Mexico Renewable Energy Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Mexico Renewable Energy Market Overview:

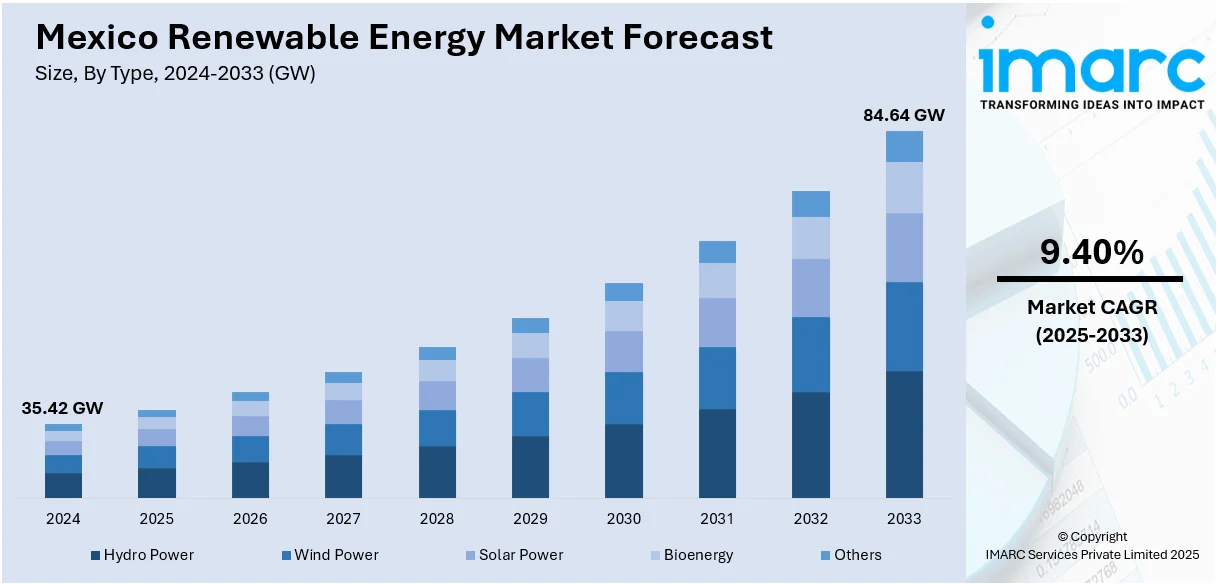

The Mexico renewable energy market size reached 35.42 GW in 2024. Looking forward, IMARC Group expects the market to reach 84.64 GW by 2033, exhibiting a growth rate (CAGR) of 9.40% during 2025-2033. Ambitious government policies, rapid expansion in solar and wind power, and rising investments in modern energy infrastructure are accelerating the transition to clean energy and strengthening the country’s energy security and sustainability, thereby stimulating the expansion of Mexico renewable energy market share globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 35.42 GW |

| Market Forecast in 2033 | 84.64 GW |

| Market Growth Rate 2025-2033 | 9.40% |

Mexico Renewable Energy Market Trends:

Strong Government Commitment and Supportive Policies

Mexico’s renewable energy sector is being propelled by decisive government action and ambitious national targets. The country has laid out a clear roadmap to transition away from fossil fuels, committing to significantly increase the share of clean energy in its power mix over the coming decades. This strategy is backed by a range of incentives, regulatory frameworks, and financial programs designed to attract private sector participation and align with global climate objectives. In March 2025, President Claudia Sheinbaum signed into law a comprehensive energy reform that reshapes Mexico’s electricity sector, prioritizing state-owned enterprises. This reform package comprises eight newly established secondary laws alongside modifications to three preexisting statutes, putting into effect the structure outlined in Sheinbaum’s constitutional reform from October 2024. Such policy support is also encouraging public and private investment in research, innovation, and infrastructure, creating a stable and attractive environment for the renewable energy industry to thrive.

To get more information on this market, Request Sample

Expansion of Solar and Wind Power

According to the International Renewable Energy Agency (IRENA), by 2030, wind and solar photovoltaic (PV) technologies together are expected to make up almost 60% of Mexico’s renewable energy output and represent 26% of the country’s overall power production. Mexico’s vast natural resources make it an ideal location for solar and wind energy generation. With high solar radiation across northern and central regions and strong, consistent wind patterns in areas such as Oaxaca and the Gulf of Mexico, the country is rapidly scaling up these technologies. Solar and wind are now the cornerstones of Mexico’s renewable energy expansion, offering cost-competitive alternatives to conventional sources. Their growing share in electricity generation is transforming the energy mix while attracting large-scale investments in utility-scale projects, thanks to improved efficiency, declining costs, and favorable site conditions.

