Mexico Railway System Market Size, Share, Trends and Forecast by Transit Type, System Type, Application, and Region, 2025-2033

Mexico Railway System Market Overview:

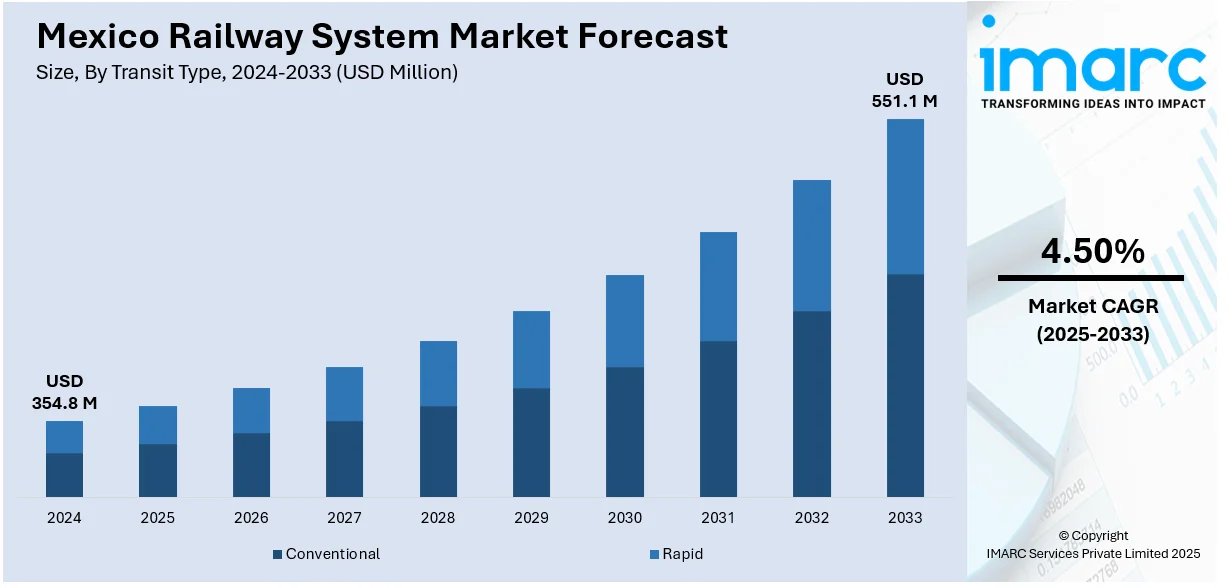

The Mexico railway system market size reached USD 354.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 551.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market share is expanding, driven by the ongoing urbanization activities, along with increasing collaborations between government agencies and private players to build new rail lines and bring in better technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 354.8 Million |

| Market Forecast in 2033 | USD 551.1 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Mexico Railway System Market Trends:

Rapid urbanization activities

The ongoing urbanization activities are offering a favorable Mexico railway system market outlook. With the rising population, more people are moving to urban areas, driving the demand for efficient and reliable public transport. According to the Worldometer’s findings based on the United Nations statistics, as of April 7, 2025, Mexico's population stood at 131,690,593. Roads have become overcrowded, and existing transport options are struggling to keep up. Railways offer a practical solution by moving large numbers of people quickly and safely. Urban planners focus more on building and upgrading metro systems, suburban trains, and light rail to support the increasing population. Apart from this, the railway offers a cost-effective and sustainable way to move freight. More investment flows into urban rail projects, and new technologies help to improve service and safety. As cities continue to broaden, the role of railways has become more important. This ongoing shift towards urban living keeps the railway system market moving forward, making it a central part of Mexico’s transport network.

Increasing expenditure on rail infrastructure

Rising investments in rail infrastructure are fueling the Mexico railway system market growth. In April 2025, the Mexican Government, via the Regulatory Agency for Railway Transport (ARTF) under the Ministry of Infrastructure, Communications, and Transport (SICT), revealed a plan to wager MXD157 Billion (USD 7.72 Billion) in railway infrastructure. This funding was intended to assist in building 774 km of passenger train lines, 70 km of freight rail for the Mayan Train, and 170 km of freight rail on the Interoceanic Corridor of the Isthmus of Tehuantepec (CIIT). With more money flowing in, the country can expand and modernize its rail network, making trains a more reliable and efficient option for both freight and passenger transport. Governing agencies and private players are working together to build new lines, remodel old ones, and bring in better technology. This not only helps to reduce congestion on the roads but also lowers transportation costs for businesses. Improved rail connections make it easier to move goods across regions. As more companies are experiencing the benefits, they are starting to rely more on rail transport. It also creates jobs and supports local industries that supply materials and services to the railway sector. Cleaner and greener trains are being introduced, which supports sustainability goals. Moreover, better rail systems attract more tourists and give locals a smoother travel option. All of this makes the railway sector more attractive for future investments, thereby positively influencing the market. Overall, the high expenditure is turning the railway system into a stronger, faster, and smarter mode of transport.

