Mexico Ready Mix Concrete Market Size, Share, Trends and Forecast by Product, End Use Sector, and Region, 2025-2033

Mexico Ready Mix Concrete Market Overview:

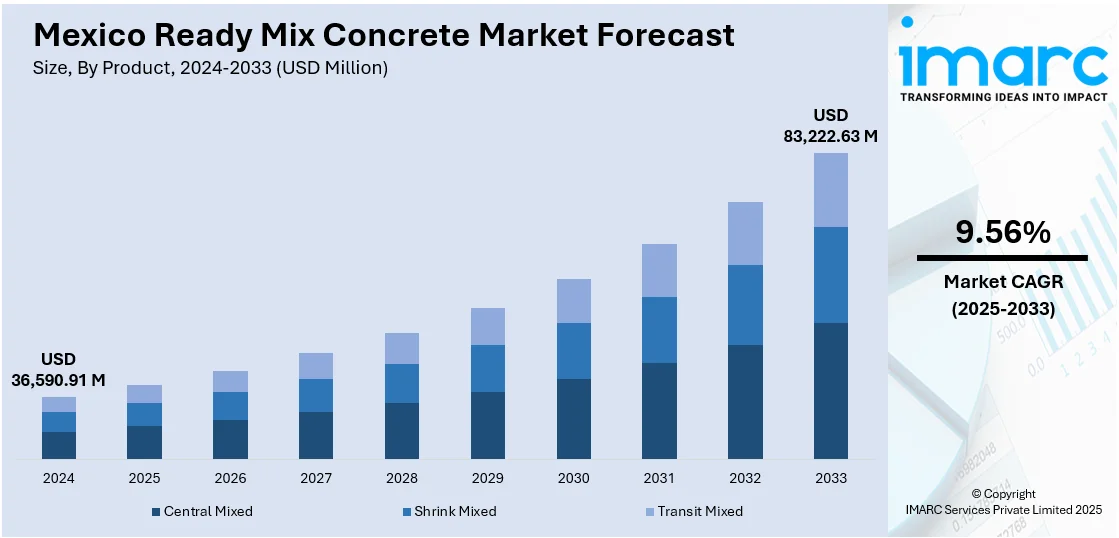

The Mexico ready mix concrete market size reached USD 36,590.91 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 83,222.63 Million by 2033, exhibiting a growth rate (CAGR) of 9.56% during 2025-2033. The market is being driven by rising urbanization, increased infrastructure investments, and demand for sustainable construction practices. Technological integration in batching processes and government initiatives to modernize transport and housing also support expansion. These dynamics have significantly influenced the Mexico ready mix concrete market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 36,590.91 Million |

|

Market Forecast in 2033

|

USD 83,222.63 Million |

| Market Growth Rate 2025-2033 | 9.56% |

Mexico Ready Mix Concrete Market Trends:

Rise in Green Construction and Environmental Regulations

The push toward sustainability in Mexico’s construction sector has fostered a notable shift toward green building practices, directly influencing the ready mix concrete industry. Stricter environmental regulations by government bodies have increased demand for eco-friendly materials with lower carbon footprints. This includes concrete mixes designed to reduce CO₂ emissions and energy use during production. Construction firms are increasingly seeking suppliers that provide sustainable ready mix solutions, including mixes incorporating industrial by-products like fly ash or slag. Additionally, the adoption of LEED-certified construction and circular economy practices further supports this shift. As green construction becomes more prevalent in public and private projects alike, the Mexico ready mix concrete market growth is benefiting from rising demand for compliant, low-impact materials across residential, commercial, and infrastructure sectors. For instance, according to industry reports, in 2024, Holcim México mitigated 1.7 million tonnes of CO₂ emissions across housing and infrastructure projects using its sustainable ECOPact, ECOPlanet, and ECOCycle product lines. ECOPact, reducing emissions by at least 30%, made up 15% of concrete sales, targeting 27% by 2027. ECOPlanet cement, with a 35–65% emission reduction, accounted for 56% of cement sales, aiming for 77% by 2027. ECOCycle technology repurposes recycled construction materials for non-structural concrete applications, further supporting low-carbon construction practices in Mexico.

Integration of Digital Technologies in Concrete Production

The incorporation of digital technologies is transforming operational efficiencies in the Mexico ready mix concrete market. Producers are investing in real-time data analytics, GPS tracking for fleet management, and automated batching systems to improve product consistency and reduce wastage. The deployment of smart sensors in mixers and during curing processes enables tighter quality control, enhancing product reliability for high-performance construction needs. Furthermore, mobile applications and cloud platforms now allow builders and contractors to track deliveries, monitor jobsite requirements, and adjust mix specifications instantly. These advancements streamline logistics and reduce downtime, especially on large-scale infrastructure projects. The move toward digitization not only cuts operational costs but also supports sustainability, reinforcing the overall trajectory of Mexico ready mix concrete market growth through innovation and precision. For instance, in April 2025, Cemex Ventures invested in OPTIMITIVE, a Spanish company using AI and advanced analytics to optimize industrial processes in energy-intensive industries, including cement. The collaboration aims to reduce energy consumption and enhance efficiency at Cemex's facilities. OPTIMITIVE’s AI software features real-time process optimization and no-code design for broad adoption. This partnership aligns with Cemex's goal of achieving carbon neutrality by improving energy efficiency and production sustainability.

