Mexico Pumps Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Mexico Pumps Market Overview:

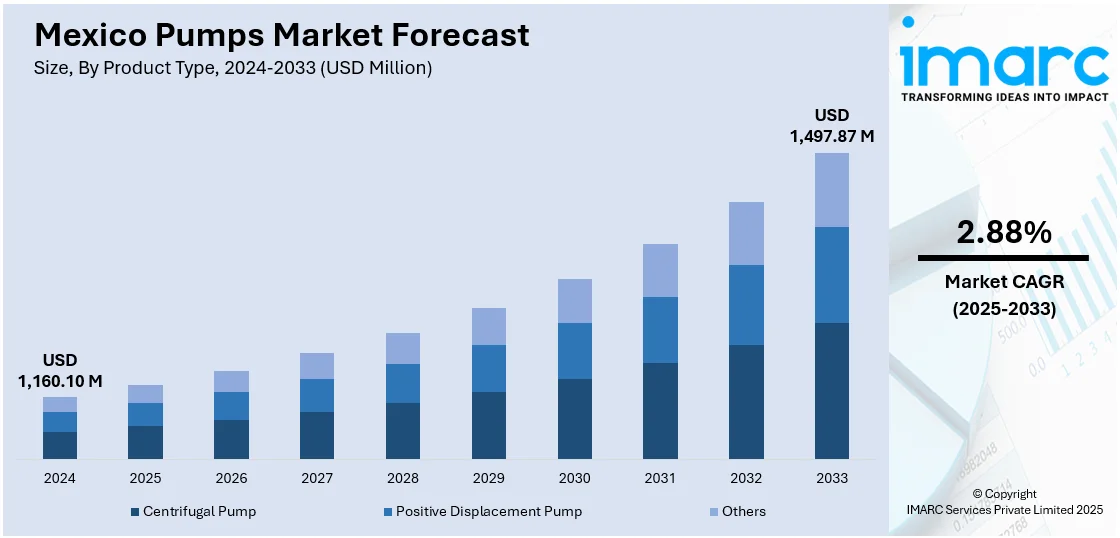

The Mexico pumps market size reached USD 1,160.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,497.87 Million by 2033, exhibiting a growth rate (CAGR) of 2.88% during 2025-2033. The increased industrialization, rising demand for water and wastewater treatment solutions, expansion in the oil and gas sectors, growing number of infrastructure projects, government investments in sustainable energy, and industrial modernization are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,160.10 Million |

| Market Forecast in 2033 | USD 1,497.87 Million |

| Market Growth Rate 2025-2033 | 2.88% |

Mexico Pumps Market Trends:

Rising Need for Water and Wastewater Treatment Solutions

The increasing need for efficient water and wastewater treatment solutions is one of the major factors propelling the growth of the Mexico pumps market. The country's water resources are under increased stress due to the rapid pace of urbanization and industrialization, making efficient management of the water supply and wastewater treatment imperative. Water shortage, particularly in dry regions, and the need for better wastewater treatment are major issues, according to the Mexican National Water Commission (CONAGUA). As a result, significant investments in water infrastructure are being made by the public and commercial sectors, which, in turn, is impelling the need for pumps used in wastewater treatment, desalination, and water purification. In 2023, Mexico’s National Infrastructure Fund (FONADIN) allocated USD 3.5 billion for water management and wastewater treatment projects over the next three years, further fueling pump demand. Additionally, initiatives like the "Water for All" program, aimed at reducing untreated wastewater discharge by 40% by 2025, will also necessitate advanced pump systems to efficiently manage treatment processes.

