Mexico Refrigerated Transport Market Size, Share, Trends and Forecast by Mode of Transportation, Technology, Temperature, Application, and Region, 2025-2033

Mexico Refrigerated Transport Market Overview:

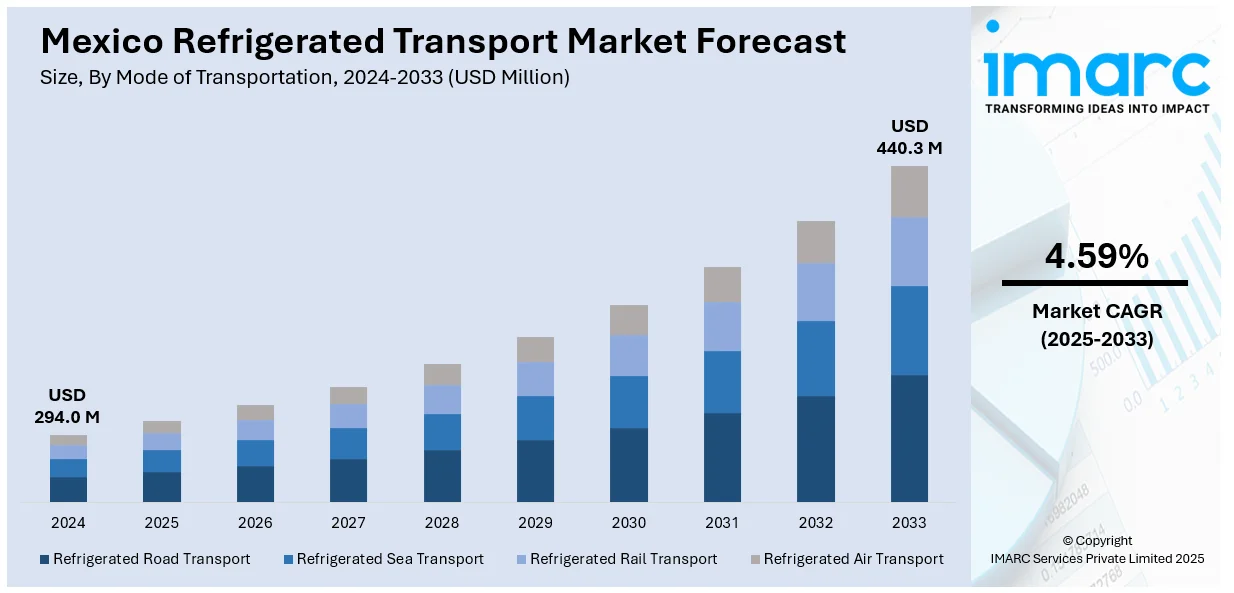

The Mexico refrigerated transport market size reached USD 294.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 440.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.59% during 2025-2033. The market is fueled by rising demand for perishable products, creating a need for temperature-controlled shipping. Improved refrigeration technology improves efficiency and environmental friendliness. Furthermore, expansion of pharmaceutical exports calls for exacting temperature control during shipping, further increasing the demand for refrigerated transport solutions across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 294.0 Million |

| Market Forecast in 2033 | USD 440.3 Million |

| Market Growth Rate 2025-2033 | 4.59% |

Mexico Refrigerated Transport Market Trends:

Growth of Cold Chain Infrastructure

The Mexico refrigerated transport market outlook is being strongly influenced by the growth and modernization of cold chain infrastructure. As the demand for perishables such as fresh produce, dairy products, and meat increases both within the country and abroad, logistics companies are investing in newer and sophisticated cold storage facilities and distribution centers. This growth is also being fueled by the necessity to ensure product quality over greater distances of transport, particularly with cross-border trade to the US. Advanced infrastructure minimizes spoilage, guarantees international standards compliance, and facilitates effective supply chain management. The establishment of strategically positioned logistics centers in proximity to primary agricultural areas and ports makes possible faster response times and improved route planning. As supply chains continue to grow in complexity, firms are focusing more on combining cold storage systems with refrigerated transportation to provide end-to-end cold chain services to the increasing demands of retailers, exporters, and consumers.

Enhanced Technology Use in Fleet Management

Technology is playing a revolutionary role in revolutionizing the Mexico refrigerated transport market share, especially in fleet management and real-time tracking. Businesses are now using telematics systems, GPS tracking, and Internet of Things (IoT) sensors to track temperature, humidity, and vehicle position during the entire transportation process. These technologies allow logistics managers greater control over the conditions of the cargo, with the ability to respond proactively to temperature deviations or route disruptions. Through the use of data analytics, companies can also make fuel efficiency better, lower maintenance costs, and enhance delivery speeds. The pairing of automation and predictive maintenance minimizes downtime and improves the overall reliability of refrigerated fleets. Furthermore, mobile apps and cloud platforms are enabling both fleet operators and drivers to access critical information in real time. As the cost of technology continues to decline and become accessible, even small- and medium-sized logistics providers are using these tools to remain competitive in a market that is increasingly dependent on transparency and efficiency.

Increasing Demand from Food Delivery and E-commerce Services

The rising popularity of food delivery and e-commerce services in Mexico is opening up new opportunities, which is fueling the Mexico refrigerated transport market growth. Consumers are increasingly buying fresh produce, dairy, meat, and even frozen products online and expecting quick and safe delivery to their homes. This change in consumer behavior has resulted in increasing demand for last-mile refrigerated delivery solutions. To address these demands, logistics firms are growing their fleets of smaller, maneuverable refrigerated trucks suited for city life. Cold chain logistics are no longer confined to mass shipments, as they are now a part of routine household deliveries. Consequently, alliances between e-commerce sites, grocery stores, and third-party logistics companies are increasingly becoming the norm. These partnerships guarantee temperature-sensitive products arrive at their destination in good condition, irrespective of the delivery volume or distance. Demand for quicker, more efficient, and more dependable cold transport solutions is set to increase with Mexico's growing digital marketplace.

