Mexico Quinoa Market Size, Share, Trends and Forecast by Source, Product Type, Application, Distribution Channel, End Use, and Region, 2025-2033

Mexico Quinoa Market Overview:

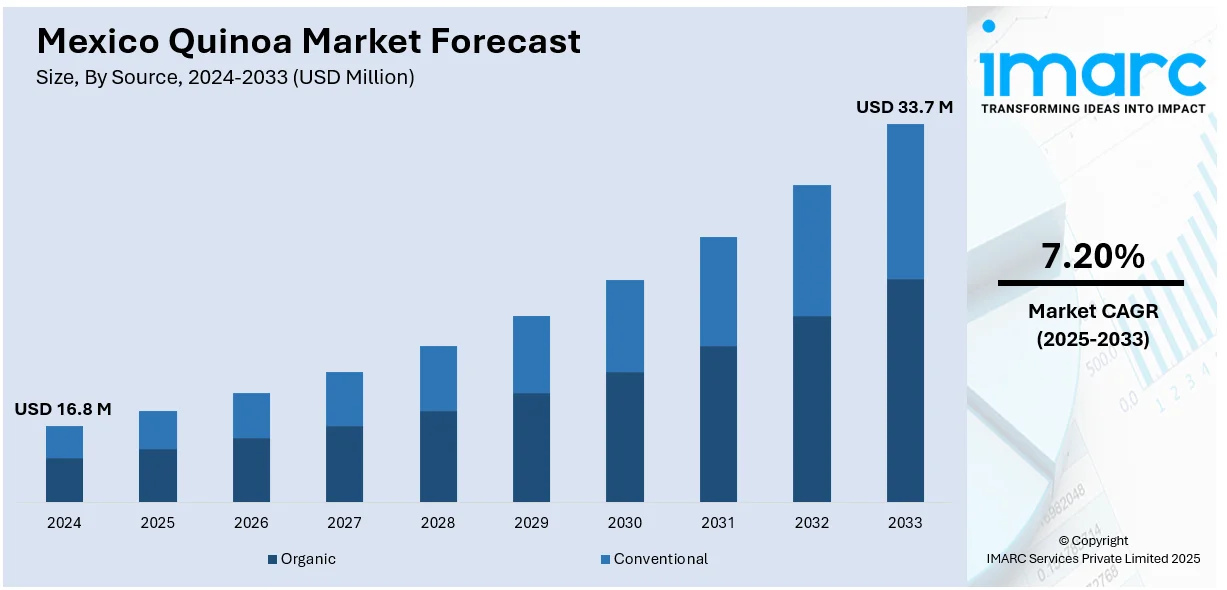

The Mexico quinoa market size reached USD 16.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 33.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is experiencing significant growth, driven by rising health awareness, urban dietary shifts, and increasing retail availability. Moreover, local cultivation efforts, plant-based consumption trends, and broader access through supermarkets and online platforms are shaping a positive market trajectory.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.8 Million |

| Market Forecast in 2033 | USD 33.7 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Quinoa Market Trends:

Rising Demand for Healthy Grains

Consumer awareness of nutrition and dietary wellness is steadily increasing across Mexico, leading to greater interest in healthy grains like quinoa. Known for being high in protein, fiber, vitamins, and essential amino acids, quinoa is widely recognized as a gluten-free superfood and a healthier substitute for rice, pasta, and corn-based staples. As more people shift toward balanced eating habits, quinoa is gaining ground in both household kitchens and restaurant menus. It appeals not only to those with dietary restrictions but also to health-conscious consumers seeking variety in their meals. Educational campaigns, food influencer endorsements, and increased visibility on store shelves are further encouraging trial and repeat purchases. This demand is also stimulating interest in locally grown quinoa to support freshness and reduce import reliance. These factors will continue to shape a positive Mexico quinoa market outlook.

Growing Adoption by Urban Consumers

Mexico’s urban population is becoming increasingly health-focused, with a strong shift toward nutrient-dense superfoods like quinoa. City dwellers, especially millennials and young professionals, are embracing quinoa as part of their daily diets due to its versatility, high protein content, and gluten-free profile. It’s commonly used in salads, bowls, breakfast dishes, and even fusion cuisine, reflecting a broader interest in functional foods. Urban consumers are also more likely to experiment with international food trends, often influenced by social media, wellness influencers, and global health movements. As quinoa becomes a regular feature in cafes, restaurants, and health food stores across major cities like Mexico City, Guadalajara, and Monterrey, its familiarity and desirability continue to grow. This urban-driven shift is playing a significant role in boosting product visibility, accessibility, and ultimately contributing to the rising Mexico quinoa market share.

