Mexico Predictive Maintenance Market Size, Share, Trends and Forecast by Component, Deployment, Enterprise Size, End Use, and Region, 2025-2033

Mexico Predictive Maintenance Market Overview:

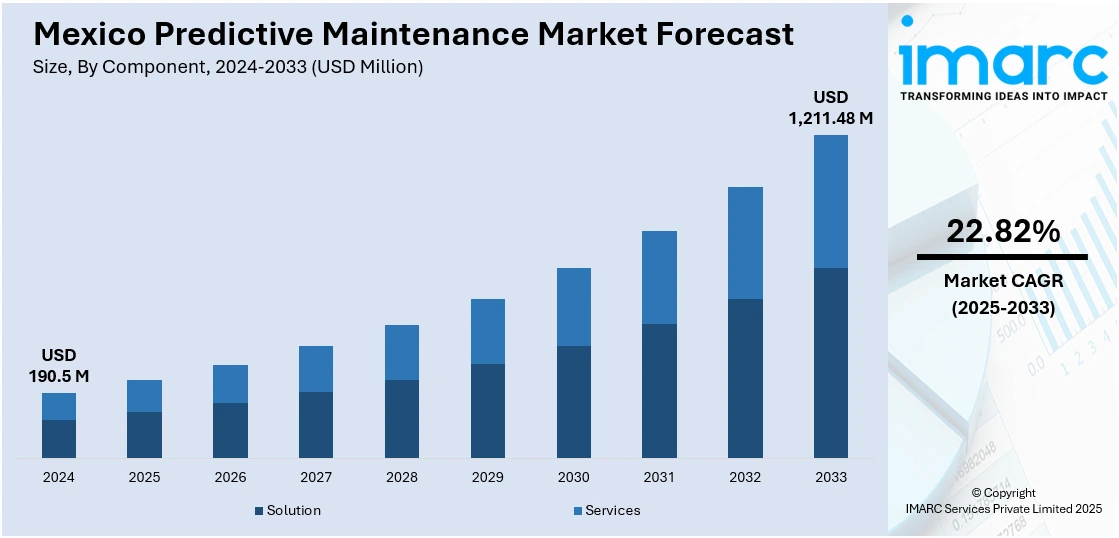

The Mexico predictive maintenance market size reached USD 190.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,211.48 Million by 2033, exhibiting a growth rate (CAGR) of 22.82% during 2025-2033. Mexican industries are increasingly focusing on improving operational efficiency and reducing maintenance costs, which is significantly driving the market. This trend, along with the heightened use of Internet of Things (IoT) and sensor technologies is impelling the market growth. Besides this, implementation of favorable government policies and regulations are expanding the Mexico predictive maintenance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 190.5 Million |

| Market Forecast in 2033 | USD 1,211.48 Million |

| Market Growth Rate 2025-2033 | 22.82% |

Mexico Predictive Maintenance Market Trends:

Increasing Adoption of Internet of Things (IoT) and Sensor Technologies

The market for predictive maintenance in Mexico is driven by the use of Internet of Things (IoT) and sensor technologies widely across many industries. Firms in industries like manufacturing, energy, and automotive are becoming more inclined to incorporate IoT-enabled devices within their operations. These devices continuously measure the performance of equipment by gathering real-time data on temperature, vibration, pressure, and other important parameters. By analyzing this data with predictive algorithms, businesses are detecting potential breakdowns ahead of time. The capability to identify anomalies early on is enabling companies to minimize downtime and maintenance costs, enhancing operational efficiency. With advancing IoT and sensor technology, their usage in predictive maintenance is rapidly increasing, and these solutions are becoming more affordable and available for Mexican businesses. This change in technology is transforming the marketplace, driving the demand for predictive maintenance systems. The IMARC Group predicts that the Mexico IoT market size is projected to attain USD 46,079.0 Million by 2033.

Rising Focus on Operational Efficiency and Cost Reduction

Mexican industries are increasingly focusing on improving operational efficiency and reducing maintenance costs, which is significantly driving the market. Companies in sectors such as manufacturing, oil and gas, and transportation are investing in predictive maintenance solutions to prevent costly downtime, which is known to disrupt operations and lead to substantial financial losses. These solutions are utilizing advanced data analytics and machine learning (ML) algorithms to forecast potential equipment failures, allowing businesses to perform maintenance only when needed. This spontaneous maintenance approach is reducing unnecessary repair costs and enhancing the lifespan of machinery and equipment. As organizations continue to seek innovative ways to streamline their operations and minimize unexpected repairs, the demand for predictive maintenance tools is rising. This shift toward preventive measures is propelling the Mexico predictive maintenance market growth.