Mexico Refrigerated Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on mode of transportation, technology, temperature, and application.

Mode of Transportation Insights:

- Refrigerated Road Transport

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

The report has provided a detailed breakup and analysis of the market based on the mode of transportation. This includes refrigerated road transport, refrigerated sea transport, refrigerated rail transport, and refrigerated air transport.

Technology Insights:

- Vapor Compression Systems

- Air-Blown Evaporators

- Eutectic Devices

- Cryogenic Systems

The report has provided a detailed breakup and analysis of the market based on the technology. This includes vapor compression systems, air-blown evaporators, eutectic devices, and cryogenic systems.

Temperature Insights:

- Single-Temperature

- Multi-Temperature

The report has provided a detailed breakup and analysis of the market based on the temperature. This includes single-temperature and multi-temperature.

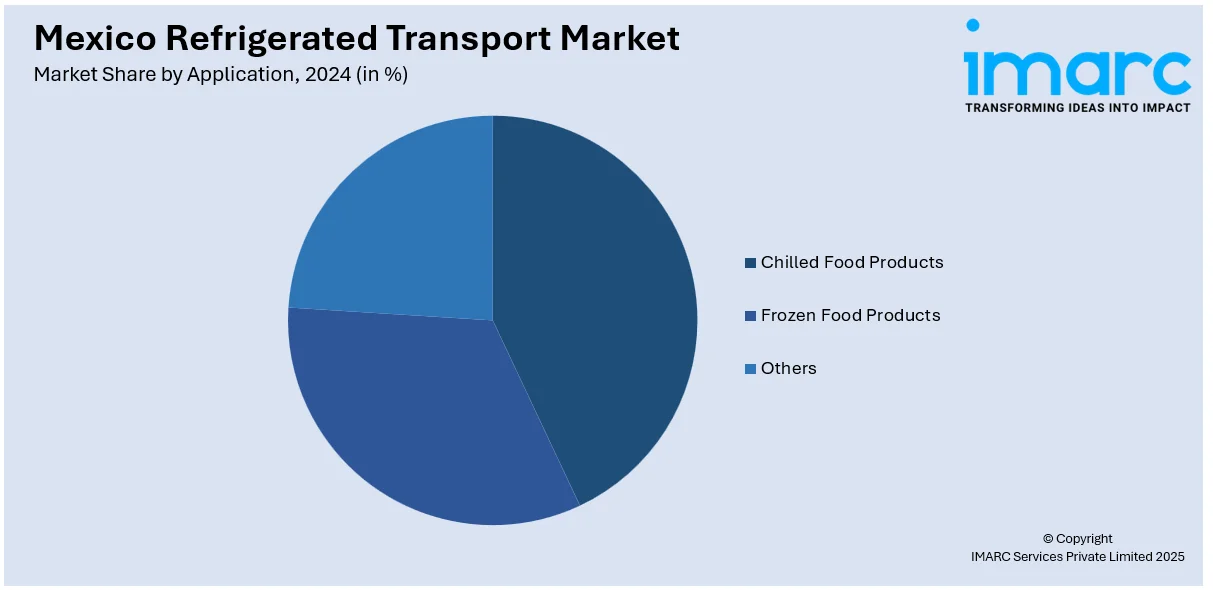

Application Insights:

- Chilled Food Products

- Dairy products

- Bakery and Confectionery Products

- Fresh Fruits and Vegetables

- Others

- Frozen Food Products

- Frozen Dairy Products

- Processed Meat Products

- Fish and Seafood Products

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes chilled food products (dairy products, bakery and confectionery products, fresh fruits and vegetables and others), frozen food products (frozen dairy products, processed meat products, fish and seafood products, others), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Refrigerated Transport Market News:

- In December 2024, the Calgary, Alberta-based railroad revealed an enhancement of its strategic partnership with temperature-controlled logistics provider Americold Realty Trust Inc. to officially investigate co-development prospects in Mexico for temperature-sensitive goods traveling between that country, the United States, and Canada. Americold manages 240 facilities within its worldwide cold chain network, linking production, distribution, and consumption for numerous leading food companies globally, according to the announcement.

- In February 2025, UPS Healthcare opened three new cold chain solutions in Mexico City, Milan, and Frankfurt, aimed at facilitating pharmaceutical shipments with different temperature and time needs. This initiative is a component of the company's strategy to address the increasing need for cold chain logistics, especially in North America, where the demand for temperature-sensitive services is predicted to grow by 76% by 2024, as reported by EY.

Mexico Refrigerated Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes of Transportations Covered | Refrigerated Road Transport, Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport |

| Technologies Covered | Vapor Compression Systems, Air-Blown Evaporators, Eutectic Devices, Cryogenic Systems |

| Temperatures Covered | Single-Temperature, Multi-Temperature |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico and Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico refrigerated transport market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico refrigerated transport market on the basis of mode of transportation?

- What is the breakup of the Mexico refrigerated transport market on the basis of technology?

- What is the breakup of the Mexico refrigerated transport market on the basis of temperature?

- What is the breakup of the Mexico refrigerated transport market on the basis of application?

- What is the breakup of the Mexico refrigerated transport market on the basis of region?

- What are the various stages in the value chain of the Mexico refrigerated transport market?

- What are the key driving factors and challenges in the Mexico refrigerated transport market?

- What is the structure of the Mexico refrigerated transport market and who are the key players?

- What is the degree of competition in the Mexico refrigerated transport market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico refrigerated transport market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico refrigerated transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico refrigerated transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)