Mexico Print Label Market Size, Share, Trends and Forecast by Raw Material, Print Process, Label Format, End Use Industry, and Region, 2025-2033

Mexico Print Label Market Overview:

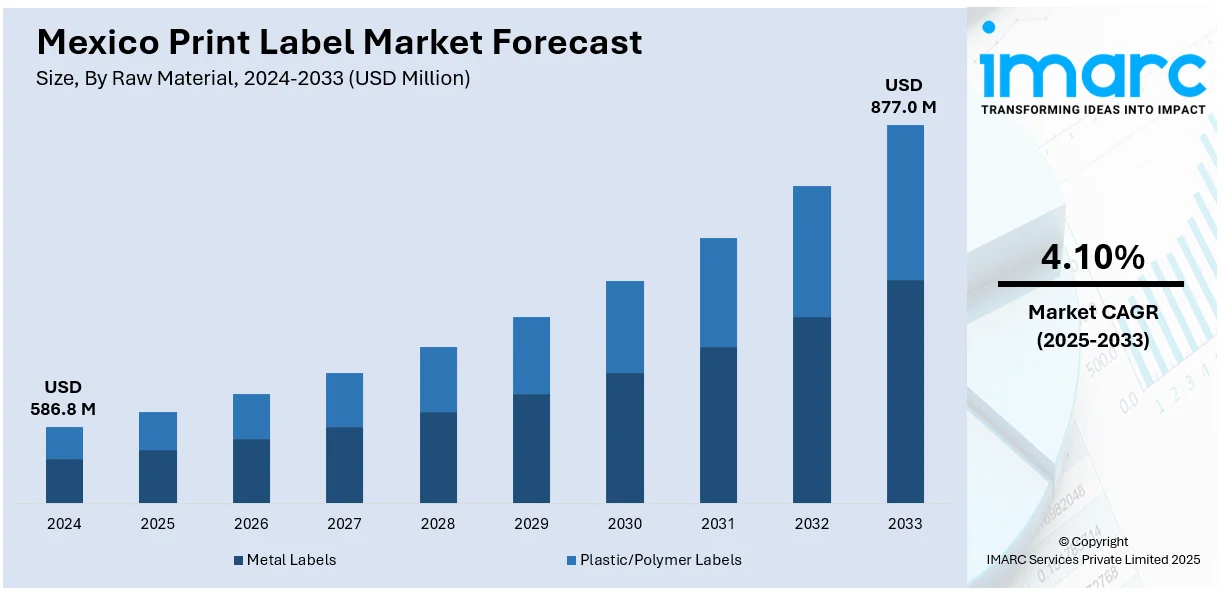

The Mexico print label market size reached USD 586.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 877.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by rising e-commerce, growing food and beverage (F&B) demand, increasing pharmaceutical labeling needs, continuous technological advancements in printing, increasing branding focus, surging regulatory compliance requirements, and expanding retail infrastructure across urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 586.8 Million |

| Market Forecast in 2033 | USD 877.0 Million |

| Market Growth Rate 2025-2033 | 4.10% |

Mexico Print Label Market Trends:

Adoption of Sustainable Labeling Practices

The adoption of sustainable labelling practices is boosting the Mexico print label market share, because consumers seek eco-friendly products, as environmental concerns keep increasing. In addition, the label manufacturing industry now uses recyclable and biodegradable materials because companies are minimizing their environmental impact. For instance, in 2025, Nefab has strengthened its presence in Mexico by expanding operations in key cities, including Guadalajara and Monterrey. The company focuses on eco-friendly packaging alternatives, such as FiberFlute and returnable thermoformed trays, addressing customer demands and environmental concerns. Sustainable practices in the Mexican print label market are also advancing due to a combination of market demand alongside regulatory requirements. Moreover, the implementation of sustainable labeling solutions aligns with the global trends to make packaging more environmentally friendly. Besides this, Mexican label producers who integrate sustainable materials and processes achieve environmental conservation goals and secure better market positions in their domestic territory and international markets. Furthermore, businesses throughout the industry are actively supporting responsible production patterns because consumers increasingly demand environmentally sustainable products, which is driving the Mexico print label market growth.

Technological Advancements and Digital Printing Integration

The Mexico print label industry is experiencing a major transformation due to continuous technological innovation, including digital printing integration. In line with this, through digital printing, manufacturers gain access to premium-quality printed materials at affordable prices alongside data customization options that accommodate evolving brand and consumer requirements. Moreover, the productive advantages of digital printing systems encourage Mexican label manufacturers to make investments in these technologies for improved manufacturing capabilities. Concurrently, the market demand for personalized and short-run labels is significantly expanding, especially in the F&B industry, as they require product differentiation. For example, in September 2024, Buskro introduced the DLP 1085 digital label press at Labelexpo Americas 2024, featuring a 4.25-inch color printhead and automated maintenance, designed for variable and short-run label printing, catering to the evolving needs of label converters. Apart from this, digital printing technologies help producers create quick market responses to consumer demands, which increases their business strength in the market. As a result, the market expects digital printing technologies to be crucial for its future development, alongside market competitiveness, thereby enhancing the Mexico print label market outlook.