Mexico Railway System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on transit type, system type, and application.

Transit Type Insights:

- Conventional

- Diesel Locomotive

- Electric Locomotive

- Electro-Diesel Locomotive

- Coaches

- Rapid

- Diesel Multiple Unit (DMU)

- Electric Multiple Unit (EMU)

- Light Rail/Tram

The report has provided a detailed breakup and analysis of the market based on the transit type. This includes conventional (diesel locomotive, electric locomotive, electro-diesel locomotive, and coaches) and rapid (diesel multiple unit (DMU), electric multiple unit (EMU), and light rail/tram).

System Type Insights:

- Auxiliary Power System

- Train Information System

- Propulsion System

- Train Safety System

- HVAC System

- On-Board Vehicle Control

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes auxiliary power system, train information system, propulsion system, train safety system, HVAC system, and on-board vehicle control.

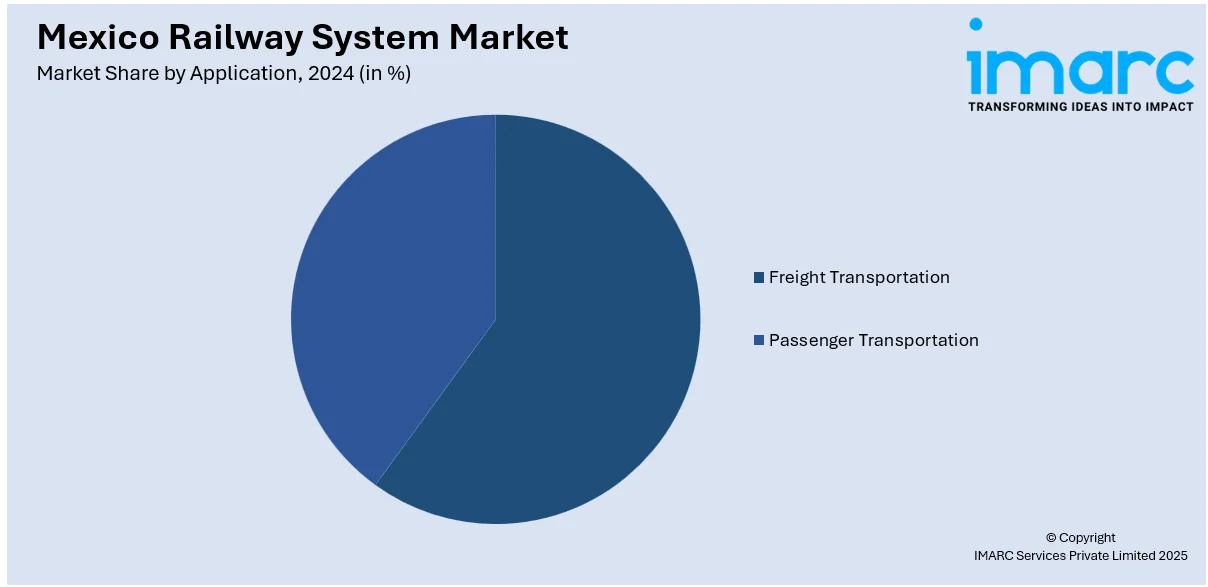

Application Insights:

- Freight Transportation

- Passenger Transportation

The report has provided a detailed breakup and analysis of the market based on the application. This includes freight transportation and passenger transportation.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Railway System Market News:

- In October 2024, the Senate's joint committees endorsed a modification to Article 28 of the Mexican Constitution, designating the railway system as a key priority for national development. The reform encompassed both freight and passenger rail services, highlighting the need to renew the nation's rail infrastructure. The reform specified that the federal government could delegate tasks to public companies or concessions to private organizations for managing rail services.

- In September 2024, the Government of Mexico announced the beginning of the construction of the new Interoceanic Railway. The USD 7.5 Billion initiative was set to extend 188 Miles through the Isthmus of Tehuantepec. The railway aimed to transfer containers from vessels to the train and carry them to vessels on the opposite side to fulfill the orders.

Mexico Railway System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transit Types Covered |

|

| System Types Covered | Auxiliary Power System, Train Information System, Propulsion System, Train Safety System, HVAC System, On-Board Vehicle Control |

| Applications Covered | Freight Transportation, Passenger Transportation |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico railway system market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico railway system market on the basis of transit type?

- What is the breakup of the Mexico railway system market on the basis of system type?

- What is the breakup of the Mexico railway system market on the basis of application?

- What is the breakup of the Mexico railway system market on the basis of region?

- What are the various stages in the value chain of the Mexico railway system market?

- What are the key driving factors and challenges in the Mexico railway system market?

- What is the structure of the Mexico railway system market and who are the key players?

- What is the degree of competition in the Mexico railway system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico railway system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico railway system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico railway system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)