Expanding Public Infrastructure and Transport Projects

The Mexican government’s ongoing investment in public infrastructure, such as highways, airports, and rail projects, is a key driver of sustained demand for ready mix concrete. For instance, as per industry reports, in 2024, Mexico received a record USD 36.87 Billion in Foreign Direct Investment (FDI), marking a 2.3% rise compared to 2023. This influx of FDI, along with the proposed 2024 budget reflecting a 4.9% GDP deficit, suggests continued investment across diverse sectors, including infrastructure. Major initiatives under programs like the National Infrastructure Plan aim to improve regional connectivity and urban development, requiring high volumes of concrete with consistent quality standards. Additionally, growing public-private partnerships (PPPs) are accelerating project execution timelines, thereby necessitating efficient, large-scale supply chains for construction materials. Ready mix concrete, known for its on-demand batching and quality assurance, is ideally suited for such infrastructure expansion. These developments provide consistent, large-volume demand, bolstering capacity utilization for concrete producers. Consequently, infrastructure development remains a pivotal force underpinning Mexico ready mix concrete market growth, with a strong influence on long-term market sustainability.

Mexico Ready Mix Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product and end use sector.

Product Insights:

- Central Mixed

- Shrink Mixed

- Transit Mixed

The report has provided a detailed breakup and analysis of the market based on the product. This includes central mixed, shrink mixed, and transit mixed.

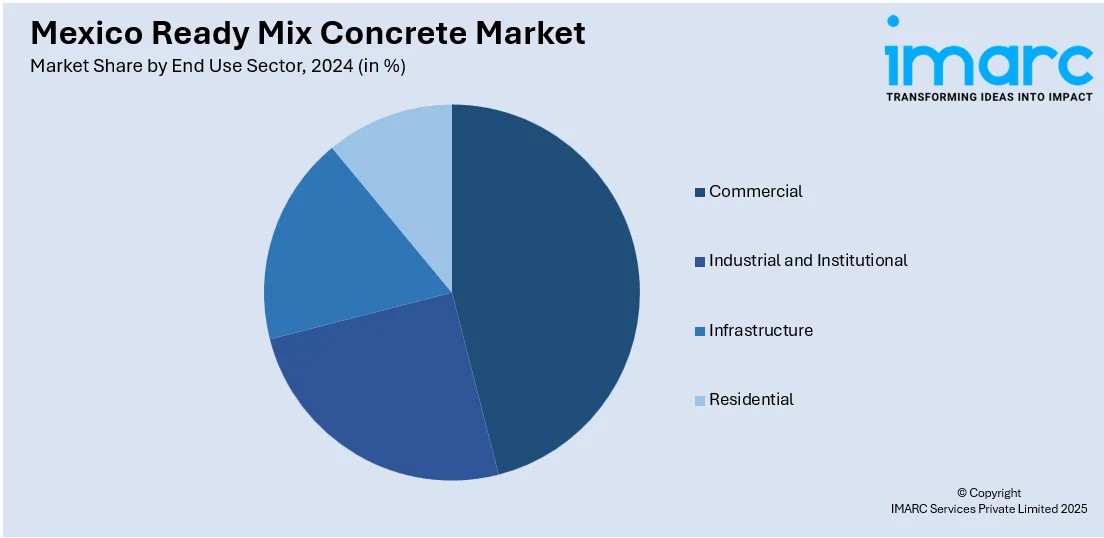

End Use Sector Insights:

- Commercial

- Industrial and Institutional

- Infrastructure

- Residential

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes commercial, industrial and institutional, infrastructure, and residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ready Mix Concrete Market News:

- In November 2024, Cemex introduced electric concrete mixers in Mexico as part of its Future in Action program to achieve net-zero CO2 emissions by 2050. These mixers are designed for efficiency with full-load capacity for a full day's work. Cemex has also invested in over 1,000 trucks powered by renewable diesel and natural gas.

- In March 2024, Holcim acquired two ready-mix concrete plants from COMOSA in Querétaro, central Mexico, enhancing its local market presence. With a combined capacity of 120m³/h, Holcim will double its output to 36,000m³ of concrete per month. This acquisition strengthens their production network and reinforces Holcim’s commitment to sustainable construction and innovation.

Mexico Ready Mix Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Central Mixed, Shrink Mixed, Transit Mixed |

| End Use Sectors Covered | Commercial, Industrial and Institutional, Infrastructure, Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ready mix concrete market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ready mix concrete market on the basis of product?

- What is the breakup of the Mexico ready mix concrete market on the basis of end use sector?

- What is the breakup of the Mexico ready mix concrete market on the basis of region?

- What are the various stages in the value chain of the Mexico ready mix concrete market?

- What are the key driving factors and challenges in the Mexico ready mix concrete market?

- What is the structure of the Mexico ready mix concrete market and who are the key players?

- What is the degree of competition in the Mexico ready mix concrete market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ready mix concrete market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ready mix concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ready mix concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)