Mexico Print Label Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on raw material, print process, label format, and end use industry.

Raw Material Insights:

- Metal Labels

- Plastic/Polymer Labels

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes metal labels and plastic/polymer labels.

Print Process Insights:

- Offset Lithography

- Gravure

- Flexography

- Screen

- Letterpress

- Electrophotography

- Inkjet

A detailed breakup and analysis of the market based on the print process have also been provided in the report. This includes offset lithography, gravure, flexography, screen, letterpress, electrophotography, and inkjet.

Label Format Insights:

- Wet-Glue Labels

- Pressure-Sensitive Labels

- Linerless Labels

- Multi-Part Tracking Labels

- In-Mold Labels

- Sleeves

The report has provided a detailed breakup and analysis of the market based on the label format. This includes wet-glue labels, pressure-sensitive labels, linerless labels, multi-part tracking labels, in-mold labels, and sleeves.

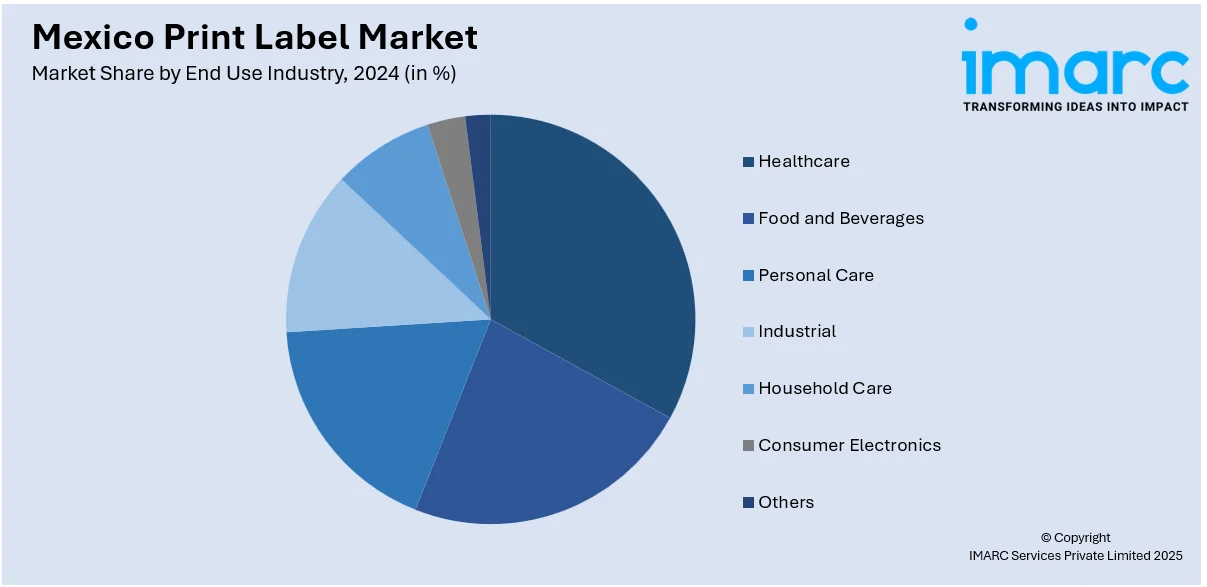

End Use Industry Insights:

- Healthcare

- Food and Beverage

- Personal Care

- Industrial

- Household Care

- Consumer Electronics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes healthcare, food and beverage, personal care, industrial, household care, consumer electronics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Print Label Market News:

- In November 2024, Tederic showcased automated injection molding lines at Expo Plásticos 2024 in Guadalajara, highlighting advanced labeling solutions and reinforcing its presence in Mexico's print label market through innovation, efficiency, and tailored technologies for regional manufacturing needs.

- In October 2024, Avery Dennison opened its largest global RFID facility in Querétaro, Mexico, investing over $100 million to expand RFID and digital ID production, strengthening Mexico’s print label market through enhanced technological capabilities and increased manufacturing capacity.

Mexico Print Label Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Metal Labels, Plastic/Polymer Labels |

| Print Processes Covered | Offset Lithography, Gravure, Flexography, Screen, Letterpress, Electrophotography, Inkjet |

| Label Formats Covered | Wet-Glue Labels, Pressure-Sensitive Labels, Linerless Labels, Multi-Part Tracking Labels, In-Mold Labels, Sleeves |

| End Use Industries Covered | Healthcare, Food and Beverage, Personal Care, Industrial, Household Care, Consumer Electronics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico print label market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico print label market on the basis of raw material?

- What is the breakup of the Mexico print label market on the basis of print process?

- What is the breakup of the Mexico print label market on the basis of label format?

- What is the breakup of the Mexico print label market on the basis of end use industry?

- What is the breakup of the Mexico print label market on the basis of region?

- What are the various stages in the value chain of the Mexico print label market?

- What are the key driving factors and challenges in the Mexico print label?

- What is the structure of the Mexico print label market and who are the key players?

- What is the degree of competition in the Mexico print label market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico print label market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico print label market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico print label industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)