducing operational downtime. These telematics solutions also facilitate swift asset redeployment during emergencies or project changes, significantly improving fleet flexibility. The convergence of decarbonization and digitalization is reshaping rental fleets, with hybrid and tele-enabled units rapidly gaining traction and accounting for a growing share of new contracts, signaling a long-term structural transformation in the sector.

Mexico Power Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fuel type, equipment type, power rating, application, and end use industry.

Fuel Type Insights:

- Diesel

- Natural Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, natural gas, and others.

Equipment Type Insights:

- Generator

- Transformer

- Load Bank

- Others

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes generator, transformer, load bank, and others.

Power Rating Insights:

- Up to 50 kW

- 51–500 kW

- 501–2,500 kW

- Above 2,500 kW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes up to 50 kW, 51–500 kW, 501–2,500 kW, and above 2,500 kW.

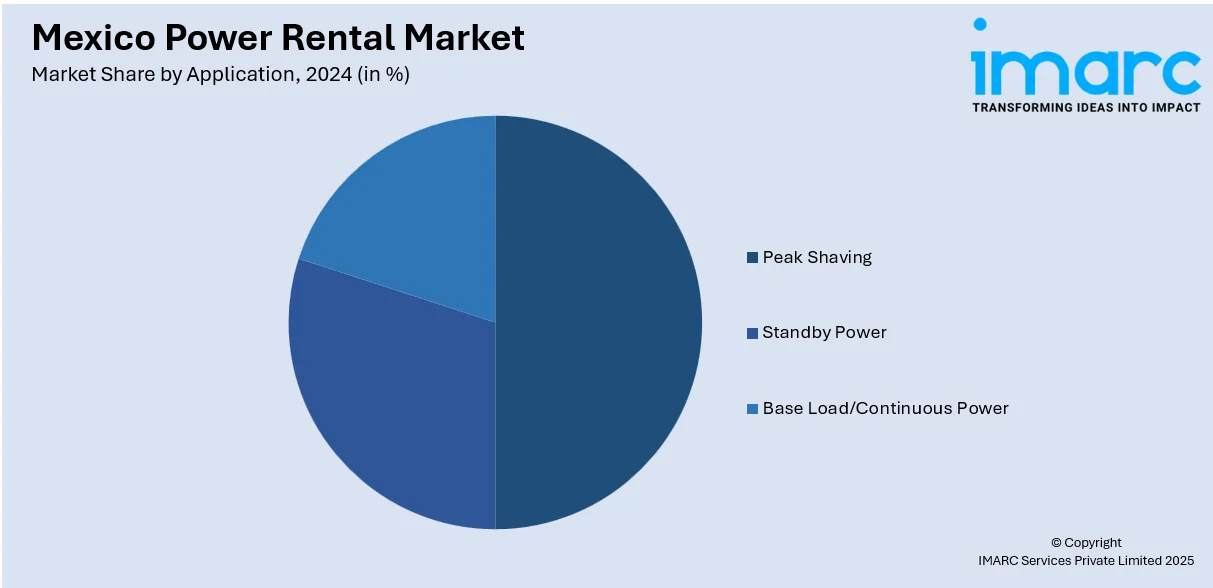

Application Insights:

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes peak shaving, standby power, and base load/continuous power.

End Use Industry Insights:

- Utilities

- Oil and Gas

- Events

- Construction

- Mining

- Data Centers

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes utilities, oil and gas, events, construction, mining, data centers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Power Rental Market News:

- March 2025: The Federal Electricity Commission (CFE) announced plans to rent portable generators to bolster the Yucatán Peninsula’s power grid, especially in Quintana Roo, Yucatán, and Campeche. Two high-capacity mobile units are being deployed temporarily to meet rising demand and prevent outages, particularly in tourist-heavy areas. This power rental initiative aims to ensure grid stability and support local needs until long-term infrastructure improvements are completed.

Mexico Power Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Power Ratings Covered | Up to 50 kW, 51–500 kW, 501–2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil and Gas, Events, Construction, Mining, Data Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico power rental market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico power rental market on the basis of fuel type?

- What is the breakup of the Mexico power rental market on the basis of equipment type?

- What is the breakup of the Mexico power rental market on the basis of power rating?

- What is the breakup of the Mexico power rental market on the basis of application?

- What is the breakup of the Mexico power rental market on the basis of end use industry?

- What is the breakup of the Mexico power rental market on the basis of the region?

- What are the various stages in the value chain of the Mexico power rental market?

- What are the key driving factors and challenges in the Mexico power rental market?

- What is the structure of the Mexico power rental market and who are the key players?

- What is the degree of competition in the Mexico power rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico power rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico power rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico power rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)