Mexico Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2026-2034

Mexico Pro AV Market Summary:

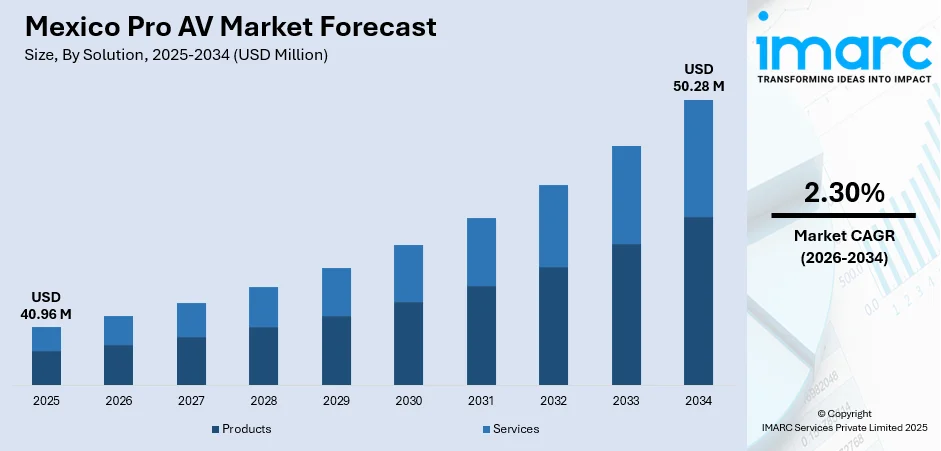

The Mexico pro AV market size was valued at USD 40.96 Million in 2025 and is projected to reach USD 50.28 Million by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034.

The Mexico pro AV market is experiencing steady expansion fueled by digital transformation initiatives across corporate, educational, and entertainment sectors. Organizations are increasingly investing in sophisticated audiovisual solutions to enhance communication efficiency, foster collaboration, and deliver immersive experiences. The growing adoption of networked AV systems, rising demand for interactive digital signage, and expansion of hybrid work environments are propelling market growth. Additionally, infrastructure development in transportation hubs, retail modernization, and hospitality sector investments contribute to the expanding Mexico pro AV market share.

Key Takeaways and Insights:

- By Solution: Products dominated the market with approximately 57.18% share in 2025, driven by widespread adoption of display technologies, projectors, and conferencing equipment across commercial and corporate installations.

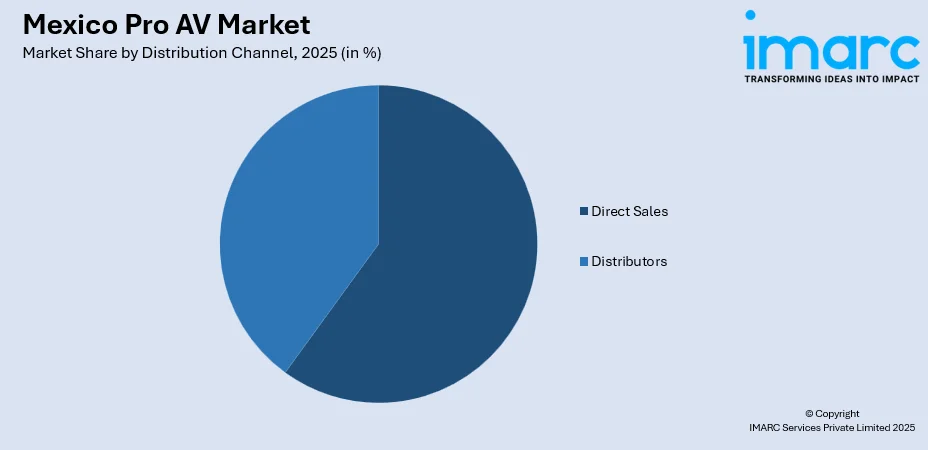

- By Distribution Channel: Direct sales led the market with a share of 38.56% in 2025, attributed to large-scale enterprise deployments requiring customized solutions and direct manufacturer relationships.

- By Application: Commercial represents the largest segment with a market share of 40% in 2025, fueled by retail digitalization, corporate office modernization, and hospitality sector technology upgrades.

- Key Players: The Mexico pro AV market exhibits a moderately fragmented competitive landscape with global manufacturers competing alongside regional integrators and service providers across various application segments and price tiers.

