Mexico Recliner Chair Market Size, Share, Trends and Forecast by Product Type, Seating Arrangement, Material, Distribution Channel, End-User, and Region, 2025-2033

Mexico Recliner Chair Market Overview:

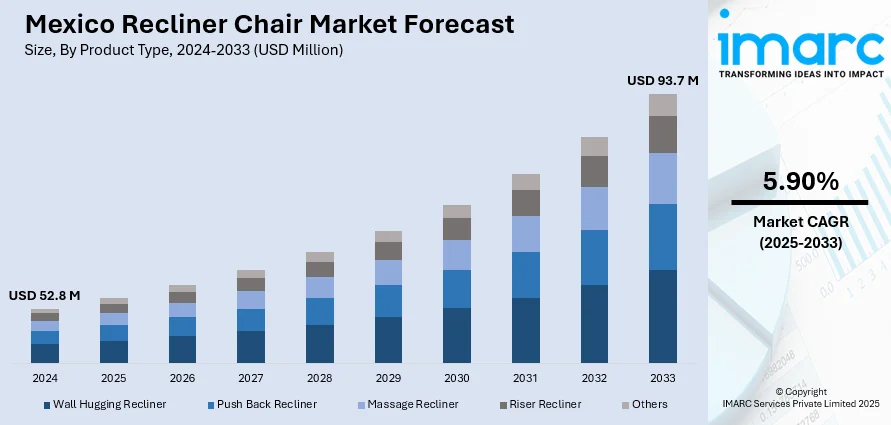

The Mexico recliner chair market size reached USD 52.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 93.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. Rising urbanization, surging disposable incomes, home-centric lifestyles, ergonomic awareness, modular furniture demand, real estate growth, e-commerce penetration, product customization, and increased presence of global brands are factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.8 Million |

| Market Forecast in 2033 | USD 93.7 Million |

| Market Growth Rate 2025-2033 | 5.90% |

Mexico Recliner Chair Market Trends:

Rising Urbanization and Disposable Income

Mexico’s steadily urbanizing population has led to an expanding base of consumers with evolving lifestyle preferences. For instance, the urban population reached around 105.8 million in 2023, reflecting a consistent annual growth rate of about 1% over the past few years. As more people move to cities and adopt nuclear family structures, the demand for modern, space-efficient, and comfort-oriented furniture such as recliner chairs is increasing. Urban dwellers often seek furnishings that align with contemporary interior aesthetics while delivering ergonomic benefits, and recliners meet both requirements. Moreover, the rise in disposable incomes, especially among the middle-class segment, is enabling consumers to prioritize convenience and luxury in home furnishing choices, which is another factor driving the Mexico recliner chair market growth. Recliners, once considered high-end items, are now increasingly viewed as attainable comfort products. With ongoing real estate development and urban housing projects, the market is expected to benefit from consistent demand in the residential segment, particularly in mid to high-income households.

Home-Centric Lifestyle Preferences

The pandemic lifestyle change has affected how consumers deploy discretionary spending in Mexico, it has also impacted upgrades on homes. As work-from-home (WFH) arrangements, distance learning and home-based entertainment settle in as more permanent fixtures, households are making investments in comfortable furniture that elevate the experience of daily living. Recliner chairs have emerged as a popular choice with their multifunctional structure that caters to not just resting but also for media consumption and, occasionally, work needs. Consumers are focusing more on indoor settings that promote physical ease and emotional wellbeing. Moreover, the shifting consumer focus towards purchases as long-term investments in wellness and productivity is projected to create a positive Mexico recliner chair market outlook.

Preference for Modular and Multifunctional Furniture

Consumers are exhibiting a clear preference for modular and multifunctional furniture solutions, driven by evolving living space configurations and shifting lifestyle requirements. Recliner chairs that offer adjustable positions, integrated storage, cup holders, and massage features are increasingly in demand. These value-added functionalities align with consumer expectations for space optimization and product versatility. Additionally, the aesthetic appeal of modular furniture complements modern and minimalist interior design trends. In line with this, the key brands operating in the Mexico market are responding by offering recliners with customizable features and finishes that adapt to diverse home settings, which is further boosting the Mexico recliner chair market growth. The multifunctional appeal also extends to consumer segments such as the elderly or individuals with mobility issues, further boosting the Mexico recliner chair market share.

