Mexico Programmable Logic Controller (PLC) Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Mexico Programmable Logic Controller (PLC) Market Overview:

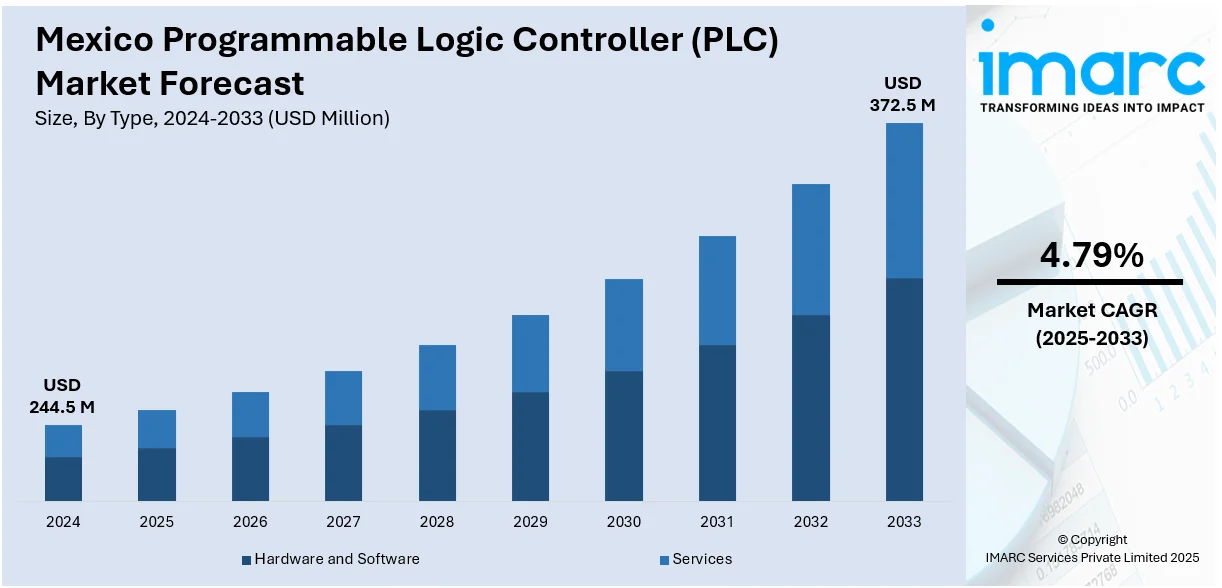

The Mexico programmable logic controller (PLC) market size reached USD 244.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 372.5 Million by 2033, exhibiting a growth rate (CAGR) of 4.79% during 2025-2033. Growth in industrial automation, rising demand for energy-efficient manufacturing, expanding automotive and food processing sectors, and increasing adoption of smart technologies in factories are some of the factors propelling the growth of the market. Government support for industrial modernization also boosts PLC deployment across key industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 244.5 Million |

| Market Forecast in 2033 | USD 372.5 Million |

| Market Growth Rate 2025-2033 | 4.79% |

Mexico Programmable Logic Controller (PLC) Market Trends:

Rising Demand for Integrated Automation in Industrial Facilities

Mexico is witnessing increasing demand for integrated automation platforms that combine process control, safety, and electrical systems. Industries such as pulp and paper are actively upgrading existing infrastructure with unified control architectures, allowing more efficient and centralized management of operations. These systems often incorporate PLC-based controls, enabling real-time performance monitoring and improved reliability. Adoption is driven by the need to enhance productivity, reduce downtime, and support digital transformation initiatives across manufacturing sectors. As industries modernize, the focus is shifting toward automation solutions that streamline complex workflows while ensuring scalability for future requirements. This shift reflects broader investments in smart factory capabilities, where programmable logic controllers serve as a foundational element in executing seamless, data-driven industrial processes across multiple verticals in Mexico. For example, in March 2024, ABB secured a major automation project at Smurfit Kappa’s board mill in Los Reyes, Mexico. The upgrade includes the ABB Ability System 800xA, integrating control and electrical systems commonly used in PLC-based operations. This deployment supports advanced process automation in the pulp and paper sector, strengthening ABB’s presence in Mexico’s industrial automation and PLC market.

Growing Focus on Engineering Hubs for Automation Support

Mexico is emerging as a strategic location for advanced engineering centers focused on automation and industrial project delivery. Facilities dedicated to electrical, automation, and software engineering are playing a critical role in supporting PLC-based systems across a wide range of industries. These centers help streamline project execution, reduce lead times, and improve technical support for complex automation solutions. By building local expertise, companies can enhance responsiveness to regional industrial demands and ensure better integration of programmable logic controllers into large-scale infrastructure and manufacturing operations. This development reflects a broader shift toward decentralizing engineering capabilities, where Mexico serves not just as a manufacturing base but also as a critical contributor to the design and implementation of modern automation systems powered by PLCs. For instance, in January 2023, ABB launched its Mexico Technology and Engineering Center (MXTEC) in Mérida to strengthen automation engineering capabilities across North America. The center focuses on automation, electrical, and software engineering, supporting project execution in industrial segments that utilize PLC systems. This expansion enhances ABB’s capacity to deliver PLC-integrated automation solutions, positioning Mexico as a key hub in ABB’s regional strategy.