To get more information on this market Request Sample

The Mexico professional audiovisual market continues to evolve as businesses and institutions prioritize enhanced communication infrastructure and immersive technological experiences. The market encompasses diverse solutions ranging from display systems, projectors, and sound reinforcement products to comprehensive installation and managed services. Corporate environments are deploying advanced video conferencing and collaboration tools to support hybrid work models, while educational institutions integrate interactive displays and digital learning platforms. The retail and hospitality sectors leverage digital signage solutions to enhance customer engagement and streamline operations. The successful inaugural edition of InfoComm América Latina held in Mexico City in October 2025, which attracted over five thousand attendees and more than 100 exhibiting companies, underscores the region's growing importance as a hub for professional audiovisual technology adoption and innovation.

Mexico Pro AV Market Trends:

Accelerated Adoption of Networked and IP-Based AV Solutions

Organizations across Mexico are transitioning from traditional point-to-point audiovisual systems to networked IP-based solutions that enable scalable distribution, centralized management, and enhanced collaboration capabilities. This trend reflects the convergence of information technology and audiovisual systems, allowing seamless integration with existing enterprise networks and cloud platforms. Businesses benefit from improved operational efficiency, reduced cabling complexity, and the flexibility to manage multiple venues remotely through unified control interfaces. For instance, in November 2025, LEA Professional entered into a strategic partnership with Audio Americas, a regional audiovisual specialist operating across Mexico, Chile, and Costa Rica. Audio Americas delivers commercial and residential AV solutions to a broad client base spanning multiple countries. Under this agreement, the company will act as a representative for LEA Professional’s Network Connect professional amplifier range and the Dante Connect series, offering Dante- and AES67-enabled solutions throughout the Latin American market.

Growing Integration of Artificial Intelligence in AV Systems

Artificial intelligence technologies are increasingly embedded within professional audiovisual systems to deliver automated content optimization, intelligent camera framing, and enhanced audio processing capabilities. These AI-driven features enhance meeting experiences by automatically tracking speakers, suppressing noise, and adjusting displays based on ambient conditions. Industry discussions at recent audiovisual conferences highlight how artificial intelligence is transforming communication and human interaction patterns within digital signage and collaboration environments. For instance, in June 2025, OpenAV Cloud, a new industry initiative, launched by a coalition of AV manufacturers and technology providers to accelerate the AV industry's transition to the cloud by promoting openness, interoperability, and customer-first innovation. The nonprofit initiative plans to sidestep proprietary systems, which can hinder integration and innovation, by developing open, cloud-based APIs and shared frameworks for secure data access and cross-brand compatibility.

Expansion of Cloud-Based Digital Signage Platforms

Cloud-based digital signage solutions are gaining traction across Mexican retail, hospitality, and transportation sectors due to their scalability, remote management capabilities, and cost-effectiveness compared to traditional on-premise systems. These platforms enable real-time content updates, centralized scheduling across multiple locations, and advanced analytics for measuring viewer engagement. The trend supports businesses seeking agile communication tools that can adapt quickly to changing marketing strategies and operational requirements. For instance, in August 2025, Creative Realities, Inc. launched a pilot digital signage system at Circle K Mexico, showcasing localized promotional content. Supporting sustainability by reducing print, the initiative enhances customer engagement, tracks sales, and signals a shift toward digital-first retail with potential expansion across multiple stores.

Market Outlook 2026-2034:

The Mexico pro AV market outlook remains positive as digital transformation continues reshaping communication infrastructure across corporate, educational, and public sectors. Investments in smart building technologies, hybrid workplace solutions, and immersive retail experiences are expected to sustain market expansion throughout the forecast period. The establishment of major audiovisual trade events in Mexico City further solidifies the country's position as a strategic market within Latin America, attracting international manufacturers and fostering regional business development. The market generated a revenue of USD 40.96 Million in 2025 and is projected to reach a revenue of USD 50.28 Million by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034.

Mexico Pro AV Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Solution | Products | 57.18% |

| Distribution Channel | Direct Sales | 38.56% |

| Application | Commercial | 40% |

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The products segment dominates with a market share of 57.18% of the total Mexico pro AV market in 2025.