Government Initiatives and Industry Regulations

Government policies and regulations in Mexico are bolstering the market growth. To meet the increasing demand for increased industrial productivity, the Mexican government is promoting the use of smart technologies in industries, specially manufacturing and energy. This is done through incentives, subsidies, and collaborations to promote digitalization in industries. In 2024, a proposed national digital industry plan, stretching to the next 15 years to 2040, was submitted during a conference at Mexican telecoms regulator IFT headquarters. Moreover, industry policies are encouraging firms to be more sustainable and efficient in their practice, including optimization of asset management and minimizing environmental footprints for operations. Companies are better suited to meet regulatory compliance through the use of predictive maintenance solutions and, at the same time, optimize their performance and emission reduction. As regulations become more dynamic, Mexican industries are increasingly adopting predictive maintenance as a way of ensuring compliance and enhancing overall productivity, further fueling the growth of the market.

Mexico Predictive Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment, enterprise size, and end use.

Component Insights:

- Solution

- Integrated

- Standalone

- Services

- Deployment / Installation

- Support and Maintenance

- Training and Consulting

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (integrated and standalone) and services (deployment/installation, support and maintenance, and training and consulting).

Deployment Insights:

- Cloud

- On-Premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud and on-premises.

Enterprise Size Insights:

- Small and Medium Enterprises

- Large Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium enterprises and large enterprise.

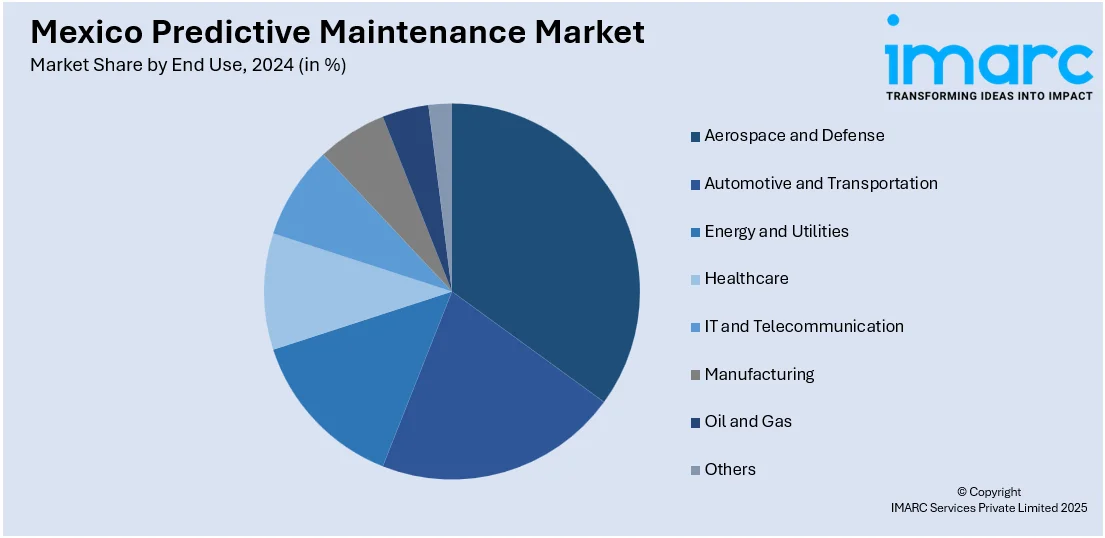

End Use Insights:

- Aerospace and Defense

- Automotive and Transportation

- Energy and Utilities

- Healthcare

- IT and Telecommunication

- Manufacturing

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes aerospace and defense, automotive and transportation, energy and utilities, healthcare, IT and telecommunication, manufacturing, oil and gas, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Predictive Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Cloud, On-Premises |

| Enterprise Sizes Covered | Small and Medium Enterprises, Large Enterprise |

| End Users Covered | Aerospace and Defense, Automotive and Transportation, Energy and Utilities, Healthcare, IT and Telecommunication, Manufacturing, Oil and Gas, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico predictive maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico predictive maintenance market on the basis of component?

- What is the breakup of the Mexico predictive maintenance market on the basis of deployment?

- What is the breakup of the Mexico predictive maintenance market on the basis of enterprise size?

- What is the breakup of the Mexico predictive maintenance market on the basis of end use?

- What is the breakup of the Mexico predictive maintenance market on the basis of region?

- What are the various stages in the value chain of the Mexico predictive maintenance market?

- What are the key driving factors and challenges in the Mexico predictive maintenance market?

- What is the structure of the Mexico predictive maintenance market and who are the key players?

- What is the degree of competition in the Mexico predictive maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico predictive maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico predictive maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico predictive maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)