Mexico Propylene Oxide Market Size, Share, Trends and Forecast by Production Process, Application, End Use Industry, and Region, 2026-2034

Mexico Propylene Oxide Market Summary:

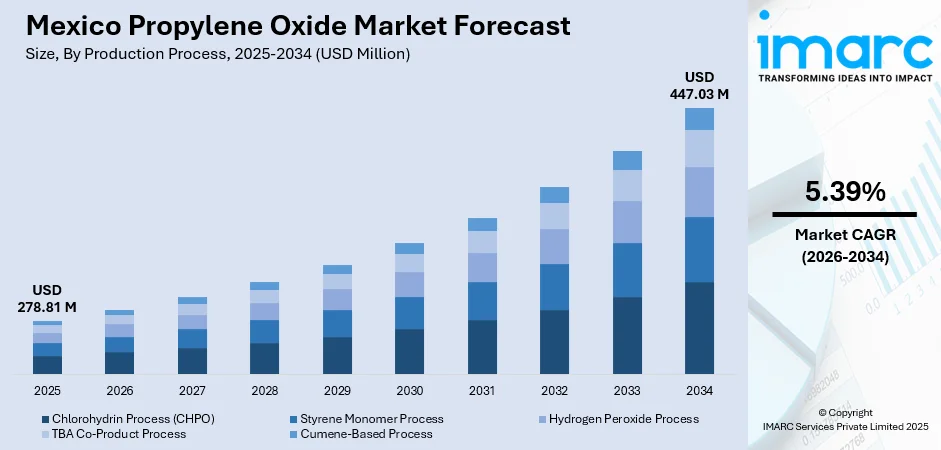

The Mexico propylene oxide market size was valued at USD 278.81 Million in 2025 and is projected to reach USD 447.03 Million by 2034, growing at a compound annual growth rate of 5.39% from 2026-2034.

The Mexico propylene oxide market is experiencing substantial momentum driven by the country's emergence as a premier nearshoring destination for manufacturing operations. Increasing investments in automotive production, coupled with robust construction sector expansion, are fundamentally reshaping demand patterns for polyurethane products and propylene oxide derivatives. The convergence of favorable trade agreements, strategic geographic positioning, and evolving industrial capabilities is creating significant opportunities for market participants across the value chain, positioning Mexico as a critical hub for propylene oxide usage.

Key Takeaways and Insights:

- By Production Process: Styrene monomer process dominates the market with a share of 40% in 2025, driven by its cost-efficiency in co-producing propylene oxide alongside styrene, which enables producers to optimize manufacturing economics while meeting the growing downstream demand for polyurethane applications.

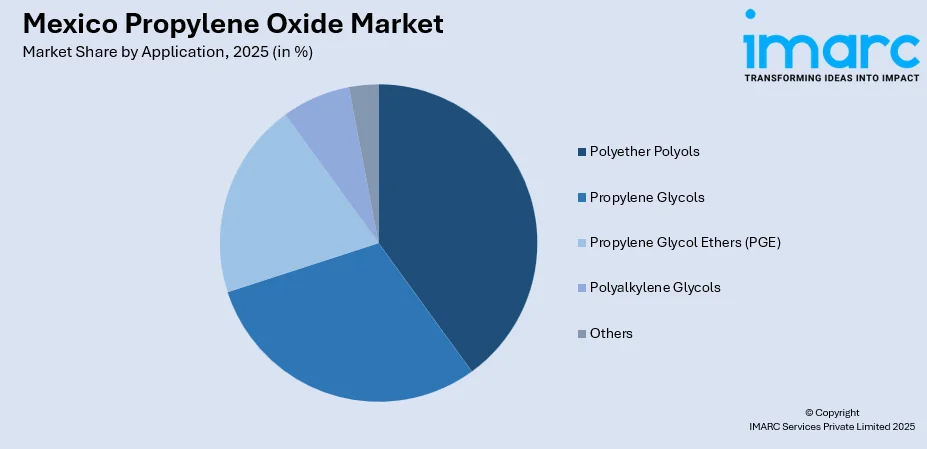

- By Application: Polyether polyols lead the market with a share of 64% in 2025. This dominance is attributed to the extensive utilization of polyether polyols in polyurethane foam production for automotive seating, thermal insulation materials, and furniture applications across Mexico's expanding industrial base.

