Mexico Power Tool Accessories Market Size, Share, Trends and Forecast by Type, Application, End-Use Sector, and Region, 2025-2033

Mexico Power Tool Accessories Market Overview:

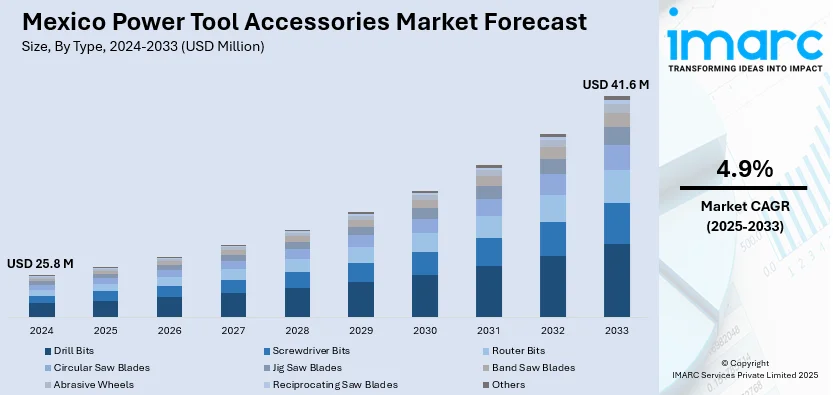

The Mexico power tool accessories market size reached USD 25.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 41.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033. The market has grown due to rising construction activity, industrial automation, and greater use of cordless tools. Infrastructure upgrades, home improvement trends, and the expansion of professional-grade tools with advanced compatibility and durability drive demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.8 Million |

| Market Forecast in 2033 | USD 41.6 Million |

| Market Growth Rate 2025-2033 | 4.9% |

Mexico Power Tool Accessories Market Trends:

Increased Cordless Tool Usage

The rising use of cordless power tools has significantly shaped the demand for compatible accessories in Mexico. Workers and contractors across construction and repair sectors are shifting to cordless tools due to improved mobility, ease of use, and enhanced battery life. This shift has directly impacted the accessories market, where manufacturers are focusing on lightweight, fast-charging, and universal-fit components. The ability to interchange batteries and accessories across multiple tools is becoming a key purchasing factor. Additionally, local workshops and commercial users are investing in accessories that offer multi-material usage and longer operational life. Bosch's AMPShare platform launch in May 2023, although introduced in North America, has influenced purchasing behavior in Mexico due to its battery-sharing benefits across brands. Such advancements have encouraged users to consolidate tool systems, reducing cost and improving workflow. This trend is pushing companies to redesign accessories with higher endurance, compatibility, and reusability. As cordless tools gain wider acceptance in both urban and semi-urban job sites, accessories that optimize performance, reduce wear, and support extended tool usage are becoming essential.

Growth in Professional Construction Demand

Mexico's ongoing construction activity, particularly in commercial, housing, and infrastructure projects, continues to boost demand for high-performance power tool accessories. The growth of industrial zones and government-backed development programs has increased the need for fast and reliable tooling solutions. Accessories that can handle heavy-duty use like cutting, grinding, and drilling through dense materials are increasingly favored. This demand has prompted brands to enhance product life cycles and develop accessories with specialized coatings and carbide-tipped edges. Notably, Bosch introduced the Bulldog Xtreme8 SDS-plus concrete drill bit in April 2025, claiming up to four times longer life in rebar-laced concrete. While launched through U.S. outlets, the product is relevant to professionals in Mexico, especially in urban infrastructure works requiring precise and durable tools. The accessory's wear indicators and dust-removal flutes reflect growing attention to safety and speed. This focus aligns with contractors seeking to meet tighter deadlines without compromising tool effectiveness. As more workers adopt standardized, brand-compatible systems, distributors and retailers in Mexico are expanding their range of performance-driven accessories to meet rising demand in the civil and industrial sectors.

Mexico Power Tool Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and end-use sector.

Type Insights:

- Drill Bits

- Screwdriver Bits

- Router Bits

- Circular Saw Blades

- Jig Saw Blades

- Band Saw Blades

- Abrasive Wheels

- Reciprocating Saw Blades

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes drill bits, screwdriver bits, router bits, circular saw blades, jig saw blades, band saw blades, abrasive wheels, reciprocating saw blades, and others.

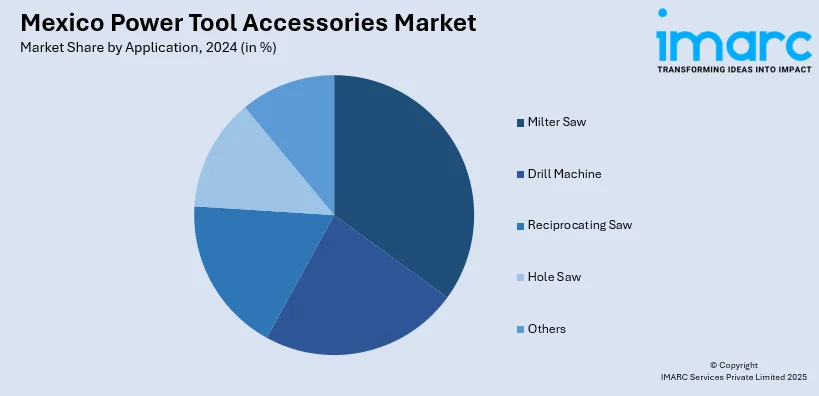

Application Insights:

- Milter Saw

- Drill Machine

- Reciprocating Saw

- Hole Saw

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes milter saw, drill machine, reciprocating saw, hole saw, and others.

End-Use Sector Insights:

- Industrial

- Automotive

- Construction

- Aerospace and Defense

- Energy

- Marine

- Others

- Residential

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes industrial (automotive, construction, aerospace and defense, energy, marine, others) and residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Power Tool Accessories Market News:

- April 2025: Bosch Power Tools introduced the world’s first 8-cutter SDS-plus concrete drill bit Bulldog Xtreme8 and Blue Xtreme carbide-tipped bits. Launched exclusively at Lowe’s, the innovation boosted durability in rebar drilling, strengthening Bosch’s foothold in the power tool accessories market.

- May 2023: Bosch, FEIN, and Rothenberger expanded the AMPShare multi-brand 18V battery platform across North America. Though U.S.-focused, its compatibility push impacted Mexico’s power tool accessories market by encouraging cross-brand cordless tool adoption, enhancing efficiency and reducing accessory redundancy for professionals.

Mexico Power Tool Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Drill Bits, Screwdriver Bits, Router Bits, Circular Saw Blades, Jig Saw Blades, Band Saw Blades, Abrasive Wheels, Reciprocating Saw Blades, Others |

| Applications Covered | Milter Saw, Drill Machine, Reciprocating Saw, Hole Saw, Others |

| End-Use Sectors Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico power tool accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico power tool accessories market on the basis of type?

- What is the breakup of the Mexico power tool accessories market on the basis of application?

- What is the breakup of the Mexico power tool accessories market on the basis of end-use sector?

- What are the various stages in the value chain of the Mexico power tool accessories market?

- What are the key driving factors and challenges in the Mexico power tool accessories market?

- What is the structure of the Mexico power tool accessories market and who are the key players?

- What is the degree of competition in the Mexico power tool accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico power tool accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico power tool accessories market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico power tool accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)