Expansion of Retail Availability Supporting Quinoa Growth in Mexico

The increasing presence of quinoa across diverse retail formats in Mexico is making the product more accessible to a broader consumer base. Supermarkets, health food stores, and specialty organic outlets are regularly stocking quinoa in various forms raw seeds, flours, snacks, and ready-to-eat meals. Online platforms are also contributing to this trend, offering home delivery and bulk purchase options, especially in urban and semi-urban regions. Retailers are promoting quinoa through health-focused marketing, recipe suggestions, and in-store displays, encouraging consumers to incorporate it into everyday meals. This expanded visibility not only improves access but also normalizes quinoa as a pantry staple, rather than a niche or foreign product. As distribution networks strengthen and consumer demand grows, retail-driven expansion is expected to play a central role in shaping the Mexico quinoa market outlook.

Mexico Quinoa Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, product type, application, distribution channel, and end use.

Source Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the source. This includes organic and conventional.

Product Type Insights:

- Red Quinoa

- Black Quinoa

- White Quinoa

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes red quinoa, black quinoa, white quinoa, and others.

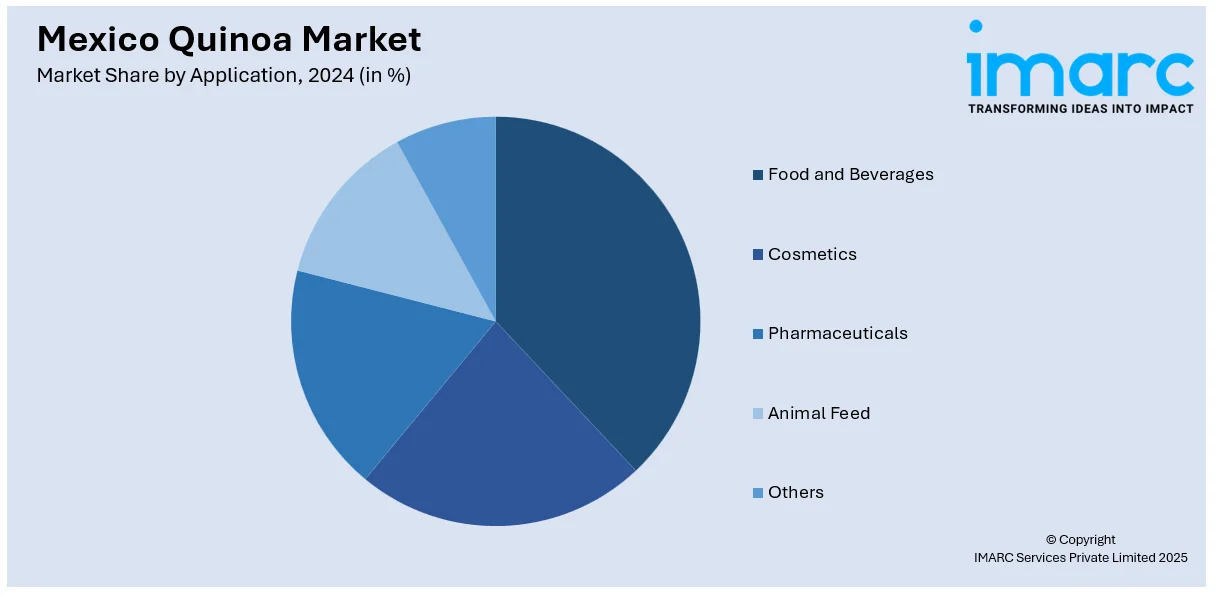

Application Insights:

- Food and Beverages

- Cosmetics

- Pharmaceuticals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, cosmetics, pharmaceuticals, animal feed, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Retail Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional retail stores, convenience stores, online, and others.

End Use Insights:

- Ingredient

- Packaged Food

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes ingredient and packaged food.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Quinoa Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Organic, Conventional |

| Product Types Covered | Red Quinoa, Black Quinoa, White Quinoa, Others |

| Applications Covered | Food and Beverages, Cosmetics, Pharmaceuticals, Animal Feed, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Retail Stores, Convenience Stores, Online, Others |

| End Uses Covered | Ingredient, Packaged Food |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico quinoa market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico quinoa market on the basis of source?

- What is the breakup of the Mexico quinoa market on the basis of product type?

- What is the breakup of the Mexico quinoa market on the basis of application?

- What is the breakup of the Mexico quinoa market on the basis of distribution channel?

- What is the breakup of the Mexico quinoa market on the basis of end user?

- What is the breakup of the Mexico quinoa market on the basis of region?

- What are the various stages in the value chain of the Mexico quinoa market?

- What are the key driving factors and challenges in the Mexico quinoa market?

- What is the structure of the Mexico quinoa market and who are the key players?

- What is the degree of competition in the Mexico quinoa market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico quinoa market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico quinoa market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico quinoa industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)