Mexico Precision Agriculture Market Size, Share, Trends and Forecast by Technology, Type, Component, Application, and Region, 2025-2033

Mexico Precision Agriculture Market Overview:

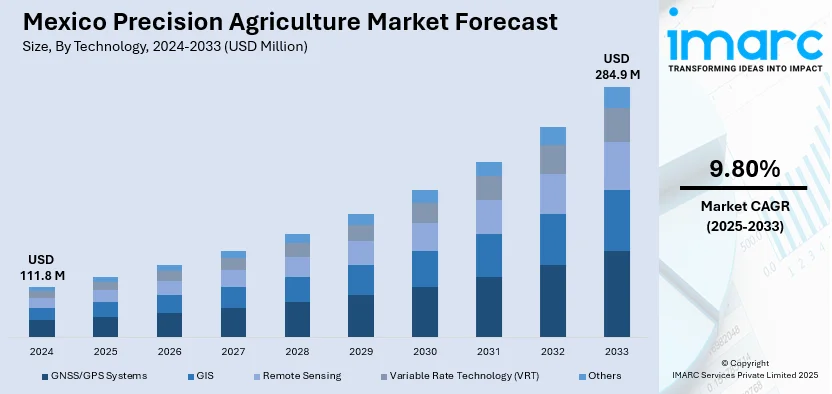

The Mexico precision agriculture market size reached USD 111.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 284.9 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is driven by rising demand for food security, government support for agri-tech innovation, and the need for sustainable farming practices. Advancements in IoT, AI, and data analytics, along with increasing farm mechanization and cost-effective smart farming tools, are further expanding the Mexico precision agriculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 111.8 Million |

| Market Forecast in 2033 | USD 284.9 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Mexico Precision Agriculture Market Trends:

Increasing Adoption of IoT and Smart Farming Technologies

The market is experiencing significant growth due to the rising adoption of IoT (Internet of Things) and smart farming technologies. Mexico is among the world’s top ten fruit and vegetable producers and exported 1.7 million metric tons of tomatoes in 2021, making USD 18 Billion in fresh produce exports in 2022 as per recent industry reports. The greenhouse industry, which is concentrated in the highlands, is embracing modern farming technologies including climate control systems, automation, and precision irrigation to combat labor shortages and water scarcity. Mexico is also solidifying its position in precision agriculture and high-tech food production, as demand from North America remains strong. Farmers are increasingly using sensors, drones, and automated machinery to increase crop yields, reduce resource waste, and make better-informed decisions. IoT devices can provide live updates about everything from soil visibility to climate tracking and crop vitality, allowing farmers to take targeted measures for irrigation and fertilizers as well as pest control. This movement is being pushed further by government programs and private investments since Mexico needs to modernize its agricultural sector to cater to domestic and export demand. In addition, the falling costs of IoT devices and improved connectivity in rural areas are bringing these technologies to small and medium-sized farms. As a result, the integration of IoT in precision agriculture is favoring Mexico precision agriculture growth.

Growing Demand for Data-Driven Farming Solutions

Another key trend in the market is the increasing demand for data-driven farming solutions. Advanced analytics, artificial intelligence (AI), and machine learning are being used to process large datasets from satellite imagery, drones, and field sensors, providing actionable insights for farmers. These technologies help predict crop performance, optimize planting schedules, and mitigate risks related to climate variability. While Mexico lacks a national AI strategy, it is the region’s leader in public sector investment for AI research and development and graduated 2,670 master's level computer science students in 2022. The country displays an internet usage rate of 81.2% and universal access to electricity, with a rising AI infrastructure, although its adoption in the private sector remains relatively low. These developments present significant opportunities for precision agriculture, where AI can foster innovation in the context of Mexico's digital growth and data preparedness. Agtech startups have been working together with agribusinesses and cooperatives to implement cloud-based software, such as farm management systems, to increase efficiency. Moreover, the rising requirement for sustainable agricultural practices due to water scarcity and other environmental challenges is motivating farmers to implement precision agriculture practices, which lead to lowered input costs and increased productivity. Mexico is gearing up to become a strong contender in the world of agri-tech, attracting both domestic and foreign investments in modern farming technology as data-driven agriculture continues to develop. Therefore, this is creating a positive Mexico precision agriculture market outlook.

Mexico Precision Agriculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, type, component, and application.

Technology Insights:

- GNSS/GPS Systems

- GIS

- Remote Sensing

- Variable Rate Technology (VRT)

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes GNSS/GPS systems, GIS, remote sensing, variable rate technology (VRT), and others.

Type Insights:

- Automation and Control Systems

- Sensing and Monitoring Devices

- Farm Management System

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes automation and control systems, sensing and monitoring devices, and farm management system.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

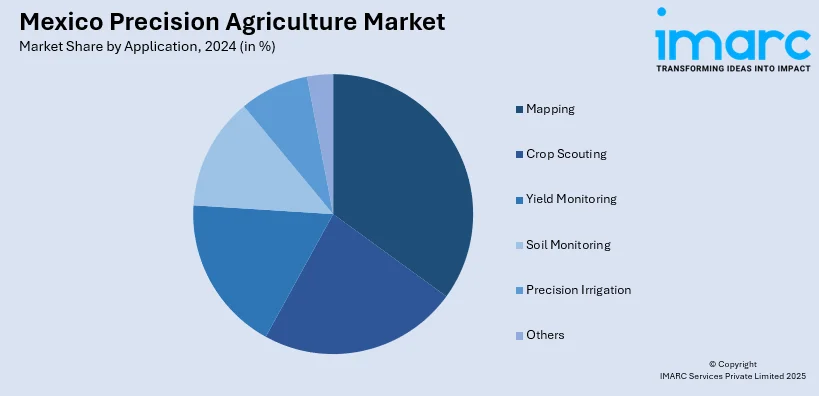

Application Insights:

- Mapping

- Crop Scouting

- Yield Monitoring

- Soil Monitoring

- Precision Irrigation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mapping, crop scouting, yield monitoring, soil monitoring, precision irrigation, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Precision Agriculture Market News:

- August 19, 2024: Bee Vectoring Technologies International Inc. (BVT) has received approval from Mexico's COFEPRIS for its proprietary Vectorite with Clonostachys Rosea CR-7 (CR-7) to be used as a fungicide on commercial crops, including berries and indoor vegetables, delivered by both bumble bees and honeybees. The company is now poised to secure a commercial arrangement with a partner in Mexico to bring its all-natural precision agriculture system to market, offering a competitive advantage to growers seeking to reduce chemical use and improve crop yields.

Mexico Precision Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | GNSS/GPS Systems, GIS, Remote Sensing, Variable Rate Technology (VRT), Others |

| Types Covered | Automation and Control Systems, Sensing and Monitoring Devices, Farm Management System |

| Components Covered | Hardware, Software |

| Applications Covered | Mapping, Crop Scouting, Yield Monitoring, Soil Monitoring, Precision Irrigation, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico precision agriculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico precision agriculture market on the basis of technology?

- What is the breakup of the Mexico precision agriculture market on the basis of type?

- What is the breakup of the Mexico precision agriculture market on the basis of component?

- What is the breakup of the Mexico precision agriculture market on the basis of application?

- What is the breakup of the Mexico precision agriculture market on the basis of region?

- What are the various stages in the value chain of the Mexico precision agriculture market?

- What are the key driving factors and challenges in the Mexico precision agriculture market?

- What is the structure of the Mexico precision agriculture market and who are the key players?

- What is the degree of competition in the Mexico precision agriculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico precision agriculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico precision agriculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico precision agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)