Mexico Printed Electronics Market Size, Share, Trends and Forecast by Material, Technology, Device, and Region, 2025-2033

Mexico Printed Electronics Market Overview:

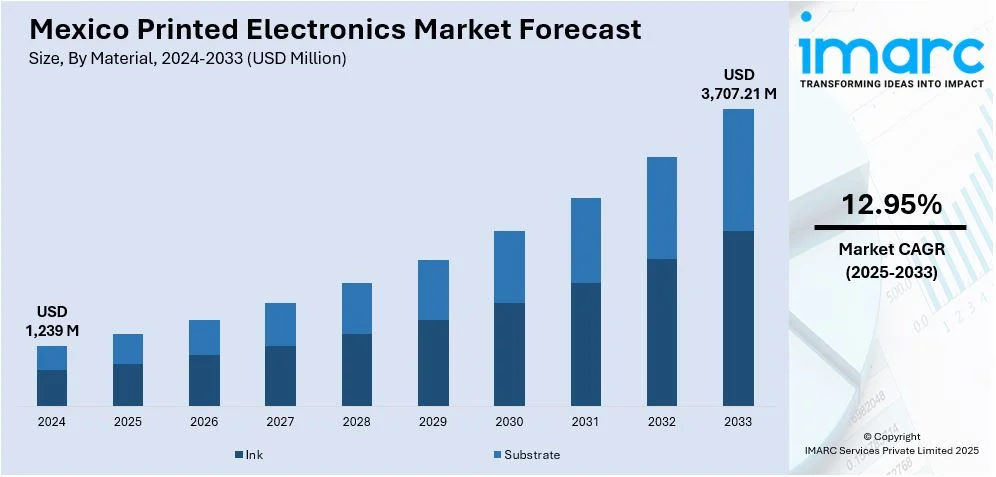

The Mexico printed electronics market size reached USD 1,239 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,707.21 Million by 2033, exhibiting a growth rate (CAGR) of 12.95% during 2025-2033. Rising demand for flexible displays, advancements in conductive inks, increasing adoption in automotive sensors, cost-effective manufacturing for RFID tags, and growing integration in consumer electronics and healthcare wearables for smart functionalities and lightweight, energy-efficient design are some of the factors contributing to Mexico printed electronics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,239 Million |

| Market Forecast in 2033 | USD 3,707.21 Million |

| Market Growth Rate 2025-2033 | 12.95% |

Mexico Printed Electronics Market Trends:

Expansion of Printed Electronics and Technical Printing

The printed electronics market in Mexico is seeing rapid advancement as companies expand their capabilities in technical screen printing, design, and assembly of functional coatings. With an increased focus on in-mold decoration and adhesive solutions, the sector is benefiting from enhanced local expertise and innovation. The strategic acquisitions in Mexico strengthen the country’s role in the growing market for advanced printed electronics, especially in automotive, industrial, and consumer electronics sectors. Mexico’s expanding manufacturing base and technological capabilities are attracting more investment, positioning it as a key player in the global printed electronics ecosystem. This development supports the increasing demand for specialized solutions in a variety of industries, from automotive to electronics, fostering further innovation and growth in the region. These factors are intensifying the Mexico printed electronics market growth. For example, in October 2024, CCL Industries acquired Desarrollo e Investigación S.A. de C.V. and Fuzetouch PTE LTD, collectively known as D&F, headquartered in San Luis Potosí, Mexico. This acquisition enhances CCL Design's capabilities in technical screen printing, printed electronics design and assembly, adhesive and functional coatings, and in-mold decoration.

