Mexico Refrigerated Trucks Market Size, Share, Trends and Forecast by Type, Tonnage Capacity, Application, and Region, 2025-2033

Mexico Refrigerated Trucks Market Overview:

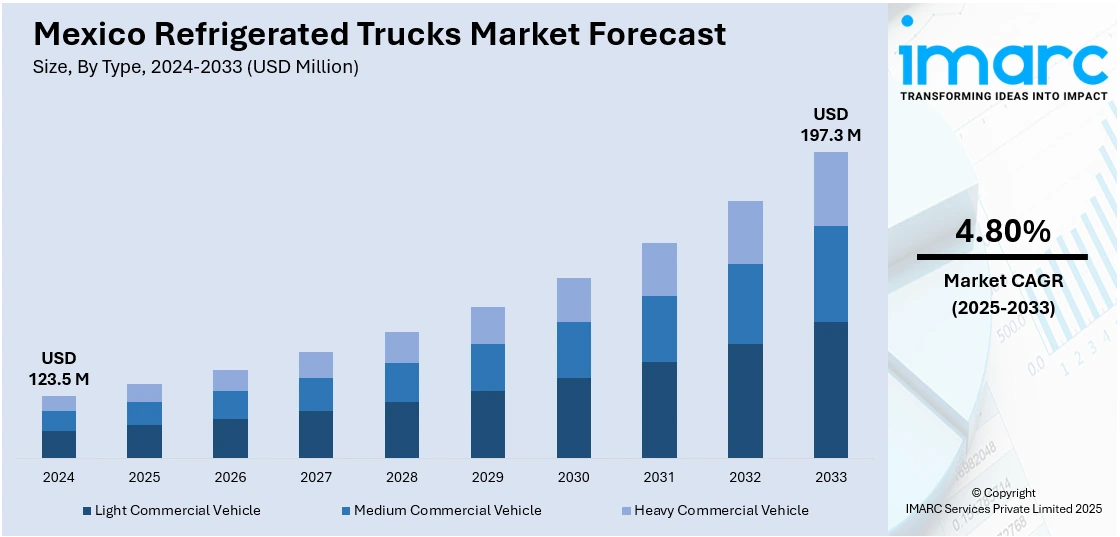

The Mexico refrigerated trucks market size reached USD 123.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 197.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. Rising demand for perishable food, expanding pharmaceutical logistics and supermarket chains, increasing cross-border trade, rapid urbanization, frozen food popularity, export-driven agri-products, environmental regulations favoring electric fleets, and improved cold chain infrastructure are some of the factors supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 123.5 Million |

| Market Forecast in 2033 | USD 197.3 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Mexico Refrigerated Trucks Market Trends:

Rising Consumption of Perishable Food and Beverages

The burgeoning demand for perishable food products is a key driver for the refrigerated trucks market. With a growing population and rising income levels, there has been a noticeable shift in consumer preferences toward fresh produce, dairy, seafood, and meat products that require controlled temperature during transportation. The expansion of the food service industry, including restaurants and meal delivery services, has also amplified the need for reliable cold chain logistics. Food safety regulations imposed by government bodies and health agencies further necessitate the use of refrigerated transport to maintain hygiene and quality standards. Apart from this, the expanding supermarkets and grocery retailers has considerably burgeoned the investments in refrigerated logistics, which is providing a positive Mexico refrigerated trucks market outlook.

Expansion of Supermarket and Convenience Store Chains

The rapid development of organized retail networks in Mexico is significantly contributing to the demand for refrigerated trucks. National and international supermarket chains such as Walmart de México, Soriana, and OXXO are expanding their footprints across urban and semi-urban areas. In 2025, Walmart de México (Walmex) announced a substantial investment of over US 6 billion for 2025, tripling its expenditure from the previous year. These retail outlets rely heavily on temperature-controlled logistics to maintain the shelf-life and integrity of perishable goods including dairy, frozen foods, meats, and beverages. Frequent replenishment cycles and centralized distribution models require an efficient cold supply chain, prompting retailers to invest in or partner with third-party logistics providers operating refrigerated truck fleets. Moreover, the proliferation of convenience stores in densely populated regions has increased the number of daily or weekly deliveries of small, perishable inventories, which necessitates efficient route optimization and refrigerated vehicle availability, which is driving the Mexico refrigerated trucks market growth.

