Mexico Ready to Drink Coffee Market Size, Share, Trends and Forecast by Packaging, Distribution Channel, and Region, 2025-2033

Mexico Ready to Drink Coffee Market Overview:

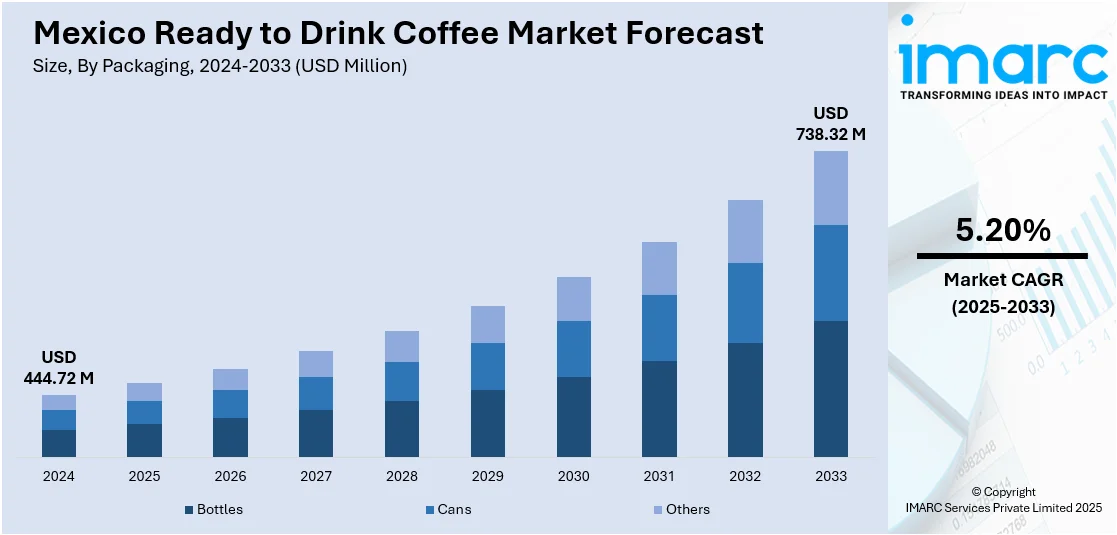

The Mexico Ready to Drink Coffee Market size reached USD 444.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 738.32 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is fueled by increasing working population opting for easy and swift beverage consumption that can be integrated with their on-the-go lifestyle. The convenient solution that provides consumers the benefit of their preferred beverage without preparation, more spending on specialty and premium drinks and rising influence of coffee culture are some of the other factors contributing to the increasing Mexico ready to drink coffee market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 444.72 Million |

| Market Forecast in 2033 | USD 738.32 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Ready to Drink Coffee Market Market Trends:

Emergence of Convenience Culture and Urban Consumption

Perhaps the most prominent trend fueling Mexico's RTD coffee market is the increase in urban life and convenience culture. With more individuals moving to urban centers in search of jobs and education, daily lives have become more hectic, with people looking for grab-and-go food and drink. RTD coffee is ideal for this transformation as it provides a quick, stimulating beverage that does not need to be brewed. According to Mexico’s National Agricultural Planning, it is predicted that by 2030, national consumption will rise from 0.80 to 0.94 Million Tons, and national production will grow from 0.82 to 4.7 Million Tons. Exports are expected to increase, enabling Mexico to regain its position among the world’s top ten largest coffee producers and exporters. Hence, young professionals, students, and daily commuters specifically gravitate toward portable coffee drinks that offer both functionality and pleasure. In cities such as Mexico City, Guadalajara, and Monterrey, where traffic jams and long working hours are the order of the day, RTD coffee provides a convenient answer. This is also supported by the rising number of convenience stores and supermarkets that make it easy for consumers to obtain a great deal of RTD coffee brands to choose from. The growth of vending machines and ready-to-consume facilities in fuel stations is also supporting the Mexico ready to drink coffee market growth.

