Mexico Pulmonary Arterial Hypertension Drugs Market Size, Share, Trends and Forecast by Drug Class, Route of Administration, End User, and Region, 2025-2033

Mexico Pulmonary Arterial Hypertension Drugs Market Overview:

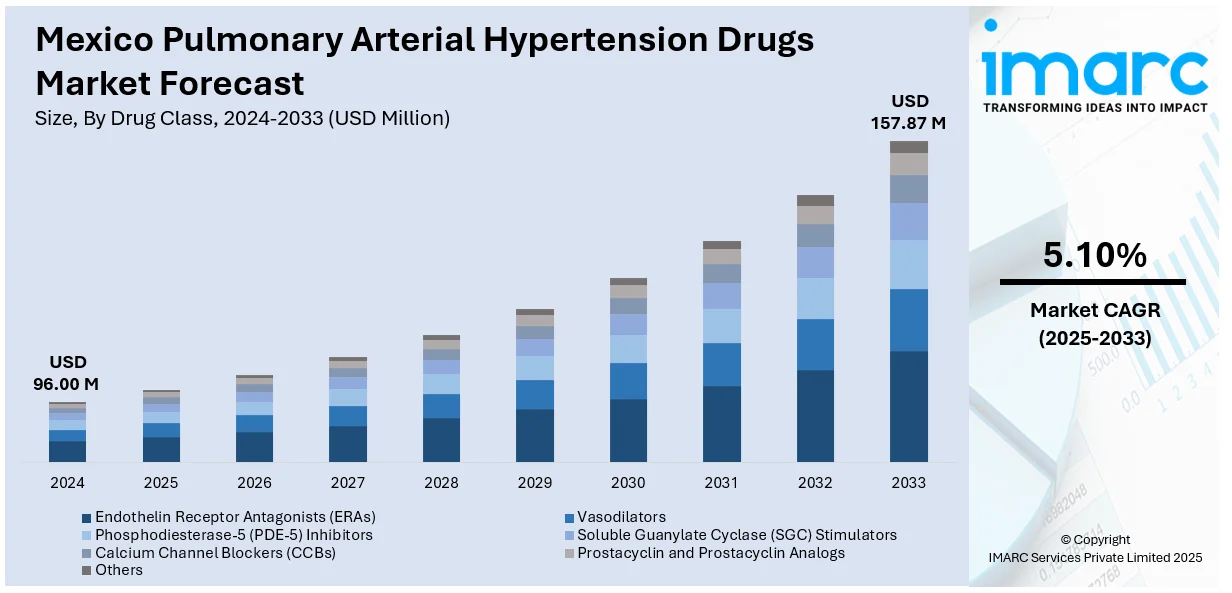

The Mexico pulmonary arterial hypertension drugs market size reached USD 96.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 157.87 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The rising disease awareness, increasing government healthcare spending, growing access to advanced therapies, and the expanding availability of generic formulations, making treatment more affordable and accessible for a broader patient population, are some of the key factors contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 96.00 Million |

| Market Forecast in 2033 | USD 157.87 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Mexico Pulmonary Arterial Hypertension Drugs Market Trends:

Increasing Adoption of Combination Therapy for PAH Treatment

Combination therapy, where two or more drugs are used together, is becoming a key trend in the treatment of pulmonary arterial hypertension (PAH) in Mexico. This approach targets multiple disease pathways like endothelin, nitric oxide, and prostacyclin, improving patient outcomes and reducing hospitalization rates. The share of diagnosed PAH patients in Mexico treated with dual or triple therapy regimens is therefore expected to rise, driven by greater clinical adoption and promising outcomes from international studies. Pharmaceutical companies are increasingly promoting combination treatments, such as endothelin receptor antagonists (ERAs) like bosentan and phosphodiesterase-5 inhibitors (PDE5i) like sildenafil. The availability of fixed-dose combinations (FDCs) has further enhanced patient adherence by reducing the pill burden and simplifying dosing. This shift is particularly crucial in Mexico, where early diagnosis and aggressive treatment are essential due to late-stage patient referrals. Studies suggest that combination therapy can reduce clinical worsening compared to monotherapy, thus creating a positive outlook for market expansion.

Expansion of Public Healthcare Coverage and Access to Generics

Mexico's public healthcare system, particularly IMSS and INSABI, has played a pivotal role in enhancing access to PAH medications by expanding formulary coverage and procuring affordable generics. Government initiatives to increase drug accessibility have been crucial, especially for low-income populations. Public funding for rare disease medications, including PAH therapies, is projected to grow, supported by federal programs aimed at improving chronic disease care. In addition to this, the availability of generic versions of sildenafil, ambrisentan, and tadalafil has also lowered treatment costs, with generic sildenafil priced lower than its branded counterpart, improving affordability and long-term adherence. Partnerships with local manufacturers have ensured steady drug supply, even in rural areas, while public health campaigns have boosted early diagnosis, ensuring timely intervention for more patients.

Mexico Pulmonary Arterial Hypertension Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drug class, route of administration, and end user.

