Mexico Rechargeable Battery Market Size, Share, Trends and Forecast by Battery Type, Capacity, Application, and Region, 2025-2033

Mexico Rechargeable Battery Market Overview:

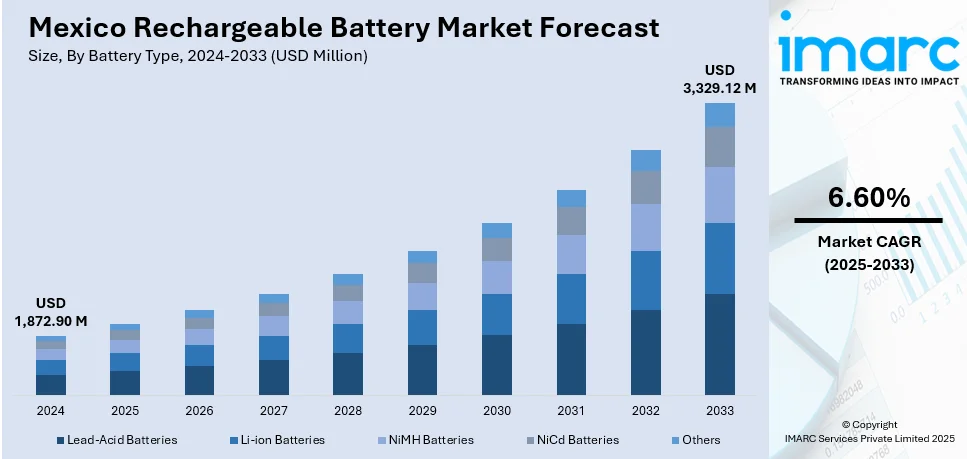

The Mexico rechargeable battery market size reached USD 1,872.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,329.12 Million by 2033, exhibiting a growth rate (CAGR) of 6.60% during 2025-2033. The market is witnessing strong growth, led by mounting demand in consumer electronics, electric vehicles, and industrial sectors. With growing industries such as automotive and manufacturing, the market is expected to continue growing, led by innovations in battery technology and initiatives towards sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,872.90 Million |

| Market Forecast in 2033 | USD 3,329.12 Million |

| Market Growth Rate 2025-2033 | 6.60% |

Mexico Rechargeable Battery Market Trends:

Surging Demand for Consumer Electronics

The Mexico rechargeable batteries market growth is strong which is being predominantly driven by consumer electronics demand. For instance, in April 2024, BMW plans to build an 80,000 sq.m battery factory in San Luis Potosi, Mexico, as part of the Neue Klasse electric vehicle localised supply chain strategy, with a $540 million investment. Moreover, because of increased penetration of smartphones, laptops, tablets, and other handheld devices, there is ever-growing dependence upon effective and reliable rechargeable batteries. The burgeoning consumer electronics growth has thus spawned a substantial rechargeable battery industry opportunity. As the middle class grows and disposable incomes amplifies in Mexico, consumer demand for high-end electronics with long battery life continues to grow. The movement toward more intelligent and energy-efficient devices further fuels the demand for high-performance rechargeable batteries. Mexico's young, technologically sophisticated population is also increasingly willing to embrace the latest technology gadgets, thereby fueling demand for rechargeable batteries. Consequently, the Mexican rechargeable battery market is poised to experience steady growth in the next few years, with a positive market environment, especially in consumer electronics, propelling the growth of the industry.

Electric Vehicle Growth Fueling Rechargeable Battery Adoption

The popularity of electric vehicles (EVs) is greatly helping amplify the market outlook. With the growing use of EVs as a greener option to conventional gasoline-powered vehicles, rechargeable batteries, especially lithium-ion batteries, are highly needed to drive these cars. The Mexican government's initiative to adopt green energy solutions, combined with heightening environmental issues, is fueling the trend, setting a favorable environment for the growth of the electric vehicle market. In addition, since Mexico plays a central role in the automobile industry, numerous international manufacturers are relocating the production of electric vehicles to Mexico, leading to accelerating demand for rechargeable batteries. For example, in March 2024, Spain's Endurance Motive will start manufacturing lithium iron phosphate batteries in Puebla, Mexico, one of the first vehicle battery assembly plants in the country. Furthermore, this increasing dependence on electric vehicles as a mode of transport not only boosts the rate of rechargeable battery market growth but also places Mexico firmly at the top in the global rechargeable battery supply chain. Mexico rechargeable battery market share will further grow with EVs taking the central stage in driving growth in battery market.