Mexico Recliner Chair Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, seating arrangement, material, distribution channel, and end-user.

Product Type Insights:

- Wall Hugging Recliner

- Push Back Recliner

- Massage Recliner

- Riser Recliner

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wall hugging recliner, push back recliner, massage recliner, riser recliner, and others.

Seating Arrangement Insights:

- Single Seater Recliner

- Multi Seater Recliner

A detailed breakup and analysis of the market based on the seating arrangement have also been provided in the report. This includes single seater recliner and multi seater recliner.

Material Insights:

- Leather

- Fabric

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes leather, fabric, and others.

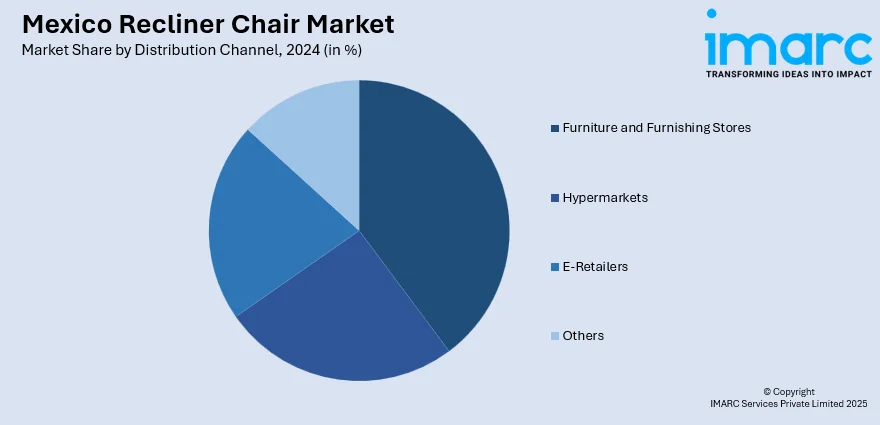

Distribution Channel Insights:

- Furniture and Furnishing Stores

- Hypermarkets

- E-Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes furniture and furnishing stores, hypermarkets, e-retailers, and others.

End User Insights:

- Residential

- Commercial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Recliner Chair Market News:

- In 2023, La-Z-Boy introduced a next-generation 3D product configurator with WebAR OnDemand™ technology, allowing customers to visualize over 29 million possible configurations of their furniture in augmented reality (AR). This innovation enhances the online shopping experience by enabling consumers to preview customized products in their own spaces.

Mexico Recliner Chair Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wall Hugging Recliner, Push Back Recliner, Massage Recliner, Riser Recliner, Others |

| Seating Arrangements Covered | Single Seater Recliner, Multi Seater Recliner |

| Materials Covered | Leather, Fabric, Others |

| Distribution Channels Covered | Furniture and Furnishing Stores, Hypermarkets, E-Retailers, Others |

| End-Users Covered | Residential, Commercial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico recliner chair market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico recliner chair market on the basis of product type?

- What is the breakup of the Mexico recliner chair market on the basis of seating arrangement?

- What is the breakup of the Mexico recliner chair market on the basis of material?

- What is the breakup of the Mexico recliner chair market on the basis of distribution channel?

- What is the breakup of the Mexico recliner chair market on the basis of end-user?

- What is the breakup of the Mexico recliner chair market on the basis of region?

- What are the various stages in the value chain of the Mexico recliner chair market?

- What are the key driving factors and challenges in the Mexico recliner chair?

- What is the structure of the Mexico recliner chair market and who are the key players?

- What is the degree of competition in the Mexico recliner chair market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico recliner chair market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico recliner chair market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico recliner chair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)