The products segment encompasses display technologies, projectors, sound reinforcement equipment, conferencing systems, and AV acquisition and delivery solutions that form the hardware foundation of professional audiovisual installations. This segment's leadership position reflects the capital-intensive nature of AV deployments, where organizations invest significantly in display walls, LED screens, high-definition projectors, and professional audio systems to enhance communication effectiveness and create immersive environments across corporate, educational, and entertainment venues.

Display technologies such as LCD panels, LED video walls, and transparent LED screens are key product categories driving market growth as organizations increasingly prioritize advanced visual communication. Large-scale installations at major transportation hubs and commercial facilities highlight the growing emphasis on impactful display solutions across Mexico. These visual systems are commonly paired with sound reinforcement and conferencing equipment, enabling fully integrated audiovisual environments that enhance communication, engagement, and operational efficiency.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributors

The direct sales channel leads the market with a share of 38.56% of the total Mexico pro AV market in 2025.

Direct sales channels serve as the primary distribution pathway for enterprise-level professional audiovisual deployments where organizations require customized solutions, dedicated technical support, and direct manufacturer relationships. Large-scale corporate implementations, government projects, and institutional installations typically proceed through direct engagement with manufacturers or their authorized system integrators to ensure technical specifications align precisely with project requirements and post-installation support commitments.

The direct sales model facilitates comprehensive needs assessment, system design consultation, and ongoing managed services relationships that extend beyond initial product delivery. Global integration providers have strengthened their direct sales presence in Mexico through strategic acquisitions and regional expansion initiatives that establish local teams and offices dedicated to serving the growing demand for sophisticated audiovisual and unified communications solutions across commercial and government sectors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The commercial application segment exhibits clear dominance with a 40% share of the total Mexico pro AV market in 2025.

Commercial applications encompass professional audiovisual deployments across corporate offices, retail environments, entertainment venues, and business facilities where technology enhances operational efficiency, customer engagement, and internal communication. The segment benefits from ongoing digital transformation investments as organizations modernize meeting spaces, deploy digital signage networks, and integrate collaboration platforms to support evolving workplace requirements and competitive positioning.

Retail sector digitalization represents a significant commercial application driver as chains expand their digital signage presence to enhance customer experiences and deliver targeted promotional content. Restaurant chains and retail outlets are investing in comprehensive audio and video hardware installations across multiple locations to strengthen brand presence and streamline customer communication. Corporate boardrooms and conference facilities increasingly feature advanced video conferencing, interactive displays, and integrated control systems that support hybrid work models.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico’s Pro AV growth is driven by industrial expansion, cross-border trade hubs, and corporate HQs in cities like Monterrey and Tijuana that demand high-end conferencing, digital signage, and control systems. Manufacturing and logistics sectors increasingly adopt IP-based AV for operational efficiency. Large entertainment venues, live events, and rising business travel also boost immersive AV installs, supported by proximity to U.S. suppliers and solutions.

Central Mexico, anchored by Mexico City and Guadalajara, leads in Pro AV adoption through corporate digital transformation, hybrid work solutions, and educational tech upgrades. Universities, media production centers, and government projects invest in interactive displays and networked AV to enhance collaboration and learning. The region’s cultural events and film/TV production growth further spur demand for high-quality AV systems, while industry expos and tech hubs reinforce innovation and adoption.

Southern Mexico’s Pro AV drivers include tourism-focused AV in hotels, museums, and resorts that enhance visitor engagement with immersive experiences. Regional development programs and public infrastructure projects use AV for smart city and educational initiatives, though growth is slower than in the north or center due to lower urban density and investment budgets. Cultural festivals and community centers also adopt digital signage and sound systems as local economies diversify.

Market Dynamics:

Growth Drivers:

Why is the Mexico Pro AV Market Growing?

Digital Transformation Across Enterprise and Institutional Sectors

Organizations throughout Mexico are accelerating digital transformation initiatives that require sophisticated audiovisual infrastructure to support enhanced communication, collaboration, and customer engagement. Corporate environments are deploying integrated AV systems that connect physical and virtual workspaces, enabling seamless hybrid meetings and presentations. Educational institutions invest in smart classroom technologies featuring interactive displays, high-definition projection systems, and distributed audio solutions that enhance learning experiences. Healthcare facilities implement telemedicine capabilities supported by professional-grade video conferencing equipment. The broader trend toward digital workplace solutions drives sustained investment in professional audiovisual products and integration services.

