Mexico Power Transformer Market Size, Share, Trends and Forecast by Core, Insulation, Phase, Rating, Application, and Region, 2025-2033

Mexico Power Transformer Market Overview:

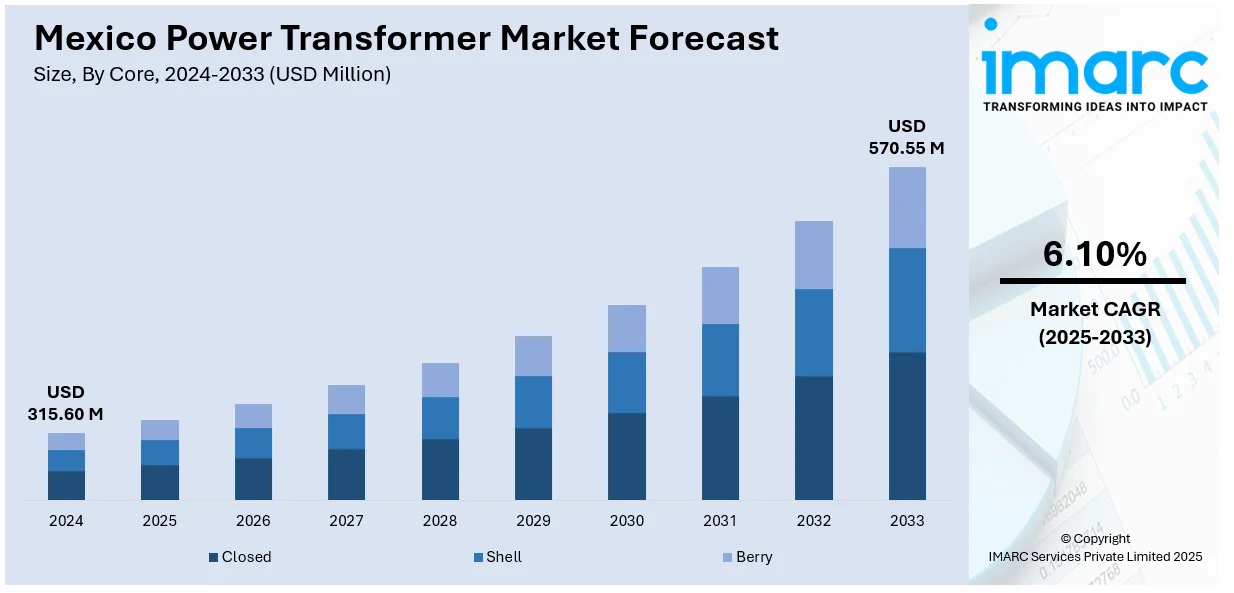

The Mexico Power Transformer Market size reached USD 315.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 570.55 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The growing demand for electricity driven by urbanization and industrialization, burgeoning government investments in infrastructure development, and the rise of renewable energy projects are some of the factors favoring the market growth. Additionally, the market is benefiting from the growing emphasis on energy efficiency, the transition to smart grid technologies, and ongoing efforts to electrify rural areas. Apart from this, the aging power infrastructure, increasing foreign investments, and expansion of industrial applications further contribute to the Mexico power transformer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 315.60 Million |

| Market Forecast in 2033 | USD 570.55 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Mexico Power Transformer Market Trends:

Increasing Demand for Electricity Due to Urbanization and Industrialization

Mexico’s rapid urbanization and industrialization are key drivers of the power transformer market. As the population continues to grow, there is an increasing demand for reliable electricity to power residential, commercial, and industrial sectors. Urban areas are expanding, leading to higher energy consumption, which, in turn, requires more robust power infrastructure. The growth in industries such as manufacturing, automotive, and construction is amplifying the need for a stable and efficient power supply. Additionally, industrial parks and new business developments are pushing the demand for transformers that can handle larger electricity loads. This urban growth, combined with expanding manufacturing capacities, requires grid enhancements and transformer installations to ensure consistent power delivery. Apart from this, the surging investments in power transformers to strengthen grid infrastructure and meet the needs of a rapidly developing economy is another factor driving Mexico's power transformer market growth.

Government Emphasis on Infrastructure Development in the Energy Sector

The Mexican government’s emphasis on infrastructure development, especially in the energy infrastructure sector, is one of the key factors propelling the market growth. In the last few years, modernization of the country’s electrical grid has been a top priority to monitor and secure the stability and mission-critical reliability of electricity distribution. In 2025, Mexico enacted new energy sector laws , including the LESE, which allows public-private electricity generation projects. The market is further driven by public sector investment in power transmission networks and favorable energy reform plans. The development of a more reliable grid and expanded coverage to underserved regions has surged the deployment of sophisticated transformer technology, which is further boosting market growth. With the energy market becoming more competitive and a greater demand for stable and reliable energy, the market for high-efficiency transformers is projected to witness considerable growth.

Growth of Renewable Energy Projects in Mexico

The expansion of renewable energy projects in Mexico is significantly influencing the power transformer market. Mexico has made substantial strides in harnessing renewable energy, particularly solar and wind power, in recent years. These energy sources require robust and reliable transformer infrastructure to integrate them efficiently into the national grid. The government’s commitment to meeting renewable energy targets under international agreements and national policies is accelerating the development of renewable energy farms across the country. With the rise in the number of renewable energy installations, power transformers play a crucial role in ensuring the stability of the grid by managing the variability of renewable generation. Wind and solar farms are often located in remote regions where the existing grid infrastructure may need enhancements or upgrades. As these renewable energy sources continue to gain traction, the demand for transformers that can handle the complex needs of renewable energy integration will remain a major market driver.