Growth in the Pharmaceutical Industry and Cold Chain Requirements

Mexico’s expanding pharmaceutical sector plays a pivotal role in driving demand for refrigerated trucks, especially given the strict temperature control requirements for certain drugs, vaccines, and biologics. In 2024, Mexico identified over USD 2 billion in pharmaceutical investments, encompassing both domestic and international projects. As the country emerges as a major manufacturer and exporter of pharmaceutical products within Latin America, the need for temperature-sensitive transportation solutions has intensified. Products such as insulin, chemotherapy drugs, and blood plasma must be stored and moved within precise thermal conditions to maintain efficacy. This has led to increased adoption of Good Distribution Practice (GDP) compliant refrigerated trucks equipped with advanced monitoring and temperature regulation systems. The post-COVID healthcare landscape, marked by an emphasis on vaccination drives and resilient healthcare logistics, has further reinforced the importance of a robust pharmaceutical cold chain. Apart from this, pharmaceutical companies and third-party logistics providers are upgrading or expanding their refrigerated fleet to ensure safe and compliant distribution, thereby boosting the Mexico refrigerated truck market in share.

Mexico Refrigerated Trucks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, tonnage capacity, and application.

Type Insights:

- Light Commercial Vehicle

- Medium Commercial Vehicle

- Heavy Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the type. This includes light commercial vehicle, medium commercial vehicle, and heavy commercial vehicle.

Tonnage Capacity Insights:

- Less Than 10 Tons

- 10-20 Tons

- More Than 20 Tons

A detailed breakup and analysis of the market based on the tonnage capacity have also been provided in the report. This includes less than 10 tons, 10–20 tons, and more than 20 tons.

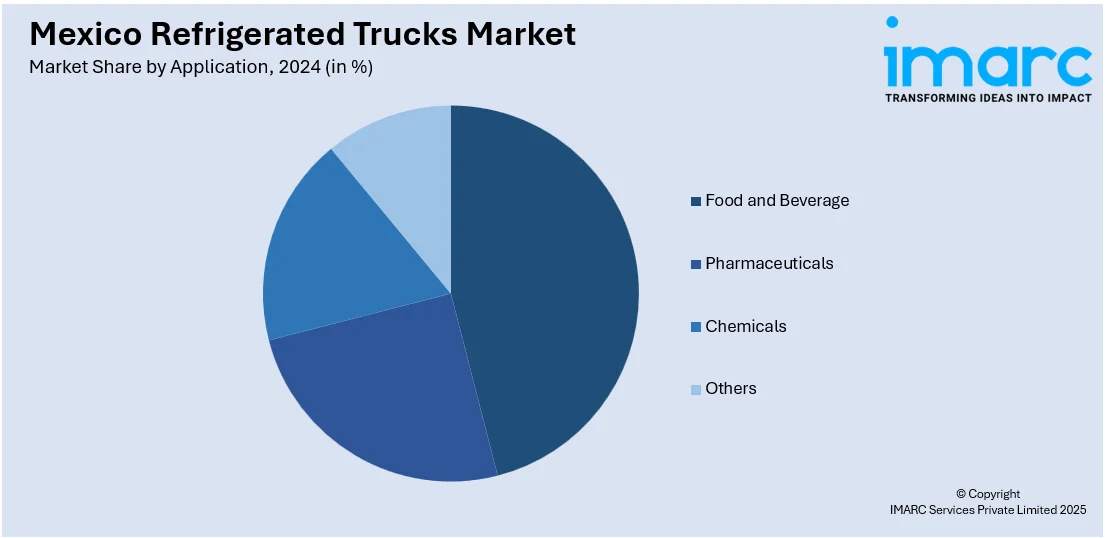

Application Insights:

- Food and Beverage

- Pharmaceuticals

- Chemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverage, pharmaceuticals, chemicals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Refrigerated Trucks Market News:

- In 2024, Sweden's AB Volvo announced plans to construct a USD 700 million heavy-duty truck factory in Monterrey, northern Mexico. This facility aims to support Volvo Trucks and Mack Trucks operations across North America and Latin America.

- In 2024, Americold and Canadian Pacific Kansas City (CPKC) established a strategic collaboration to optimize temperature-controlled logistics across North America, including Mexico. CPKC's TempPro™ temperature-protected intermodal containers are central to this initiative, enhancing reliable door-to-door transit competitive with over-the-road trucks.

Mexico Refrigerated Trucks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light Commercial Vehicle, Medium Commercial Vehicle, Heavy Commercial Vehicle |

| Tonnage Capacities Covered | Less Than 10 Tons, 10–20 Tons, More Than 20 Tons |

| Applications Covered | Food and Beverage, Pharmaceuticals, Chemicals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico refrigerated trucks market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico refrigerated trucks market on the basis of type?

- What is the breakup of the Mexico refrigerated trucks market on the basis of tonnage capacity?

- What is the breakup of the Mexico refrigerated trucks market on the basis of application?

- What is the breakup of the Mexico refrigerated trucks market on the basis of region?

- What are the various stages in the value chain of the Mexico refrigerated trucks market?

- What are the key driving factors and challenges in the Mexico refrigerated trucks market?

- What is the structure of the Mexico refrigerated trucks market and who are the key players?

- What is the degree of competition in the Mexico refrigerated trucks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico refrigerated trucks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico refrigerated trucks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico refrigerated trucks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)