Mexico Public Cloud Market Size, Share, Trends and Forecast by Service, Enterprise Size, End Use, and Region, 2025-2033

Mexico Public Cloud Market Overview:

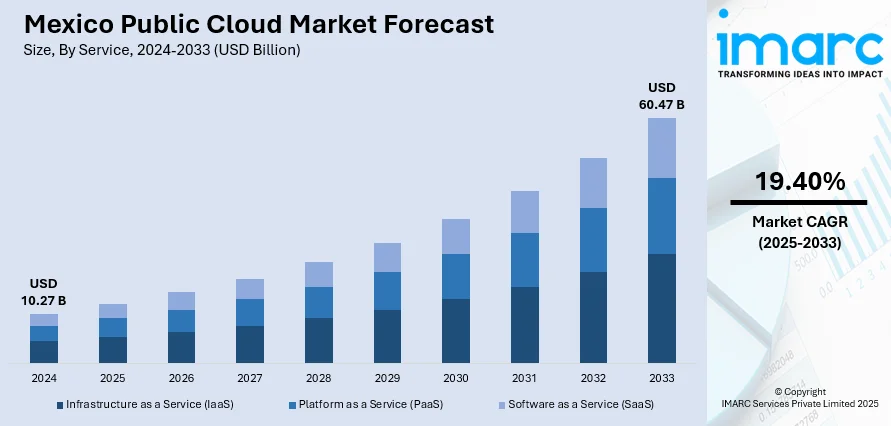

The Mexico public cloud market size reached USD 10.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 60.47 Billion by 2033, exhibiting a growth rate (CAGR) of 19.40% during 2025-2033. The market is expanding as businesses embrace digital transformation, remote work, and scalable IT solutions. Key sectors such as finance, retail, and manufacturing, along with increasing investment by global and local providers to focus on compliance and data residency are accelerating cloud adoption and shaping the evolving dynamics of the Mexico public cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.27 Billion |

| Market Forecast in 2033 | USD 60.47 Billion |

| Market Growth Rate 2025-2033 | 19.40% |

Mexico Public Cloud Market Trends:

Rising Demand for Scalable and Flexible IT Infrastructure

The shift from traditional IT systems to cloud-based infrastructure is being driven by the need for scalability, flexibility, and operational efficiency. In Mexico, organizations increasingly require IT environments that adapt quickly to changing business demands, especially in response to supply chain disruptions, seasonal spikes, and remote collaboration. Public cloud platforms offer on-demand resource provisioning, allowing companies to scale operations without major upfront costs. This is particularly valuable for small and medium-sized enterprises (SMEs), which are central to Mexico’s economy. Hybrid and multi-cloud strategies are also gaining traction, offering tailored solutions that balance performance, cost, and control. This need for adaptable infrastructure is a key factor driving cloud adoption. For instance, in January 2025, according to Amazon Web Services (AWS), the AWS Mexico (Central) Region launched a division of Amazon.com, Inc. As of right now, there will be more possibilities for developers, startups, entrepreneurs, and enterprises, as well as government, educational, and charitable institutions, to use AWS data centers in Mexico to run their apps and offer services to end users. As part of its long-term commitment, AWS plans to invest over $5 billion in Mexico over 15 years. To assist local organizations, schools, and others in starting new community projects, AWS has also established a $300,000 AWS InCommunities Fund in Queretaro.

Strengthened Focus on Data Security, Sovereignty, and Compliance

As Mexican businesses and public institutions digitize sensitive processes, data security and regulatory compliance are becoming top priorities. Public cloud providers are responding by building local data centers and aligning their services with national data protection laws, such as the Federal Law on Protection of Personal Data (LFPDPPP). This supports the growing emphasis on data sovereignty and builds trust among organizations operating in regulated sectors like finance, healthcare, and government. Enhanced cybersecurity measures, certifications, and compliance frameworks from cloud vendors reassure customers that cloud environments are secure and legally compliant. This increased focus on security and sovereignty is encouraging more organizations in Mexico to move to the cloud. For instance, in February 2025, the first cloud region in Mexico was officially launched, according to Alibaba Cloud, the digital technology and intelligence foundation of Alibaba Group. This is a major step in the company's mission to accelerate Mexico's digital transformation and promote innovation throughout Latin America. By providing safe, robust, and scalable cloud services, the new infrastructure will enable Latin American companies, startups, developers, and organizations, opening up new avenues for growth and innovation and solidifying Mexico's standing as a preeminent regional technology hub.

Mexico Public Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, enterprise size, and end use.

Service Insights:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

Enterprise Size Insights:

- Large Enterprise

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprise and small and medium-sized enterprises.

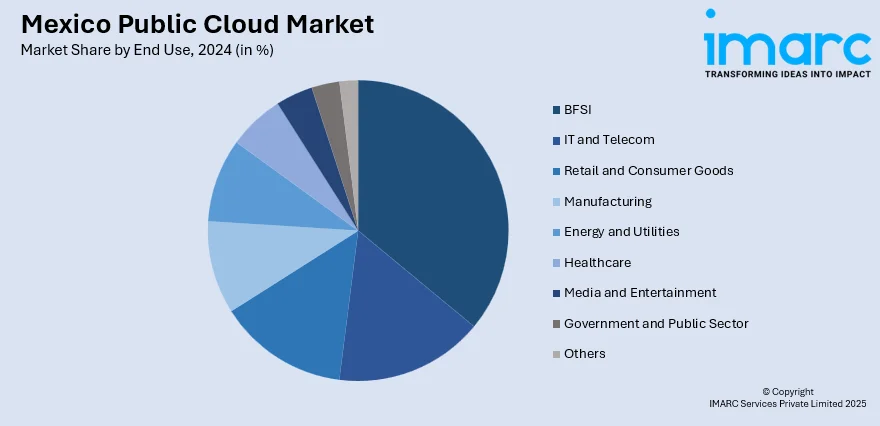

End Use Insights:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes BFSI, IT and telecom, retail and consumer goods, manufacturing, energy and utilities, healthcare, media and entertainment, government and public sector, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Public Cloud Market News:

- In November 2024, Huawei Cloud revealed intentions to improve strategic partnerships, encourage local innovation, and grow its digital and technological infrastructure. With three Availability Zones and Tier 3+ data centers, the firm will introduce the first local hyperscale cloud in Mexico.

- In May 2024, Microsoft declared that the first data center region in Mexico is now operational. It is situated in Queretaro and will offer scalable, highly available, and robust cloud services both domestically and internationally.

Mexico Public Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium-sized Enterprises |

| End Uses Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico public cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico public cloud market on the basis of service?

- What is the breakup of the Mexico public cloud market on the basis of enterprise size?

- What is the breakup of the Mexico public cloud market on the basis of end use?

- What is the breakup of the Mexico public cloud market on the basis of region?

- What are the various stages in the value chain of the Mexico public cloud market?

- What are the key driving factors and challenges in the Mexico public cloud?

- What is the structure of the Mexico public cloud market and who are the key players?

- What is the degree of competition in the Mexico public cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico public cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico public cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico public cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)