Mexico Programmable Logic Controller (PLC) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Hardware and Software

- Large PLC

- Nano PLC

- Small PLC

- Medium PLC

- Others

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes hardware and software (large PLC, nano PLC, small PLC, medium PLC, and others) and services.

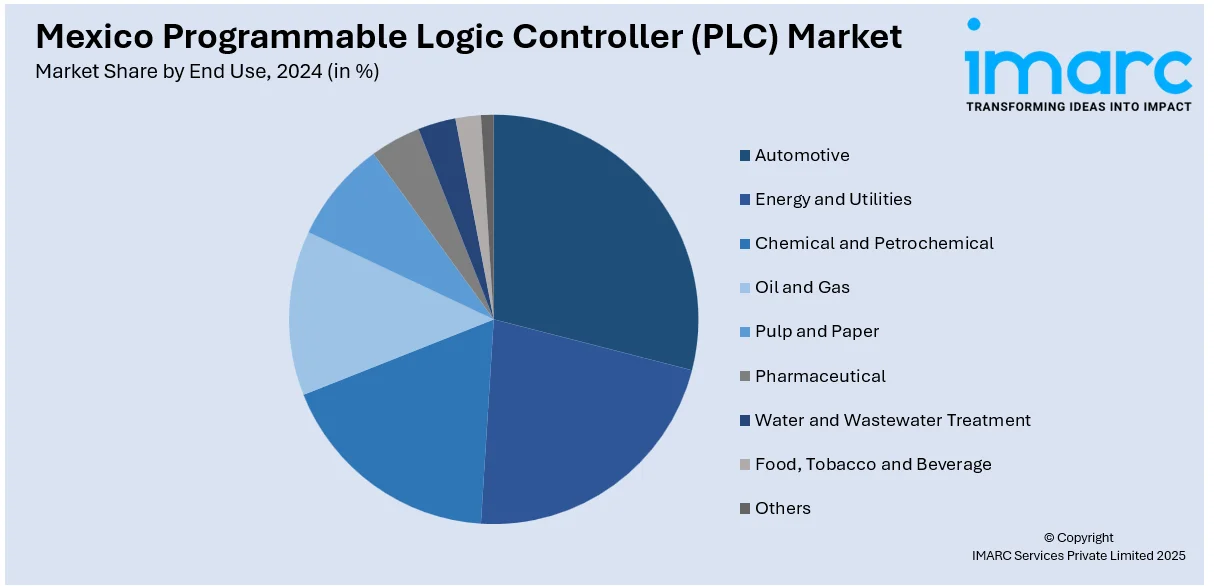

End Use Insights:

- Automotive

- Energy and Utilities

- Chemical and Petrochemical

- Oil and Gas

- Pulp and Paper

- Pharmaceutical

- Water and Wastewater Treatment

- Food, Tobacco and Beverage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes automotive, energy and utilities, chemical and petrochemical, oil and gas, pulp and paper, pharmaceutical, water and wastewater treatment, food, tobacco and beverage, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Programmable Logic Controller (PLC) Market News:

- In May 2024, Arduino partnered with Blues to launch a wireless expansion module for the Arduino Opta PLC, enhancing its connectivity with cellular and Wi-Fi options. Designed for industrial automation, the Arduino Opta is used in PLC applications, including those in Mexico. This collaboration supports wider adoption of connected PLC systems, offering scalable and cost-effective automation solutions for industrial users.

Mexico Programmable Logic Controller (PLC) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Uses Covered | Automotive, Energy and Utilities, Chemical and Petrochemical, Oil and Gas, Pulp and Paper, Pharmaceutical, Water and Wastewater Treatment, Food, Tobacco and Beverage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico programmable logic controller (PLC) market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico programmable logic controller (PLC) market on the basis of type?

- What is the breakup of the Mexico programmable logic controller (PLC) market on the basis of end use?

- What are the various stages in the value chain of the Mexico programmable logic controller (PLC) market?

- What are the key driving factors and challenges in the Mexico programmable logic controller (PLC) market?

- What is the structure of the Mexico programmable logic controller (PLC) market and who are the key players?

- What is the degree of competition in the Mexico programmable logic controller (PLC) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico programmable logic controller (PLC) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico programmable logic controller (PLC) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico programmable logic controller (PLC) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)