Retail and Hospitality Sector Modernization

The retail and hospitality industries in Mexico are investing significantly in digital signage, immersive audio systems, and interactive display technologies to enhance customer experiences and differentiate their offerings in competitive markets. Retailers deploy video walls, transparent LED displays, and digital kiosks to create engaging shopping environments and deliver targeted promotional content. The Mexico retail market size reached USD 475.2 Billion in 2025. Looking forward, the market is expected to reach USD 698.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034. Hotels and resorts implement comprehensive audiovisual systems spanning lobby displays, conference facilities, and guest entertainment systems. Restaurant chains integrate audio and video hardware across multiple locations to maintain brand consistency and operational efficiency, with industry participants noting increased investment patterns across hospitality and retail segments.

Infrastructure Development and Transportation Hub Upgrades

Mexico's ongoing infrastructure development programs include significant audiovisual technology investments in transportation facilities, public spaces, and commercial complexes. Airports, bus terminals, and railway stations are deploying large-format display walls, wayfinding systems, and public address solutions to improve passenger communication and operational efficiency. Commercial real estate developments incorporate sophisticated AV infrastructure as a standard feature of modern building design, including conference center capabilities, digital signage networks, and integrated building management interfaces that enhance property value and tenant satisfaction.

Market Restraints:

What Challenges the Mexico Pro AV Market is Facing?

High Initial Investment Requirements

Professional audiovisual deployments require substantial upfront capital expenditure for hardware acquisition, installation services, and system integration that may exceed budget capabilities for small and medium enterprises. The comprehensive nature of enterprise AV projects involving display systems, audio equipment, control infrastructure, and networking components creates financial barriers that limit market penetration among cost-sensitive organizations.

Technical Complexity and Skilled Workforce Availability

The convergence of audiovisual technology with information technology networks creates implementation complexity requiring specialized technical expertise that remains limited in availability. Organizations face challenges securing qualified system integrators, certified technicians, and ongoing support resources necessary for successful deployment and maintenance of sophisticated networked AV solutions.

Import Dependencies and Supply Chain Considerations

The Mexico pro AV market relies substantially on imported equipment from international manufacturers, creating exposure to currency fluctuations, trade policy changes, and global supply chain disruptions that can impact product availability, delivery timelines, and overall project costs for end users and system integrators.

Competitive Landscape:

The Mexico pro AV market exhibits a moderately fragmented competitive structure featuring global audiovisual manufacturers, multinational system integrators, regional distribution partners, and specialized service providers competing across product categories and application segments. International companies leverage established brand recognition, comprehensive product portfolios, and global service capabilities to serve enterprise customers requiring standardized solutions across multiple locations. Regional integrators compete through local market knowledge, customized service offerings, and responsive technical support. The market has witnessed consolidation activity as global integration providers expand their Latin American presence through strategic acquisitions and partnership agreements, strengthening capabilities to serve multinational clients while building regional expertise.

Recent Developments:

- February 2025: Sonance announced strategic expansion of its professional audio business in Mexico through increased investment and the appointment of new regional leadership, reflecting the company's commitment to capitalizing on growth opportunities in the Mexican professional audio solutions market.

- January 2025: AVI-SPL completed its acquisition of ICAP Global, expanding its global reach in audiovisual and unified communications, particularly across Latin America, positioning the combined entity as a leading provider of digital workplace solutions with enhanced service capabilities throughout the region.

Mexico Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico pro AV market size was valued at USD 40.96 Million in 2025.

The Mexico pro AV market is expected to grow at a compound annual growth rate of 2.30% from 2026-2034 to reach USD 50.28 Million by 2034.

The products segment dominated the Mexico pro AV market with approximately 57.18% share in 2025, driven by widespread adoption of display technologies, projectors, and conferencing equipment across commercial and corporate installations.

Key factors driving the Mexico pro AV market include digital transformation across enterprise sectors, retail and hospitality modernization, infrastructure development projects, growing adoption of networked AV solutions, and expansion of hybrid work environments.

Major challenges include high initial investment requirements for professional AV deployments, limited availability of skilled technical workforce, technical complexity of converged IT-AV systems, import dependencies affecting costs and availability, and competitive pressures requiring continuous technology upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)