Mexico Power Transformer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on core, insulation, phase, rating, and application.

Core Insights:

- Closed

- Shell

- Berry

The report has provided a detailed breakup and analysis of the market based on the core. This includes closed, shell, and berry.

Insulation Insights:

- Gas

- Oil

- Solid

- Air

- Others

A detailed breakup and analysis of the market based on the insulation type have also been provided in the report. This includes gas, oil, solid, air, and others.

Phase Insights:

- Single

- Three

The report has provided a detailed breakup and analysis of the market based on the phase. This includes single and three.

Rating Insights:

- 100 MVA to 500 MVA

- 501 MVA to 800 MVA

- 801 MVA to 1200 MVA

A detailed breakup and analysis of the market based on the rating have also been provided in the report. This includes 100 MVA to 500 MVA, 501 MVA to 800 MVA, and 801 MVA to 1200 MVA.

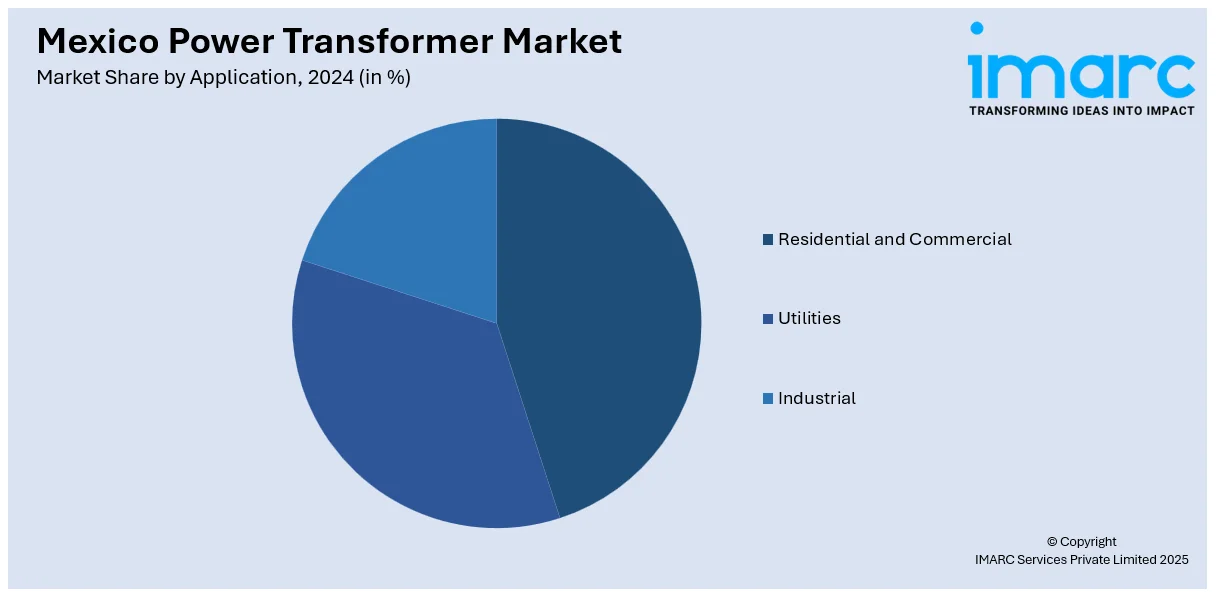

Application Insights:

- Residential and Commercial

- Utilities

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial, utilities, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Power Transformer Market News:

- In 2023, CHINT delivered two 115 kV power transformers to Pemex's El Paredón substation. This move is part of CHINT's strategy to build a talent pool for future orders from the Comisión Federal de Electricidad (CFE) and expand its presence in Mexico's energy sector.

- In 2023, Exus North America Holdings acquired a 15% stake in New Mexico Renewable Development for USD 115 million. This acquisition reflects the ongoing consolidation in Mexico's power sector, with a focus on renewable energy investments.

Mexico Power Transformer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cores Covered | Closed, Shell, Berry |

| Insulations Covered | Gas, Oil, Solid, Air, Others |

| Phases Covered | Single, Three |

| Ratings Covered | 100 MVA to 500 MVA, 501 MVA to 800 MVA, 801 MVA to 1200 MVA |

| Applications Covered | Residential and Commercial, Utilities, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico power transformer market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico power transformer market on the basis of core?

- What is the breakup of the Mexico power transformer market on the basis of insulation?

- What is the breakup of the Mexico power transformer market on the basis of phase?

- What is the breakup of the Mexico power transformer market on the basis of rating?

- What is the breakup of the Mexico power transformer market on the basis of application?

- What is the breakup of the Mexico power transformer market on the basis of region?

- What are the various stages in the value chain of the Mexico power transformer market?

- What are the key driving factors and challenges in the Mexico power transformer market?

- What is the structure of the Mexico power transformer market and who are the key players?

- What is the degree of competition in the Mexico power transformer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico power transformer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico power transformer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico power transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)