Mexico Rare Earth Elements Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Mexico Rare Earth Elements Market Overview:

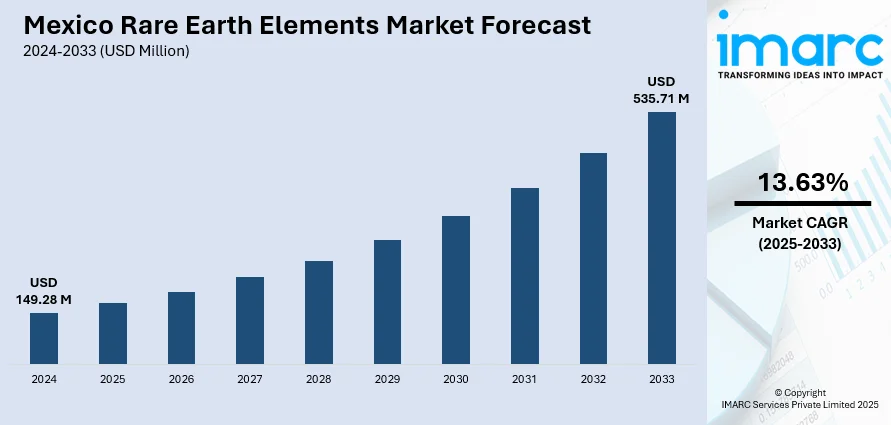

The Mexico rare earth elements market size reached USD 149.28 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 535.71 Million by 2033, exhibiting a growth rate (CAGR) of 13.63% during 2025-2033. Mexico’s rare earth elements market is being driven by substantial foreign investments, strategic government incentives, elevating product demand from domestic clean energy and EV industries, and the global shift toward diversified supply chains away from China, positioning the country as a key emerging hub for critical mineral sourcing and advanced manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 149.28 Million |

| Market Forecast in 2033 | USD 535.71 Million |

| Market Growth Rate 2025-2033 | 13.63% |

Mexico Rare Earth Elements Market Trends:

Rising Strategic Interest Due to Geopolitical Shifts and Supply Chain Diversification

One of the strongest drivers of Mexico's rare earth elements market is the increasing geopolitical need for nations to diversify their REE supply chains. China has long been the world's dominant producer of rare earths, holding more than 80% of supply. But recent trade tensions between China and Western countries—most notably the United States—have revealed weaknesses in global supply chains. This has accelerated a global trend towards finding and developing alternative sources of REEs. Mexico, endowed with extensive untapped mineral resources and a relatively stable political environment, is now a more enticing option for investors and governments to invest in secure sources of supply outside Asia. Strategic partnerships and bilateral agreements are stimulating foreign direct investment in Mexico's mining industry. US policymakers, for example, have listed Mexico as an essential partner under such initiatives as the US-Mexico-Canada Agreement (USMCA) and North American critical minerals strategies. In addition to this, Mexico's proximity to large North American markets, such as the US and Canada, considerably lowers logistical risks and transportation expenses, providing an attractive alternative to extended and politically risky routes from Asia.

Domestic Industrial Growth in Clean Energy and High-Tech Manufacturing Sectors

Another key driver of the Mexican rare earth elements market is domestic industrial development, particularly in clean energy and high-tech manufacturing industries. Rare earth elements such as neodymium, dysprosium, and praseodymium are critical in the manufacture of wind turbines, electric vehicles, advanced electronics, and energy-efficient lighting—all industries picking up considerable pace in Mexico's changing industrial landscape. Mexico is fast evolving into a manufacturing center for green technology and high-value electronics, driven by government incentives, expanding consumer demand, and heightened investment in sustainable infrastructure. For example, the country's auto sector—historically concentrated on internal combustion engines—is making a significant shift towards the production of electric vehicles (EVs). Large auto manufacturers such as General Motors and BMW are setting up EV production facilities in northern and central Mexico, directly stimulating local demand for REE-based components like magnets and batteries. At the same time, the nation is increasing its renewable energy programs, especially wind and solar power. These industries rely significantly on REEs for effective energy generation and storage systems.

Mexico Rare Earth Elements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application.

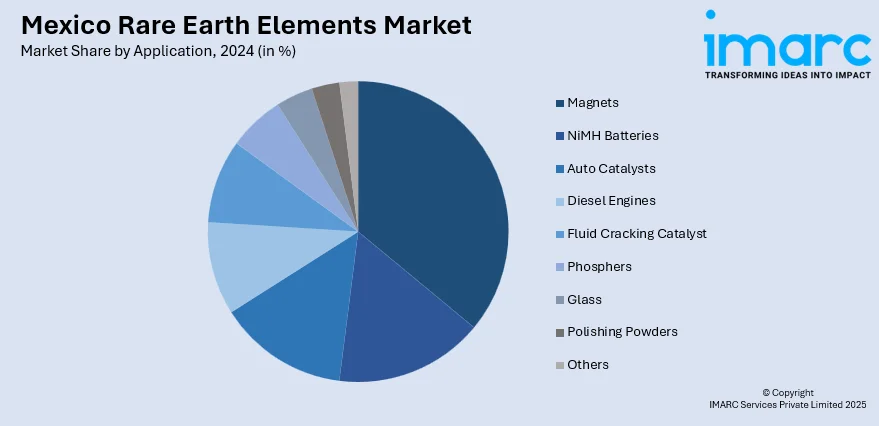

Application Insights:

- Magnets

- NiMH Batteries

- Auto Catalysts

- Diesel Engines

- Fluid Cracking Catalyst

- Phosphers

- Glass

- Polishing Powders

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes magnets, NiMH batteries, auto catalysts, diesel engines, fluid cracking catalyst, phosphers, glass, polishing powders, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Rare Earth Elements Market News:

- October 2024: Mexico’s government announced plans to offer tax incentives to attract foreign firms in sectors like rare earths, EVs, and semiconductors. The move aims to boost domestic manufacturing and reduce reliance on Asian imports.

- October 2023: Chinese rare earths company JL Mag Rare-Earth Co. Ltd. announced a USD 100 million investment to expand its production plant in Nuevo León, Mexico. This expansion is expected to enhance Mexico's capacity to produce high-quality rare earth magnets, which are essential for electric vehicle motors and other advanced technologies.

Mexico Rare Earth Elements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Magnets, NiMH Batteries, Auto Catalysts, Diesel Engines, Fluid Cracking Catalyst, Phosphers, Glass, Polishing Powders, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico rare earth elements market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico rare earth elements market on the basis of application?

- What are the various stages in the value chain of the Mexico rare earth elements market?

- What are the key driving factors and challenges in the Mexico rare earth elements market?

- What is the structure of the Mexico rare earth elements market and who are the key players?

- What is the degree of competition in the Mexico rare earth elements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico rare earth elements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico rare earth elements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico rare earth elements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)