Industrial Applications Driving Rechargeable Battery Growth

Rechargeable batteries are achieving major momentum in industrial use across Mexico, adding significantly to large-scale market expansion. The take-up of rechargeable battery-driven solutions in sectors like manufacturing, logistics, and energy storage continues to grow. Batteries are intenesly being implemented in forklifts, drones, and backup power, all of which boost operational performance and lower expenditures in industrial operations. Mexico's manufacturing base expansion and expansion of logistics chains are major determinants of the trend. Rechargeable batteries provide industries a cost-efficient and dependable source of energy, especially in operations that require constant supply of power. Moreover, since Mexico is increasing its emphasis on renewable energy, rechargeable batteries play a pivotal role in energy storage systems as they complement solar and wind power projects. As industries increasingly embrace these energy-efficient and sustainable solutions, the Mexican rechargeable battery market outlook is poised to experience steady growth, with industrial applications looking promising.

Mexico Rechargeable Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on battery type, capacity, and application.

Battery Type Insights:

- Lead-Acid Batteries

- Li-ion Batteries

- NiMH Batteries

- NiCd Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lead-acid batteries, li-ion batteries, NiMH batteries, NiCd batteries, and others.

Capacity Insights:

- 150 - 1000 mAh

- 1300 - 2700 mAh

- 3000 - 4000 mAh

- 4000 - 6000 mAh

- 6000 - 10000 mAh

- More than 10000 mAh

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes 150 - 1000 mAh, 1300 - 2700 mAh, 3000 - 4000 mAh, 4000 - 6000 mAh, 6000 - 10000 mAh, and more than 10000 mAh.

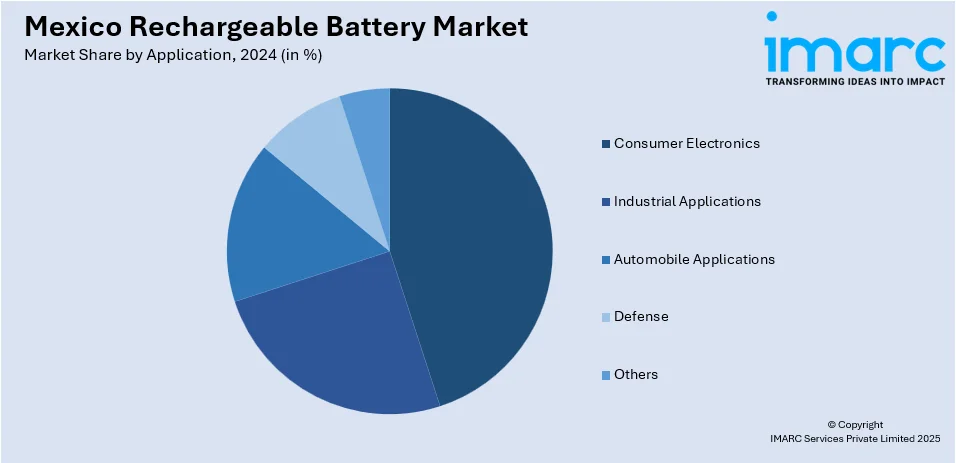

Application Insights:

- Consumer Electronics

- Industrial Applications

- Automobile Applications

- Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, industrial applications, automobile applications, defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Rechargeable Battery Market News:

- In April 2024, Leoch International announced plans to set up two more lead battery manufacturing factories, one in Mexico and the other in Malaysia. The second Mexican plant is scheduled to start trial production in Q2 2025, a major milestone for the company's expansion globally and boosting production capacity.

Mexico Rechargeable Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lead-Acid Batteries, Li-ion Batteries, NiMH Batteries, NiCd Batteries, Others |

| Capacities Covered | 150 - 1000 mAh, 1300 - 2700 mAh, 3000 - 4000 mAh, 4000 - 6000 mAh, 6000 - 10000 mAh, More than 10000 mAh |

| Applications Covered | Consumer Electronics, Industrial Applications, Automobile Applications, Defence, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico rechargeable battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico rechargeable battery market on the basis of battery type?

- What is the breakup of the Mexico rechargeable battery market on the basis of capacity?

- What is the breakup of the Mexico rechargeable battery market on the basis of application?

- What is the breakup of the Mexico rechargeable battery market on the basis of region?

- What are the various stages in the value chain of the Mexico rechargeable battery market?

- What are the key driving factors and challenges in the Mexico rechargeable battery?

- What is the structure of the Mexico rechargeable battery market and who are the key players?

- What is the degree of competition in the Mexico rechargeable battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico rechargeable battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico rechargeable battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico rechargeable battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)