Mexico RegTech Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033

Mexico RegTech Market Overview:

The Mexico RegTech market size reached USD 237.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,056.83 Million by 2033, exhibiting a growth rate (CAGR) of 18.07% during 2025-2033. Increasing regulatory complexity, stricter enforcement by domestic authorities, and adherence to international compliance standards, together with accelerated fintech adoption, digital financial services expansion, and government-backed inclusion initiatives, are some of the factors positively impacting the market. Automated compliance tools, real-time risk monitoring, and digital onboarding requirements are additional factors augmenting the Mexico RegTech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 237.00 Million |

| Market Forecast in 2033 | USD 1,056.83 Million |

| Market Growth Rate 2025-2033 | 18.07% |

Mexico RegTech Market Trends:

Regulatory Complexity and Enforcement in the Financial Sector

Mexico’s financial ecosystem has become increasingly complex due to enhanced scrutiny from national regulatory bodies and alignment with global compliance standards. Financial institutions operating within the country are mandated to adhere to intricate anti-money laundering (AML) regulations, know-your-customer (KYC) protocols, and real-time reporting frameworks. As these compliance demands expand, organizations are under pressure to adopt robust technologies that streamline regulatory obligations while minimizing operational risks. Traditional methods of compliance management, typically labor-intensive and prone to error, have proven inadequate for meeting the dynamic pace of regulatory updates. Consequently, RegTech solutions are being adopted to automate processes, enhance transparency, and ensure seamless audit trails. Moreover, the integration of international standards, such as those outlined by the Financial Action Task Force (FATF), has increased the urgency for digital compliance tools. Institutions are investing in tools capable of consolidating regulatory data, identifying anomalies, and generating insights that support strategic decisions. This demand is particularly pronounced among fintechs and challenger banks navigating competitive financial environments with limited internal compliance infrastructure, thereby resulting in Mexico RegTech market growth.

.webp)

Rapid Digitization and Financial Technology Expansion

The financial services landscape in Mexico has undergone significant transformation as a result of accelerating digital adoption across consumer and institutional segments. With the rise of digital wallets, online banking, and peer-to-peer payment systems, the need for real-time monitoring, fraud detection, and identity verification tools has intensified. Fintech startups, neo-banks, and digital lenders are expanding rapidly, supported by public and private sector initiatives that promote financial inclusion. In parallel, the government’s regulatory frameworks now emphasize digital onboarding, data privacy, and cybersecurity compliance, compelling institutions to seek agile compliance solutions.In this context, Mexico RegTech solutions are increasingly viewed as essential infrastructure within the broader fintech value chain. Automated systems that integrate seamlessly with application programming interfaces (APIs), real-time transaction monitoring platforms, and AI-driven risk assessment engines are being prioritized by firms across the financial sector. These capabilities not only enhance regulatory adherence but also drive operational efficiency and customer trust.

Rise in Financial Crime and Cybersecurity Threats

Mexico has seen a marked increase in financial crime, including identity fraud, money laundering, and digital transaction manipulation, prompting both government agencies and financial institutions to re-evaluate their risk management frameworks. As cybercriminals adopt more sophisticated tactics, organizations must implement technologies capable of real-time threat detection and compliance tracking. In this climate, advanced analytics, AI-based anomaly detection, and biometric verification systems are becoming essential to mitigate risks across various digital channels. Financial service providers are under pressure to proactively safeguard customer data, detect irregular behavior patterns, and generate actionable insights to prevent regulatory violations. This heightened risk environment has led to increased investment in intelligent platforms that offer continuous compliance monitoring and cybersecurity integration. Institutions are turning to centralized solutions that consolidate data, automate suspicious activity reports (SARs), and align seamlessly with regulatory updates. These developments are not limited to major banks; smaller fintechs and payment service providers are also implementing comprehensive compliance infrastructures to maintain operational resilience.

Mexico RegTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, application, and end user.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

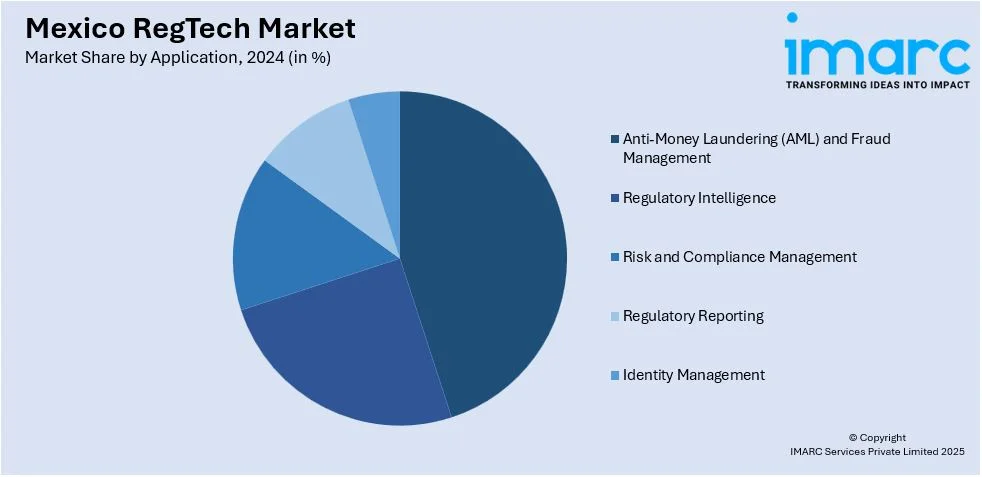

Application Insights:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

The report has provided a detailed breakup and analysis of the market based on the application. This includes anti-money laundering (AML) and fraud management, regulatory intelligence, risk and compliance management, regulatory reporting, and identity management.

End User Insights:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, insurance companies, FinTech firms, IT and telecom, public sector, energy and utilities, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico RegTech Market News:

- On April 28, 2025, Nubank's Mexican subsidiary, Nu Mexico, secured approval for a banking licence from Mexico's National Banking and Securities Commission (CNBV). This approval allows Nu Mexico to transform into a bank, expanding its product offerings to include payroll accounts, higher deposit limits, and enhanced deposit insurance coverage. The move follows Nubank’s success in the region, with over 10 million customers and USD 4.5 Billion in deposits by Q4 2024, as the company continues to grow its footprint in Latin America.

Mexico RegTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Anti-Money Laundering (AML) and Fraud Management, Regulatory Intelligence, Risk and Compliance Management, Regulatory Reporting, Identity Management |

| End Users Covered | Banks, Insurance Companies, FinTech Firms, IT and Telecom, Public Sector, Energy and Utilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico RegTech market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico RegTech market on the basis of component?

- What is the breakup of the Mexico RegTech market on the basis of deployment mode?

- What is the breakup of the Mexico RegTech market on the basis of enterprise size?

- What is the breakup of the Mexico RegTech market on the basis of application?

- What is the breakup of the Mexico RegTech market on the basis of end user?

- What is the breakup of the Mexico RegTech market on the basis of region?

- What are the various stages in the value chain of the Mexico RegTech market?

- What are the key driving factors and challenges in the Mexico RegTech market?

- What is the structure of the Mexico RegTech market and who are the key players?

- What is the degree of competition in the Mexico RegTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico RegTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico RegTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico RegTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)