Influence of Global Coffee Culture and Premiumization

Global coffee trends are profoundly impacting consumer choice in Mexico's RTD coffee market. SADER data shows that Chiapas is the leading producing state, accounting for 41.3%, with Veracruz next at 24.4%, and Oaxaca at 8.2%. Mexican coffee currently accounts for 1.34% of the country's total agro-industrial product production and 0.66% of its agricultural GDP. Moreover, state initiatives aim to establish conditions that will boost both the production and consumption of coffee in the coming years. Alongside over 500,000 producers, Mexico's coffee industry includes more than 75,500 coffee shops, a figure that continues to rise steadily. As international café chains spread, and as people learn about products and styles through social media, consumers are increasingly sophisticated in their palate, looking for higher-quality, specialty-style coffee experiences packaged in convenient forms. This has resulted in the premiumization of RTD coffee products, with companies providing cold brews, flavored lattes, and plant-based milk alternatives. Gourmet and artisanal flavor profiles are increasingly in demand, particularly among young consumers who equate premium coffee with lifestyle and status. To meet the challenge, local and global brands are putting money into packaging that communicates quality and style, frequently highlighting sustainable sourcing and distinctive flavor combinations. Where lifestyle branding and premium drink culture intersect is enabling RTD coffee to evolve from a generic energy drink into a lifestyle product, meeting the changing demands of an expanding middle class and wellness-oriented, trend-savvy consumers.

Local Ingredient Innovation and Sustainability Focus

One increasing trend specific to the Mexican RTD coffee industry is using locally sourced ingredients and emphasizing sustainability. As consumers take a greater interest in the source of their purchase and its ethical footprint, brands are more and more emphasizing that their products utilize Mexican-bred coffee beans from areas such as Chiapas, Veracruz, and Oaxaca. This benefits local farmers and appeals to national pride and the desire for locally made products. Furthermore, companies are also testing traditional flavors like cinnamon, piloncillo (unrefined cane sugar), and chocolate, combining contemporary coffee formats with cultural flavor preferences. Sustainability is also becoming a consideration, with brands using recyclable packaging, minimizing the use of plastic, and encouraging fair trade practices.

Mexico Ready to Drink Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on packaging and distribution channel.

Packaging Insights:

- Bottles

- Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes bottles, cans, and others.

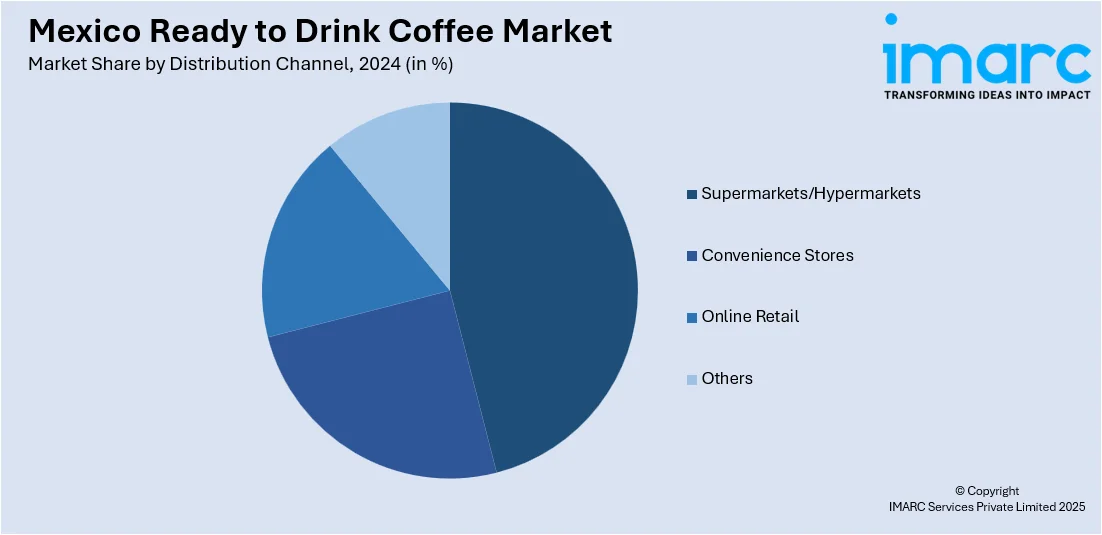

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets/hypermarkets, convenience stores, online retail, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ready to Drink Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packagings Covered | Bottles, Cans, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ready to drink coffee market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ready to drink coffee market on the basis of packaging?

- What is the breakup of the Mexico ready to drink coffee market on the basis of distribution channel?

- What is the breakup of the Mexico ready to drink coffee market on the basis of region?

- What are the various stages in the value chain of the Mexico ready to drink coffee market?

- What are the key driving factors and challenges in the Mexico ready to drink coffee market?

- What is the structure of the Mexico ready to drink coffee market and who are the key players?

- What is the degree of competition in the Mexico ready to drink coffee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ready to drink coffee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ready to drink coffee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ready to drink coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)