Growth in Oil and Gas Exploration and Production

Another significant market driver is the expansion of the oil and gas sector. As one of Latin America’s major oil producers, Mexico continues to see substantial investments in oil exploration and production, especially with its rich reserves in the Gulf of Mexico. The country’s energy reforms, particularly the opening of its oil sector to private investments, have led to a surge in exploration and production (E&P) activities. Mexico’s Energy Ministry projects a 10% rise in oil output, from around 1.7 million barrels per day in 2023 to 1.9 million barrels per day by 2025. This increase is fueling greater demand for pumps, which are critical for moving crude oil, natural gas, and petroleum products throughout key stages of the oil and gas value chain, including pipelines, storage facilities, and refineries. As oil companies optimize efficiency in challenging offshore and onshore environments, the demand for corrosion-resistant, high-capacity pumps has surged. Furthermore, the rising emphasis on enhanced oil recovery (EOR) techniques, such as water and gas injection systems, is boosting the need for specialized pumps to inject fluids into reservoirs. Mexico is projected to invest heavily in its oil and gas sector, accelerating the adoption of advanced pump technologies in oil production and refining operations.

Mexico Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes centrifugal pump (axial flow pump, radial flow pump, and mixed flow pump), positive displacement pump (reciprocating pump and rotary pump), and others.

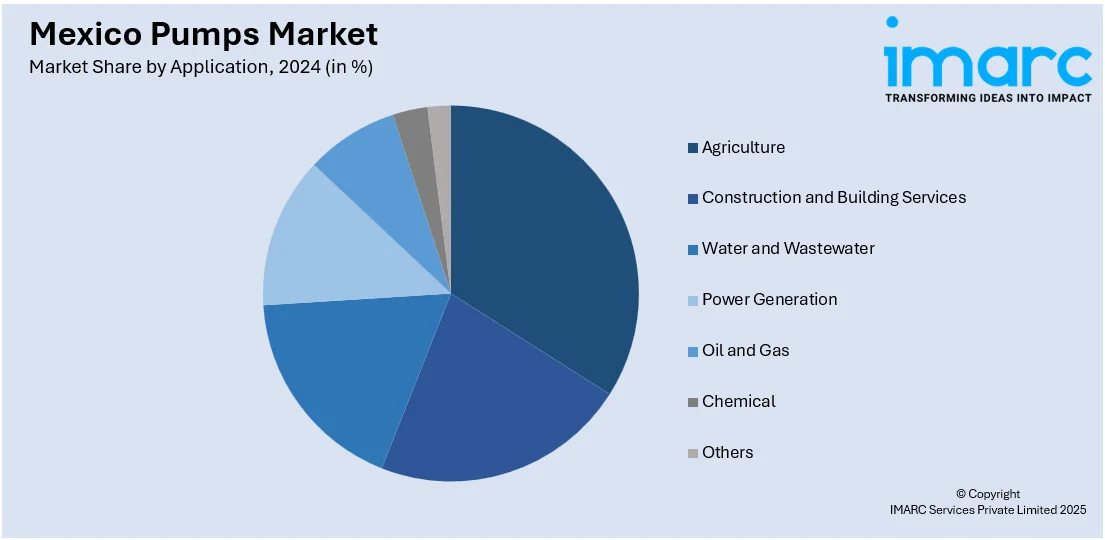

Application Insights:

- Agriculture

- Construction and Building Services

- Water and Wastewater

- Power Generation

- Oil and Gas

- Chemical

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agriculture, construction and building services, water and wastewater, power generation, oil and gas, chemical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pumps Market News:

- September 2024: Cleartide launched its new ECNP 30 and ECNP 50 condensate pumps in Mexico, featuring a compact, household-friendly design and exceptional efficiency. These pumps offer ultra-quiet, energy-efficient operation, high performance, and are specifically tailored for residential applications.

- March 2024: Sulzer inaugurated a new high-performance pump facility in Mexico, expanding its production capacity to meet the rising demand for infrastructure in the region. The state-of-the-art facility features advanced hydraulics testing, ensuring the reliability and efficiency of large pumps.

Mexico Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Agriculture, Construction and Building Services, Water and Wastewater, Power Generation, Oil and Gas, Chemical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pumps market on the basis of product type?

- What is the breakup of the Mexico pumps market on the basis of application?

- What are the various stages in the value chain of the Mexico pumps market?

- What are the key driving factors and challenges in the Mexico pumps market?

- What is the structure of the Mexico pumps market and who are the key players?

- What is the degree of competition in the Mexico pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)