Rising Investment and Infrastructure Modernization

Mexico is witnessing a notable surge in both local and international investment in its renewable energy market. Capital is flowing into modernizing energy infrastructure, particularly the national grid and energy storage systems, to better handle the variability of renewable sources. This modernization is essential for reliable integration of solar and wind energy. Long-term power purchase agreements, coupled with advances in generation and battery storage technologies, are driving large-scale renewable developments. These efforts are not only enhancing energy security but also making the country a more attractive destination for clean energy investment and technological innovation.

Mexico Renewable Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydro power, wind power, solar power, bioenergy, and others.

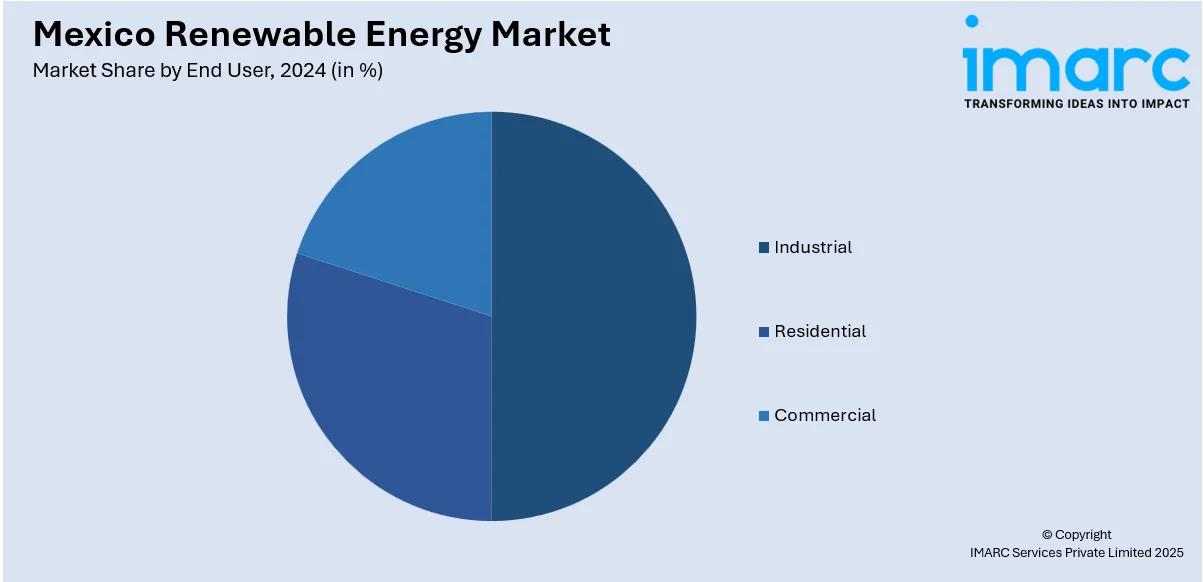

End User Insights:

- Industrial

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, residential, and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Renewable Energy Market News:

- June 2025: Exagon Impact Capital, a private equity firm focused on sustainable growth in Latin America, acquired a controlling stake in SunRoof, a leading renewable energy platform operating in Mexico and Chile. SunRoof specializes in providing customized solar and battery storage solutions to commercial and industrial clients, securing long-term contracts with major global brands. The investment will accelerate SunRoof’s expansion in Mexico, leveraging its innovative, water-saving solar panel cleaning technology and supporting the region’s transition to clean energy.

- May 2025: GEODIS and Prologis launched a rooftop solar project in Mexico, advancing sustainable logistics and supporting both companies’ ambitious climate goals. The installation, located in a major industrial zone, aims to reduce GEODIS’ greenhouse gas emissions, particularly Scope 2, and enhance energy resilience. This initiative aligns with GEODIS’ SBTi-validated targets and Prologis’ goal of deploying 1 GW of solar globally by 2025. The project stabilizes energy costs, supports sustainable certifications, and reinforces both firms’ leadership in environmental stewardship

- April 2025: Revolve Renewable Power plans development of its two utility-scale wind projects in Mexico, totaling 531 MW. The El 24 (131 MW) and Presa Nueva (400 MW) projects have completed wind assessments, are optimizing designs, and are advancing interconnection and permitting processes. The company’s business model combines project development, ownership, and strategic acquisitions across the region.

Mexico Renewable Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GW |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydro Power, Wind Power, Solar Power, Bioenergy, Others |

| End Users Covered | Industrial, Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico renewable energy market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico renewable energy market on the basis of type?

- What is the breakup of the Mexico renewable energy market on the basis of end user?

- What is the breakup of the Mexico renewable energy market on the basis of region?

- What are the various stages in the value chain of the Mexico renewable energy market?

- What are the key driving factors and challenges in the Mexico renewable energy market?

- What is the structure of the Mexico renewable energy market and who are the key players?

- What is the degree of competition in the Mexico renewable energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico renewable energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico renewable energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico renewable energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)