- By End Use Industry: Construction represents the largest segment with a market share of 32% in 2025. This leadership reflects increasing infrastructure investments, urbanization trends, and the growing emphasis on energy-efficient building materials incorporating polyurethane insulation.

- Key Players: The Mexico propylene oxide market exhibits moderate competitive intensity, characterized by multinational chemical corporations leveraging established supply chains alongside regional distributors focusing on specialized applications and client proximity.

To get more information on this market Request Sample

The Mexico propylene oxide market is supported by the growing demand for polyurethane-based products used in construction, automotive, and household applications. Rising urban development and infrastructure upgrades are increasing the usage of insulation materials, adhesives, and coatings, all of which rely on propylene oxide derivatives. The growing demand for polyurethane-based products driven by urban development and infrastructure upgrades is strongly validated by the government's investment strategy, as highlighted in President Claudia Sheinbaum's 2025 annual report, which launched the MXN 811 billion (USD 43.35 billion) National Infrastructure Plan 2025, targeting rail, highways, ports, airports, and urban projects. Furthermore, improved access to imported feedstocks and efforts to enhance petrochemical capacity are helping producers maintain more stable operations. In addition, multinational companies expanding their presence in Mexico are strengthening local supply chains and encouraging investment in modern equipment and quality standards. These factors together contribute to a gradual rise in the demand and offer a positive market outlook for propylene oxide production.

Mexico Propylene Oxide Market Trends:

Expansion of Automotive and Transportation Uses

Mexico’s strong automotive manufacturing base supports steady demand for propylene oxide, as polyurethane materials made from polyether polyols are widely used in seating, interior components, insulation, and vibration-control systems. According to the National Institute of Statistics and Geography (INEGI) in 2025, Mexico exported 331,517 light vehicles in a single month, a 14.04% increase from the previous year, while production reached 361,047 units, marking a 4.89% rise. These output levels reinforce the need for reliable chemical inputs across supplier networks serving automotive clusters. As manufacturers prioritize lightweight structures and consistent material performance, propylene oxide–derived intermediates remain important for meeting durability, comfort, and design requirements throughout the sector.

Growing Demand in Refrigeration and Cold-Chain Infrastructure

Propylene oxide aids the insulation materials employed in cold-chain logistics, as rigid polyurethane foams derived from its polyether polyols ensure consistent thermal efficiency and extended durability. In 2025, Emergent Cold LatAm inaugurated a cold-storage facility in Guadalajara featuring 12,000 pallet slots within 81,000 m³, demonstrating ongoing growth in temperature-controlled infrastructure. Facilities of this magnitude need insulation that upholds efficiency amid constant loads, humidity fluctuations, and regular operational cycles. The reliable properties of propylene oxide–based foams enable operators to maintain product quality and energy efficiency, supporting continuous demand for these intermediates as cold-chain systems expand in food, retail, and pharmaceutical sectors.

Rising Applications in Construction and Infrastructure

Propylene oxide plays a central role in producing insulation panels, structural foams, sealants, and adhesive systems used across construction activities, with polyether polyols derived from it providing stable thermal behavior, controlled rigidity, and dependable bonding performance. In 2025, Mexico confirmed the delivery of 6,401 homes under the Housing for Well-Being program, including 4,871 units supported by INFONAVIT and 1,530 by CONAVI, reflecting national efforts to expand residential development. Such initiatives increase demand for materials that maintain mechanical integrity, resist moisture, and perform reliably under varying conditions, making propylene oxide–based intermediates essential for durable and efficient building components in expanding housing projects.

Market Outlook 2026-2034:

The Mexico propylene oxide market demonstrates growth potential throughout the forecast period, underpinned by structural industrial expansion and favorable macroeconomic conditions that bolster the demand across key sectors. This upward trajectory stems from increasing reliance on propylene oxide derivatives in manufacturing processes vital to economic development, supported by steady infrastructure advancements and policy frameworks promoting industrial efficiency. The market generated a revenue of USD 278.81 Million in 2025 and is projected to reach a revenue of USD 447.03 Million by 2034, growing at a compound annual growth rate of 5.39% from 2026-2034.