Drug Class Insights:

- Endothelin Receptor Antagonists (ERAs)

- Vasodilators

- Phosphodiesterase-5 (PDE-5) Inhibitors

- Soluble Guanylate Cyclase (SGC) Stimulators

- Calcium Channel Blockers (CCBs)

- Prostacyclin and Prostacyclin Analogs

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes endothelin receptor antagonists (ERAs), vasodilators, phosphodiesterase-5 (PDE-5) inhibitors, soluble guanylate cyclase (SGC) stimulators, calcium channel blockers (CCBs), prostacyclin and prostacyclin analogs, and others.

Route of Administration Insights:

- Inhalation

- Injectable

- Oral Administration

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes inhalation, injectable, and oral administration.

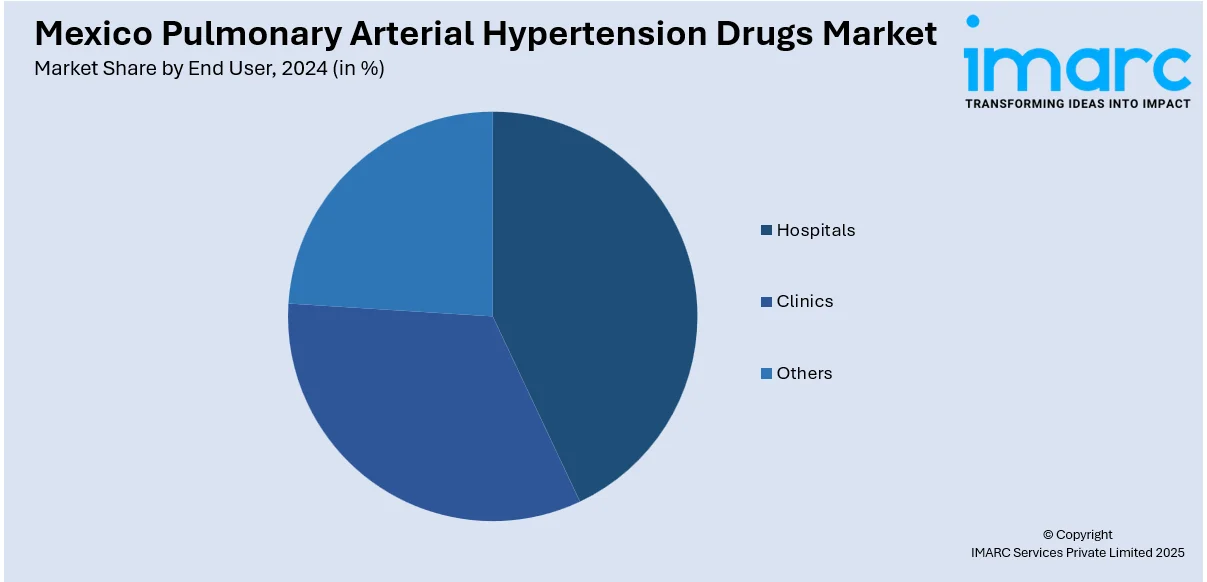

End User Insights:

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, clinics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pulmonary Arterial Hypertension Drugs Market News:

- March 2024: Cereno Scientific secured a new patent in Mexico for its Phase II drug candidate CS1, an HDAC inhibitor targeting pulmonary arterial hypertension (PAH). This patent strengthens CS1’s global intellectual property portfolio, enhancing its commercial potential. In the US, The FDA has also approved an Expanded Access Program, allowing continued treatment for trial participants.

- July 2023: Mexico approved Tyvaso (treprostinil), an inhaled therapy developed by United Therapeutics, for the treatment of PAH. Tyvaso, available in both nebulized and dry powder inhaler (DPI) forms, enhances exercise capacity by delivering prostacyclin directly to the lungs. This approval expands access to advanced PAH treatments in Mexico, offering patients a non-invasive option to manage this progressive disease.

Mexico Pulmonary Arterial Hypertension Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Endothelin Receptor Antagonists (ERAs), Vasodilators, Phosphodiesterase-5 (PDE-5) Inhibitors, Soluble Guanylate Cyclase (SGC) Stimulators, Calcium Channel Blockers (CCBs), Prostacyclin and Prostacyclin Analogs, Others |

| Routes of Administration Covered | Inhalation, Injectable, Oral Administration |

| End Users Covered | Hospitals, Clinics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pulmonary arterial hypertension drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pulmonary arterial hypertension drugs market on the basis of drug class?

- What is the breakup of the Mexico pulmonary arterial hypertension drugs market on the basis of route of administration?

- What is the breakup of the Mexico pulmonary arterial hypertension drugs market on the basis of end user?

- What is the breakup of the Mexico pulmonary arterial hypertension drugs market on the basis of region?

- What are the various stages in the value chain of the Mexico pulmonary arterial hypertension drugs market?

- What are the key driving factors and challenges in the Mexico pulmonary arterial hypertension drugs?

- What is the structure of the Mexico pulmonary arterial hypertension drugs market and who are the key players?

- What is the degree of competition in the Mexico pulmonary arterial hypertension drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pulmonary arterial hypertension drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pulmonary arterial hypertension drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pulmonary arterial hypertension drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)