Growth in Printed Electronics and Smart Textiles

Based on the Mexico printed electronics market outlook, the printed electronics market in Mexico is experiencing significant growth, driven by increased demand in the medical, industrial, and wearable technology sectors. As the country strengthens its manufacturing base, companies are expanding their capabilities to meet the rising need for advanced, integrated solutions such as smart textiles. Innovations in wearable technology, particularly for healthcare and industrial applications, are creating new opportunities for businesses to leverage Mexico’s growing market. With its expanding presence in Mexico, the printed electronics sector is poised for accelerated development, capitalizing on the country’s evolving technological landscape and its strategic position in the global manufacturing network. This shift is paving the way for more advanced and efficient electronic products in the region. For instance, in December 2024, Interlink Electronics acquired UK-based Conductive Transfers and Global Print Solutions, boosting its capabilities in printed electronics, especially for smart textiles and wearables. This move supports Interlink’s expansion into high-growth regions, including Mexico, where demand for printed electronics in medical and industrial sectors is rising. The acquisition positions Interlink to tap into Mexico’s growing manufacturing base and innovation in wearable technology.

Mexico Printed Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, technology, and device.

Material Insights:

- Ink

- Substrate

The report has provided a detailed breakup and analysis of the market based on the material. This includes ink and substrate.

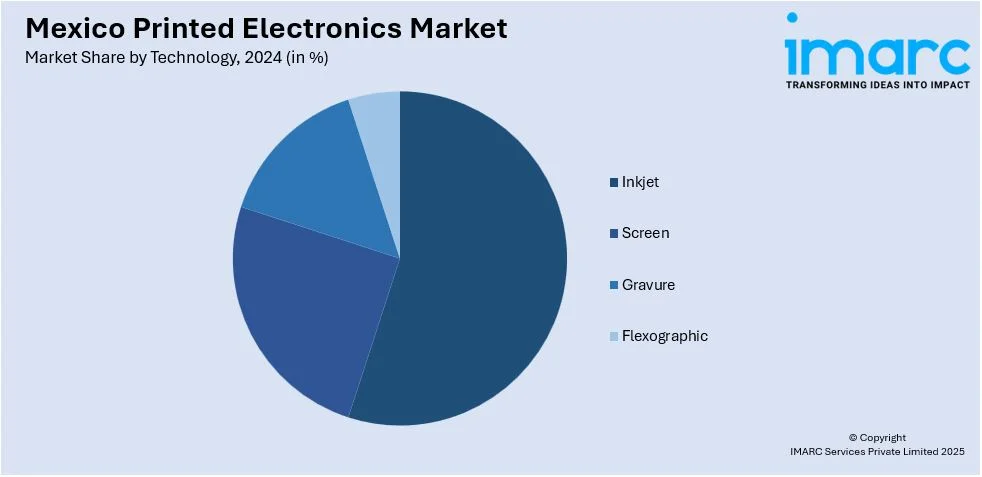

Technology Insights:

- Inkjet

- Screen

- Gravure

- Flexographic

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes inkjet, screen, gravure, and flexographic.

Device Insights:

- Display

- Photovoltaic

- Lighting

- RFID

- Others

A detailed breakup and analysis of the market based on the device have also been provided in the report. This includes display, photovoltaic, lighting, RFID, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Printed Electronics Market News:

- In November 2024, DuPont showcased its advanced silver nanowire technologies and Pyralux flexible laminates at Electronica 2024, highlighting innovations in transparent conductors and flexible circuits. These developments are pertinent to Mexico's printed electronics market, which focuses on applications like flexible displays, sensors, and smart packaging.

Mexico Printed Electronics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Ink, Substrate |

| Technologies Covered | Inkjet, Screen, Gravure, Flexographic |

| Devices Covered | Display, Photovoltaic, Lighting, RFID, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico printed electronics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico printed electronics market on the basis of material?

- What is the breakup of the Mexico printed electronics market on the basis of technology?

- What is the breakup of the Mexico printed electronics market on the basis of device?

- What is the breakup of the Mexico printed electronics market on the basis of region?

- What are the various stages in the value chain of the Mexico printed electronics market?

- What are the key driving factors and challenges in the Mexico printed electronics market?

- What is the structure of the Mexico printed electronics market and who are the key players?

- What is the degree of competition in the Mexico printed electronics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico printed electronics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico printed electronics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico printed electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)