Mexico Propylene Oxide Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Production Process | Styrene Monomer Process | 40% |

| Application | Polyether Polyols | 64% |

| End Use Industry | Construction | 32% |

Production Process Insights:

- Chlorohydrin Process (CHPO)

- Styrene Monomer Process

- Hydrogen Peroxide Process

- TBA Co-Product Process

- Cumene-Based Process

Styrene monomer process dominates with a market share of 64% of the total Mexico propylene oxide market in 2025.

Styrene monomer process represents the largest segment owing to its integrated co-production efficiency that aligns with regional industrial capabilities. This approach leverages established oxidation mechanisms for seamless propylene oxide generation alongside styrene, optimizing resource flows within local manufacturing frameworks. Proven process reliability ensures consistent performance amid varying operational demands.

Market dominance persists through adaptable catalyst systems that enhance reaction selectivity and minimize by-product formation in Mexico's context. The process supports streamlined separation techniques, facilitating high-purity outputs vital for downstream applications. Its compatibility with existing petrochemical infrastructure reinforces leadership in production scalability.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Polyether Polyols

- Propylene Glycols

- Propylene Glycol Ethers (PGE)

- Polyalkylene Glycols

- Others

Polyether polyols lead with a market share of 40% of the total Mexico propylene oxide market in 2025.

Polyether polyols dominate the market due to their versatile formulation capabilities that align with expanding industrial requirements. This dominance stems from inherent chemical properties enabling superior performance in diverse manufacturing processes. Their adaptability to regional production needs ensures sustained preference across key sectors.

Market leadership also persists through efficient integration into value-added chains that support economic growth initiatives. Polyether polyols provide essential structural benefits vital for product durability and functionality. Ongoing alignment with local infrastructure developments further cements their prevailing position in application demand.

End Use Industry Insights:

- Automotive

- Construction

- Chemicals and Pharmaceuticals

- Packaging

- Textile and Furnishing

- Others

Construction exhibits a clear dominance with a 32% share of the total Mexico propylene oxide market in 2025.

Construction holds the biggest market share because of the rising infrastructure demands that necessitate durable material solutions derived from propylene oxide intermediates. This leadership arises from essential roles in formulating high-performance components vital for structural integrity. Alignment with national development priorities further entrenches its position amid expanding building activities.

Sustained dominance arises from the sector’s capacity to absorb large volumes through ongoing project expansions and modernization efforts. This sustained dominance and capacity for large-volume absorption in the construction sector are being actively supported by massive infrastructure projects, such as Mexico's 2025 launch of a USD 16 billion plan (MXN 297.2 billion total) to modernize six key ports, blending public and private investment. Propylene oxide supports performance enhancements in building components of such projects, meeting rigorous environmental and safety standards.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico is a vital segment in the market due to its advanced petrochemical infrastructure and proximity to major export hubs. Robust industrial clusters facilitate efficient distribution and usage across key applications. Strategic trade agreements further enhance regional competitiveness and market penetration.

Central Mexico sustains strong market presence through concentrated manufacturing activities and urban development demands. Central locations optimize logistics for domestic supply chains while supporting diverse end-use industries. Ongoing infrastructure investments reinforce its pivotal role in national usage patterns.

Southern Mexico exhibits growth in the market driven by expanding industrial initiatives and resource availability. Regional development projects drive the demand for derivative products in local applications. Improving connectivity strengthens its integration into broader market dynamics.

Others contribute to the market growth through specialized production niches and supportive economic policies. These areas leverage unique geographic advantages for targeted applications. Gradual infrastructure enhancements ensure their sustained participation in national supply frameworks

Market Dynamics:

Growth Drivers:

Why is the Mexico Propylene Oxide Market Growing?

Rising Use in Textiles and Upholstery

Propylene oxide plays a vital role in the textile and upholstery industry by enabling the production of padding, shaped inserts, and performance coatings made from polyether polyols. These materials provide uniform softness, resilience, and stable structural behavior, assisting manufacturers improve comfort and extend product life. In 2025, Mexico announced plans for more than $5 billion in investments to strengthen its textile sector, which recorded a 2024 GDP of 488 billion pesos according to INEGI, highlighting the scale of applications that depend on such inputs. The consistent mechanical response and protective qualities offered by propylene oxide–based materials make them essential for producing high-quality textile and upholstery products.

Increasing Role in Furniture and Bedding

Propylene oxide supports the creation of cushioning materials for furniture and bedding by enabling the formulation of flexible polyurethane systems made from polyether polyols. These materials provide balanced weight distribution, long-term resilience, and stable structural response, which are central to comfort and durability. According to the National Statistical Directory of Economic Units (DENUE) 2025, Furniture and Related Product Manufacturing recorded 32,357 economic units, showing the scale of producers relying on these inputs. Manufacturers adjust foam characteristics to meet specific softness and support requirements, and the dependable behavior of propylene oxide–based intermediates helps maintain quality across mattresses, seating products, and upholstered items.

Employment in Packaging and Protective Materials

Propylene oxide is utilized in the development of molded and rigid foams used in protective packaging systems that safeguard goods during transport and storage. These foams, formed from polyether polyols, offer controlled density and firmness that help manufacturers stabilize products and limit damage. The Mexico industrial packaging market reached USD 768.0 million in 2024, as per the IMARC Group, reflecting the scale of industries that depend on reliable cushioning and impact-management materials. Propylene oxide–based foams provide predictable deformation behavior, enabling effective vibration control and pressure absorption. Their resistance to compression, adaptable structure, and suitability for varied product profiles reinforce their importance in modern protective-packaging applications.

Market Restraints:

What Challenges the Mexico Propylene Oxide Market is Facing?

High Production Costs

Producers face significant expenses related to feedstock procurement, utilities, and ongoing plant maintenance. Sudden increases in input prices place direct pressure on operating margins, particularly when existing contracts restrict rapid price adjustments. Companies frequently absorb part of these additional costs, which reduces financial flexibility, delays modernization efforts, and limits investment in advanced technologies or capacity improvements.

Limited Local Supply of Propylene

Mexico depends on a small number of domestic propylene suppliers, making the market vulnerable to operational disruptions. Any reduction in output at these facilities restricts feedstock availability, forcing producers to operate plants at inconsistent rates. Managing scheduled shutdowns, delayed maintenance, and unpredictable supply conditions complicates production planning, reduces efficiency, and hinders the ability to establish reliable long-term commitments.

Regulatory Pressure

Producers must comply with evolving requirements on emissions control, industrial safety, and waste management. Meeting these obligations demands continuous investment in compliance systems, staff training, and equipment upgrades. Frequent inspections, new permits, or mandatory modernization measures may slow routine operations. Smaller companies, in particular, experience greater financial strain, as compliance-related expenditures utilize a substantial share of their operating budgets.

Competitive Landscape:

The Mexico propylene oxide market exhibits moderate competitive intensity characterized by the presence of multinational chemical corporations alongside regional distributors and systems houses competing across application segments and geographic territories. Market dynamics reflect strategic positioning ranging from integrated production capabilities emphasizing supply chain reliability to specialized application expertise targeting specific end-use sectors. Competition is increasingly shaped by sustainability credentials, technical service capabilities, and supply chain resilience considerations. Domestic players maintain significant market presence alongside international participants.

Mexico Propylene Oxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Processes Covered | Chlorohydrin Process (CHPO), Styrene Monomer Process, Hydrogen Peroxide Process, TBA Co-Product Process, Cumene-Based Process |

| Applications Covered | Polyether Polyols, Propylene Glycols, Propylene Glycol Ethers (PGE), Polyalkylene Glycols, Others |

| End Use Industries Covered | Automotive, Construction, Chemicals and Pharmaceuticals, Packaging, Textile and Furnishing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico propylene oxide market size was valued at USD 278.81 Million in 2025.

The Mexico propylene oxide market is expected to grow at a compound annual growth rate of 5.39% from 2026-2034 to reach USD 447.03 Million by 2034.

The styrene monomer process dominates the market with 40% share in 2025, driven by its cost-efficiency in co-producing propylene oxide alongside styrene for polyurethane manufacturing applications.

Key factors driving the Mexico propylene oxide market include the growing use in automotive industry for polyurethane seating, insulation, and interior materials. INEGI reported 331,517 light-vehicle exports in 2025, up 14.04%, with production at 361,047 units, up 4.89%, supporting continued chemical procurement.

Major challenges include rising production costs, limited feedstock availability, and stringent regulatory demands. These issues strain margins, disrupt operational stability, and require continuous investment in compliance and infrastructure, making long-term planning, capacity expansion, and technological upgrades more difficult for producers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)